Tokenized Funds Servicing: Deutsche Bank And FinaXai Collaboration

Table of Contents

The Potential of Tokenized Funds Servicing

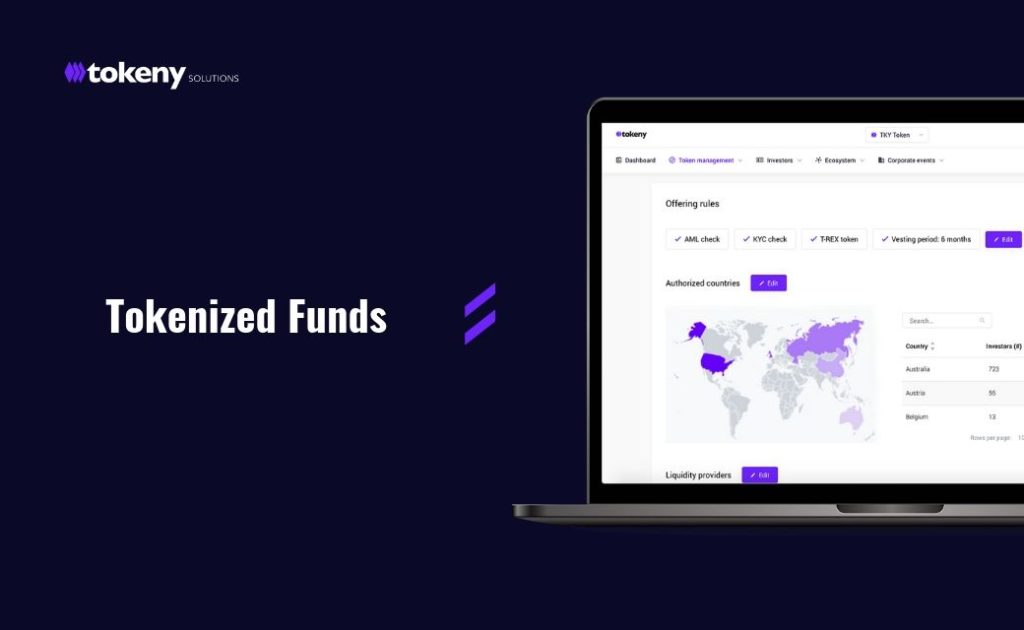

The application of blockchain technology to fund servicing, specifically through tokenization, offers significant advantages over traditional methods. Tokenization transforms traditional assets, like fund shares, into digital tokens on a blockchain. This offers numerous benefits for fund managers and investors alike:

- Streamlined Fund Administration: Tokenization automates numerous manual tasks involved in fund administration, such as record-keeping, transfer processing, and compliance reporting. This automation significantly reduces operational overhead and human error.

- Improved Liquidity and Faster Transfers: The inherent speed and efficiency of blockchain transactions translate to faster and more cost-effective fund transfers. This improved liquidity benefits both investors seeking quicker access to their funds and fund managers needing to execute transactions rapidly.

- Enhanced Transparency and Real-time Access: Blockchain's transparent and immutable ledger provides investors with real-time access to fund information, such as holdings, valuations, and transaction history, fostering greater trust and accountability.

- Reduced Operational Costs: Automating processes and eliminating intermediaries reduces the substantial operational costs associated with traditional fund servicing, leading to significant savings for both fund managers and investors.

- Facilitating Fractional Ownership: Tokenization allows for fractional ownership of assets, making investments more accessible to a broader range of participants and potentially increasing liquidity.

Deutsche Bank and finaXai's Collaboration: A Strategic Alliance

Deutsche Bank's partnership with finaXai represents a significant commitment to leveraging cutting-edge technology to improve its fund servicing offerings. This strategic alliance combines Deutsche Bank's established presence and expertise in the financial industry with finaXai's innovative tokenization platform.

- Deutsche Bank's Commitment to Innovation: This collaboration underscores Deutsche Bank's proactive approach to embracing technological advancements to enhance its services and maintain a competitive edge in the evolving financial landscape.

- finaXai's Platform and Key Features: finaXai's platform provides the crucial infrastructure for the tokenization process, offering secure, scalable, and compliant solutions for managing digital assets. Key features likely include robust security measures, streamlined workflows, and seamless integration with existing systems.

- Strategic Benefits for Both Organizations: The partnership benefits both firms. Deutsche Bank gains access to a leading-edge technology, enhancing its service offerings. finaXai benefits from the validation and reach provided by a global financial powerhouse like Deutsche Bank.

- Potential for Expansion: This initial collaboration in tokenized funds servicing has the potential to expand into other areas of fund administration, further revolutionizing financial processes.

Addressing Regulatory Compliance in Tokenized Funds Servicing

The adoption of tokenized funds servicing necessitates careful consideration of regulatory compliance. The partnership between Deutsche Bank and finaXai prioritizes adherence to all applicable regulations.

- Navigating Regulatory Challenges: The partnership proactively addresses the regulatory challenges surrounding digital assets, working to ensure compliance with evolving legal frameworks.

- KYC/AML Compliance: Robust Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures are integrated into the platform to prevent illicit activities.

- Legal Framework for Tokenized Funds: The legal framework governing security tokens and other forms of tokenized assets is carefully considered to ensure legal compliance.

- Security and Risk Management: Security and risk management are paramount, incorporating robust measures to protect against cyber threats and maintain data integrity.

The Future of Tokenized Funds Servicing: Market Adoption and Technological Advancements

The collaboration between Deutsche Bank and finaXai is expected to significantly accelerate the adoption of tokenized funds servicing across the financial industry.

- Wider Market Adoption: The success of this partnership will likely encourage other financial institutions to explore and adopt similar tokenization solutions.

- Technological Advancements: Future technological advancements, such as improvements in scalability and interoperability of blockchain platforms, will further enhance the efficiency and capabilities of tokenized funds servicing.

- Impact on Investment Strategies: Tokenization is likely to reshape investment strategies, enabling new investment products and improving access to previously illiquid assets.

- Long-Term Benefits: The long-term benefits for investors include increased transparency, lower fees, and improved liquidity. For fund managers, it translates to streamlined operations, reduced costs, and a more efficient way to manage funds.

Conclusion: Embracing the Future of Fund Management with Tokenized Funds Servicing

This collaboration between Deutsche Bank and finaXai represents a pivotal moment in the evolution of fund management. By leveraging the power of blockchain technology and focusing on regulatory compliance, they are building a more efficient, transparent, and cost-effective system for tokenized funds servicing. This initiative paves the way for a future where fund administration is streamlined, accessible, and significantly improved for all participants. Learn more about how Deutsche Bank and finaXai are revolutionizing the future of finance with tokenized funds servicing. Explore the possibilities of this innovative solution and discover how it can benefit your investment strategies. Embrace the future of fund management with tokenized funds servicing.

Featured Posts

-

Virtual Venue De Ticketmaster Asegurate De Tener La Mejor Vista

May 30, 2025

Virtual Venue De Ticketmaster Asegurate De Tener La Mejor Vista

May 30, 2025 -

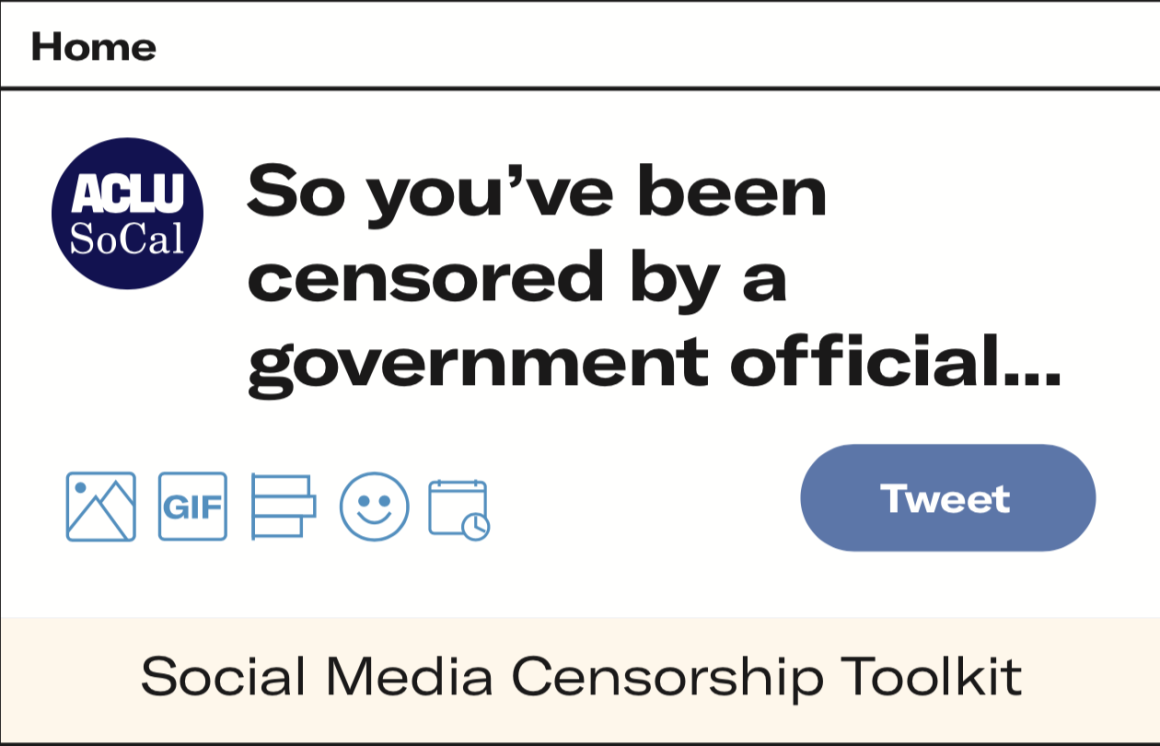

Us Imposes Visa Curbs Over Concerns Of Social Media Censorship

May 30, 2025

Us Imposes Visa Curbs Over Concerns Of Social Media Censorship

May 30, 2025 -

Jin De Bts Una Escena De Accion Inolvidable En Run Bts

May 30, 2025

Jin De Bts Una Escena De Accion Inolvidable En Run Bts

May 30, 2025 -

1 050 V Mware Price Hike At And T Details Broadcoms Proposed Increase

May 30, 2025

1 050 V Mware Price Hike At And T Details Broadcoms Proposed Increase

May 30, 2025 -

Bruno Fernandes Man United Stars Near Miss With Tottenham Hotspur

May 30, 2025

Bruno Fernandes Man United Stars Near Miss With Tottenham Hotspur

May 30, 2025