Tracking The Amundi MSCI World Catholic Principles UCITS ETF's Daily NAV

Table of Contents

Understanding the Amundi MSCI World Catholic Principles UCITS ETF and its NAV

What is a Net Asset Value (NAV)?

The Net Asset Value (NAV) represents the total value of an ETF's assets minus its liabilities, divided by the number of outstanding shares. Simply put, it's the per-share value of the ETF's holdings. For ETF investors, the NAV is a critical indicator of the fund's underlying performance. It's calculated daily, usually at the end of the trading day, reflecting the closing prices of the assets held within the ETF.

The Specifics of the Amundi MSCI World Catholic Principles UCITS ETF:

The Amundi MSCI World Catholic Principles UCITS ETF is designed to track the performance of a broad global equity market index, while adhering to specific ethical guidelines aligned with Catholic social teaching. This means the ETF invests in companies that meet certain criteria relating to environmental, social, and governance (ESG) factors, excluding those involved in activities considered contrary to Catholic principles. These criteria might include restrictions on companies involved in weapons manufacturing, alcohol production, pornography, or gambling. The ETF's investment strategy aims to provide long-term capital growth while aligning with the values of its investors. Remember to always check the ETF's fact sheet for the most up-to-date information on expense ratios and fees.

-

Definition of UCITS ETF: UCITS stands for Undertakings for Collective Investment in Transferable Securities. It's a European regulatory framework for investment funds, ensuring investor protection and harmonized standards across the EU. This makes the Amundi MSCI World Catholic Principles UCITS ETF accessible to investors throughout Europe.

-

Explanation of the MSCI World index and its relevance: The MSCI World Index is a widely recognized benchmark representing the performance of large and mid-cap companies across developed markets globally. The ETF's tracking of this index provides a broad exposure to the global economy.

-

Briefly describe the Catholic principles screening criteria used by the ETF: The specific exclusion criteria applied by the ETF are clearly defined and readily available in its prospectus. It's crucial to review these to ensure alignment with your personal investment philosophy.

-

Highlight the target investor profile for this type of ETF: This ETF is well-suited for investors seeking long-term growth while aligning their investments with Catholic social teachings and ESG principles.

Methods for Tracking the Daily NAV of the Amundi MSCI World Catholic Principles UCITS ETF

Using Brokerage Platforms:

Most reputable online brokerage accounts provide real-time or delayed NAV data for ETFs held within the account. Platforms like Interactive Brokers, Fidelity, and Schwab typically offer this functionality. The delay in data may vary depending on the brokerage and data provider.

Utilizing the Amundi Website:

Amundi, the ETF's issuer, usually provides daily NAV updates on its official website. This is a reliable source for the official NAV, though there might be a slight delay in posting compared to real-time trading data. Look for sections on investor relations or fund information.

Employing Financial News Websites and Data Providers:

Several financial news websites and data providers, such as Yahoo Finance, Google Finance, and Bloomberg, display ETF NAVs. While generally reliable, it’s always best to cross-reference information from multiple sources to ensure accuracy.

-

Step-by-step instructions for each method: Detailed instructions can typically be found within the help sections of your brokerage account, the Amundi website, or on the relevant financial news website.

-

Comparison of the different methods in terms of accuracy, timeliness, and accessibility: Brokerage platforms usually offer the most timely data, while Amundi's website provides the official NAV. Financial news websites offer a readily accessible overview but may have slight discrepancies.

-

Mention potential limitations of each method (e.g., delays, data discrepancies): Data delays are common, especially outside of regular trading hours. Always check the timestamp of the data provided.

Interpreting and Utilizing Daily NAV Data for Investment Decisions

Tracking NAV Performance Over Time:

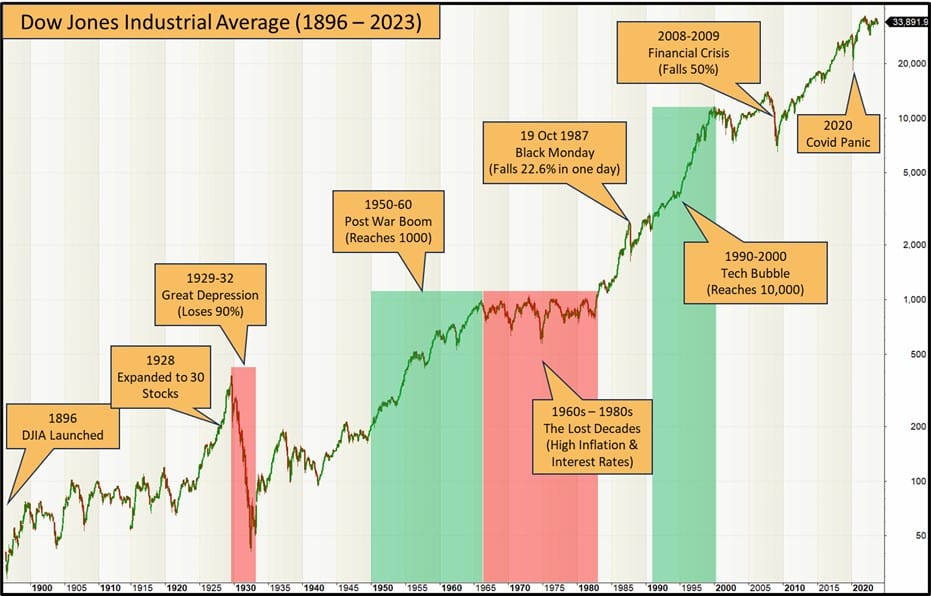

Charting the ETF's NAV over time allows you to assess its performance and compare it to its benchmark, the MSCI World Index. This long-term perspective is essential for understanding the ETF's overall trend.

Comparing NAV to the ETF's Market Price:

The NAV and the market price of an ETF may differ slightly. These discrepancies can be due to various market factors, such as supply and demand. Understanding this difference is crucial, and it shouldn't be cause for immediate alarm, but rather something to monitor.

Using NAV Data for Buy/Sell Decisions (with caution):

While tracking the daily NAV is valuable, it should not be the sole factor driving your buy or sell decisions. Other factors like your long-term investment goals, your risk tolerance, and overall market conditions are significantly more important.

-

Importance of long-term perspective: Investing in ETFs is generally a long-term strategy. Short-term fluctuations in the NAV should be viewed within the broader context of the ETF's performance over time.

-

Risks associated with frequent trading based solely on daily NAV fluctuations: Frequent trading based on short-term NAV changes can lead to increased transaction costs and potential losses.

-

Advice on seeking professional financial advice before making investment decisions: Consult with a qualified financial advisor before making any investment decisions. They can help you develop a personalized investment strategy aligned with your goals and risk tolerance.

Conclusion

Tracking the Amundi MSCI World Catholic Principles UCITS ETF's daily NAV provides valuable insights into its performance. However, it's vital to utilize this information responsibly and in conjunction with a comprehensive investment strategy. Remember that several methods exist for accessing this information, each with its own advantages and limitations. Understanding the NAV, comparing it with the market price, and considering long-term trends are crucial. But always remember that professional financial advice is strongly recommended before investing in any ETF, including the Amundi MSCI World Catholic Principles UCITS ETF. Take the time to research and understand your investment options before committing your capital. For more information, consider visiting the Amundi website.

Featured Posts

-

Nyt Mini Crossword Clues And Solutions Sunday April 19

May 24, 2025

Nyt Mini Crossword Clues And Solutions Sunday April 19

May 24, 2025 -

Dax Surge Will A Wall Street Rebound Dampen German Market Gains

May 24, 2025

Dax Surge Will A Wall Street Rebound Dampen German Market Gains

May 24, 2025 -

Solutions For Nyt Connections Puzzle 646 March 18 2025

May 24, 2025

Solutions For Nyt Connections Puzzle 646 March 18 2025

May 24, 2025 -

Glastonbury 2025 Lineup Is It The Strongest Yet Featuring Charli Xcx And Neil Young

May 24, 2025

Glastonbury 2025 Lineup Is It The Strongest Yet Featuring Charli Xcx And Neil Young

May 24, 2025 -

Planning Your Memorial Day 2025 Trip Smart Flight Dates

May 24, 2025

Planning Your Memorial Day 2025 Trip Smart Flight Dates

May 24, 2025

Latest Posts

-

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025 -

Shes Still Waiting By The Phone A Personal Story

May 24, 2025

Shes Still Waiting By The Phone A Personal Story

May 24, 2025 -

She Still Waiting By The Phone My Experience

May 24, 2025

She Still Waiting By The Phone My Experience

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Nav Calculation And Implications

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Nav Calculation And Implications

May 24, 2025 -

Amundi Djia Ucits Etf A Guide To Net Asset Value Nav

May 24, 2025

Amundi Djia Ucits Etf A Guide To Net Asset Value Nav

May 24, 2025