Tracking The Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF USD Hedged Dist

Table of Contents

How the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist is Calculated

The NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist represents the net value of the ETF's underlying assets per share. This calculation is a critical process that directly reflects the fund's performance.

-

Underlying Assets: The ETF tracks the MSCI World Index, a broad market-cap weighted index representing large and mid-cap equities across developed markets globally. The NAV calculation begins with the total market value of all the stocks held within the ETF, mirroring the composition of the MSCI World Index.

-

Currency Hedging: The "USD Hedged" designation signifies that the ETF employs currency hedging strategies to minimize the impact of fluctuations between the Euro (the ETF's base currency) and the US dollar. This hedging involves using financial derivatives to offset potential losses from currency exchange rate movements. This hedging significantly impacts the NAV calculation, as the value of the underlying assets is converted to USD before the final NAV is determined.

-

Daily Calculation: The NAV is typically calculated daily at the close of market hours, reflecting the closing prices of the constituent stocks in the MSCI World Index and the prevailing exchange rates.

-

Fund Manager's Role: Amundi, as the fund manager, is responsible for the accurate and timely calculation and dissemination of the NAV. This involves employing sophisticated valuation models and adhering to strict regulatory requirements. They use reliable data sources to ensure accuracy.

Keywords: "Amundi MSCI World II NAV calculation," "MSCI World Index NAV," "USD Hedged NAV," "ETF NAV calculation"

Where to Find Real-Time and Historical NAV Data for Amundi MSCI World II UCITS ETF USD Hedged Dist

Access to accurate and timely NAV data is paramount for effective monitoring of your investment. Several reliable sources provide this information:

-

Amundi's Website: The official website of Amundi is the primary source for the most accurate and up-to-date NAV information. You can usually find this data within the ETF's dedicated fact sheet or fund details page.

-

Financial News Websites: Major financial news providers (e.g., Bloomberg, Yahoo Finance, Google Finance) typically list real-time and historical NAV data for widely traded ETFs like the Amundi MSCI World II UCITS ETF USD Hedged Dist.

-

Brokerage Platforms: If you hold the ETF through a brokerage account, the platform usually provides real-time NAV data alongside your portfolio holdings.

-

Data Providers: Specialized financial data providers offer comprehensive ETF data, including NAVs, often with subscription-based access.

Comparing Sources: While most reputable sources offer similar data, minor discrepancies may occur due to timing differences or data aggregation methods. Always prioritize the data provided directly by the ETF issuer (Amundi) for the most reliable information.

Keywords: "Amundi MSCI World II NAV data," "ETF NAV data sources," "Real-time ETF NAV," "Historical ETF NAV"

Factors Influencing the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

Several factors influence the daily fluctuations in the Amundi MSCI World II UCITS ETF USD Hedged Dist's NAV:

-

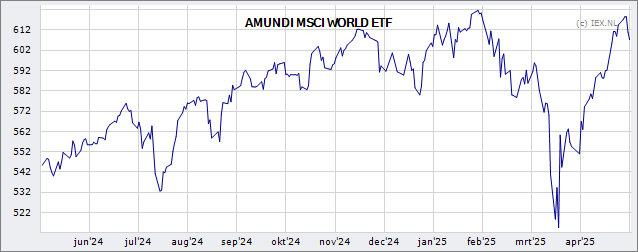

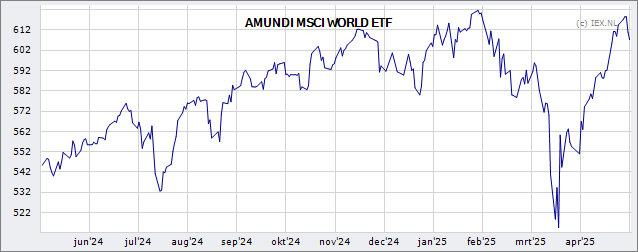

Global Market Performance: The primary driver is the performance of the underlying MSCI World Index. Positive movements in global equity markets generally lead to an increase in the NAV, while negative movements result in a decrease.

-

Currency Fluctuations: Despite the USD hedging, residual currency fluctuations can still influence the NAV. Changes in the EUR/USD exchange rate, even after hedging, can introduce minor variations.

-

Dividend Payouts: Dividend payments from the underlying stocks increase the NAV, reflecting the distribution of profits to the ETF. These payments are typically reinvested back into the ETF, further boosting the NAV over time.

-

Expense Ratio: The ETF's expense ratio (management fees) reduces the NAV incrementally over time. This cost is deducted from the assets under management.

Keywords: "Amundi MSCI World II NAV factors," "Market impact on ETF NAV," "Currency impact on ETF NAV," "Dividend impact on ETF NAV"

Interpreting the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

Understanding and interpreting the NAV is key to evaluating the ETF's performance and making informed investment decisions.

-

NAV vs. Market Price: The NAV represents the intrinsic value of the ETF, whereas the market price reflects the price at which it trades on the exchange. These prices can diverge slightly, but significant differences may warrant investigation.

-

NAV Changes Over Time: Tracking NAV changes over time helps assess the ETF's performance. Comparing the NAV against previous periods reveals growth or decline, providing a measure of return.

-

Investment Decision-Making: Analyzing historical NAV data and identifying trends can inform your investment strategy. Comparing the NAV performance against benchmarks or other similar ETFs can help assess whether the Amundi MSCI World II UCITS ETF USD Hedged Dist is meeting your investment goals.

Keywords: "Amundi MSCI World II NAV interpretation," "ETF NAV analysis," "ETF performance evaluation"

Conclusion: Mastering Amundi MSCI World II UCITS ETF USD Hedged Dist NAV Tracking

Tracking the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist is crucial for evaluating its performance and making sound investment decisions. By understanding how the NAV is calculated, where to find reliable data, and the factors influencing it, you can effectively monitor your investment and adjust your strategy as needed. Regularly review the NAV data from reliable sources such as Amundi's website and reputable financial news sites to stay informed. Stay informed about the performance of your Amundi MSCI World II UCITS ETF USD Hedged Dist investments by diligently tracking its NAV. Regularly review the NAV data from reliable sources to make informed investment decisions.

Featured Posts

-

Memorial Day 2025 Air Travel Avoid Peak Days

May 24, 2025

Memorial Day 2025 Air Travel Avoid Peak Days

May 24, 2025 -

Skandal An Der Uni Duisburg Essen Notenverkauf Fuer 900 Euro

May 24, 2025

Skandal An Der Uni Duisburg Essen Notenverkauf Fuer 900 Euro

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Understanding Net Asset Value Nav

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Understanding Net Asset Value Nav

May 24, 2025 -

Porsche Atidare Nauja Elektromobiliu Ikrovimo Stoti Europoje

May 24, 2025

Porsche Atidare Nauja Elektromobiliu Ikrovimo Stoti Europoje

May 24, 2025 -

Todays Nyt Mini Crossword Answers March 26 2025

May 24, 2025

Todays Nyt Mini Crossword Answers March 26 2025

May 24, 2025

Latest Posts

-

Glastonbury 2025 A Lineup Analysis Charli Xcx Neil Young And More

May 24, 2025

Glastonbury 2025 A Lineup Analysis Charli Xcx Neil Young And More

May 24, 2025 -

Is The Glastonbury 2025 Lineup A Winner Charli Xcx Neil Young And Other Highlights

May 24, 2025

Is The Glastonbury 2025 Lineup A Winner Charli Xcx Neil Young And Other Highlights

May 24, 2025 -

Glastonbury 2025 Charli Xcx Neil Young And The Must See Artists

May 24, 2025

Glastonbury 2025 Charli Xcx Neil Young And The Must See Artists

May 24, 2025 -

Glastonbury 2025 Lineup Is It The Strongest Yet Featuring Charli Xcx And Neil Young

May 24, 2025

Glastonbury 2025 Lineup Is It The Strongest Yet Featuring Charli Xcx And Neil Young

May 24, 2025 -

Is Glastonbury 2025s Lineup The Best Yet Charli Xcx Neil Young And More Must See Acts

May 24, 2025

Is Glastonbury 2025s Lineup The Best Yet Charli Xcx Neil Young And More Must See Acts

May 24, 2025