Tracking The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

Understanding Net Asset Value (NAV) for ETFs

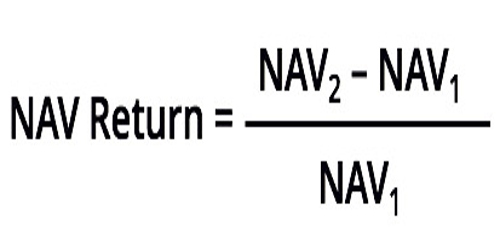

The Net Asset Value (NAV) represents the per-share value of an ETF's underlying assets. For an index-tracking ETF like the Amundi Dow Jones Industrial Average UCITS ETF, the NAV is calculated by taking the total market value of all the constituent stocks in the Dow Jones Industrial Average held by the ETF, subtracting any liabilities, and dividing by the total number of outstanding ETF shares.

- Definition of NAV: NAV is the net asset value of an investment fund per share. It represents the theoretical price of a share if the fund were to be liquidated.

- Calculation Methodology: For index-tracking ETFs, the NAV is calculated daily by valuing each holding in the index at its closing market price. This process ensures that the ETF closely mirrors the performance of the underlying index.

- Factors Influencing NAV Fluctuations: The primary driver of NAV fluctuations is the movement of the underlying Dow Jones Industrial Average. Other factors, such as dividend payments received by the ETF and any associated fees, will also influence the NAV.

- NAV vs. Market Price: While the NAV provides the intrinsic value, the market price is the actual price at which the ETF is traded. Discrepancies can occur due to supply and demand forces and intraday trading activity. These discrepancies usually are small and short-lived for actively traded ETFs like this one.

Accessing the Amundi Dow Jones Industrial Average UCITS ETF NAV

Obtaining accurate and up-to-date NAV information is vital. The most reliable source for the Amundi Dow Jones Industrial Average UCITS ETF NAV is Amundi's official website.

- Amundi's Official Website as the Primary Source: Amundi, the fund manager, publishes the daily NAV on its website dedicated to the ETF. Look for a dedicated section on fund factsheets or performance data.

- Specific Page/Section on the Amundi Website: The exact location may vary, but generally, you will find this information under the ETF's product page, often within a factsheet or performance section.

- Reputable Financial Data Providers: Bloomberg Terminal, Refinitiv Eikon, and other financial data providers often include real-time and historical NAV data for major ETFs like the Amundi Dow Jones Industrial Average UCITS ETF.

- Brokerage Account Platforms: Many brokerage platforms display the NAV alongside the market price of your ETF holdings. Check your account statements and trade history.

Interpreting and Utilizing the Amundi Dow Jones Industrial Average UCITS ETF NAV Data

Understanding and using the NAV data effectively is key to informed investment decisions.

- Using NAV for Performance Evaluation: Comparing the NAV over time helps gauge the ETF's performance against the Dow Jones Industrial Average.

- Comparing NAV to Market Price for Potential Arbitrage: While generally small, occasional discrepancies between NAV and market price may present minor arbitrage opportunities. However, this requires advanced trading knowledge and is not recommended for inexperienced investors.

- Monitoring NAV Trends to Identify Investment Opportunities: Tracking the NAV's trends can help identify potential buying or selling opportunities based on your investment strategy and risk tolerance.

- Understanding the Limitations of Relying Solely on NAV: NAV is a snapshot of the fund’s value at a specific point in time. It doesn't account for future market movements or other unforeseen events.

Factors Affecting the Amundi Dow Jones Industrial Average UCITS ETF NAV

Several factors directly influence the NAV of the Amundi Dow Jones Industrial Average UCITS ETF.

- Dow Jones Industrial Average Performance: The primary driver of NAV changes is the overall performance of the Dow Jones Industrial Average. Positive movement in the index generally leads to an increase in NAV.

- Currency Exchange Rate Impacts: Since this is a UCITS ETF, currency fluctuations between the ETF's base currency and the currencies of the underlying assets can impact the NAV.

- Dividend Distributions and their Impact on NAV: When the companies within the Dow Jones Industrial Average pay dividends, the ETF receives these dividends, which, after deducting fees, increase the NAV.

- Expense Ratio and its Influence on NAV: The ETF's expense ratio (the annual cost of managing the fund) is deducted from the fund's assets, subtly affecting the NAV over time.

Conclusion

Tracking the Amundi Dow Jones Industrial Average UCITS ETF NAV is straightforward using Amundi's official website, reputable financial data providers, or your brokerage platform. By regularly monitoring the NAV and comparing it to the market price, you can gain valuable insights into the ETF's performance and make better-informed investment decisions. Remember to consult Amundi's official resources for the most accurate and up-to-date Amundi Dow Jones Industrial Average UCITS ETF NAV data. Continue your research by searching for "Amundi Dow Jones Industrial Average UCITS ETF NAV" to find more information and refine your investment strategy.

Featured Posts

-

Masivne Prepustanie V Nemecku Tisice Ludi Prichadzaju O Pracu

May 24, 2025

Masivne Prepustanie V Nemecku Tisice Ludi Prichadzaju O Pracu

May 24, 2025 -

8 Stock Market Increase On Euronext Amsterdam Impact Of Trumps Tariff Decision

May 24, 2025

8 Stock Market Increase On Euronext Amsterdam Impact Of Trumps Tariff Decision

May 24, 2025 -

Analiz Dostizheniy Chto Udalos Nashemu Pokoleniyu Izmenit

May 24, 2025

Analiz Dostizheniy Chto Udalos Nashemu Pokoleniyu Izmenit

May 24, 2025 -

Ekonomicka Kriza V Nemecku Tisice Prepustenych Zamestnancov

May 24, 2025

Ekonomicka Kriza V Nemecku Tisice Prepustenych Zamestnancov

May 24, 2025 -

Analyzing The Net Asset Value Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Analyzing The Net Asset Value Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Latest Posts

-

Boosting Regional And International Travel The Ae Xplore Campaign At England Airpark And Alexandria International Airport

May 24, 2025

Boosting Regional And International Travel The Ae Xplore Campaign At England Airpark And Alexandria International Airport

May 24, 2025 -

Ae Xplore England Airpark And Alexandria International Airports New Travel Campaign

May 24, 2025

Ae Xplore England Airpark And Alexandria International Airports New Travel Campaign

May 24, 2025 -

Amsterdam Accueille Le Ces Unveiled Europe Les Technologies Du Futur En Presentation

May 24, 2025

Amsterdam Accueille Le Ces Unveiled Europe Les Technologies Du Futur En Presentation

May 24, 2025 -

Alexandria International Airport And England Airpark Partner For Ae Xplore Global Campaign Launch

May 24, 2025

Alexandria International Airport And England Airpark Partner For Ae Xplore Global Campaign Launch

May 24, 2025 -

Retour Du Ces Unveiled A Amsterdam Les Innovations Europeennes A Decouvrir

May 24, 2025

Retour Du Ces Unveiled A Amsterdam Les Innovations Europeennes A Decouvrir

May 24, 2025