Trade War And Crypto: Identifying A Potential Winner

Table of Contents

Trade Wars and Market Volatility

Impact of Trade Wars on Traditional Markets

Trade wars inject significant uncertainty into global markets. Imposed tariffs and trade restrictions disrupt established supply chains, leading to increased production costs and inflation. This uncertainty translates directly into stock market volatility, as investors react to shifting economic forecasts and potential losses. Currency devaluation is another common consequence, as trade disputes impact national economies and investor confidence.

- Examples: The US-China trade war of 2018-2020 saw significant market fluctuations, with both countries' stock markets experiencing periods of sharp decline. Specific sectors like technology and manufacturing were particularly hard hit by tariffs.

- Keywords: stock market volatility, currency devaluation, inflation, tariffs, trade restrictions, economic downturn

Safe Haven Assets During Economic Uncertainty

During times of economic turmoil, investors instinctively seek safe haven assets – investments perceived as relatively stable and less susceptible to market fluctuations. Traditionally, gold and other precious metals have held this position. The perceived stability of these assets stems from their inherent value and limited supply. However, their returns can be comparatively modest compared to other higher-risk assets.

- Why investors seek safe havens: Investors aim to protect their capital during times of uncertainty and minimize potential losses. Diversification into safe havens helps mitigate portfolio risk.

- Gold vs. other assets: While gold often performs well during periods of trade war uncertainty, its performance is not always guaranteed, and it can be susceptible to various other macroeconomic factors.

- Keywords: safe haven assets, gold, precious metals, diversification, portfolio protection, risk mitigation

Cryptocurrency as a Potential Winner

Decentralization and Geopolitical Risk

Cryptocurrencies, particularly Bitcoin, offer a compelling alternative due to their decentralized nature. Unlike traditional fiat currencies controlled by central banks, cryptocurrencies operate on blockchain technology, making them resistant to government control and manipulation. This inherent decentralization makes them less vulnerable to the geopolitical risks associated with trade wars and sanctions. Crypto can potentially bypass trade barriers and sanctions, offering a route for international transactions unconstrained by political tensions.

- Independence from government control: The decentralized structure of blockchain makes cryptocurrencies resistant to censorship and government intervention.

- Bypassing trade barriers: Crypto transactions can potentially occur across borders without being subject to the same restrictions as traditional financial transactions.

- Keywords: decentralization, blockchain technology, geopolitical risk, sanctions, censorship resistance, peer-to-peer transactions

Increased Demand for Crypto During Uncertainty

The uncertainty generated by trade wars can drive investors towards assets perceived as less correlated with traditional markets. Cryptocurrencies, with their unique characteristics, could be such an asset. As investor confidence in traditional markets wanes, there’s a potential for a “flight to safety” into cryptocurrencies, particularly stablecoins pegged to fiat currencies.

- Flight to safety: Investors may seek alternative investments to preserve their capital during market downturns.

- Stablecoins: Stablecoins offer relative price stability, making them an attractive alternative to highly volatile cryptocurrencies during times of uncertainty.

- Keywords: flight to safety, stablecoins, bitcoin price, altcoin market cap, investor sentiment, market correlation

Technological Advancements and Adoption

The ongoing development and adoption of cryptocurrencies are further strengthening their position. Improvements in blockchain scalability and infrastructure, such as the development of layer-2 solutions, address previous limitations. The increasing involvement of institutional investors also demonstrates growing confidence in the long-term viability of the crypto market. The rise of decentralized finance (DeFi) further expands the potential applications of cryptocurrency.

- Scaling solutions: Technological advancements aim to improve the speed and efficiency of cryptocurrency transactions.

- Institutional adoption: Large financial institutions are increasingly exploring and investing in the crypto market.

- Keywords: blockchain scalability, institutional adoption, DeFi, crypto regulation, technological advancement

Potential Risks and Considerations

Regulatory Uncertainty and Volatility

While cryptocurrencies present exciting opportunities, it's crucial to acknowledge the inherent risks. The cryptocurrency market is notoriously volatile, and price fluctuations can be dramatic. Regulatory uncertainty poses another significant risk, as governments worldwide are still grappling with how to regulate this nascent asset class. Different jurisdictions have varying regulatory approaches, creating a complex and potentially unpredictable environment for investors.

- Market Volatility: The crypto market is known for its significant price swings. Investors need to be prepared for potential losses.

- Regulatory Landscape: The lack of clear and consistent regulation globally presents challenges for investors.

- Keywords: crypto regulation, regulatory uncertainty, market volatility, risk management, investment risk

Conclusion: Trade War and Crypto: A Winning Strategy?

Trade wars create economic uncertainty, impacting traditional markets and driving investors towards safe haven assets. While gold remains a traditional choice, cryptocurrencies present a compelling alternative, offering decentralization, resistance to geopolitical risks, and the potential for increased demand during uncertain times. However, it’s crucial to remember that cryptocurrencies are highly volatile and subject to regulatory uncertainty. Therefore, while there’s a potential for trade war and crypto to be a winning combination for investors, thorough research, risk management, and diversification are crucial before investing in this space. Learn more about the intricacies of cryptocurrency investment and explore resources dedicated to responsible trading to make informed decisions. Consider carefully diversifying your portfolio; exploring the trade war and crypto relationship is only the first step.

Featured Posts

-

Stock Market Update Sensex And Nifty Surge Sectoral Analysis

May 09, 2025

Stock Market Update Sensex And Nifty Surge Sectoral Analysis

May 09, 2025 -

Early Childhood Development Should You Delay Daycare

May 09, 2025

Early Childhood Development Should You Delay Daycare

May 09, 2025 -

High Potential Episode Count Season 2 Release Date Speculation

May 09, 2025

High Potential Episode Count Season 2 Release Date Speculation

May 09, 2025 -

De Ligt To Inter Manchester United Defender Eyed In Loan To Buy Deal

May 09, 2025

De Ligt To Inter Manchester United Defender Eyed In Loan To Buy Deal

May 09, 2025 -

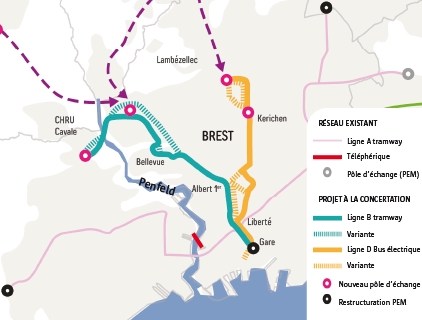

3e Ligne De Tram A Dijon La Concertation Citoyenne Est Lancee

May 09, 2025

3e Ligne De Tram A Dijon La Concertation Citoyenne Est Lancee

May 09, 2025