Trade War Fears Trigger 7% Drop In Amsterdam Stock Market Opening

Table of Contents

The Impact of Trade War Fears on Global Markets

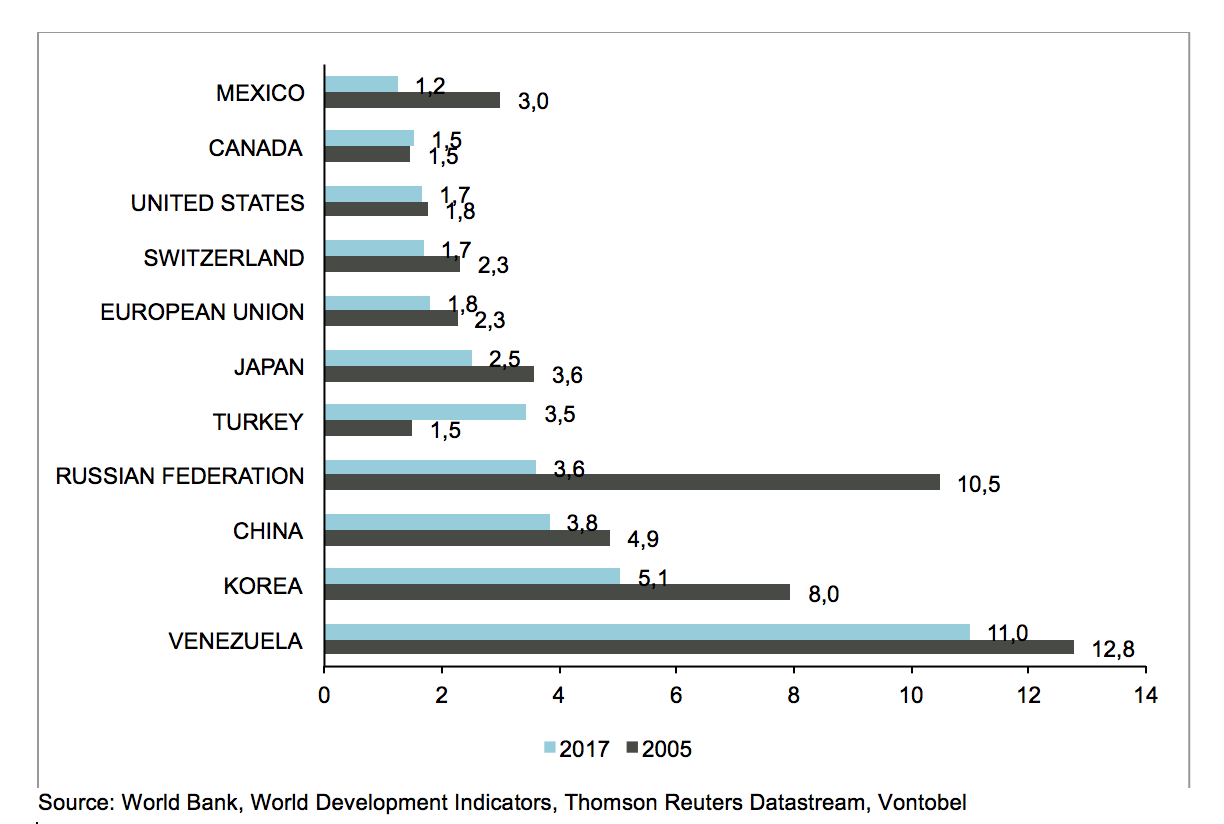

The current global trade environment is characterized by significant uncertainty, largely driven by escalating trade wars. These disputes, marked by the imposition of tariffs and trade restrictions, are creating a ripple effect across global markets. The resulting instability significantly impacts investor confidence.

- Increased tariffs impacting international trade flows: Higher tariffs increase the cost of imported goods, impacting both consumers and businesses. This disruption to the free flow of goods leads to reduced trade volume and economic slowdown.

- Supply chain disruptions and their effects on businesses: Trade wars disrupt established supply chains, forcing businesses to find alternative suppliers, often at higher costs. This leads to increased production costs and potential delays in product delivery.

- Investor sentiment and its impact on market confidence: Uncertainty surrounding trade policies creates a climate of fear and uncertainty among investors, leading to decreased investment and increased market volatility. Negative news about trade negotiations can trigger immediate sell-offs, as seen in the recent Amsterdam Stock Market crash.

- Examples of other markets affected by similar trade tensions: The impact isn't limited to Amsterdam. Other global markets, particularly those heavily reliant on exports or specific trade relationships, have also experienced significant downturns due to escalating trade tensions. This highlights the interconnected nature of the global economy and the systemic risk posed by trade wars.

This combination of factors contributes to market volatility and significant investor anxiety. The uncertainty surrounding future trade policies makes it difficult for businesses to plan for the future, leading to decreased investment and economic growth.

Amsterdam Stock Market's Specific Vulnerabilities

The Amsterdam Stock Market, while generally considered robust, possesses specific vulnerabilities that exacerbated the impact of the trade war fears.

- Reliance on export-oriented industries: A significant portion of the Dutch economy relies on exporting goods and services. Trade wars directly impact export-oriented businesses, leading to reduced revenues and potentially job losses.

- Dependence on specific trade partners affected by the trade war: The Netherlands has strong trade ties with countries involved in the current trade disputes. Disruptions in these relationships directly affect Dutch businesses and the Amsterdam Stock Market.

- The impact on specific sectors (e.g., technology, manufacturing): Sectors like technology and manufacturing, heavily reliant on international trade, are particularly vulnerable to the negative effects of trade wars. These sectors are significant components of the AEX index, making the Amsterdam Stock Market especially sensitive to trade disruptions.

- Comparison to other European markets' performance: While other European markets experienced some downturn, the 7% drop in the Amsterdam Stock Market was significantly steeper, highlighting its particular susceptibility to these specific trade anxieties.

The composition of the Amsterdam Stock Market, with its heavy reliance on export-driven industries and its interconnectedness with global trade flows, makes it particularly vulnerable to the uncertainties created by global trade wars. Understanding the Dutch economy's structure is key to comprehending the market's reaction.

Investor Response and Market Reactions

The sharp 7% drop in the Amsterdam Stock Market triggered significant investor reactions.

- Increased selling pressure: Investors rushed to sell their holdings, contributing to the rapid market decline. This selling pressure reflects a widespread sentiment of risk aversion.

- Flight to safety (e.g., investment in gold or government bonds): Many investors sought the perceived safety of assets such as gold and government bonds, considered less risky in times of market uncertainty. This "flight to safety" further exacerbated the selling pressure in the stock market.

- Impact on short-term and long-term investment strategies: The market downturn forced investors to reassess both short-term and long-term investment strategies. Many investors are likely to adopt a more cautious approach in the near term.

- Analyst comments and predictions: Market analysts are closely monitoring the situation, offering varying predictions on the market's future trajectory. Uncertainty remains high, and the market's recovery path is far from clear.

The immediate consequence was a significant market correction, highlighting the impact of risk aversion. The potential long-term consequences include slower economic growth and potentially further market volatility.

Potential Mitigation Strategies for Investors

Navigating this market instability requires a proactive approach. Investors should consider the following mitigation strategies:

- Diversification of investment portfolios: Spreading investments across different asset classes and geographical regions reduces the impact of any single market downturn.

- Risk management strategies: Employing risk management techniques, such as stop-loss orders, helps limit potential losses in volatile markets.

- Monitoring of global economic indicators: Closely following global economic news and indicators, including trade developments, helps in anticipating potential market movements.

- Long-term investment perspectives: Maintaining a long-term investment perspective is crucial, minimizing the impact of short-term market fluctuations.

Adopting these strategies can help investors mitigate the risks associated with the current market uncertainty and prepare for potential future shocks.

Conclusion

The 7% drop in the Amsterdam Stock Market at its opening serves as a stark reminder of the significant impact that trade war fears can have on even the most robust markets. The Amsterdam Stock Exchange’s heavy reliance on export-oriented industries and its interconnectedness with global trade partners made it particularly vulnerable to this recent downturn. This highlights the importance of understanding the specific vulnerabilities of different markets and adapting investment strategies accordingly. Investors must stay informed about global trade developments and adjust their portfolios to mitigate risks associated with future trade war fears. Seeking professional financial advice is crucial before making any significant investment decisions in the context of Amsterdam Stock Market volatility or broader global trade uncertainty. Understanding the Amsterdam Stock Market outlook requires a keen awareness of the ongoing impact of trade war anxieties. Careful planning and proactive risk management are essential for navigating the complexities of the current global economic landscape.

Featured Posts

-

Analisi Dei Prezzi Moda Dopo L Introduzione Dei Dazi Usa

May 24, 2025

Analisi Dei Prezzi Moda Dopo L Introduzione Dei Dazi Usa

May 24, 2025 -

Kak Izglezhda Konchita Vurst Dnes

May 24, 2025

Kak Izglezhda Konchita Vurst Dnes

May 24, 2025 -

Avrupa Borsalarinda Duesues Stoxx Europe 600 Ve Dax 40 In 16 Nisan 2025 Performansi

May 24, 2025

Avrupa Borsalarinda Duesues Stoxx Europe 600 Ve Dax 40 In 16 Nisan 2025 Performansi

May 24, 2025 -

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist Analysis And Interpretation

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist Analysis And Interpretation

May 24, 2025 -

Hot Wheels Ferrari New Releases Have Arrived Mamma Mia

May 24, 2025

Hot Wheels Ferrari New Releases Have Arrived Mamma Mia

May 24, 2025

Latest Posts

-

Gambling On Calamity The Los Angeles Wildfires And Societal Shifts

May 24, 2025

Gambling On Calamity The Los Angeles Wildfires And Societal Shifts

May 24, 2025 -

Last Minute Rush China Us Trade Volume Explodes Before Trade Truce

May 24, 2025

Last Minute Rush China Us Trade Volume Explodes Before Trade Truce

May 24, 2025 -

French Prosecutors Najib Razaks Role In 2002 Submarine Scandal

May 24, 2025

French Prosecutors Najib Razaks Role In 2002 Submarine Scandal

May 24, 2025 -

Is Betting On Wildfires The New Normal The Case Of Los Angeles

May 24, 2025

Is Betting On Wildfires The New Normal The Case Of Los Angeles

May 24, 2025 -

China Us Trade Deal The Final Push Before The Deadline

May 24, 2025

China Us Trade Deal The Final Push Before The Deadline

May 24, 2025