Trade War Uncertainty Fuels Gold Price Rally: A Safe Haven Investment?

Table of Contents

The Impact of Trade Wars on Global Markets

Trade wars introduce significant uncertainty and volatility into global markets. Imposed tariffs and retaliatory measures disrupt established supply chains, increase production costs, and stifle international trade. This uncertainty erodes investor confidence, leading to increased risk aversion. Investors often seek safer, more stable assets as a protective measure against potential market downturns.

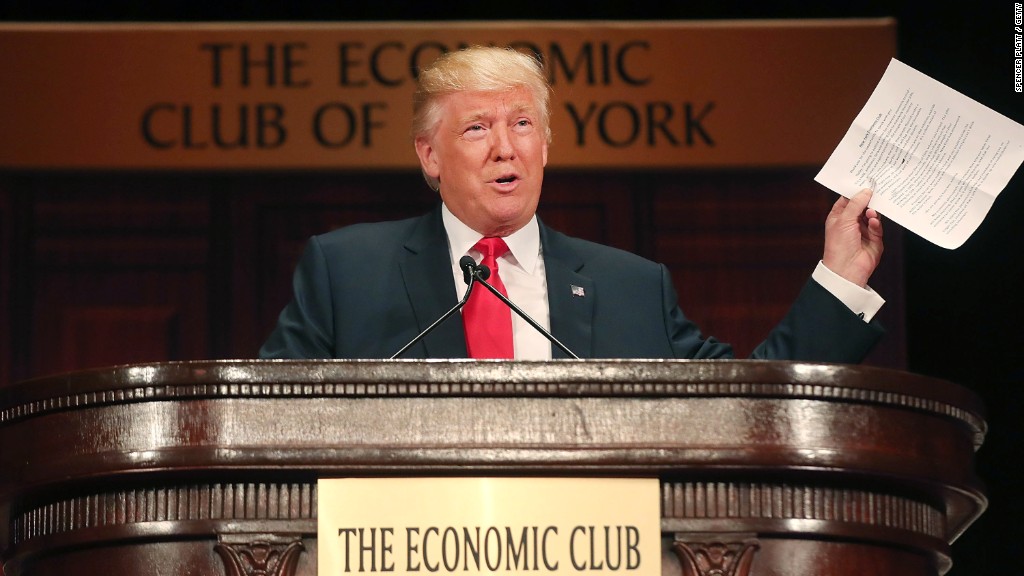

Recent trade disputes, such as the ongoing tensions between the US and China, provide clear examples of this impact. These disputes have:

- Impact on stock markets: Created significant market volatility, with sharp fluctuations in stock prices across various sectors.

- Currency fluctuations: Led to unpredictable movements in exchange rates, increasing the risk for businesses involved in international trade.

- Increased inflation concerns: Contributed to fears of rising inflation as tariffs increase the cost of imported goods.

Gold as a Safe Haven Asset

Throughout history, gold has served as a reliable safe haven asset during periods of economic and political turmoil. Its enduring appeal stems from several key characteristics:

- Limited Supply: Gold's finite supply makes it a scarce commodity, inherently increasing its value during times of uncertainty.

- Tangible Asset: Unlike paper currencies or digital assets, gold is a physical asset that can be held and stored, offering a sense of security to investors.

- Non-correlated with other assets: Gold often moves independently of traditional asset classes like stocks and bonds, providing diversification benefits to investors seeking to reduce overall portfolio risk.

Gold offers several compelling advantages during periods of risk aversion:

- Hedging against inflation: Gold's value tends to rise during inflationary periods, acting as a hedge against the erosion of purchasing power.

- Protection against currency devaluation: Gold can safeguard against currency fluctuations and devaluation, providing a stable store of value.

- Portfolio diversification: Including gold in a diversified investment portfolio can help reduce overall risk and potentially improve long-term returns.

Analyzing the Recent Gold Price Rally

Recent months have witnessed a notable increase in gold prices, closely mirroring the escalation of trade tensions. (Insert chart or graph showing gold price increase correlated with trade war events here). The correlation between rising trade uncertainty and increasing gold prices is undeniable. However, it's crucial to acknowledge other factors contributing to this rally:

- Specific price data points: Highlight key dates and price movements, emphasizing the relationship with specific trade war events.

- Correlation analysis between trade tensions and gold price: Quantify the correlation using statistical measures (e.g., correlation coefficient).

- Analysis of other influencing factors: Discuss the role of interest rate changes, geopolitical instability, and other market forces.

Risks and Considerations of Investing in Gold

While gold offers significant potential benefits, it's essential to acknowledge inherent risks:

- Risk of price fluctuations: Gold prices are subject to volatility, and investors could experience losses if prices decline.

- Comparison of different investment vehicles: Investors can access gold through various means: physical gold, gold ETFs (Exchange Traded Funds), and gold mining stocks, each with its own set of risks and rewards.

- Importance of diversification: Diversification remains crucial. Investing solely in gold is risky. A balanced portfolio incorporating other asset classes can mitigate potential losses.

Trade War Uncertainty and the Gold Market: A Final Verdict

The connection between trade war uncertainty, heightened risk aversion, and the subsequent gold price rally is clear. Gold's role as a potential safe haven asset is supported by historical trends and current market dynamics. However, it's crucial to remember that gold's performance is not guaranteed, and price fluctuations are inherent. A balanced approach is key.

Assess your current portfolio's risk tolerance and consider incorporating gold investments as part of a diversified strategy to navigate trade war uncertainty. Learn more about strategic gold investments and how they can benefit your portfolio in times of global economic instability. Don't let trade war uncertainty leave your investments vulnerable – explore the potential of gold as part of a robust investment strategy.

Featured Posts

-

Callaway Parker Delivered To Ptc By Verret Waterways Journal Update

Apr 26, 2025

Callaway Parker Delivered To Ptc By Verret Waterways Journal Update

Apr 26, 2025 -

European Stock Market Outlook Strategists Turn Pessimistic Amid Trump Trade War

Apr 26, 2025

European Stock Market Outlook Strategists Turn Pessimistic Amid Trump Trade War

Apr 26, 2025 -

Trumps Economic Policies Increased Difficulty For The Next Federal Reserve Chair

Apr 26, 2025

Trumps Economic Policies Increased Difficulty For The Next Federal Reserve Chair

Apr 26, 2025 -

Zuckerbergs Next Chapter Navigating A Trump Presidency

Apr 26, 2025

Zuckerbergs Next Chapter Navigating A Trump Presidency

Apr 26, 2025 -

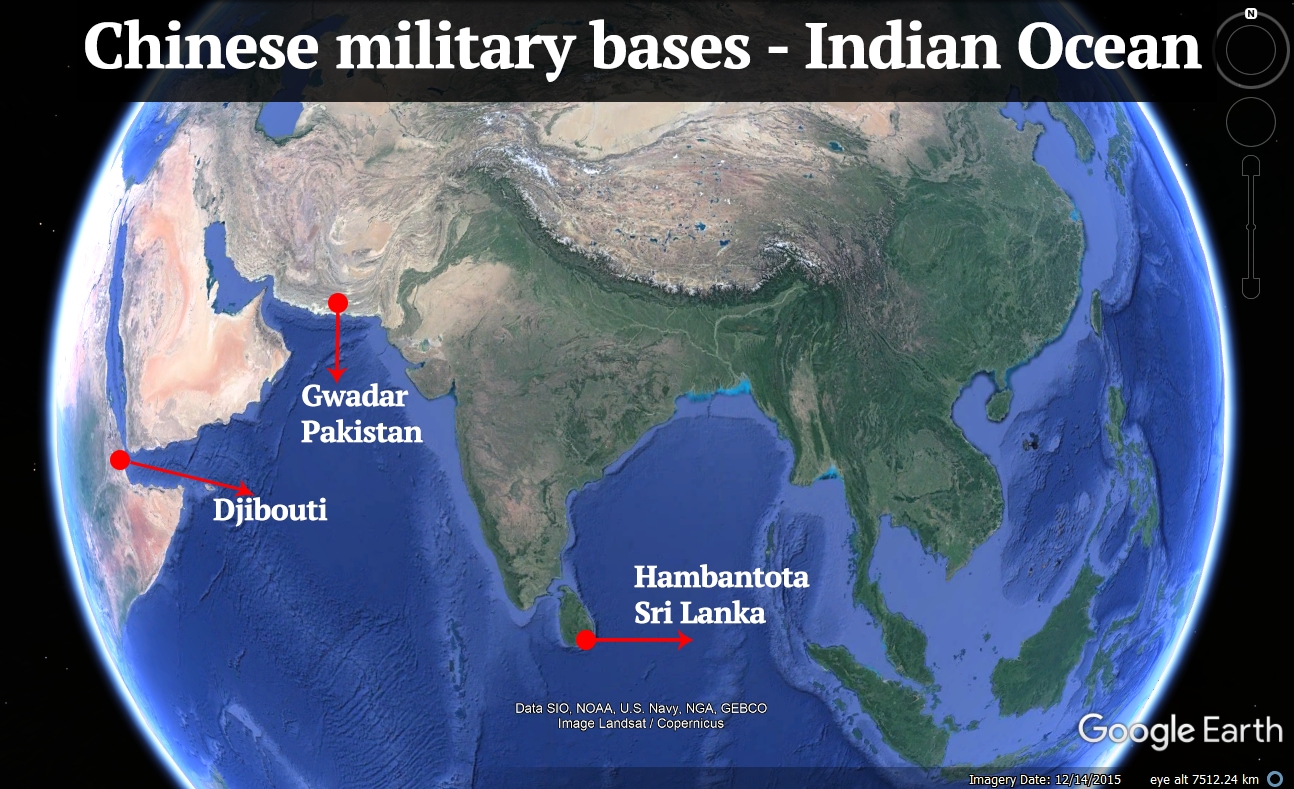

Geopolitical Showdown A Us Military Base And The China Challenge

Apr 26, 2025

Geopolitical Showdown A Us Military Base And The China Challenge

Apr 26, 2025

Latest Posts

-

Rihannas Savage X Fenty Lingerie Perfect For Your Wedding Night

May 06, 2025

Rihannas Savage X Fenty Lingerie Perfect For Your Wedding Night

May 06, 2025 -

Four Seasons On Netflix First Look At Fey Carell And Domingo

May 06, 2025

Four Seasons On Netflix First Look At Fey Carell And Domingo

May 06, 2025 -

Where To Stream Colman Domingos Oscar Nominated A24 Movie

May 06, 2025

Where To Stream Colman Domingos Oscar Nominated A24 Movie

May 06, 2025 -

Rihannas Savage X Fenty Wedding Night Lingerie Campaign

May 06, 2025

Rihannas Savage X Fenty Wedding Night Lingerie Campaign

May 06, 2025 -

Colman Domingos A24 Film 97 Rt Your Guide To Streaming

May 06, 2025

Colman Domingos A24 Film 97 Rt Your Guide To Streaming

May 06, 2025