Trump And Cheap Oil: Examining The Tensions Within The Energy Sector

Table of Contents

Trump's Energy Policies and Their Impact on Oil Prices

The Trump administration's approach to energy policy significantly impacted oil prices, primarily through deregulation and a push for "energy dominance."

Deregulation and Increased Domestic Production

Deregulation under the Trump administration led to a surge in US oil production, particularly shale oil. This was achieved through:

- Increased drilling permits: The administration eased restrictions on drilling on federal lands, accelerating the pace of shale oil extraction.

- Reduced environmental regulations: Rollbacks of environmental protections, such as those related to methane emissions and water pollution, lowered the cost of oil production.

- Impact on employment in the oil and gas industry: The boom in domestic production created thousands of jobs in the oil and gas sector, boosting economic activity in certain regions.

This combination of factors contributed to increased supply, exerting downward pressure on global oil prices. The resulting "Trump administration oil policy" of deregulation had a profound effect on the global market, significantly impacting the "deregulation impact on oil prices" and bolstering "shale oil production."

The "Energy Dominance" Agenda

Central to the Trump administration's energy strategy was the goal of "energy dominance"—reducing reliance on foreign oil and becoming a net energy exporter. This ambition influenced oil production and pricing strategies in several ways:

- Emphasis on fossil fuels: The administration prioritized fossil fuel development over renewable energy sources, leading to increased investment in oil and gas infrastructure.

- Reduced reliance on foreign oil: Increased domestic production aimed to lessen US dependence on OPEC nations, reducing vulnerability to geopolitical instability.

- Impact on international relations with OPEC: The administration's approach sometimes led to strained relationships with OPEC, as increased US production impacted global oil prices and market share.

The pursuit of "energy dominance" under "Trump's energy policy" significantly impacted the global energy market, creating both opportunities and challenges in its relationship with "OPEC and Trump."

International Relations and Oil Market Volatility

Trump's foreign policy significantly influenced oil market volatility through his interactions with OPEC and other oil-producing nations and his initiation of trade wars.

Relationships with OPEC and Other Oil-Producing Nations

The Trump administration's relationships with OPEC nations, particularly Saudi Arabia, played a crucial role in shaping global oil supply and prices:

- Negotiations with Saudi Arabia: The administration engaged in direct negotiations with Saudi Arabia to influence oil production levels and stabilize prices.

- Impact of sanctions on Iran and Venezuela: US sanctions on Iran and Venezuela disrupted oil supplies from these major producers, contributing to price fluctuations.

- Effect on global oil markets: The combined effects of these actions created uncertainty and volatility in the global oil market, making it difficult to predict future prices.

This complex interplay between "Trump OPEC relations" and global geopolitics underscores the significant role international relations play in determining "oil price volatility" and influencing the "international oil market."

Trade Wars and Their Influence on Energy Markets

The Trump administration's trade wars also impacted the global energy landscape, including the oil sector:

- Tariffs on imported goods: Tariffs on imported steel and aluminum, for example, increased the cost of building and maintaining energy infrastructure.

- Potential disruption of supply chains: Trade disputes could disrupt the supply chains necessary for the global energy industry, potentially leading to shortages.

- Impact on energy investment: Uncertainty created by trade wars could deter investment in the energy sector, slowing down the development of new projects.

The "trade wars and oil prices" demonstrated how "Trump's trade policy" could inadvertently impact "global energy security," highlighting the interconnectedness of global trade and the energy market.

Economic and Environmental Consequences of Cheap Oil under Trump

The era of "cheap oil" under Trump had both positive and negative economic and environmental consequences.

Benefits and Drawbacks of Low Oil Prices

Low oil prices had a mixed impact on different sectors of the economy:

- Lower fuel costs for consumers: Consumers benefited from lower gasoline prices, freeing up disposable income for other spending.

- Impact on the profitability of oil companies: Oil companies experienced reduced profitability due to lower oil prices, leading to job cuts and reduced investment.

- Environmental implications: While low prices benefited consumers, the increased demand resulting from cheap oil led to increased carbon emissions and environmental concerns.

The "cheap oil benefits" were not universally distributed, with "economic impact of low oil prices" varying significantly across different sectors, and the "environmental impact of cheap oil" becoming a significant concern.

The Paradox of Cheap Oil and Environmental Concerns

A key paradox of the Trump administration's energy policy was the tension between the economic benefits of low oil prices and the associated environmental damage:

- Increased carbon emissions: Increased consumption of fossil fuels led to higher carbon emissions, exacerbating climate change concerns.

- Climate change concerns: The administration's focus on fossil fuels clashed with the growing global concern over climate change and the need for a transition to renewable energy.

- Conflicting policy goals: The pursuit of economic growth through increased fossil fuel production conflicted with environmental protection goals, creating policy contradictions.

The "cheap oil and environment" debate highlighted the inherent conflict between "climate change and oil production" and the need for a more "sustainable energy" future.

Conclusion

The relationship between "Trump and cheap oil" was complex and multifaceted, characterized by deregulation, a focus on energy dominance, and volatile international relations. While the administration's policies led to increased domestic oil production and lower prices for consumers, they also created challenges in terms of international relations, environmental protection, and the long-term sustainability of the energy sector. Key takeaways include the significant impact of deregulation on oil prices, the complexities of navigating international relations in the global energy market, and the inherent tension between economic growth and environmental sustainability. Understanding the complex relationship between Trump and cheap oil requires further investigation. Continue your research to form your own informed opinion on the lasting effects of this administration's energy policies, exploring "Trump's legacy on oil prices," "understanding the Trump administration's energy policy," and "the future of oil under changing administrations."

Featured Posts

-

Virginia Giuffres Car Crash Prince Andrew Accuser Facing Life Threatening Situation

May 12, 2025

Virginia Giuffres Car Crash Prince Andrew Accuser Facing Life Threatening Situation

May 12, 2025 -

Could Henry Cavill Become Marvels Nova A Look At The Rumor Mill

May 12, 2025

Could Henry Cavill Become Marvels Nova A Look At The Rumor Mill

May 12, 2025 -

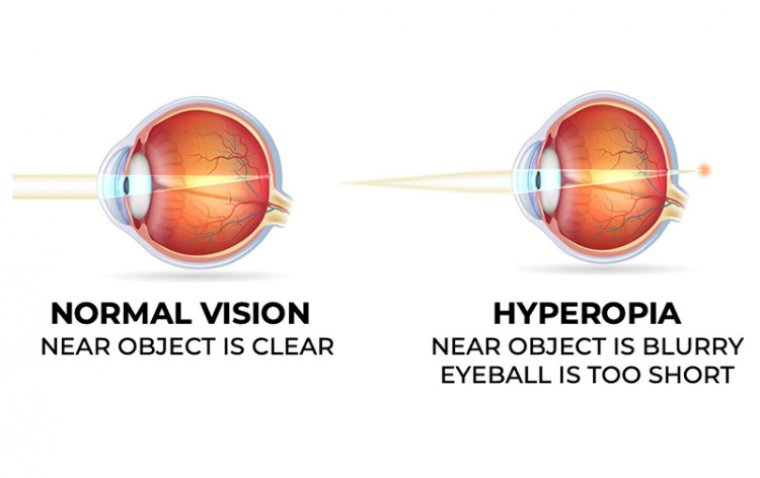

Bilateral Anophthalmia Understanding This Rare Condition Affecting Newborn Babies

May 12, 2025

Bilateral Anophthalmia Understanding This Rare Condition Affecting Newborn Babies

May 12, 2025 -

Calvin Kleins New Campaign With Lily Collins Images And Details

May 12, 2025

Calvin Kleins New Campaign With Lily Collins Images And Details

May 12, 2025 -

Karlyn Pickens 78 2 Mph Fastball A New Standard In Ncaa Softball

May 12, 2025

Karlyn Pickens 78 2 Mph Fastball A New Standard In Ncaa Softball

May 12, 2025

Latest Posts

-

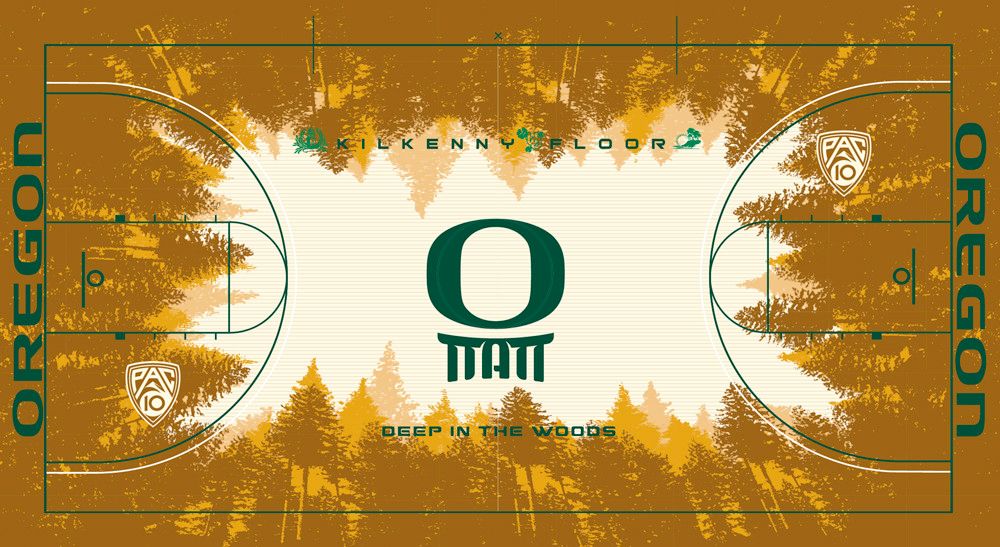

University Of Oregon Basketball Graves New Australian Addition

May 13, 2025

University Of Oregon Basketball Graves New Australian Addition

May 13, 2025 -

City Town Name Obituaries Those We Ve Lost Recently

May 13, 2025

City Town Name Obituaries Those We Ve Lost Recently

May 13, 2025 -

Graves Lands Promising Aussie Recruit For Ducks

May 13, 2025

Graves Lands Promising Aussie Recruit For Ducks

May 13, 2025 -

Community Protest Erupts During Trumps State Of The Union Address

May 13, 2025

Community Protest Erupts During Trumps State Of The Union Address

May 13, 2025 -

Obituaries For City Town Name Recent Losses

May 13, 2025

Obituaries For City Town Name Recent Losses

May 13, 2025