Trump-Era Tariffs: Winners And Losers In US Manufacturing

Table of Contents

Winners of Trump-Era Tariffs

While the overall economic impact of Trump-era tariffs remains a subject of debate, certain sectors experienced noticeable benefits.

The Steel and Aluminum Industries

Significant tariffs were imposed on steel and aluminum imports, aiming to protect domestic producers. This resulted in:

- Increased domestic production: US steel and aluminum mills saw a surge in production as imported materials became more expensive. While precise figures vary depending on the specific product and year, some reports indicated a notable increase in output.

- Higher steel and aluminum prices: The reduced supply of imported materials led to higher prices for these crucial commodities, boosting the profitability of domestic producers.

- Job growth in certain regions: The increased production led to job creation in some regions with significant steel and aluminum manufacturing, particularly in states like Pennsylvania and Ohio.

- Challenges faced by downstream industries: However, the higher prices for steel and aluminum created challenges for downstream industries that relied on these materials as inputs, increasing their production costs and potentially harming their competitiveness.

These effects highlight the complex interplay between protectionist measures and their broader economic ramifications. Analyzing the effects of steel tariffs and aluminum tariffs requires considering both the immediate gains for domestic producers and the ripple effects throughout the supply chain.

Certain Agricultural Sectors (with caveats)

Some agricultural sectors initially benefited from retaliatory tariffs imposed by other countries on their exports. For instance:

- Government subsidies: Farmers received government subsidies to compensate for reduced exports to certain markets due to retaliatory tariffs.

- Increased domestic consumption: Import restrictions on some agricultural products led to increased domestic consumption, providing a partial offset to export losses.

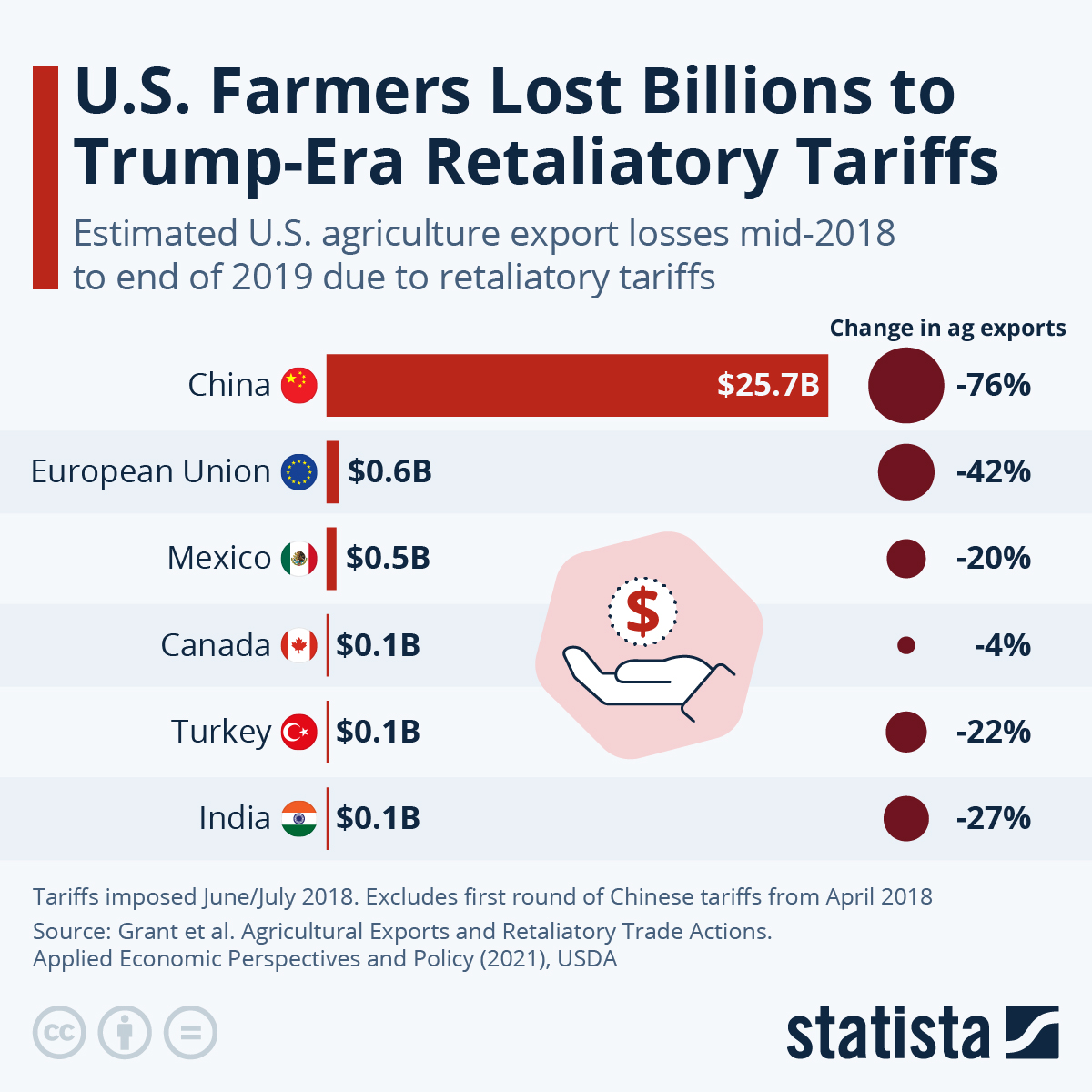

- Challenges from retaliatory tariffs: However, many agricultural sectors faced significant challenges due to retaliatory tariffs imposed by trading partners. For example, the soybean industry was significantly impacted by tariffs imposed by China. The effects of soybean tariffs showcased the vulnerability of relying on a single, major export market.

The impact of agricultural tariffs was highly variable, depending on the specific product and the countries involved. The interplay of government subsidies and retaliatory tariffs created a complex and often unpredictable scenario for many farmers.

Some Domestic Manufacturers of Substitutable Goods

Companies producing goods that could substitute for imported goods saw increased opportunities:

- Increased market share: As imported goods became more expensive, domestic manufacturers of substitutable goods gained market share.

- Investment in domestic production: The increased demand prompted investment in expanding domestic production capacity.

- Potential for long-term growth: For some companies, this period represented a chance for long-term growth and market consolidation.

- Challenges in competing on price: However, even with increased market share, domestic producers often faced challenges in competing on price with lower-cost imports in the long run.

The success of domestic manufacturers in this context depended largely on their ability to quickly adapt to changing market conditions and invest in their production capabilities.

Losers of Trump-Era Tariffs

While some sectors benefited, many others experienced significant negative consequences.

Manufacturing Sectors Relying on Imported Inputs

Industries heavily reliant on imported raw materials or components faced severe challenges:

- Increased production costs: The tariffs on imported inputs dramatically increased production costs for many manufacturers.

- Reduced competitiveness: These higher costs made many US manufacturers less competitive in global markets.

- Job losses in some sectors: As a result, some sectors experienced job losses, particularly those with slim profit margins.

- Higher consumer prices for finished goods: The increased input costs were often passed on to consumers in the form of higher prices for finished goods.

The disruptions to global supply chains caused by Trump-era tariffs significantly impacted many manufacturing sectors, highlighting the interconnectedness of global trade.

Consumers

Consumers felt the impact of Trump-era tariffs through higher prices:

- Higher prices for imported goods: Tariffs directly increased the price of many imported goods, reducing consumer purchasing power.

- Reduced purchasing power: This rise in prices, particularly for essential goods, eroded consumers' purchasing power.

- Potential impact on inflation: The widespread increase in prices had a potential impact on overall inflation rates.

The burden of these tariffs fell disproportionately on lower-income consumers who spend a larger percentage of their income on goods affected by the tariffs.

Small and Medium-Sized Businesses (SMBs)

Small and medium-sized businesses were particularly vulnerable to the negative impacts:

- Higher input costs: The increased cost of imported inputs disproportionately impacted SMBs with limited financial resources.

- Difficulty competing with larger companies: SMBs found it harder to absorb higher costs and compete effectively against larger, more established companies.

- Potential business closures: Some SMBs were forced to close due to the increased costs and reduced competitiveness.

The impact of Trump-era tariffs on SMBs underscored the vulnerability of smaller businesses to major economic shifts.

Conclusion

The Trump-era tariffs had an uneven impact on US manufacturing, creating clear winners and losers across various sectors. While some industries, like steel and aluminum, experienced short-term gains, many others, including those relying on imported inputs and consumers, faced increased costs and reduced competitiveness. Small and medium-sized businesses were particularly hard-hit. Understanding the complex legacy of Trump-era tariffs is crucial for policymakers and businesses alike. Further research into the long-term effects of these tariffs on US manufacturing is needed to inform future trade policy and mitigate potential negative consequences. Analyzing the lasting impact of Trump-era tariffs remains essential for navigating the complexities of global trade.

Featured Posts

-

Patrick Schwarzenegger Responds To Nepotism Accusations After White Lotus Role

May 06, 2025

Patrick Schwarzenegger Responds To Nepotism Accusations After White Lotus Role

May 06, 2025 -

The Impact Of Staffing Shortages On Newark Airport Operations

May 06, 2025

The Impact Of Staffing Shortages On Newark Airport Operations

May 06, 2025 -

Ddgs Dont Take My Son A Diss Track Targeting Halle Bailey

May 06, 2025

Ddgs Dont Take My Son A Diss Track Targeting Halle Bailey

May 06, 2025 -

Trumps Constitution Comments I Dont Know

May 06, 2025

Trumps Constitution Comments I Dont Know

May 06, 2025 -

Guevenilirlik Ve Koku Olumsuz Alginin Oenlenmesi

May 06, 2025

Guevenilirlik Ve Koku Olumsuz Alginin Oenlenmesi

May 06, 2025

Latest Posts

-

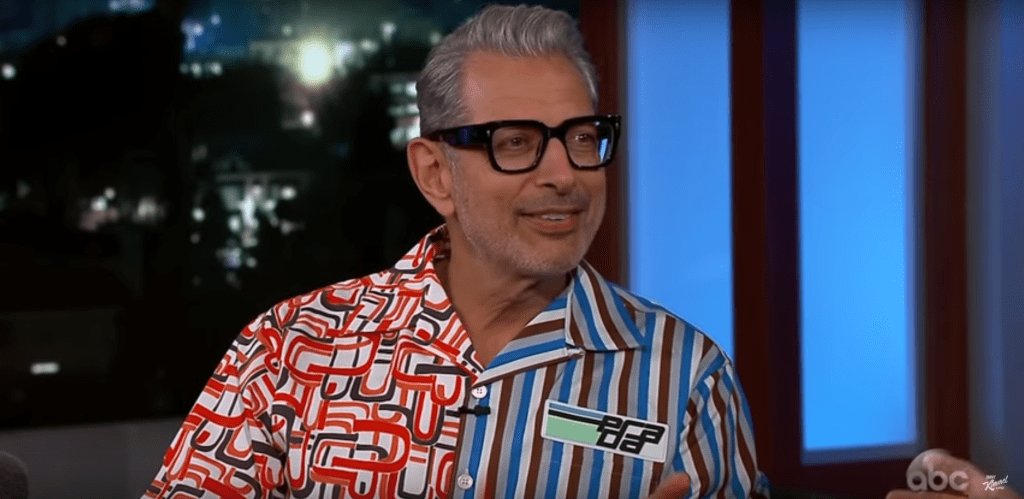

Jeff Goldblum Releases Unexpected New Music Album

May 06, 2025

Jeff Goldblum Releases Unexpected New Music Album

May 06, 2025 -

Jeff Goldblums New Album A Surprising Musical Turn

May 06, 2025

Jeff Goldblums New Album A Surprising Musical Turn

May 06, 2025 -

The One Thing Jeff Goldblum Never Experienced A Candid Confession

May 06, 2025

The One Thing Jeff Goldblum Never Experienced A Candid Confession

May 06, 2025 -

Jeff Goldblum Opens Up The One Thing Missing From His Life

May 06, 2025

Jeff Goldblum Opens Up The One Thing Missing From His Life

May 06, 2025 -

Listen Now Ariana Grande And Jeff Goldblums I Dont Know Why

May 06, 2025

Listen Now Ariana Grande And Jeff Goldblums I Dont Know Why

May 06, 2025