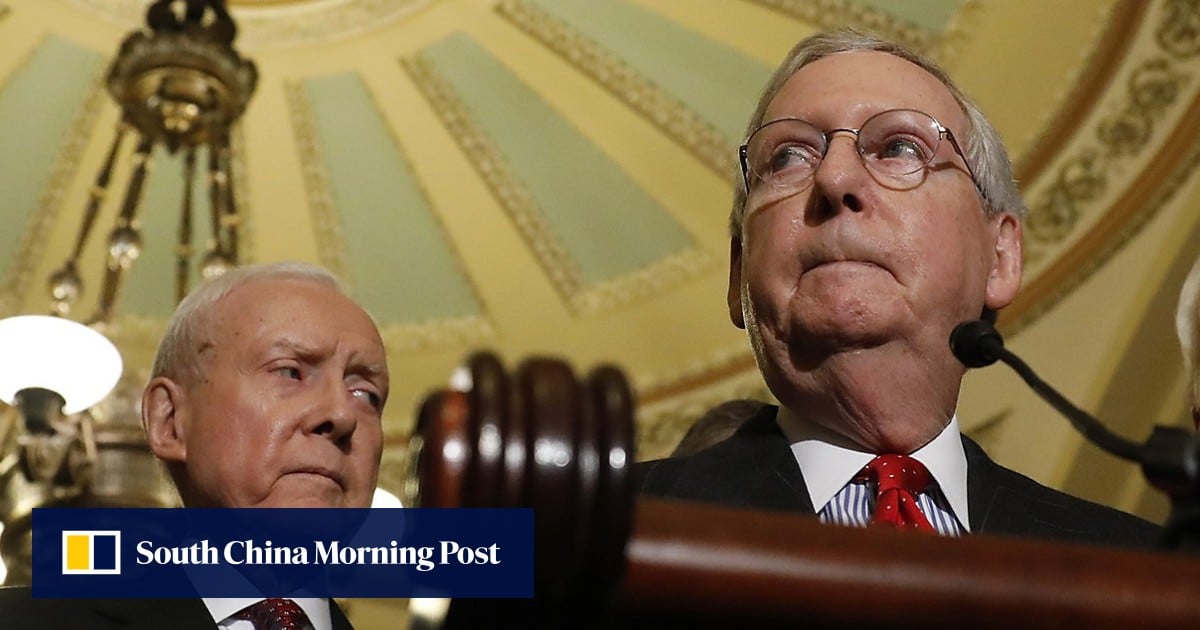

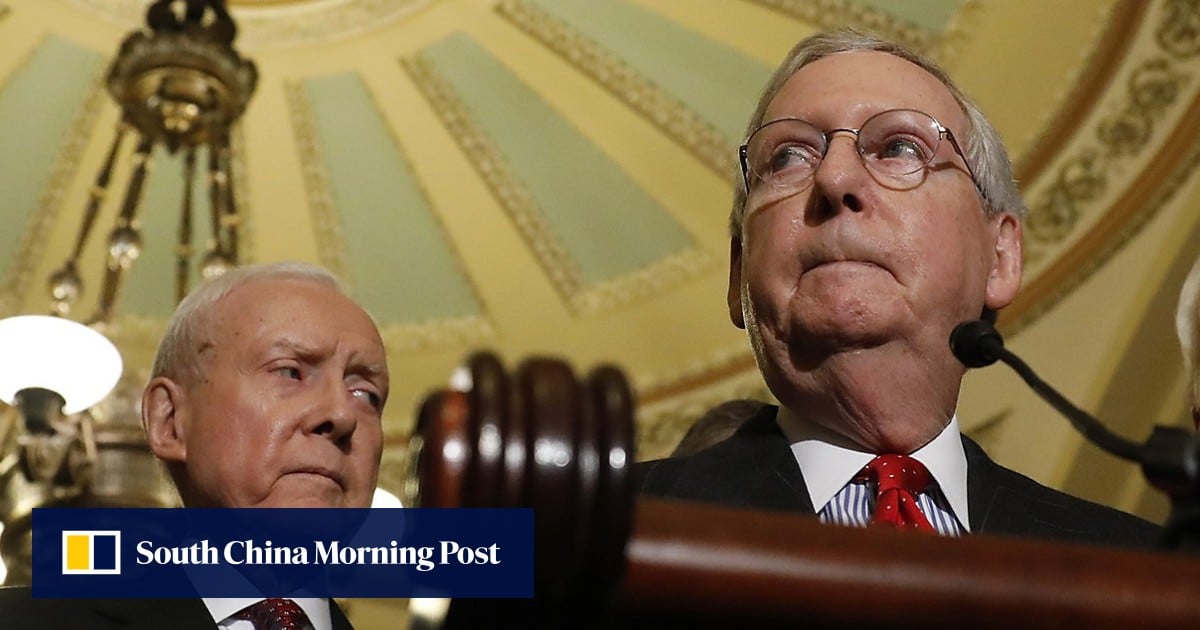

Trump Tax Cut Bill: House Republicans Release Details

Table of Contents

Individual Tax Rate Changes

The Trump Tax Cut Bill proposed significant changes to individual income tax brackets. Understanding these changes is key to assessing the bill's impact on your personal finances.

Proposed Changes to Brackets

The proposed bill aimed to simplify the tax brackets and lower rates. While specific numbers varied depending on the version of the bill, a common proposal was a reduction in the number of brackets and a lowering of the top marginal tax rate. For example, a proposed change might have reduced the top bracket from 39.6% to 35%, impacting high-income earners significantly. These changes would have resulted in varying degrees of tax savings or increases depending on individual income levels.

- Example: A taxpayer earning $200,000 annually might see a tax reduction of several thousand dollars under the proposed changes. Conversely, a taxpayer earning $50,000 might experience a smaller tax decrease or no change at all.

Standard Deduction and Personal Exemptions

The Trump Tax Cut Bill also proposed significant changes to the standard deduction and personal exemptions. A key element was a substantial increase in the standard deduction amounts for all filing statuses.

- Increased Standard Deduction: The proposed bill significantly raised the standard deduction for single filers, married couples filing jointly, and heads of households. This change aimed to simplify tax preparation and potentially benefit many taxpayers who previously itemized deductions.

- Elimination of Personal Exemptions: In many versions of the bill, personal exemptions were eliminated. This meant that taxpayers could no longer claim deductions for themselves or their dependents. The increased standard deduction was intended to offset this loss for many. The impact varied greatly depending on individual circumstances.

Child Tax Credit Modifications

The proposed Trump Tax Cut Bill included modifications to the Child Tax Credit (CTC), making it more beneficial for many families.

- Increased Credit Amount: The bill sought to increase the amount of the child tax credit. This would have provided a larger tax break for families with children.

- Expanded Eligibility: Some proposals aimed to broaden the eligibility requirements for the CTC, ensuring that more families could benefit from the credit. This included possible adjustments to income limits.

Corporate Tax Rate Reductions

A central feature of the Trump Tax Cut Bill was a substantial reduction in the corporate tax rate. This had significant implications for businesses of all sizes.

Proposed Corporate Tax Rate

The most widely discussed proposal was a reduction in the corporate tax rate from 35% to 21%. This dramatic decrease aimed to boost business investment and stimulate economic growth.

- Increased Competitiveness: Proponents argued that the lower rate would make American businesses more competitive globally, attracting investment and creating jobs.

- Increased Profits: The reduction was expected to significantly increase corporate profits, potentially leading to higher stock prices and increased dividends for shareholders.

Impact on Small Businesses

The proposed changes had a considerable impact on small businesses, many of which are structured as pass-through entities (sole proprietorships, partnerships, S corporations, and LLCs).

- Pass-Through Deductions: The bill included provisions to help small businesses through deductions for pass-through income. This aimed to offer tax relief and encourage small business growth.

- Simplified Tax Filing: While not a direct tax cut, streamlining tax procedures for small businesses was viewed as a secondary benefit, reducing the administrative burden on owners.

International Tax Implications

The Trump Tax Cut Bill also contained provisions related to international taxation.

- Repatriation Tax Holiday: Some proposals included a temporary reduction in taxes on repatriated profits – money earned overseas and brought back to the U.S. This aimed to incentivize companies to bring back money held offshore.

- Foreign Tax Credits: Changes to foreign tax credits might have had both positive and negative impacts on multinational corporations, affecting how they manage their international tax obligations.

Potential Economic Consequences

The Trump Tax Cut Bill had far-reaching potential consequences for the U.S. economy. Analyzing these impacts is crucial for understanding the bill's overall effectiveness.

Projected Impact on GDP Growth

Economists offered differing predictions on the bill's impact on GDP growth.

- Stimulus Effect: Supporters argued that the tax cuts would stimulate economic activity, leading to higher GDP growth through increased consumer spending and business investment.

- Varying Forecasts: However, the magnitude of this effect was subject to considerable debate, with forecasts varying widely depending on the underlying economic models used.

National Debt Implications

A major concern surrounding the tax cuts was their potential impact on the national debt.

- Increased Deficit: The substantial revenue loss from the tax cuts was projected to increase the federal budget deficit significantly.

- Long-Term Concerns: Critics raised concerns about the long-term sustainability of the debt and the potential for higher interest rates in the future.

Impact on Income Inequality

The effect of the tax cuts on income inequality was a highly debated topic.

- Benefiting High-Income Earners: Critics argued that the cuts disproportionately benefited high-income individuals and corporations, exacerbating income inequality.

- Trickle-Down Economics: Supporters countered that the tax cuts would stimulate the economy, ultimately benefiting all income groups through job creation and increased investment.

Conclusion

The Trump Tax Cut Bill, as detailed by House Republicans, presented significant changes to the U.S. tax code. Understanding the proposed modifications to individual and corporate tax rates, as well as the potential economic consequences, is vital for navigating the financial landscape. This bill's impact on various income groups and businesses was complex and far-reaching. Further analysis and debate are necessary to fully understand its long-term consequences. Stay informed about updates to the Trump Tax Cut Bill and its potential impact on your financial future by regularly consulting reputable financial news sources. For more detailed information, refer to the official government documentation on the proposed legislation.

Featured Posts

-

Dutch Bicycle Thefts Reach All Time High In Amsterdam

May 13, 2025

Dutch Bicycle Thefts Reach All Time High In Amsterdam

May 13, 2025 -

Doom The Dark Ages Your Essential Resource

May 13, 2025

Doom The Dark Ages Your Essential Resource

May 13, 2025 -

No 10 Oregons Overtime Win Against No 7 Vanderbilt In Womens Ncaa Tournament

May 13, 2025

No 10 Oregons Overtime Win Against No 7 Vanderbilt In Womens Ncaa Tournament

May 13, 2025 -

Chris Evans And Scarlett Johansson Co Star Chemistry And Mutual Admiration

May 13, 2025

Chris Evans And Scarlett Johansson Co Star Chemistry And Mutual Admiration

May 13, 2025 -

Dot Secretary Blames Biden For Air Traffic Control Issues Newark Flights Delayed

May 13, 2025

Dot Secretary Blames Biden For Air Traffic Control Issues Newark Flights Delayed

May 13, 2025