Trump's Tariff Decision: 8% Stock Market Surge On Euronext Amsterdam

Table of Contents

Understanding the Initial Tariff Announcement and Market Reaction

The initial announcement of Trump's tariff policy, focusing on [insert specific goods or sectors initially targeted], created widespread apprehension among European market analysts. The anticipated negative impact was significant, fueled by fears of a wider trade war and escalating protectionist measures.

- Initial market predictions of losses: Pre-announcement forecasts pointed towards a considerable downturn in European stock markets, particularly impacting export-oriented sectors.

- Sectors most vulnerable to tariffs: The automotive, technology, and agricultural sectors were identified as the most vulnerable, with predictions of substantial job losses and reduced competitiveness.

- Analyst quotes predicting market downturn: Leading financial analysts warned of increased market volatility and significant losses, citing the potential for retaliatory tariffs from the EU and a general decline in global trade.

Market performance before the announcement reflected this anxiety, with a noticeable decline in major European stock indices and increased volatility in the days leading up to the official statement. The term "trade war" dominated financial news headlines, reflecting the widespread fear of a damaging escalation in global trade tensions.

The Unexpected Twist: Revised Tariff Policy and its Implications

The unexpected positive market reaction stemmed from a significant revision to Trump's initial tariff policy. Instead of the expected escalation, the revised policy [explain the specific changes, e.g., reduced tariff rates, exemption of certain sectors, or a focus on different target industries]. This unexpected shift caught many analysts off guard.

- Specific changes to tariff rates or targeted industries: Detail the exact changes here, referencing official statements or reports. For example, "The revised policy reduced tariffs on automobiles by 10% and completely exempted agricultural products from the initial sanctions."

- Explanation of the reasons behind the policy shift: Analyze potential reasons for this change, considering factors such as political pressure, newly available economic data, or a shift in negotiating strategy.

- Mention any statements made by Trump or his administration: Include direct quotes if available to support the explanation of the policy shift.

This unexpected pivot injected a significant dose of "economic stimulus" into the market, reversing the negative sentiment and fostering a sense of relief and renewed optimism. The keywords "trade negotiations" and "US-EU trade relations" became synonymous with unexpected positive outcomes.

Euronext Amsterdam's Outsized Gain: Sectoral Analysis

Euronext Amsterdam's disproportionately large 8% surge compared to other European markets highlights the specific sectoral composition of its listed companies. Certain sectors within the Amsterdam exchange benefited disproportionately from the revised tariff policy.

- Analysis of specific sectors within Euronext Amsterdam that benefited most: Identify these sectors. For example, "The technology sector, specifically companies involved in [mention specific technology related to the tariff changes], experienced the most significant gains."

- Explanation of the unique relationship between these sectors and the revised tariff policy: Explain how the revised policy specifically benefited these sectors. For instance, "The exemption of certain technological components from the tariffs directly boosted the profitability of these companies."

- Consideration of any other contributing factors: Consider other factors, such as currency fluctuations or positive investor sentiment unrelated to the tariffs, that may have contributed to the surge.

Analyzing the performance of individual stocks and sectors within Euronext Amsterdam provides further insight into the specific drivers behind this exceptional market response. The keywords "sectoral performance," "market capitalization," and "investment opportunities" become crucial in understanding the nuances of this market surge.

Long-Term Implications and Future Market Outlook

While the revised tariff policy brought about a short-term surge, the long-term implications for both the US and European economies remain uncertain. The revised policy offers a potential path toward improved trade relations but carries inherent risks.

- Potential risks and uncertainties remaining in the US-EU trade relationship: Acknowledge that the situation isn't entirely resolved and risks remain. Discuss potential future disagreements or unforeseen challenges.

- Predictions for future market performance based on the revised policy: Offer a balanced outlook considering both the positive and negative possibilities.

- Analysis of potential investor strategies in light of the revised tariffs: Suggest different investment strategies based on the altered risk profile.

Predicting the future requires careful consideration of various economic indicators and a thorough risk assessment. Using keywords like "economic forecast," "investment strategy," and "risk assessment" is crucial for providing relevant insights to investors navigating this dynamic landscape.

Conclusion

Trump's revised tariff decision, initially expected to negatively impact European markets, unexpectedly resulted in an 8% surge on Euronext Amsterdam. This was due to specific changes in the policy and the unique sectoral composition of the Amsterdam exchange. Understanding the complexities of Trump's Tariff Decision and its impact on global markets requires constant vigilance. Stay informed on further developments in US trade policy to make informed investment decisions. Follow our updates for more analysis on Trump's Tariff Decision and its continuing effect on global markets.

Featured Posts

-

Dazi Usa E Costo Abbigliamento Un Analisi Del Mercato

May 25, 2025

Dazi Usa E Costo Abbigliamento Un Analisi Del Mercato

May 25, 2025 -

Brb Acquires Banco Master Public Meets Private In Brazils Banking Sector

May 25, 2025

Brb Acquires Banco Master Public Meets Private In Brazils Banking Sector

May 25, 2025 -

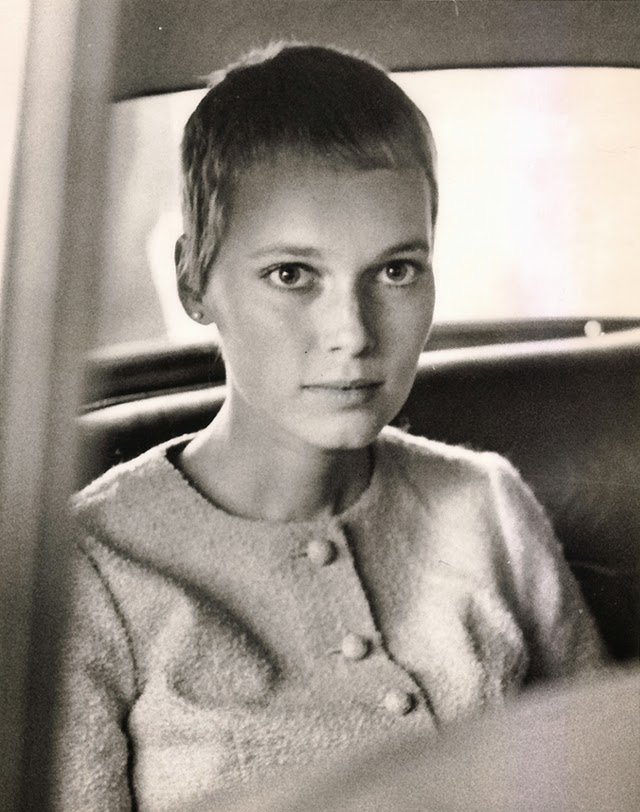

Mia Farrows Warning Trump Congress And The Fate Of American Democracy

May 25, 2025

Mia Farrows Warning Trump Congress And The Fate Of American Democracy

May 25, 2025 -

Obzor Stati Gryozy Lyubvi Ili Ilicha V Gazete Trud

May 25, 2025

Obzor Stati Gryozy Lyubvi Ili Ilicha V Gazete Trud

May 25, 2025 -

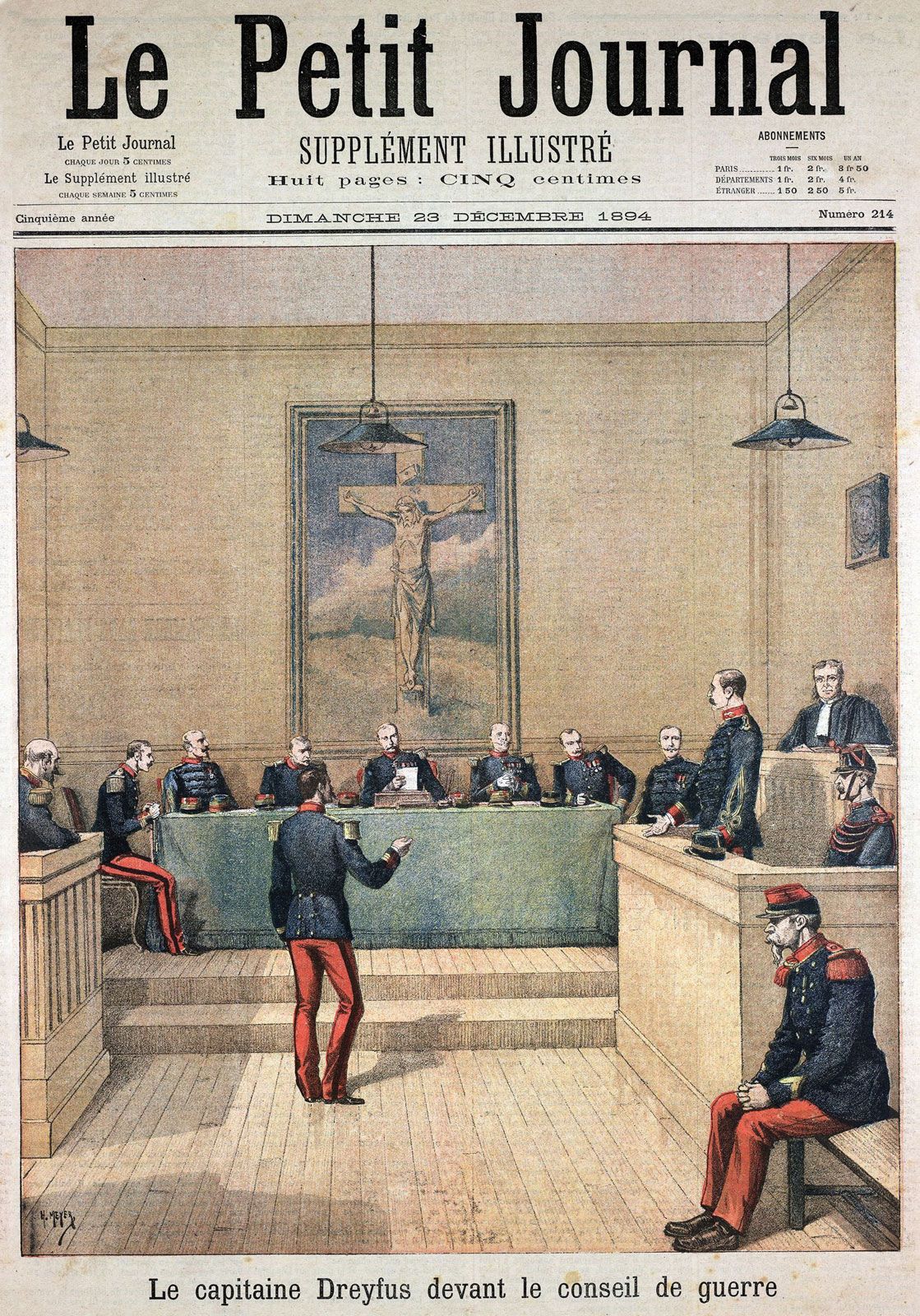

Posthumous Honor For Alfred Dreyfus French Parliament Considers Symbolic Promotion

May 25, 2025

Posthumous Honor For Alfred Dreyfus French Parliament Considers Symbolic Promotion

May 25, 2025

Latest Posts

-

Thames Water Executive Bonuses Fuel Public Anger And Calls For Reform

May 25, 2025

Thames Water Executive Bonuses Fuel Public Anger And Calls For Reform

May 25, 2025 -

Monacos Royal Family A Corruption Scandal And Its Financial Implications

May 25, 2025

Monacos Royal Family A Corruption Scandal And Its Financial Implications

May 25, 2025 -

19 Year Old Cold Case Georgia Man Arrested For Wifes Murder Nannys Abduction

May 25, 2025

19 Year Old Cold Case Georgia Man Arrested For Wifes Murder Nannys Abduction

May 25, 2025 -

Public Outcry Over Thames Water Executive Bonuses A Detailed Analysis

May 25, 2025

Public Outcry Over Thames Water Executive Bonuses A Detailed Analysis

May 25, 2025 -

Monaco Corruption Scandal The Prince And His Financial Advisor

May 25, 2025

Monaco Corruption Scandal The Prince And His Financial Advisor

May 25, 2025