U.S. Federal Reserve Pauses Rate Hikes: Inflation And Unemployment Outlook

Table of Contents

The Fed's Rationale for Pausing Rate Hikes

The Federal Reserve's decision to pause interest rate hikes wasn't arbitrary; it stemmed from a careful consideration of several key economic indicators.

Inflation Slowdown

Recent data suggests a cooling of inflation, a primary factor in the Fed's decision. The Consumer Price Index (CPI) and Producer Price Index (PPI), key inflation metrics, have shown a deceleration in recent months.

- Decreased Inflation: The slower-than-expected rise in prices contributed significantly to the pause. The Fed is aiming for a 2% inflation target, and while inflation remains above this level, the recent slowdown offered some breathing room.

- Core Inflation: While headline inflation (CPI and PPI) has cooled, core inflation (excluding volatile food and energy prices) remains a concern. Persistent inflation in certain sectors indicates the fight against inflation is far from over.

- Fed's Inflation Target: The 2% inflation target remains the Fed's primary objective. The pause doesn't signal an abandonment of this goal but rather a strategic recalibration in light of recent economic data.

Unemployment Concerns

The current unemployment rate, while historically low, also played a role in the Fed's decision. A robust labor market, while positive, presents a potential downside.

- Strong Labor Market: A strong labor market, characterized by low unemployment and high job openings, can lead to increased wage pressures, potentially fueling inflation.

- Recession Risk: Aggressive rate hikes carry the risk of triggering a recession by significantly slowing economic growth. The Fed likely weighed the risk of a recession against the need to combat inflation.

- Dual Mandate: The Federal Reserve operates under a dual mandate: to maintain maximum employment and stable prices. The pause reflects a balancing act between these two competing goals.

Data Dependency and Future Rate Hikes

The Fed has emphasized its commitment to data dependency, meaning future decisions will hinge on incoming economic data. The possibility of future rate increases remains very real.

- Key Economic Indicators: The Fed will closely monitor various factors, including inflation data (CPI, PPI, core inflation), employment reports (non-farm payrolls, unemployment rate), and consumer spending.

- Potential Scenarios: Several scenarios are possible: further rate hikes if inflation remains stubbornly high; maintaining the current rate if inflation continues its downward trajectory; or even rate cuts if the economy shows signs of significant weakening. The uncertainty underscores the dynamic nature of monetary policy.

Implications for Inflation

The Fed's decision to pause rate hikes has immediate and long-term implications for inflation.

Short-Term Impact

The short-term impact of the pause on inflation expectations is mixed.

- Elevated or Declining Inflation: The pause might allow inflation to remain elevated for a longer period, or it could contribute to further declines, depending on other economic factors.

- Market Reactions: Market reactions to the pause have been varied, reflecting the uncertainty surrounding the future path of inflation. Some interpret it as a sign of easing monetary policy, while others remain cautious.

Long-Term Outlook

The long-term consequences of the Fed's decision on inflation control are uncertain.

- Resurgence of Inflation: The pause could potentially lead to a resurgence of inflation if the underlying drivers of inflation are not addressed effectively.

- Anchoring Inflation Expectations: A prolonged period of higher inflation could lead to anchoring inflation expectations at a higher level, making it more challenging for the Fed to bring inflation back down to its 2% target in the future.

Implications for Unemployment

The pause's effects on unemployment are complex and depend on the broader economic context.

Job Market Strength and Weakness

The labor market presents both strengths and weaknesses.

- Impact on Job Growth: The pause might support continued job growth, but it could also lead to slower hiring if economic growth weakens. The overall effect on employment remains uncertain.

- Increased Hiring or Layoffs: Depending on the economic response to the pause, businesses might increase hiring or reduce their workforce, leading to shifts in employment figures.

Recession Risk and Mitigation

The pause aims to mitigate the risk of a recession.

- Avoiding a Recession: By pausing rate hikes, the Fed aims to avoid a potential recession triggered by excessively tight monetary policy.

- Trade-offs: The Fed faces a trade-off: controlling inflation versus maintaining employment. The pause reflects an attempt to find a balance between these competing goals.

Conclusion

The Federal Reserve's pause on interest rate hikes reflects a careful assessment of inflation and unemployment data. While the pause may offer some short-term relief, the long-term implications for inflation and unemployment remain uncertain. The possibility of future rate adjustments, determined by incoming economic data, underscores the ongoing challenges in navigating the current economic climate. The key takeaway is the significant uncertainty surrounding the future economic trajectory and the Fed's response.

Call to Action: Stay informed about the ongoing developments in monetary policy by following updates from the Federal Reserve and expert commentary. Understanding the Federal Reserve's actions is critical to navigating the complexities of the current economic climate and the impact of U.S. Federal Reserve rate decisions.

Featured Posts

-

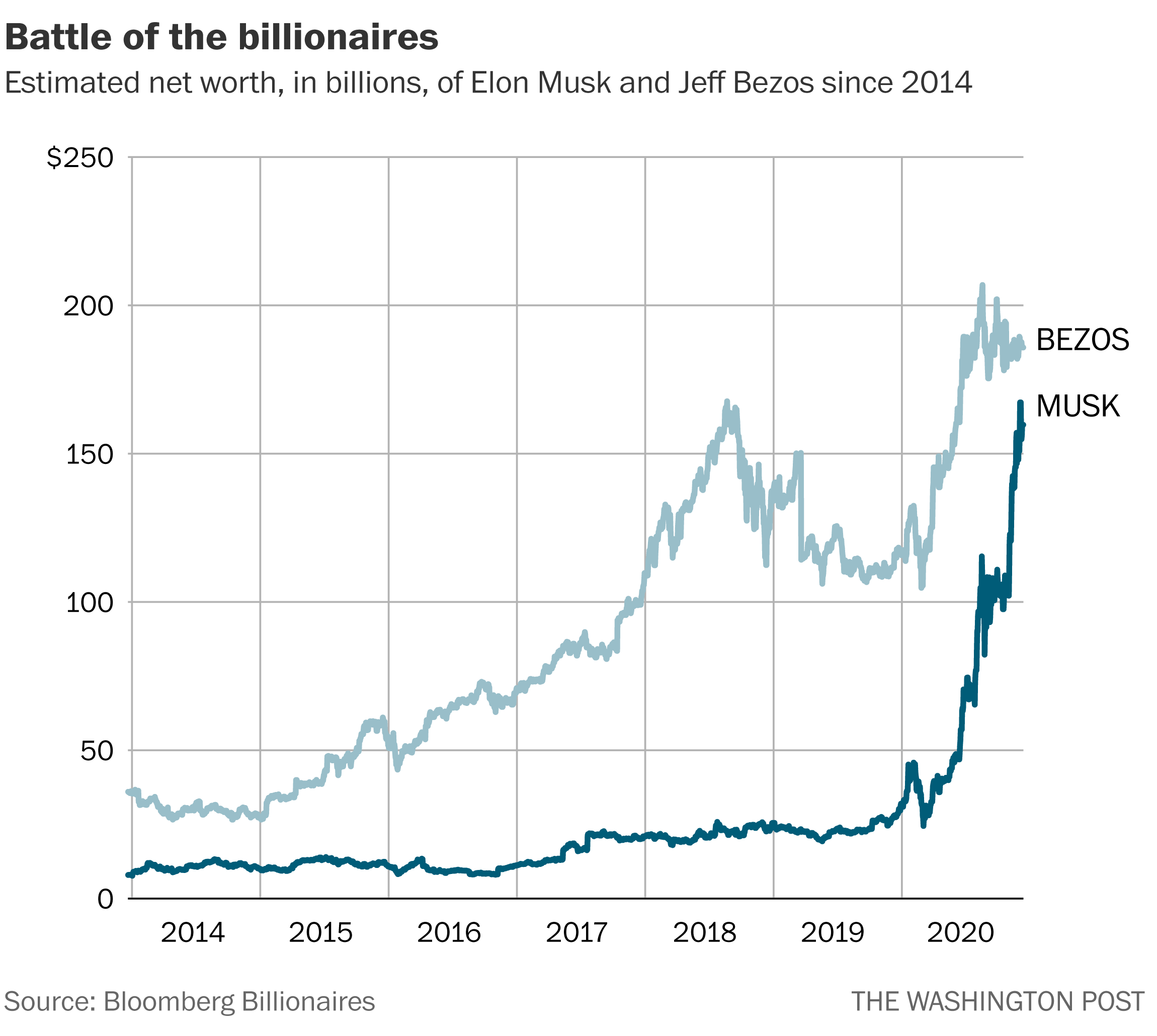

Tracking The Billions Musk Bezos And Zuckerbergs Net Worth Changes Since Trumps Presidency

May 10, 2025

Tracking The Billions Musk Bezos And Zuckerbergs Net Worth Changes Since Trumps Presidency

May 10, 2025 -

5 Times Stephen King Publicly Clashed With Other Celebrities

May 10, 2025

5 Times Stephen King Publicly Clashed With Other Celebrities

May 10, 2025 -

It And Stranger Things A Look At Stephen Kings Perspective

May 10, 2025

It And Stranger Things A Look At Stephen Kings Perspective

May 10, 2025 -

Les Mis Cast May Boycott Trumps Kennedy Center Performance

May 10, 2025

Les Mis Cast May Boycott Trumps Kennedy Center Performance

May 10, 2025 -

Fate Of Historic Broad Street Diner Sealed Hyatt Hotel Plans

May 10, 2025

Fate Of Historic Broad Street Diner Sealed Hyatt Hotel Plans

May 10, 2025

Latest Posts

-

Stiven King Chi Ye Mask Ta Tramp Zradnikami Obgovorennya Superechlivoyi Zayavi

May 10, 2025

Stiven King Chi Ye Mask Ta Tramp Zradnikami Obgovorennya Superechlivoyi Zayavi

May 10, 2025 -

King Proti Maska Ta Trampa Pismennik Zvinuvachuye Yikh U Prorosiyskiy Pozitsiyi

May 10, 2025

King Proti Maska Ta Trampa Pismennik Zvinuvachuye Yikh U Prorosiyskiy Pozitsiyi

May 10, 2025 -

V Sotsseti X Stiven King I Ego Napadki Na Ilona Maska

May 10, 2025

V Sotsseti X Stiven King I Ego Napadki Na Ilona Maska

May 10, 2025 -

King Protiv Maska Skandal Na Platforme X

May 10, 2025

King Protiv Maska Skandal Na Platforme X

May 10, 2025 -

Chto Skazal King O Trampe I Maske

May 10, 2025

Chto Skazal King O Trampe I Maske

May 10, 2025