Uber Stock And Recession: Why Analysts Are Bullish

Table of Contents

Uber's Diversified Revenue Streams as a Recession Hedge

Uber's success isn't solely reliant on its ridesharing services. The company has strategically diversified its revenue streams, creating a resilience that many analysts believe will help it weather even a significant recession. This diversification acts as a powerful hedge against economic downturns.

The Power of Ridesharing in a Downturn

Even during recessions, people still need transportation. Commuting to work, visiting family, and attending essential appointments remain necessary, making Uber's ridesharing segment surprisingly resilient. Statistics show that transportation remains a consistently high priority in household budgets, even during economic hardship. Furthermore, Uber's ability to adjust its pricing strategies based on demand (price elasticity) allows it to maintain profitability, even when demand fluctuates.

- Transportation remains a non-discretionary expense for most individuals.

- Uber's dynamic pricing model helps adapt to changing demand and maintain profitability.

- Even during economic slowdowns, essential travel remains consistent.

The Growth Potential of Uber Eats and Delivery Services

The demand for food delivery services often increases during economic uncertainty. As people cut back on dining out, the convenience and affordability of food delivery become more appealing. Uber Eats has capitalized on this trend, holding a significant market share and demonstrating strong growth potential compared to competitors. The increasing reliance on online grocery delivery further fuels this growth, adding another layer to Uber's revenue streams.

- Uber Eats benefits from increased demand during economic downturns.

- Strong market share and growth trajectory compared to competitors.

- Expansion into grocery delivery further strengthens its position in the market.

Freight Services and the Expanding Logistics Market

Uber Freight operates within the essential logistics sector, a market that remains relatively stable regardless of the broader economic climate. The movement of goods is crucial regardless of economic conditions, providing a consistent revenue stream for Uber. The potential for growth in this sector is substantial, and Uber's strategic advantages, including its existing technological infrastructure and network, position it for significant success.

- Uber Freight operates in a recession-resistant sector.

- Significant growth potential within the expanding logistics market.

- Leveraging existing technology for competitive advantage.

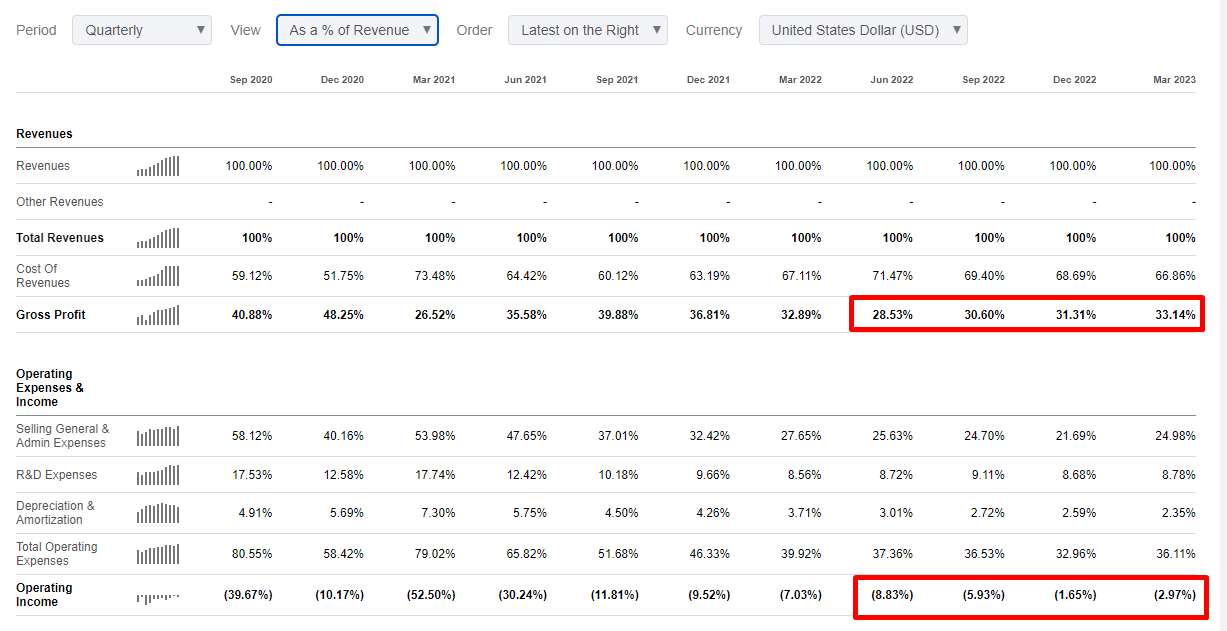

Cost-Cutting Measures and Operational Efficiency

Beyond its diverse revenue streams, Uber's commitment to cost-cutting measures and operational efficiency strengthens its position during a potential recession. This proactive approach ensures profitability even in challenging economic environments.

Technological Advancements and Automation

Uber's significant investments in technology and automation are directly contributing to efficiency and cost reduction. AI-powered route optimization, improved matching algorithms for drivers and riders, and automated customer support systems all lead to streamlined operations and reduced expenditures.

- AI-driven route optimization reduces fuel consumption and improves driver efficiency.

- Automated customer support reduces operational costs.

- Improved matching algorithms maximize efficiency and minimize wait times.

Dynamic Pricing and Demand Management

Uber's dynamic pricing strategy is not just a revenue-generating tool; it's a crucial component of its recession resilience. By adjusting prices based on real-time demand, Uber optimizes its profitability and mitigates the impact of fluctuating demand during economic downturns.

- Dynamic pricing helps maintain profitability during periods of low demand.

- Effective demand management ensures efficient resource allocation.

- Adaptability to market fluctuations minimizes risk.

Long-Term Growth Prospects and Market Dominance

Looking beyond immediate economic concerns, Uber's long-term growth prospects are significant. Its global reach and strategic initiatives further solidify its bullish outlook.

Global Expansion and Emerging Markets

Uber's expansion into international markets, particularly developing economies, represents a significant growth opportunity. These markets often have a large untapped potential for ride-sharing and delivery services, offering significant future revenue streams.

- Large, untapped markets in developing countries represent significant growth potential.

- Continued international expansion diversifies revenue streams and mitigates risk.

- Strategic entry into new markets through partnerships and acquisitions.

Strategic Partnerships and Acquisitions

Uber's strategic partnerships and acquisitions have been instrumental in strengthening its market position and expanding its services. These strategic moves provide access to new technologies, markets, and customer bases, further enhancing the company's long-term growth prospects.

- Strategic acquisitions enhance Uber's capabilities and market share.

- Partnerships provide access to new technologies and customer bases.

- Synergies created through acquisitions enhance overall efficiency.

Conclusion: Investing in Uber Stock During a Recession? A Bullish Outlook

In summary, bullish analysts see Uber stock as a compelling investment opportunity, even amidst recessionary concerns. The company's diversified revenue streams, proactive cost-cutting measures, and robust long-term growth prospects provide a strong foundation for future success. The resilience of its core services, coupled with strategic expansion and technological advancements, suggests that Uber is well-positioned to navigate economic uncertainties. While no investment is without risk, the arguments presented suggest that Uber stock might be a compelling addition to a diversified portfolio, even during a recession. Conduct your own due diligence before making any investment decisions related to Uber stock.

Featured Posts

-

Leslie Cables Eurovision Belgium Reign Ends Michael De Lil Takes Over After 2026

May 19, 2025

Leslie Cables Eurovision Belgium Reign Ends Michael De Lil Takes Over After 2026

May 19, 2025 -

Remote Island Deportation Plan Ignites Fury In France Migrant Crisis Deepens

May 19, 2025

Remote Island Deportation Plan Ignites Fury In France Migrant Crisis Deepens

May 19, 2025 -

Assessing The Investment Potential Of Uber Uber

May 19, 2025

Assessing The Investment Potential Of Uber Uber

May 19, 2025 -

Ufc 313 Alex Pereira Vs Magomed Ankalaev Complete Event Guide

May 19, 2025

Ufc 313 Alex Pereira Vs Magomed Ankalaev Complete Event Guide

May 19, 2025 -

Uber Cancels Foodpanda Taiwan Purchase Regulatory Hurdles Cited

May 19, 2025

Uber Cancels Foodpanda Taiwan Purchase Regulatory Hurdles Cited

May 19, 2025

Latest Posts

-

Chateau Diy Projects Easy Tutorials And Creative Ideas For Home Decor

May 19, 2025

Chateau Diy Projects Easy Tutorials And Creative Ideas For Home Decor

May 19, 2025 -

Apple Crop Losses Rosy Apple Aphid Infestation To Reduce Yields By 10 30

May 19, 2025

Apple Crop Losses Rosy Apple Aphid Infestation To Reduce Yields By 10 30

May 19, 2025 -

Chateau Diy Projects Inspiration And Tutorials For The Home

May 19, 2025

Chateau Diy Projects Inspiration And Tutorials For The Home

May 19, 2025 -

Eurovision Belgium A New Era Begins With Michael De Lil

May 19, 2025

Eurovision Belgium A New Era Begins With Michael De Lil

May 19, 2025 -

Chateau Diy Designing Your Dream Castle At Home

May 19, 2025

Chateau Diy Designing Your Dream Castle At Home

May 19, 2025