Uber Stock: Can Its Robotaxi Strategy Fuel A Comeback?

Table of Contents

Analyzing Uber's Current Financial Performance and Challenges

Recent Stock Performance and Investor Sentiment

Uber's stock price has experienced volatility in recent years, reflecting fluctuating investor sentiment. While periods of growth have occurred, overall investor confidence hasn't always been high. This uncertainty stems from various factors affecting the company's financial health.

- Key Financial Indicators: Revenue growth has been inconsistent, profit margins remain thin, and the company carries substantial debt. Recent earnings reports haven't always met analyst expectations.

- Investor Reports and Analyst Predictions: Many analyst reports highlight concerns about intense competition and high operational costs. Predictions for future growth vary significantly, reflecting the uncertainty surrounding Uber's long-term strategy.

Competition in the Ride-Sharing Market

Uber faces stiff competition in the ride-sharing market, primarily from Lyft but also from emerging players and alternative transportation options. Market saturation in major cities leads to intense pricing wars, squeezing profit margins.

- Competitive Advantages and Disadvantages: Uber's global brand recognition and extensive network are key advantages. However, Lyft's strong regional presence and focused marketing strategies pose significant challenges.

- Market Share Analysis: While Uber maintains a considerable market share, the competitive landscape is dynamic, and losing market share to competitors could negatively impact its financial performance.

Operational Costs and Profitability

Uber's operational costs are substantial, largely driven by driver compensation, insurance premiums, and vehicle maintenance. Achieving profitability remains a significant challenge.

- Breakdown of Uber's Operating Costs: Driver payments represent a massive portion of operational expenditure, along with significant investments in technology and marketing.

- Potential Cost Savings with Autonomous Vehicles: Robotaxis promise to significantly reduce labor costs, potentially boosting profit margins. However, the initial investment in autonomous vehicle technology is substantial.

- Timeline for Achieving Profitability: The success of Uber's robotaxi strategy is crucial to its timeline for achieving sustained profitability.

The Potential of Uber's Robotaxi Strategy for Growth

Technological Advancements and Partnerships

Uber has made significant strides in developing its autonomous vehicle technology, forming partnerships and making strategic acquisitions to accelerate progress.

- Specific Details about Uber's Autonomous Vehicle Fleet: Uber's self-driving fleet is undergoing continuous testing and development, with increasing numbers of autonomous vehicles deployed in select cities.

- Technology Partnerships (e.g., with Aurora): Collaborations with companies like Aurora provide access to advanced technology and expertise, accelerating the development process.

- Testing Locations: Pilot programs are being conducted in various locations to gather data and refine the technology before widespread deployment.

Cost Reduction Potential through Automation

The primary advantage of robotaxis lies in their potential to dramatically reduce operating costs. Eliminating driver salaries could significantly improve profit margins and enhance operational efficiency.

- Projected Cost Savings: Analysts project substantial cost savings with widespread robotaxi adoption, leading to improved profitability and increased investor confidence.

- Potential for Increased Driverless Vehicle Utilization: Autonomous vehicles can operate for longer hours with less downtime, increasing overall vehicle utilization rates.

- Impact on Overall Operational Efficiency: Automation promises streamlined operations, reducing scheduling complexities and improving overall efficiency.

Expansion into New Markets and Services

Robotaxi technology could open doors to new revenue streams and market expansions for Uber. Autonomous vehicles can serve underserved areas and potentially offer new services beyond ride-sharing.

- Potential Expansion into Underserved Areas: Robotaxis could offer transportation options in areas currently lacking reliable public transit or ride-sharing services.

- New Service Offerings (e.g., autonomous delivery): Autonomous vehicles could expand into delivery services, potentially competing with existing delivery platforms.

- Potential for Global Market Expansion: The global adoption of autonomous vehicles could significantly expand Uber's market reach and revenue potential.

Risks and Challenges Associated with the Robotaxi Strategy

Regulatory Hurdles and Legal Liabilities

Deploying autonomous vehicles faces significant regulatory hurdles and legal complexities. Licensing requirements, safety standards, and liability in case of accidents are major concerns.

- Specific Regulatory Obstacles in Different Regions: Regulatory frameworks vary significantly across different regions, creating challenges for consistent deployment.

- Potential Legal Ramifications of Accidents Involving Autonomous Vehicles: Determining liability in case of accidents involving autonomous vehicles is a complex legal issue.

- Timeline for Regulatory Approval: Obtaining necessary regulatory approvals could significantly delay the widespread deployment of robotaxis.

Technological Challenges and Development Costs

Perfecting self-driving technology remains a significant technological challenge. Software development, sensor technology, and ensuring fail-safe operations require substantial investment.

- Ongoing Technical Challenges: Challenges include navigating complex traffic situations, adapting to varying weather conditions, and ensuring reliable sensor performance.

- Research and Development Costs: The development of autonomous vehicle technology requires substantial investment in research and development.

- Potential for Delays in Deployment: Technological hurdles could lead to unforeseen delays in deploying a fully operational robotaxi service.

Public Acceptance and Safety Concerns

Public perception of autonomous vehicles is crucial for their success. Addressing safety concerns and building public trust are essential for widespread adoption.

- Public Opinion Surveys: Surveys reveal a mixed public perception of autonomous vehicles, with safety concerns being a primary driver of hesitancy.

- Safety Features Implemented in Uber's Autonomous Vehicles: Uber is actively developing and implementing advanced safety features in its autonomous vehicles to mitigate risks.

- Strategies to Address Public Concerns: Uber needs effective communication strategies to address public concerns and build trust in the safety and reliability of its robotaxi technology.

Conclusion: Uber Stock's Future Hinges on Autonomous Vehicles

Uber's future stock performance hinges heavily on the success of its robotaxi strategy. While the potential for significant cost reductions, increased efficiency, and market expansion is substantial, significant risks and challenges remain. Regulatory hurdles, technological complexities, and public acceptance all play crucial roles in determining the ultimate impact of this strategy. Can Uber overcome these obstacles and successfully integrate autonomous vehicles into its operations? The answer remains uncertain, but the potential rewards are immense. Keep a close eye on Uber stock and the development of its robotaxi technology to make informed investment decisions.

Featured Posts

-

76

May 08, 2025

76

May 08, 2025 -

110 Potential Growth Why Billionaires Are Investing In This Black Rock Etf

May 08, 2025

110 Potential Growth Why Billionaires Are Investing In This Black Rock Etf

May 08, 2025 -

Nathan Fillion From Wwii Movie To The Rookie Star

May 08, 2025

Nathan Fillion From Wwii Movie To The Rookie Star

May 08, 2025 -

K Or

May 08, 2025

K Or

May 08, 2025 -

The Economic Implications Of Chinas Relaxed Lending Policies

May 08, 2025

The Economic Implications Of Chinas Relaxed Lending Policies

May 08, 2025

Latest Posts

-

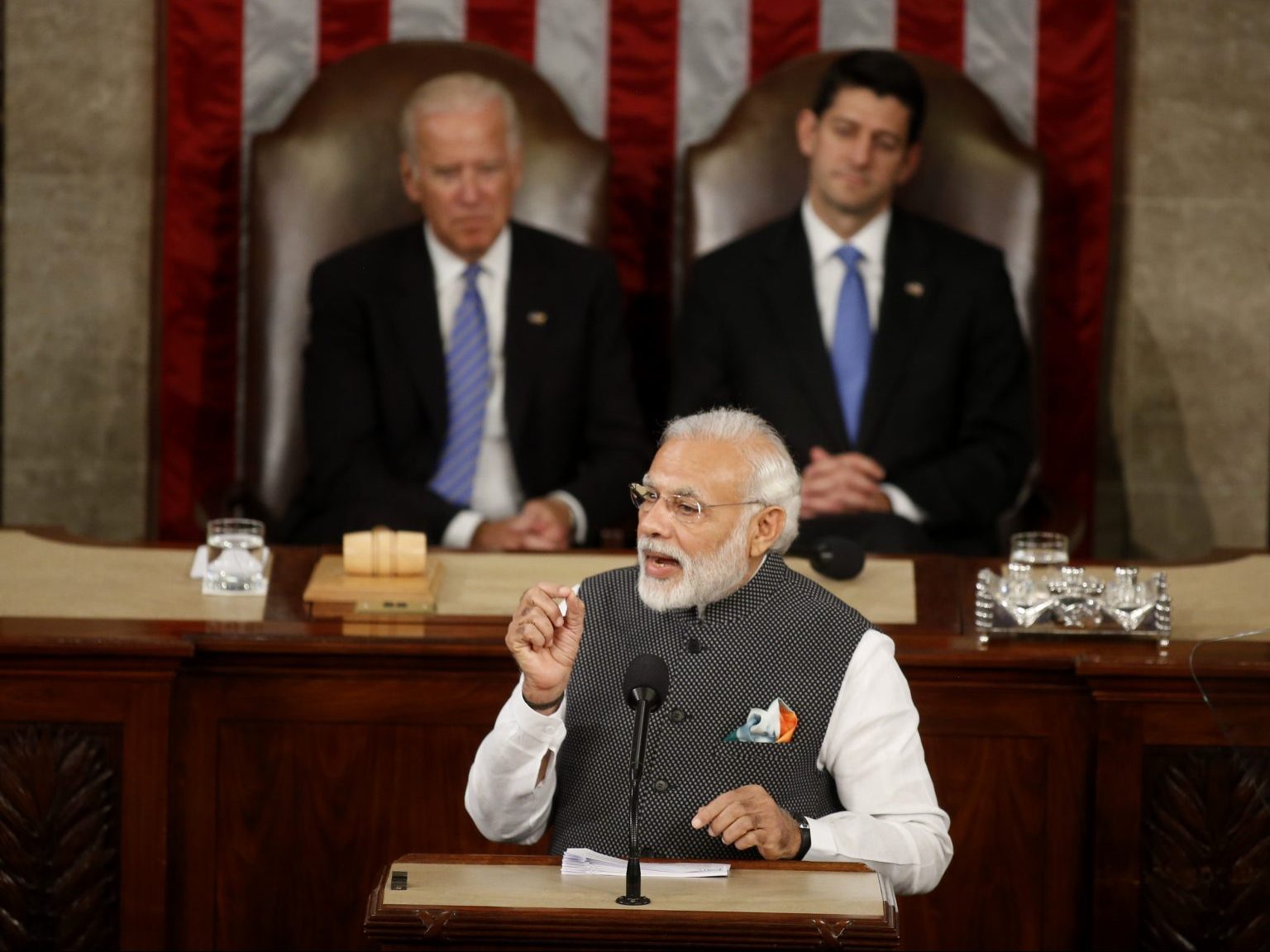

Bilateral Trade Agreement India And Us To Hold Key Discussions

May 09, 2025

Bilateral Trade Agreement India And Us To Hold Key Discussions

May 09, 2025 -

Upcoming India Us Talks Focus On Bilateral Trade Deal

May 09, 2025

Upcoming India Us Talks Focus On Bilateral Trade Deal

May 09, 2025 -

India And Us To Discuss New Bilateral Trade Agreement

May 09, 2025

India And Us To Discuss New Bilateral Trade Agreement

May 09, 2025 -

Dieu Tra Vu Bao Mau Tat Tre Em O Tien Giang Can Minh Bach Va Cong Khai

May 09, 2025

Dieu Tra Vu Bao Mau Tat Tre Em O Tien Giang Can Minh Bach Va Cong Khai

May 09, 2025 -

The High Cost Of Childcare A Mans Story Of Unexpected Expenses

May 09, 2025

The High Cost Of Childcare A Mans Story Of Unexpected Expenses

May 09, 2025