Ueda Monitors Long-Term Yield Increase For Economic Impact

Table of Contents

Governor Ueda's Yield Curve Control Policy and its Evolution

The Original YCC Policy and its Limitations

The BOJ's initial implementation of Yield Curve Control (YCC) aimed to stimulate economic growth by keeping long-term Japanese Government Bond (JGB) yields near zero. The target range for 10-year JGB yields was set quite low, intended to lower borrowing costs for businesses and consumers.

- Target Range: The initial target range for 10-year JGB yields was extremely narrow, reflecting a commitment to keeping borrowing costs exceptionally low.

- Challenges: Maintaining this narrow band proved increasingly difficult in the face of rising global inflation and upward pressure on yields worldwide. The BOJ faced significant challenges in purchasing enough JGBs to keep yields within the target.

- Early Criticisms: Critics argued that the policy was unsustainable in the long run and distorted market signals, hindering the efficient allocation of capital.

Recent Adjustments to the YCC Framework

In December 2022 and subsequently, the BOJ made significant adjustments to its YCC framework, most notably by widening the permissible fluctuation band for 10-year JGB yields. This represented a significant shift in policy.

- Widening the Band: The increase in the acceptable range of yield fluctuation allowed for greater flexibility in responding to market pressures.

- Reasons for Adjustments: The adjustments were driven by several factors, including rising global inflation, upward pressure on global bond yields, and a strengthening US dollar impacting the Yen. The BOJ acknowledged the need for a more flexible approach.

- Immediate Market Impact: The adjustments led to an immediate increase in Japanese long-term bond yields and a significant weakening of the Japanese Yen.

Ueda's Stance on Maintaining YCC

Governor Ueda has emphasized a data-driven approach to monetary policy, suggesting a willingness to adjust YCC further based on economic indicators. He has stressed the importance of flexibility and a gradual transition towards a more sustainable monetary policy framework.

- Flexibility and Data-Driven Decisions: Ueda has consistently reiterated the need to closely monitor economic data and adjust policy accordingly, signaling a more flexible approach compared to previous administrations.

- Emphasis on Sustainability: His statements underscore a long-term perspective, aiming for a sustainable and less interventionist monetary policy regime.

- Gradual Transition: The adjustments to the YCC framework suggest a gradual, rather than abrupt, shift towards normalization of monetary policy in Japan.

Economic Impacts of Rising Long-Term Yields

Impact on Inflation and Consumer Spending

Rising long-term yields can influence inflation expectations and consumer spending. Higher borrowing costs can lead to reduced consumer spending and business investment, potentially dampening economic growth.

- Higher Borrowing Costs: Increased yields translate to higher borrowing costs for individuals and businesses, potentially reducing investment and consumption.

- Dampened Economic Activity: Reduced investment and consumption could lead to slower economic growth and potentially lower inflation, creating a complex interplay.

- Inflation Expectations: Market reaction to the yield changes reflects shifting expectations about future inflation, influencing the central bank's policy decisions.

Effects on the Japanese Yen and Exchange Rates

Changes in Japanese long-term bond yields significantly impact the value of the Japanese yen. Higher yields can attract foreign investment, strengthening the yen.

- Yen Appreciation: Higher yields can make Japanese assets more attractive to foreign investors, leading to an increase in demand for the yen.

- Impact on Exports: A stronger yen can make Japanese exports more expensive, potentially hindering competitiveness in global markets.

- Impact on Imports: Conversely, it can make imports cheaper.

Influence on Government Debt Management

Japan's substantial public debt makes it particularly vulnerable to rising interest rates. Higher yields increase the cost of servicing this debt, potentially straining government finances.

- Increased Debt Servicing Costs: Rising yields directly increase the interest payments on Japan's massive public debt.

- Fiscal Policy Challenges: This necessitates careful fiscal management and may necessitate adjustments to government spending plans.

- Potential Strategies: The government might need to explore strategies like increased taxation or spending cuts to manage the increased debt burden.

Market Reactions and Future Outlook

Market Response to Yield Curve Adjustments

The BOJ's adjustments to the YCC framework triggered significant market reactions. Japanese government bond prices fell, reflecting the rise in yields, while the yen initially weakened. Stock markets displayed mixed responses, reflecting uncertainty about the future direction of monetary policy.

- JGB Prices: The widening of the yield band led to a fall in JGB prices, as investors adjusted to the new policy environment.

- Stock Market Response: The stock market reaction varied, depending on the sector and investor sentiment. Some sectors benefited from the change while others faced headwinds.

- Yen Volatility: The yen's value experienced significant volatility following the announcements, reflecting the uncertainty surrounding the BOJ's future actions.

Potential Scenarios for Future Yield Movements

Several scenarios are possible for future yield movements in Japan. These depend on factors such as the persistence of inflation, global economic conditions, and potential further policy adjustments by the BOJ.

- Continued Gradual Rise: A gradual and controlled increase in long-term yields is a plausible scenario, reflecting a measured approach to policy normalization.

- Sharp Increase: A more abrupt increase could occur if inflation rises unexpectedly or global economic conditions shift dramatically.

- Yield Curve Flattening or Inversion: Various possibilities exist; for instance, short-term yields might rise faster than long-term yields, leading to a flattening or even an inversion of the yield curve.

Expert Opinions and Forecasts

Leading economists and market analysts offer a range of forecasts, often emphasizing the uncertainty inherent in predicting future interest rate movements. Many believe a gradual normalization of monetary policy is likely, but the timing and pace remain subject to debate.

- Diverse Forecasts: Forecasts vary significantly, reflecting the complex interplay of domestic and global factors affecting Japanese interest rates.

- Underlying Assumptions: Forecasts are based on differing assumptions about future inflation, economic growth, and BOJ policy decisions.

- Monitoring Key Indicators: Closely monitoring key economic indicators such as inflation, GDP growth, and unemployment is crucial for understanding the direction of future interest rates.

Conclusion: Understanding the Long-Term Implications of Ueda's Yield Management

Governor Ueda's approach to managing long-term yields in Japan involves a delicate balancing act. The recent adjustments to the YCC framework reflect a move towards a more flexible and data-driven policy, acknowledging the need to adapt to evolving economic conditions. The economic implications of rising long-term yields are multifaceted, affecting inflation, the Japanese yen, and government debt management. Understanding Ueda Monitors Long-Term Yield Increase for Economic Impact is crucial for comprehending the future trajectory of the Japanese economy. The future direction of monetary policy remains uncertain, but careful observation of market reactions and economic data will be vital in assessing its long-term impact. Stay informed about future developments by following reputable financial news sources and economic analysis to better understand the evolving landscape of Japanese monetary policy and the long-term effects of yield curve adjustments.

Featured Posts

-

New Air Jordans In May 2025 Release Calendar And Details

May 29, 2025

New Air Jordans In May 2025 Release Calendar And Details

May 29, 2025 -

Long Covid In Canada Comprehensive Guidelines For Diagnosis Prevention And Treatment

May 29, 2025

Long Covid In Canada Comprehensive Guidelines For Diagnosis Prevention And Treatment

May 29, 2025 -

Nike Air Max 95 97 Ducks Of A Feather By Division Street Release Info

May 29, 2025

Nike Air Max 95 97 Ducks Of A Feather By Division Street Release Info

May 29, 2025 -

Space Xs Starbase Gains Official Texas City Status

May 29, 2025

Space Xs Starbase Gains Official Texas City Status

May 29, 2025 -

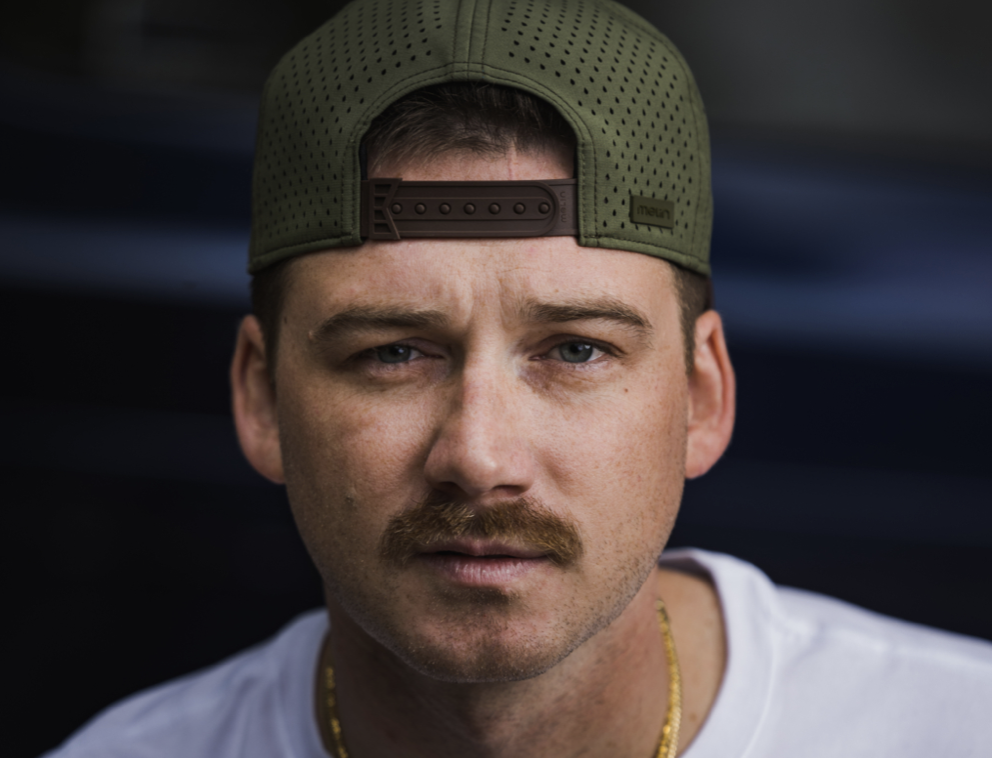

Revealed Morgan Wallens Grandmas Special Nickname

May 29, 2025

Revealed Morgan Wallens Grandmas Special Nickname

May 29, 2025

Latest Posts

-

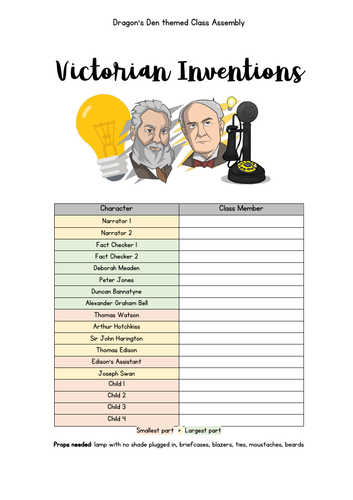

Dragon Den Investors New Padel Court Venture At Chafford Hundred Health Club

May 31, 2025

Dragon Den Investors New Padel Court Venture At Chafford Hundred Health Club

May 31, 2025 -

Dragons Den Investment Pays Off Entrepreneur Sees 40 Profit Rise

May 31, 2025

Dragons Den Investment Pays Off Entrepreneur Sees 40 Profit Rise

May 31, 2025 -

Dragon Den Star Invests In Chafford Hundred Padel Courts

May 31, 2025

Dragon Den Star Invests In Chafford Hundred Padel Courts

May 31, 2025 -

From Dragons Den To 40 Higher Profits One Entrepreneurs Tale

May 31, 2025

From Dragons Den To 40 Higher Profits One Entrepreneurs Tale

May 31, 2025 -

Creating The Good Life Actionable Steps For Lasting Happiness

May 31, 2025

Creating The Good Life Actionable Steps For Lasting Happiness

May 31, 2025