UK Households: Urgent Action Needed On New HMRC Letters

Table of Contents

Identifying Legitimate HMRC Letters

Receiving an official-looking letter can be unnerving, especially when it concerns your taxes. Knowing how to identify a genuine HMRC letter is crucial to avoid falling victim to scams. Fake HMRC letters, designed to steal your personal and financial information, are unfortunately common. Therefore, carefully verifying the legitimacy of any HMRC correspondence is paramount.

Keywords: HMRC letter format, fake HMRC letters, identify HMRC correspondence, HMRC scam.

Here's how to spot a genuine HMRC letter:

- Check for official HMRC letterhead and branding: Genuine HMRC letters will feature the official HMRC logo and letterhead, consistent with their current branding guidelines. Look for inconsistencies or unprofessional design elements.

- Verify the sender's address and contact details: Never rely solely on the information provided in the letter. Cross-reference the sender's address and contact details with the official HMRC website. Any discrepancies should raise a red flag.

- Be wary of urgent requests for immediate payment via unconventional methods: HMRC will rarely request immediate payment via unusual methods like prepaid debit cards or untraceable money transfer services. Legitimate requests for payment will typically be through established banking channels.

- Report suspected fraudulent letters to Action Fraud: If you suspect you've received a fraudulent HMRC letter, report it immediately to Action Fraud, the UK's national reporting centre for fraud and cybercrime.

Understanding Different Types of HMRC Letters

HMRC sends various types of letters for different reasons. Understanding the type of letter you've received is the first step in taking appropriate action. Ignoring or misinterpreting these letters can lead to significant penalties.

Keywords: Tax return reminder, tax assessment letter, payment reminder letter, tax investigation letter UK, penalty letter HMRC.

Here are some common types of HMRC letters:

- Tax return reminders: These letters remind you to submit your self-assessment tax return by the deadline. Failure to file on time will incur penalties. If you haven't filed, act immediately.

- Tax assessment letters: These letters detail your tax liability for a given tax year. Carefully review the assessment to ensure its accuracy. If you disagree with the assessment, you have the right to appeal.

- Payment reminder letters: These letters remind you of an outstanding tax payment and may highlight potential penalties for late payment. Contact HMRC immediately if you're experiencing financial difficulties.

- Tax investigation letters: These letters indicate that HMRC is investigating your tax affairs. Seek professional tax advice immediately. This is a serious matter requiring expert guidance.

- Penalty notices: These letters inform you of a penalty for non-compliance, such as late filing or inaccurate tax returns. Understand your options for appealing the penalty if you believe it's unjustified.

What to Do If You Receive an HMRC Letter

Receiving an HMRC letter can be stressful, but a prompt and organized response is key. Knowing the steps to take will help you manage the situation effectively.

Keywords: Respond to HMRC letter, HMRC online account, contact HMRC, HMRC helpline, tax advisor.

Here's a step-by-step guide:

- Access your HMRC online account: Check your online account to verify the information in the letter and ensure everything is up-to-date.

- Gather all relevant documents: Collect all necessary documents, such as P60s, payslips, bank statements, and any other supporting evidence relevant to the letter's content.

- Contact HMRC directly via their official channels: Never respond to unofficial emails or phone numbers. Use the contact details provided on the official HMRC website or in the letter itself.

- Consider seeking advice from a qualified tax advisor: If you're unsure about the letter's content or the required actions, seek professional help. A tax advisor can provide expert guidance and representation.

Seeking Professional Help

Navigating complex tax issues can be challenging. A qualified tax advisor can provide invaluable support and alleviate the stress of dealing with HMRC correspondence.

Keywords: Tax accountant, tax advisor UK, HMRC specialist, tax advice UK.

Here are some benefits of seeking professional help:

- Understanding complex tax issues: Tax advisors can help you understand the intricacies of tax law and interpret the information in your HMRC letter.

- Representation in tax investigations: If you're facing a tax investigation, a tax advisor can represent you and negotiate on your behalf.

- Negotiating payment plans: If you're struggling to pay your tax debt, a tax advisor can help you negotiate a manageable payment plan with HMRC.

Conclusion

Receiving an HMRC letter requires prompt attention. Ignoring official correspondence can lead to significant financial penalties and further complications. By understanding the different types of letters, verifying their legitimacy, and responding appropriately, you can effectively manage your tax affairs. Remember to utilise the official HMRC channels and consider seeking professional help when needed. Don't delay! If you've received an HMRC letter, take immediate action. Understand your responsibilities and seek professional help if needed. Learn more about navigating your HMRC correspondence today. Contact a tax advisor or visit the official HMRC website for further guidance on your next steps regarding your HMRC letter.

Featured Posts

-

Aghatha Krysty Tewd Llhyat Rwayat Jdydt Bfdl Aldhkae Alastnaey

May 20, 2025

Aghatha Krysty Tewd Llhyat Rwayat Jdydt Bfdl Aldhkae Alastnaey

May 20, 2025 -

La Decision De Schumacher En 2010 Un Amigo Revela Una Charla Crucial

May 20, 2025

La Decision De Schumacher En 2010 Un Amigo Revela Una Charla Crucial

May 20, 2025 -

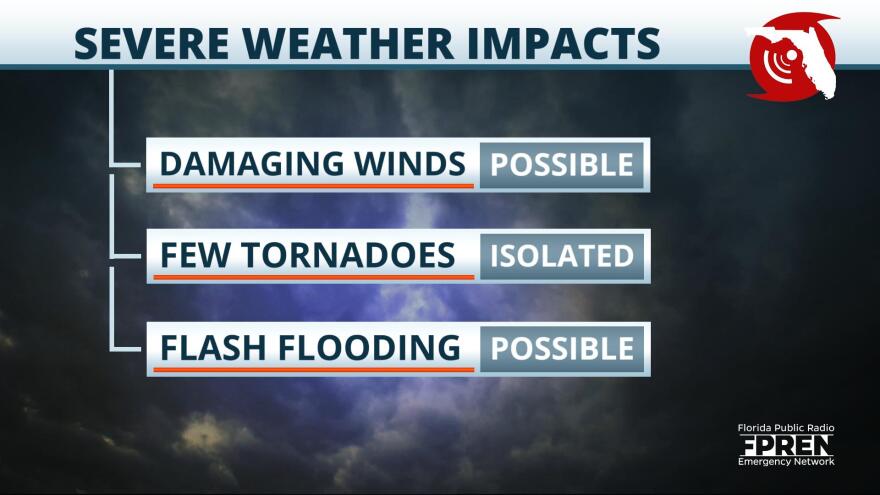

Watch Out For Damaging Winds Fast Moving Storms

May 20, 2025

Watch Out For Damaging Winds Fast Moving Storms

May 20, 2025 -

Should You Buy This Ai Quantum Computing Stock

May 20, 2025

Should You Buy This Ai Quantum Computing Stock

May 20, 2025 -

Exploring The World Of Agatha Christies Poirot From Books To Film

May 20, 2025

Exploring The World Of Agatha Christies Poirot From Books To Film

May 20, 2025