Understanding The Volatility Of Riot Platforms Stock (RIOT)

Table of Contents

Factors Influencing RIOT Stock Volatility

Several interconnected factors contribute to the volatility of Riot Platforms stock (RIOT). Understanding these factors is crucial for navigating the risks and potential rewards associated with this investment.

Bitcoin Price Fluctuations

The price of Bitcoin (BTC) is intrinsically linked to RIOT's financial performance and, subsequently, its stock price. This correlation is undeniably strong.

- Bitcoin price increases lead to higher RIOT revenue and stock price: When Bitcoin's value rises, Riot Platforms' Bitcoin mining operations become more profitable, leading to increased revenue and, generally, a higher RIOT stock price. Investors see this as a positive sign, fueling further demand.

- Bitcoin price drops negatively impact profitability and share value: Conversely, a drop in Bitcoin's price directly reduces the profitability of RIOT's mining activities. This diminished profitability often translates into a lower RIOT stock price, as investors become less optimistic about future earnings.

- Importance of analyzing Bitcoin price trends for RIOT investment strategies: Therefore, anyone considering investing in RIOT stock needs to carefully analyze Bitcoin price trends and forecasts. Understanding Bitcoin's price volatility is key to mitigating risk.

Cryptocurrency Mining Difficulty

The difficulty of Bitcoin mining, a metric that adjusts the computational power needed to mine a block, significantly influences the profitability of mining operations and, thus, RIOT's earnings.

- Increased difficulty reduces profitability: A higher mining difficulty means more computational power is needed to mine a Bitcoin, increasing energy consumption and reducing the overall profitability for miners like Riot Platforms.

- Difficulty adjustments are unpredictable: The difficulty adjustment algorithm is designed to maintain a consistent block generation time. These adjustments, however, are not always predictable, introducing an element of uncertainty into RIOT's operational projections.

- Impact of energy costs and hashrate on mining profitability: The interplay between energy costs and hashrate (the computational power of a miner's network) heavily impacts profitability. High energy costs coupled with a lower hashrate can severely impact the bottom line.

Regulatory Uncertainty

The evolving regulatory landscape for cryptocurrencies globally poses a considerable risk to Riot Platforms and its stock price.

- Regulatory changes can impact mining operations: Governments worldwide are increasingly scrutinizing the cryptocurrency industry, and changes in regulations can directly affect RIOT's operations, potentially limiting its activities or increasing compliance costs.

- Varying regulations across different jurisdictions: The regulatory environment for cryptocurrencies varies significantly across different countries and regions. This inconsistency creates operational complexities and uncertainty for companies like RIOT that operate internationally.

- Uncertainty creates volatility: The lack of clear, consistent, and globally harmonized regulations in the cryptocurrency space fosters uncertainty, leading to increased volatility in RIOT's stock price.

Energy Costs and Environmental Concerns

Energy costs are a major factor impacting the profitability of Bitcoin mining, and Riot Platforms is particularly vulnerable to energy price fluctuations. Furthermore, Environmental, Social, and Governance (ESG) concerns also play a role.

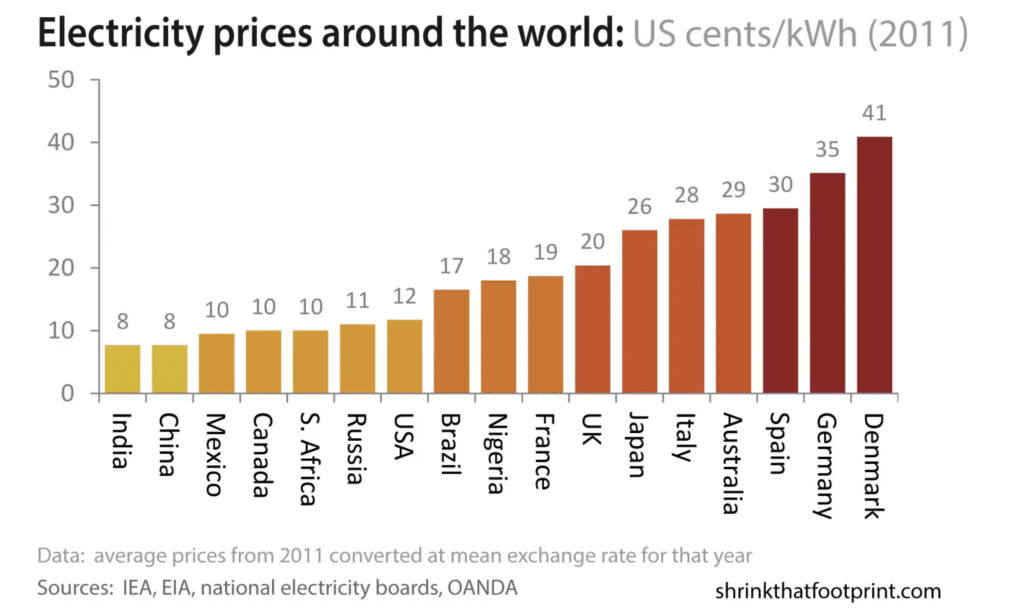

- Energy costs are a major expense: Bitcoin mining is energy-intensive. Significant fluctuations in energy prices directly affect RIOT's operational expenses and profitability.

- Impact of renewable energy adoption: The shift towards renewable energy sources in Bitcoin mining can mitigate some of these concerns but remains a complex and evolving aspect of the industry.

- Environmental concerns influence investor perception and RIOT stock valuation: Growing environmental consciousness among investors is pushing many to favor companies with sustainable practices. RIOT's commitment to environmental responsibility will influence its valuation.

Market Sentiment and Speculation

Market sentiment towards cryptocurrencies and speculative trading play a crucial role in driving RIOT's stock price.

- Increased investor interest drives price increases: Positive news or broader market enthusiasm for cryptocurrencies can lead to increased investor interest in RIOT, driving up its stock price.

- Negative news can lead to sharp declines: Conversely, negative news related to the cryptocurrency market, regulatory crackdowns, or security breaches can trigger significant declines in RIOT's share price.

- Speculative bubbles and market corrections impact RIOT significantly: The cryptocurrency market is prone to speculative bubbles and subsequent corrections. These market movements significantly affect RIOT stock, amplifying its volatility.

Analyzing RIOT Stock Risk and Reward

Investing in RIOT stock requires a careful assessment of both the potential risks and rewards.

Risk Assessment

Investing in RIOT stock carries significant risks:

- Potential for significant capital loss: The high volatility of RIOT's stock price means investors face the potential for substantial capital loss.

- Importance of risk tolerance: Only investors with a high-risk tolerance should consider investing in RIOT.

- Diversification strategies: Diversifying your investment portfolio is crucial to mitigate the risks associated with RIOT's volatility.

Potential Rewards

Despite the risks, RIOT stock presents significant potential rewards:

- High growth potential in the cryptocurrency mining sector: The cryptocurrency mining sector is still relatively young and holds significant growth potential.

- Potential for significant capital appreciation: If the cryptocurrency market continues to expand, RIOT's stock price could experience substantial appreciation.

- Long-term investment opportunities: For investors with a long-term horizon, RIOT could offer attractive growth opportunities.

Conclusion

Investing in Riot Platforms (RIOT) stock presents both significant opportunities and considerable risks. The volatility of RIOT's stock price is largely tied to Bitcoin's price, regulatory changes, energy costs, and market sentiment. Understanding these factors is crucial for informed investment decisions. Before investing in Riot Platforms stock (RIOT), carefully assess your risk tolerance and conduct thorough research into the cryptocurrency mining industry and the factors influencing RIOT's performance. Learn more about managing the volatility of RIOT stock and make informed investment choices.

Featured Posts

-

Dutch Experiment Lowering Electricity Prices When Solar Power Is High

May 03, 2025

Dutch Experiment Lowering Electricity Prices When Solar Power Is High

May 03, 2025 -

South Carolina Election Trust 93 Of Voters Say Yes

May 03, 2025

South Carolina Election Trust 93 Of Voters Say Yes

May 03, 2025 -

Acquisition Attempt Toronto Firm Targets Hudsons Bays Brand And Charter

May 03, 2025

Acquisition Attempt Toronto Firm Targets Hudsons Bays Brand And Charter

May 03, 2025 -

Poppys Legacy Familys Moving Tribute To A Devoted Manchester United Supporter

May 03, 2025

Poppys Legacy Familys Moving Tribute To A Devoted Manchester United Supporter

May 03, 2025 -

Strong Winds In Oklahoma A Detailed Weather Timeline

May 03, 2025

Strong Winds In Oklahoma A Detailed Weather Timeline

May 03, 2025