Unlocking Opportunities: A Side Hustle Trading Stakes In Elon Musk's Private Businesses

Table of Contents

Identifying Potential Investment Opportunities in Musk's Private Companies

Understanding the Landscape

Investing in private companies, particularly those associated with high-profile figures like Elon Musk, presents significant hurdles. The world of private company investing is exclusive, often requiring substantial capital and established networks.

- Limited Public Information: Unlike publicly traded companies, private companies are not obligated to disclose detailed financial information.

- Strong Networks are Essential: Access to deals often relies on personal connections and referrals within the investment community.

- Accredited Investor Status: Many private investments require accredited investor status, meaning a high net worth or significant income.

Examples of Musk's private companies ripe with potential (and risk) include SpaceX, The Boring Company, and Neuralink. SpaceX, pioneering space exploration and reusable rockets, represents a massive market with potentially enormous future value. The Boring Company, focused on innovative infrastructure solutions, and Neuralink, developing advanced brain-computer interfaces, both hold immense – albeit uncertain – long-term potential. However, it's crucial to remember that these are high-risk ventures; success is far from guaranteed.

Accessing Information and Due Diligence

Thorough research is paramount before committing capital to any private company investment. Due diligence becomes even more critical given the limited public information.

- Reputable Sources: Rely on reliable financial news outlets, industry publications, and specialized investment research firms.

- Independent Verification: Never rely solely on one source. Cross-reference information from multiple reputable sources to ensure accuracy.

- Valuation Challenges: Evaluating the true worth of a private company is complex. Unlike publicly traded companies with readily available market valuations, private company valuation often relies on complex models and projections, making accurate assessment challenging.

Strategies for Participating in a Side Hustle Focused on Musk's Private Investments

Networking and Building Relationships

Building connections within the investment community is crucial for accessing exclusive opportunities. This is not a passive endeavor; it requires active engagement.

- Industry Events: Attend conferences, workshops, and networking events focused on venture capital, private equity, or space technology (depending on your focus).

- Online Communities: Join relevant online forums, groups, and social media communities to connect with other investors and industry professionals.

- Leveraging LinkedIn: Optimize your LinkedIn profile to highlight your investment interests and network strategically with individuals involved in private equity and venture capital.

Building trust and credibility is key. Demonstrate your knowledge, professionalism, and commitment to responsible investing to foster meaningful relationships that can open doors to promising investment opportunities.

Understanding Investment Vehicles

Several avenues can facilitate participation in these investments, each with its own set of pros and cons.

- Private Equity Funds: These funds pool capital from multiple investors to invest in private companies. This offers diversification but might entail higher management fees.

- Secondary Market Transactions: This involves buying shares from existing investors in a private company. This can be less expensive than participating in a primary funding round but might entail less growth potential.

- Angel Investing: Investing directly as an angel investor offers significant potential returns, but also requires more capital and expertise.

Understanding the regulatory landscape, including securities laws and regulations pertaining to private placements, is essential. Always seek legal counsel to ensure compliance.

Managing Risk and Diversification

Investing in private companies, particularly those with high growth potential but also considerable risk, demands a robust risk management strategy.

- Diversification: Never put all your eggs in one basket. Diversify your investments across different asset classes and private companies to mitigate risk.

- Risk Tolerance: Understand your personal risk tolerance before committing capital. Only invest an amount you can afford to lose.

- Alignment with Financial Goals: Ensure your investments align with your overall financial goals and timeline. Don't invest money you need for short-term objectives.

Legal and Ethical Considerations

Regulatory Compliance

Adherence to all relevant securities laws and regulations is crucial. Violating these laws can result in severe penalties.

- Unauthorized Trading: Avoid trading in securities without proper authorization or registration.

- Insider Information: Never use insider information to gain an unfair advantage in the market.

- Professional Advice: Consult with legal and financial professionals to ensure compliance with all applicable laws and regulations.

Ethical Investing

Responsible and ethical investing practices are paramount. Transparency and accountability should guide all investment decisions.

- Responsible Investing: Consider the social and environmental impact of the companies you invest in.

- Avoid Speculative Behavior: Don't make investment decisions based solely on hype or speculation.

- Long-Term Perspective: Focus on the long-term potential of the companies rather than short-term gains.

Conclusion: Unlocking Your Potential with a Side Hustle in Elon Musk's Private Businesses

Investing in Elon Musk's private companies offers substantial potential rewards, but it also involves significant risks. Success hinges on thorough due diligence, a strong network, effective risk management, and strict adherence to legal and ethical guidelines. This side hustle requires commitment, research, and a deep understanding of the investment landscape. Before considering a side hustle trading stakes in Elon Musk's private businesses, conduct thorough research, seek professional advice from financial and legal experts, and develop a well-defined investment strategy that aligns with your risk tolerance and financial goals. Remember, this is a high-risk venture, and careful consideration is crucial before committing any capital.

Featured Posts

-

Climate Change And Africas Workforce Adapting To The Green Transition

Apr 26, 2025

Climate Change And Africas Workforce Adapting To The Green Transition

Apr 26, 2025 -

Positieve Trend Steun Voor Koningshuis Bereikt 59

Apr 26, 2025

Positieve Trend Steun Voor Koningshuis Bereikt 59

Apr 26, 2025 -

Jorgensons Paris Nice Victory A Dominant Performance

Apr 26, 2025

Jorgensons Paris Nice Victory A Dominant Performance

Apr 26, 2025 -

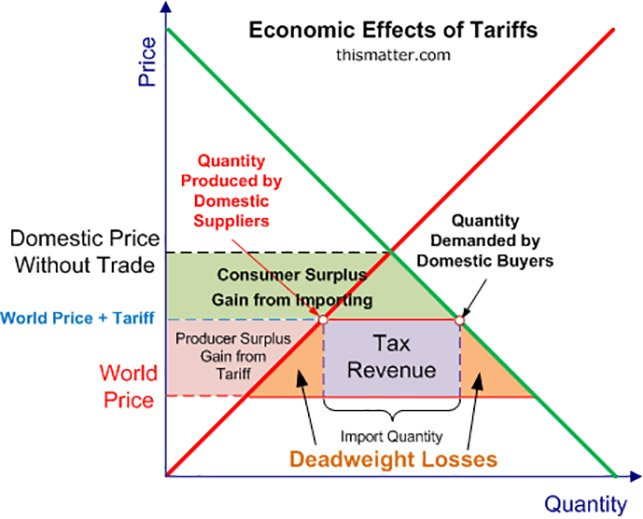

Trumps Tariffs Ceos Highlight Negative Impact On Economy And Consumer Confidence

Apr 26, 2025

Trumps Tariffs Ceos Highlight Negative Impact On Economy And Consumer Confidence

Apr 26, 2025 -

Benson Boones Sheer Lace Top At The 2025 I Heart Radio Music Awards

Apr 26, 2025

Benson Boones Sheer Lace Top At The 2025 I Heart Radio Music Awards

Apr 26, 2025

Latest Posts

-

Sabrina Carpenters Fun Size Friend Makes Snl Appearance

May 06, 2025

Sabrina Carpenters Fun Size Friend Makes Snl Appearance

May 06, 2025 -

Snl Sabrina Carpenter Teams Up With Fun Size Castmate For Surprise Performance

May 06, 2025

Snl Sabrina Carpenter Teams Up With Fun Size Castmate For Surprise Performance

May 06, 2025 -

Unexpected Snl Guest Sabrina Carpenter And A Fun Size Friend

May 06, 2025

Unexpected Snl Guest Sabrina Carpenter And A Fun Size Friend

May 06, 2025 -

Snl Sabrina Carpenters Unexpected Fun Size Collaboration

May 06, 2025

Snl Sabrina Carpenters Unexpected Fun Size Collaboration

May 06, 2025 -

Sabrina Carpenter Joins Quinta Brunson For A Hilarious Snl Moment

May 06, 2025

Sabrina Carpenter Joins Quinta Brunson For A Hilarious Snl Moment

May 06, 2025