Unseen Risks: The Growing Threat Of A Bond Market Collapse

Table of Contents

Rising Interest Rates and Their Impact

The Inverse Relationship

The foundation of understanding the risk of a bond market collapse lies in grasping the inverse relationship between interest rates and bond prices. Bonds are essentially loans, and their value is inversely proportional to prevailing interest rates. When interest rates rise, newly issued bonds offer higher yields, making existing bonds with lower yields less attractive. This leads to a decline in their market price. This dynamic is crucial for assessing the potential for a bond market collapse.

The Fed's Role

The Federal Reserve (Fed), the central bank of the United States, plays a pivotal role in influencing interest rates through its monetary policy. Aggressive rate hikes, aimed at combating inflation, can significantly increase the risk of a bond market collapse. By raising the cost of borrowing, the Fed makes bonds less appealing, potentially triggering a sell-off. The Fed's actions, therefore, are a key factor to monitor when assessing the stability of the bond market and the likelihood of a collapse.

- Impact on bond yields: Higher interest rates lead to higher bond yields on new issues, pushing down prices of existing bonds.

- Increased borrowing costs for governments and corporations: Higher rates make it more expensive for governments and corporations to borrow money, potentially leading to defaults.

- Potential for defaults: Increased borrowing costs can push financially vulnerable entities into default, further destabilizing the bond market.

- Liquidity concerns in the bond market: A rapid increase in interest rates can cause a sudden decrease in liquidity, making it difficult to buy or sell bonds without significant price movements.

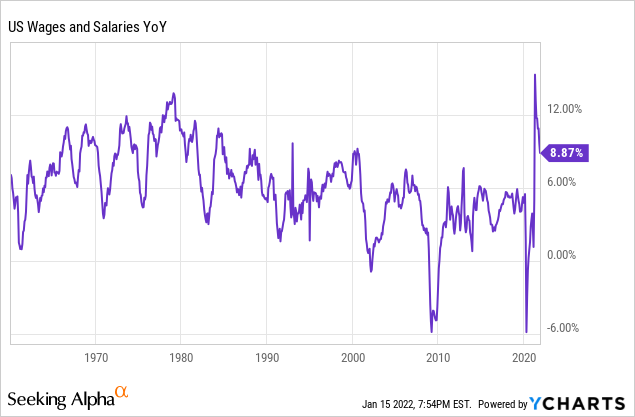

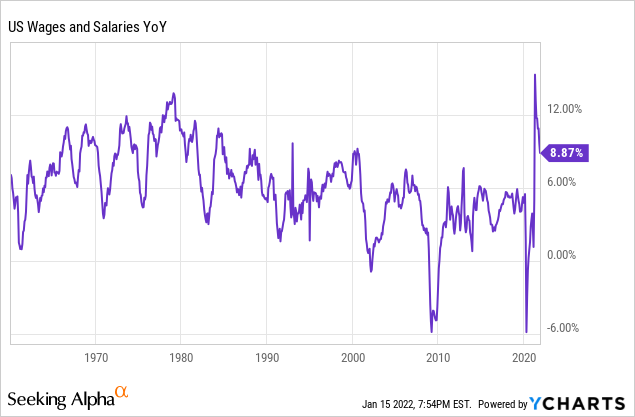

Inflation and its Erosive Effect on Bond Returns

Inflation's Impact on Fixed Income

High inflation significantly erodes the purchasing power of fixed-income investments like bonds. If inflation outpaces the bond's yield, the investor receives less in real terms than they initially invested. This loss of real value can trigger a sell-off, contributing to a potential bond market collapse. Understanding inflation's impact is critical for any investor in the bond market.

Real Yields and Their Significance

The concept of real yield – the nominal yield (the stated interest rate) minus the inflation rate – is crucial for assessing bond investments. Negative real yields signal that the investor is losing purchasing power, creating a highly unfavorable investment environment. Persistently negative real yields can be a significant warning sign of impending market instability, potentially leading to a bond market collapse.

- The impact of unexpected inflation spikes: Sudden, sharp increases in inflation can dramatically reduce the real return on bonds, causing investors to flee the market.

- The difficulty of predicting inflation accurately: The unpredictable nature of inflation makes it challenging to accurately assess the risk of negative real yields, increasing the uncertainty surrounding bond investments.

- The flight to safety (or lack thereof) during inflationary periods: Traditionally, bonds are considered a safe haven during times of economic uncertainty. However, high inflation can negate this benefit, potentially leading to a decline in demand for bonds.

Geopolitical Instability and its Influence on Bond Markets

Global Uncertainty

Geopolitical events, such as wars, political upheavals, and international tensions, create significant uncertainty in the global financial system. This uncertainty can lead to massive bond sell-offs as investors seek safer assets. The resulting volatility increases the risk of a bond market collapse.

Safe Haven Status Challenged

Bonds have traditionally been viewed as a "safe haven" asset during times of turmoil. However, recent geopolitical events have challenged this status. Increased global uncertainty has led investors to question the stability of even the most highly-rated bonds, increasing the risk of a market collapse.

- Examples of recent geopolitical events affecting bond markets: The war in Ukraine, escalating US-China tensions, and political instability in various regions have all contributed to bond market volatility.

- Increased risk aversion among investors: Geopolitical uncertainty drives investors toward less risky assets, potentially leading to a sharp decline in demand for bonds.

- Capital flight from bond markets: Investors may pull their money out of bond markets and move it to perceived safer assets like gold or cash, further exacerbating the potential for a collapse.

Signs of a Potential Bond Market Collapse

Key Indicators to Watch

Several key indicators can help investors gauge the health of the bond market and identify potential warning signs of a collapse. These include: credit spreads (the difference between the yields of corporate bonds and government bonds), yield curves (a graphical representation of bond yields across different maturities), and investor sentiment (the overall feeling of optimism or pessimism towards the bond market). Closely monitoring these indicators is crucial for informed investment decisions.

Early Warning Signals

Several factors can signal an impending bond market crisis. These early warning signs should be taken seriously.

- Increased volatility in bond prices: Significant and sustained price swings can be a sign of underlying instability.

- Widening credit spreads: A widening gap between corporate and government bond yields suggests increased risk aversion and potential defaults.

- Inverted yield curves: When short-term bond yields exceed long-term yields, it's often seen as a predictor of economic recession and potential bond market collapse.

- Decreased liquidity in the bond market: Difficulty in buying or selling bonds without significant price impacts indicates a weakening market.

Conclusion

A potential bond market collapse presents a significant threat to the global economy. Rising interest rates, high inflation, geopolitical instability, and several key warning signs all contribute to this risk. The consequences of such a collapse could be far-reaching and severe. To mitigate this risk, investors should stay informed about bond market developments, closely monitor key indicators, and consider diversifying their investment portfolios to reduce their exposure to this potentially devastating event. Further research into bond market analysis and risk management strategies is highly recommended to navigate this complex and potentially volatile landscape. Understanding the threats and mitigating your risks is crucial to avoiding the potentially catastrophic consequences of a bond market collapse.

Featured Posts

-

Marlin Fishing The Increasing Popularity Of Torpedo Bats

May 28, 2025

Marlin Fishing The Increasing Popularity Of Torpedo Bats

May 28, 2025 -

Basarnas Cari Balita Yang Hilang Di Batu Ampar Balikpapan

May 28, 2025

Basarnas Cari Balita Yang Hilang Di Batu Ampar Balikpapan

May 28, 2025 -

Liverpool Transfers Assessing Two Potential Wingers Amidst Salah Contract Talks

May 28, 2025

Liverpool Transfers Assessing Two Potential Wingers Amidst Salah Contract Talks

May 28, 2025 -

Bali Belly A Comprehensive Guide To Diagnosis And Management

May 28, 2025

Bali Belly A Comprehensive Guide To Diagnosis And Management

May 28, 2025 -

Understanding The Rise In Rainfall In Western Massachusetts A Climate Change Study

May 28, 2025

Understanding The Rise In Rainfall In Western Massachusetts A Climate Change Study

May 28, 2025

Latest Posts

-

Thnyt Alshykh Fysl Alhmwd Llardn Beyd Alastqlal Ma Zlt Asher Anny Byn Ahly

May 30, 2025

Thnyt Alshykh Fysl Alhmwd Llardn Beyd Alastqlal Ma Zlt Asher Anny Byn Ahly

May 30, 2025 -

Amanda Anisimova Stops Mirra Andreevas Momentum In Miami

May 30, 2025

Amanda Anisimova Stops Mirra Andreevas Momentum In Miami

May 30, 2025 -

Miami Open Anisimova Defeats Andreeva Halts Winning Streak

May 30, 2025

Miami Open Anisimova Defeats Andreeva Halts Winning Streak

May 30, 2025 -

Anisimova Upsets Andreeva At Miami Open

May 30, 2025

Anisimova Upsets Andreeva At Miami Open

May 30, 2025 -

Amanda Anisimova Ends Mirra Andreevas Winning Run In Miami

May 30, 2025

Amanda Anisimova Ends Mirra Andreevas Winning Run In Miami

May 30, 2025