US-China Trade Talks: Will Words Translate To Action? Market Reaction Crucial

Table of Contents

Recent Developments in US-China Trade Negotiations

Key Points of Contention

The core issues in the US-China trade talks remain complex and multifaceted. Major sticking points include:

- Tariffs: The imposition and potential escalation of tariffs on billions of dollars worth of goods remain a significant obstacle. These tariffs impact various sectors, leading to increased costs for consumers and businesses.

- Intellectual Property Rights (IPR): The US consistently accuses China of inadequate protection of IPR, including forced technology transfer and theft of trade secrets. Addressing this requires substantial changes to Chinese laws and enforcement practices.

- Technology Transfer: Concerns persist over China's policies requiring foreign companies to share technology in exchange for market access. The US seeks to prevent this practice, arguing it undermines American competitiveness.

- Trade Deficit: The significant US trade deficit with China is another point of contention. The US seeks to reduce this imbalance through various trade agreements and policies.

Previous attempts at trade deals, such as the "Phase One" agreement, have yielded limited success, highlighting the entrenched nature of these disagreements. Many key issues remain unresolved, fueling uncertainty.

Statements and Promises from Both Sides

Recent public statements from both sides reveal a complex interplay of rhetoric and action. While US officials emphasize the need for concrete changes in Chinese policies, Chinese officials often highlight their commitment to cooperation while also defending their national interests. Discrepancies between official statements and actual actions remain a cause for concern, undermining trust and hindering progress in the US-China trade talks. For example, while both sides may publicly express optimism, actions such as the imposition of new tariffs can quickly negate the positive sentiment.

Potential Outcomes and Their Market Implications

Scenario 1: A Comprehensive Trade Deal

A successful and comprehensive trade agreement would likely trigger a significant positive market reaction. This could include:

- Increased Trade Volume: Reduced tariffs and improved market access would lead to increased trade between the US and China, benefiting both economies.

- Reduced Uncertainty: A clear and stable trade relationship would boost investor confidence, encouraging investment and economic growth.

- Strengthened Global Growth: Positive spillover effects could be seen globally, leading to improved economic conditions in other countries.

- Specific Sector Benefits: Sectors like agriculture and technology could see significant gains from improved market access and reduced trade barriers.

Scenario 2: Limited Progress or Stalemate

Failure to reach a meaningful agreement would likely result in continued economic uncertainty and negative market consequences. This could involve:

- Continued Tariff Escalation: A lack of progress could lead to further increases in tariffs, impacting consumer prices and harming businesses.

- Economic Slowdown: Prolonged uncertainty could dampen investment and consumer spending, leading to a slowdown in economic growth in both countries and globally.

- Increased Market Volatility: Uncertainty often leads to increased market volatility, impacting stock prices and investor sentiment.

Scenario 3: Escalation of Tensions

A worst-case scenario involves a further deterioration of relations, potentially escalating into a full-blown trade war. This would have severe consequences:

- Significant Market Declines: A trade war could trigger significant declines in stock markets globally, as investors react to increased uncertainty and reduced economic prospects.

- Supply Chain Disruptions: Increased tariffs and trade restrictions could disrupt global supply chains, impacting businesses and consumers alike.

- Geopolitical Instability: Escalated tensions could further destabilize global geopolitical relations, increasing uncertainty and risk.

- Higher Consumer Prices: Consumers would likely face significantly higher prices for imported goods due to increased tariffs.

Analyzing Market Reactions as a Key Indicator

Stock Market Performance

Stock market indices such as the S&P 500 (US) and the Shanghai Composite (China) offer valuable insights into market sentiment surrounding US-China trade talks. Positive news tends to lead to increases in these indices, while negative news often causes declines. Analyzing historical data allows for identification of trends and patterns in market reactions to trade-related events. Technical analysis and sentiment indicators provide further insights into investor confidence and expectations.

Currency Fluctuations

The exchange rate between the US dollar (USD) and the Chinese yuan (CNY) is a key indicator of market sentiment. A strengthening dollar often reflects increased investor confidence in the US economy, potentially driven by positive developments in the US-China trade talks. Conversely, a weakening dollar may indicate uncertainty or negative expectations.

Commodity Prices

Commodity prices, particularly those heavily impacted by trade, like soybeans and oil, are directly affected by the ongoing negotiations. Tariffs and trade restrictions can significantly impact the prices of these commodities, influencing agricultural and energy markets globally.

Conclusion

The ongoing US-China trade talks represent a complex and dynamic situation with significant implications for global markets. The potential outcomes range from a mutually beneficial trade agreement to a full-blown trade war, each with drastically different consequences. Analyzing market reactions – from stock market performance and currency fluctuations to commodity prices – is crucial for understanding the progress (or lack thereof) in these negotiations. Keep a close eye on the unfolding developments in US-China trade talks and their reflection in global market performance. Understanding these dynamics is crucial for informed decision-making in today's interconnected world. The long-term implications of these talks will shape the future of the global economy and the US-China economic relationship for years to come.

Featured Posts

-

Rotorua A Deep Dive Into New Zealands Cultural Heritage And Geothermal Activity

May 12, 2025

Rotorua A Deep Dive Into New Zealands Cultural Heritage And Geothermal Activity

May 12, 2025 -

Tzesika Simpson I Fonitiki Tis Texniki Kai I Asynithisti Diatrofi

May 12, 2025

Tzesika Simpson I Fonitiki Tis Texniki Kai I Asynithisti Diatrofi

May 12, 2025 -

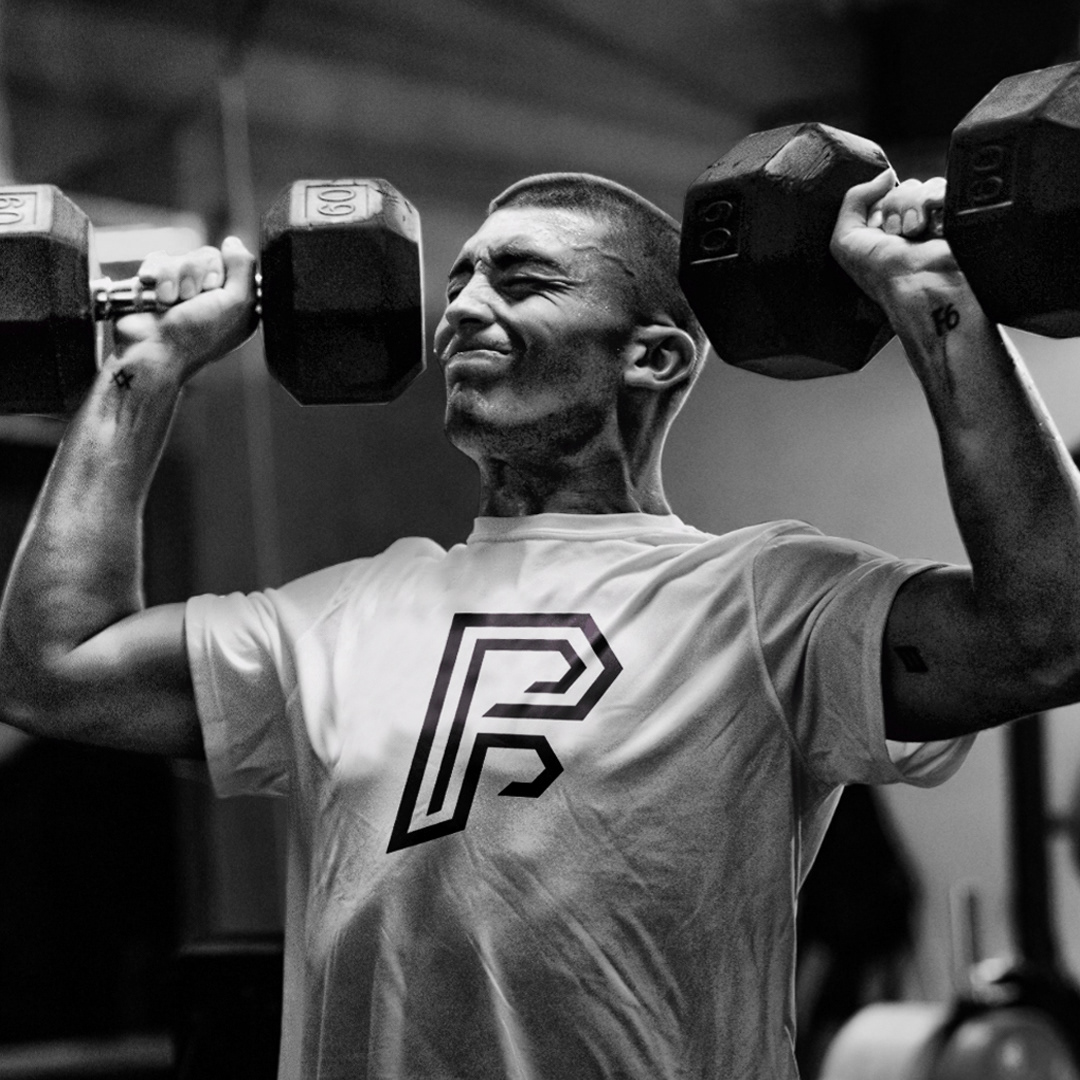

Converse Signs Celtics Guard Payton Pritchard

May 12, 2025

Converse Signs Celtics Guard Payton Pritchard

May 12, 2025 -

Aaron Judges Historic Start A New Yankees Legend Emerges

May 12, 2025

Aaron Judges Historic Start A New Yankees Legend Emerges

May 12, 2025 -

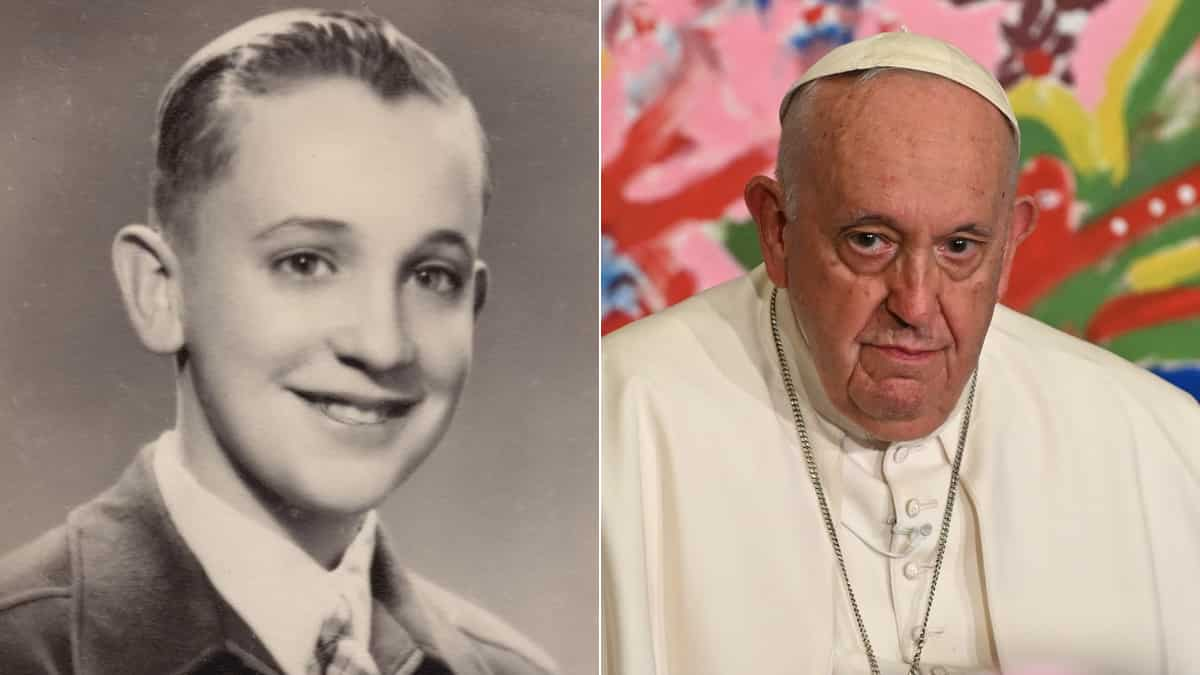

After Pope Francis A Look At The Leading Contenders For The Papacy

May 12, 2025

After Pope Francis A Look At The Leading Contenders For The Papacy

May 12, 2025

Latest Posts

-

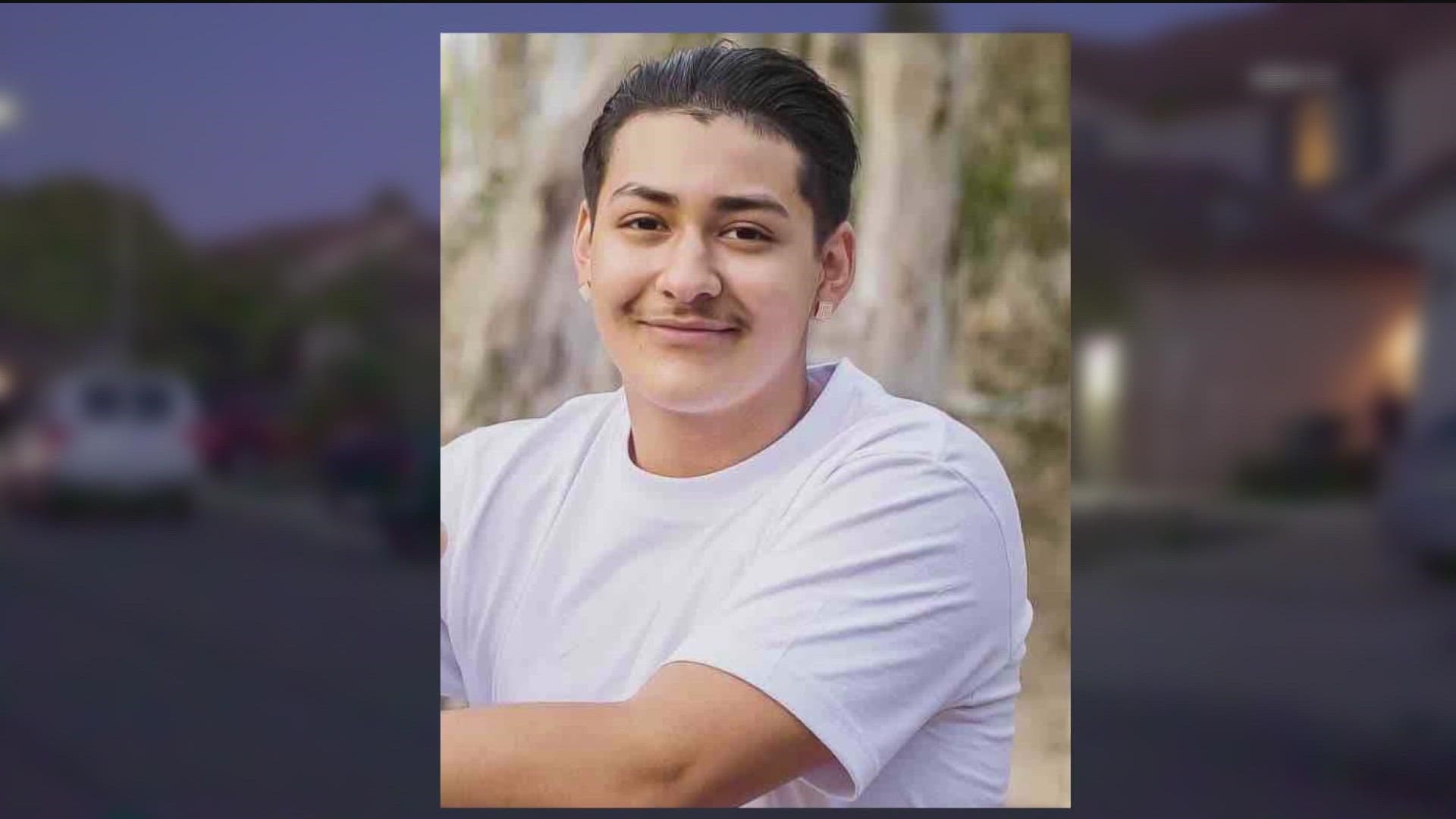

Funeral Arrangements For 15 Year Old School Stabbing Victim Announced

May 13, 2025

Funeral Arrangements For 15 Year Old School Stabbing Victim Announced

May 13, 2025 -

Community Mourns 15 Year Old Boy Stabbed At School Funeral Details

May 13, 2025

Community Mourns 15 Year Old Boy Stabbed At School Funeral Details

May 13, 2025 -

15 Year Old School Stabbing Victims Funeral Service

May 13, 2025

15 Year Old School Stabbing Victims Funeral Service

May 13, 2025 -

Funeral Held For 15 Year Old Stabbing Victim

May 13, 2025

Funeral Held For 15 Year Old Stabbing Victim

May 13, 2025 -

Cp Music Productions Booking Information For Father Son Musical Duo

May 13, 2025

Cp Music Productions Booking Information For Father Son Musical Duo

May 13, 2025