US Credit Rating Cut By Moody's: White House Responds With Sharp Criticism

Table of Contents

Moody's Rationale Behind the US Credit Rating Downgrade

Moody's cited several key factors in its decision to lower the US credit rating. The agency pointed to the persistent and escalating challenges related to the US government's fiscal strength, emphasizing the increasing risk of further deterioration in government finances. Key aspects of their rationale included:

-

Increased National Debt: The burgeoning national debt, fueled by years of budget deficits and increased spending, is a primary concern. The debt ceiling debates have repeatedly highlighted the fragility of the nation's fiscal management and the potential for future defaults. This unsustainable debt trajectory significantly impacts the nation's long-term fiscal outlook.

-

Erosion of Governance: Moody's expressed concerns about the erosion of governance effectiveness and predictability. The repeated near-misses on the debt ceiling, coupled with increasing political polarization, have created uncertainty about the government's ability to manage its finances responsibly. This lack of consistent, bipartisan action undermines investor confidence.

-

Political Gridlock Hindering Fiscal Policy: The deep partisan divisions in Congress have hampered the implementation of effective fiscal policies. The inability to reach bipartisan consensus on long-term fiscal solutions contributes to the escalating debt and instability. This political gridlock directly impacts the nation's ability to address its fiscal challenges proactively.

-

Repeated Debt Ceiling Crises: The recurring debt ceiling crises create significant uncertainty and risk for investors. The brinkmanship and last-minute deals demonstrate a lack of fiscal discipline and predictability, negatively affecting the US government's creditworthiness. This repeated pattern of near-defaults erodes confidence in the government's ability to manage its finances.

The White House's Response and Criticism of Moody's Decision

The White House responded swiftly and forcefully to Moody's downgrade, issuing a statement that sharply criticized the rating agency's methodology and conclusions. Treasury Secretary [Insert Name] and other administration officials echoed this sentiment, highlighting what they view as a flawed assessment. Key elements of the White House's response included:

-

Specific Criticisms of Moody's Methodology: The White House challenged the methodology used by Moody's, arguing that it failed to adequately account for the strength of the US economy and its resilience. They specifically disputed the weighting given to certain factors in the agency's assessment.

-

Highlighting Positive Economic Indicators: Administration officials pointed to positive economic indicators, such as strong job growth and low unemployment rates, to counter the negative assessment. They argued that the long-term economic outlook for the US remains positive, despite the current fiscal challenges.

-

Accusations of Partisan Bias (if applicable): Depending on the political climate, the White House might accuse Moody's of partisan bias, suggesting the downgrade is politically motivated rather than a purely objective assessment.

-

Emphasis on Economic Strengths Despite the Downgrade: The White House repeatedly emphasized the underlying strength of the US economy, arguing that the downgrade doesn't reflect the full picture. They focused on the nation's innovative capacity, resilient workforce, and substantial economic potential.

Potential Economic and Market Impacts of the Downgrade

The Moody's downgrade carries significant implications for the US and global economies. The immediate and long-term impacts could be substantial:

-

Increased Borrowing Costs for the US Government: A lower credit rating typically leads to higher borrowing costs for the US government, making it more expensive to finance the national debt. This increased cost of borrowing will likely impact future government spending and programs.

-

Potential Impact on the Dollar's Value: The downgrade could weaken the value of the US dollar relative to other currencies, potentially leading to increased inflation and impacting international trade. Market volatility will influence the dollar's short and long-term value.

-

Effects on Consumer and Business Confidence: A credit downgrade could erode consumer and business confidence, leading to reduced spending and investment. This decreased confidence could potentially slow economic growth and hamper future economic expansion.

-

Potential Ripple Effects on International Markets: The downgrade could have ripple effects across global financial markets, impacting investor confidence and potentially triggering volatility in other countries' economies. International investors might shift investments away from US assets, affecting global market stability.

Historical Context and Comparison to Previous Downgrades

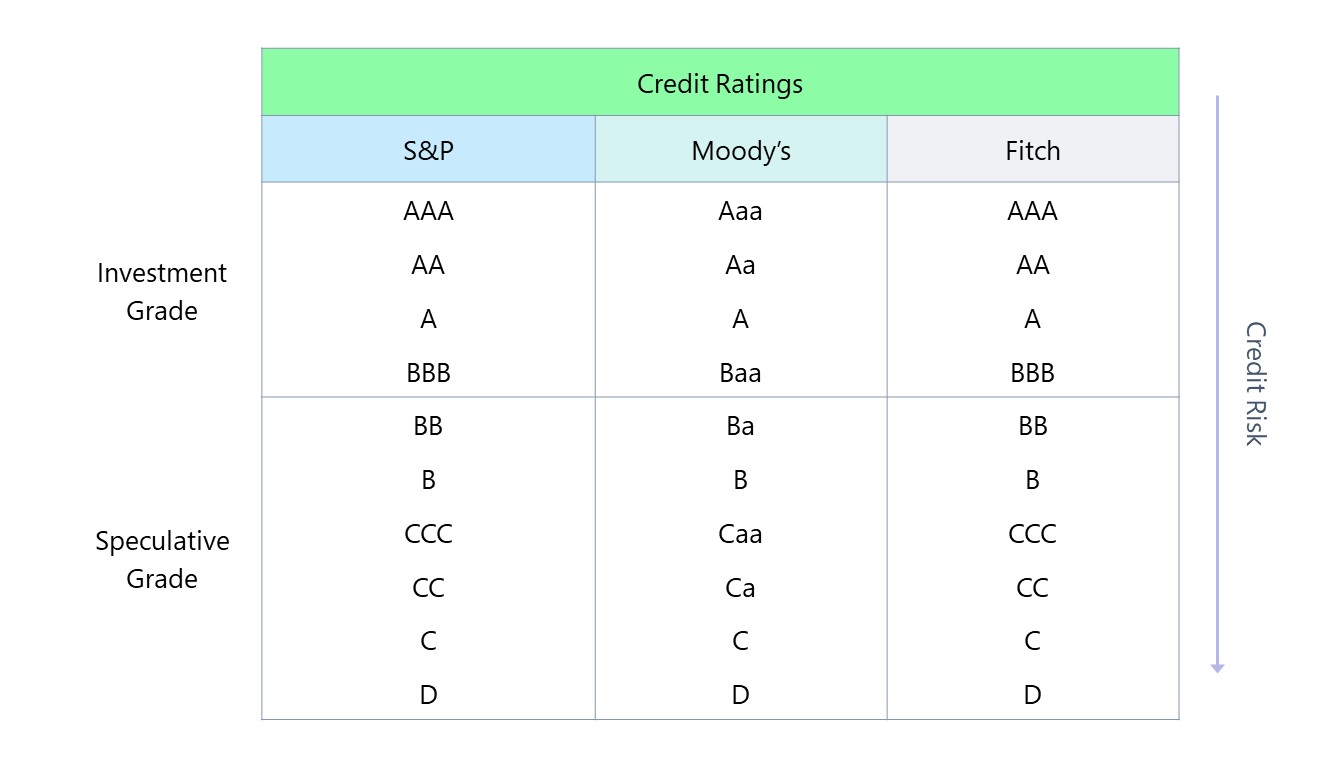

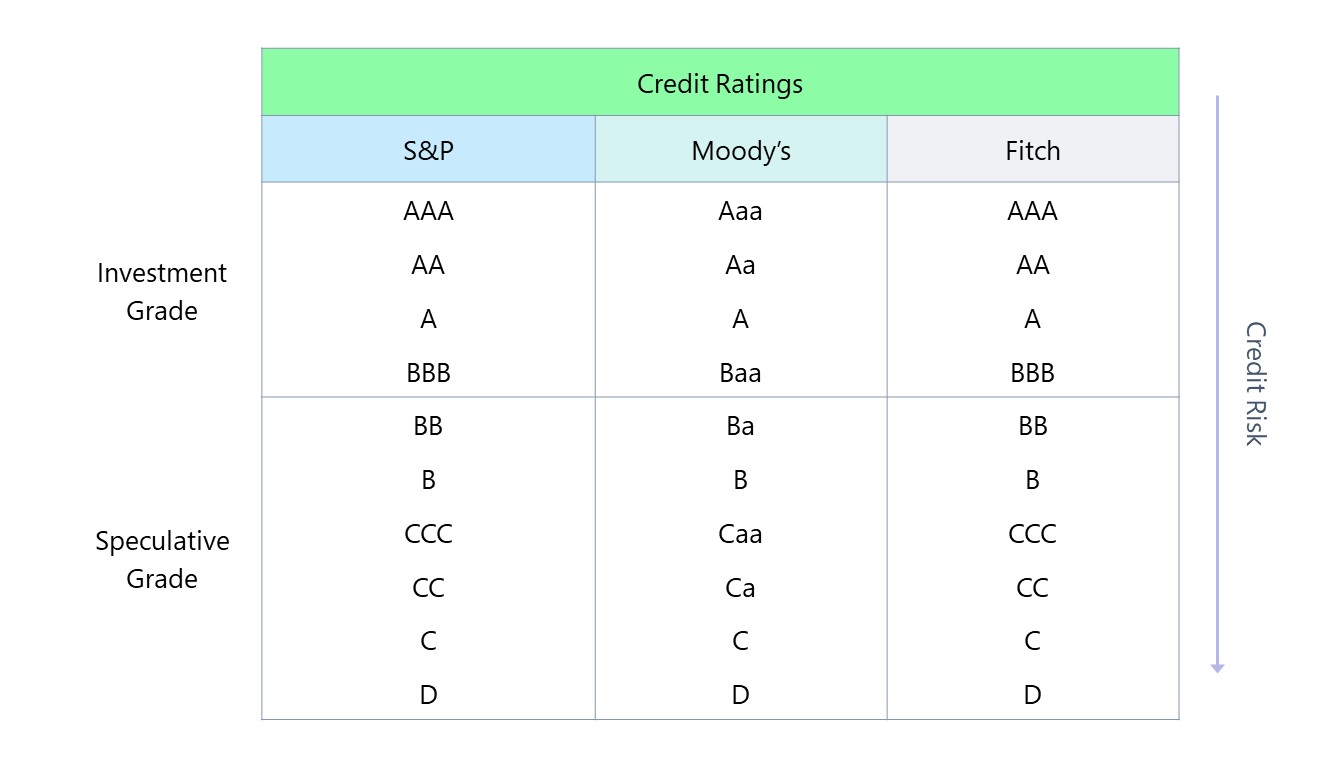

This is not the first time the US credit rating has faced scrutiny. A comparison to previous downgrades, such as the S&P downgrade in 2011, provides valuable historical context:

-

Similarities and Differences to Past Downgrades: Analyzing past downgrades helps assess the severity and potential impact of the current situation. Comparing the underlying reasons and the market's reaction provides valuable insight into likely future trends.

-

Long-Term Implications Compared to Past Events: Examining the long-term consequences of past rating changes helps anticipate potential future outcomes and inform appropriate policy responses. Learning from past experiences is critical for managing current challenges.

-

Analysis of the Market Reaction to Previous Downgrades: Understanding past market reactions offers clues about how investors might respond to this latest downgrade. Analyzing previous responses helps predict current market volatility and inform investment strategies.

Conclusion: Understanding the Implications of the US Credit Rating Cut

Moody's downgrade of the US credit rating is a significant event with potential long-term economic and political consequences. The agency's rationale centers on concerns about escalating national debt, weakening governance, political gridlock, and recurring debt ceiling crises. The White House responded with strong criticism, challenging the methodology and highlighting positive economic indicators. However, the potential impacts, including increased borrowing costs, a weaker dollar, and decreased investor confidence, are significant and warrant careful monitoring. Understanding the implications of this US credit rating downgrade is crucial for navigating the evolving economic landscape. Stay informed about further developments by following reputable news sources and government agencies for updates on the US credit rating downgrade and its impact. The continued monitoring of this situation is vital for all stakeholders.

Featured Posts

-

Latest Transfer Update Arsenal And Stuttgart Midfielder

May 18, 2025

Latest Transfer Update Arsenal And Stuttgart Midfielder

May 18, 2025 -

Gop Tax Plan Stalled Conservative Opposition Over Medicaid And Clean Energy Provisions

May 18, 2025

Gop Tax Plan Stalled Conservative Opposition Over Medicaid And Clean Energy Provisions

May 18, 2025 -

Taylor Swift Eras Tour An In Depth Look At Her Wardrobe And Costumes

May 18, 2025

Taylor Swift Eras Tour An In Depth Look At Her Wardrobe And Costumes

May 18, 2025 -

Japans Metropolis A Case Study In Urban Planning

May 18, 2025

Japans Metropolis A Case Study In Urban Planning

May 18, 2025 -

Why India Is Turning Away From Pakistan Turkey And Azerbaijan

May 18, 2025

Why India Is Turning Away From Pakistan Turkey And Azerbaijan

May 18, 2025

Latest Posts

-

Instruktsiya Kane Uesta K Sobstvennym Pokhoronam Vdokhnovenie Ot Pashi Tekhnikom

May 18, 2025

Instruktsiya Kane Uesta K Sobstvennym Pokhoronam Vdokhnovenie Ot Pashi Tekhnikom

May 18, 2025 -

Fans React Is Jenna Bush Hagers Today Show Presence A Permanent Fixture

May 18, 2025

Fans React Is Jenna Bush Hagers Today Show Presence A Permanent Fixture

May 18, 2025 -

The Night Snl Went Unfiltered Audience Swears On Live Television

May 18, 2025

The Night Snl Went Unfiltered Audience Swears On Live Television

May 18, 2025 -

Kane Uest I Pokhorony Instruktsiya Ot Pashi Tekhnikom

May 18, 2025

Kane Uest I Pokhorony Instruktsiya Ot Pashi Tekhnikom

May 18, 2025 -

G105 Captures Raw Snl Audience Reaction With Explicit Language

May 18, 2025

G105 Captures Raw Snl Audience Reaction With Explicit Language

May 18, 2025