US Debt Limit: Potential August Crisis, According To Treasury

Table of Contents

Understanding the US Debt Ceiling and its Implications

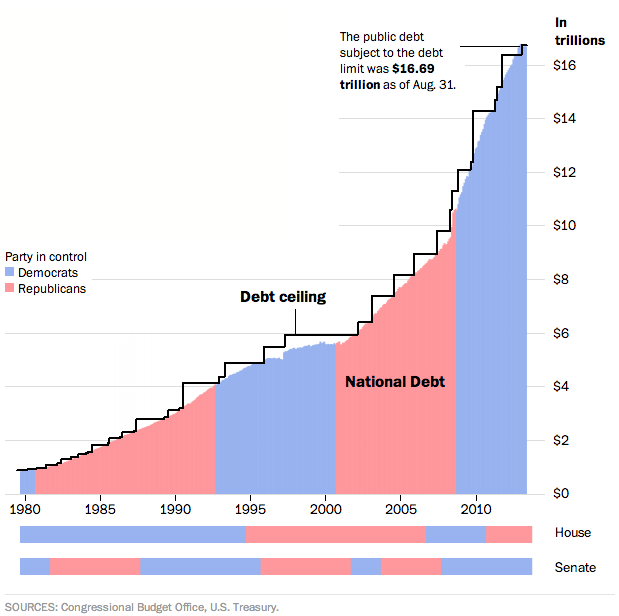

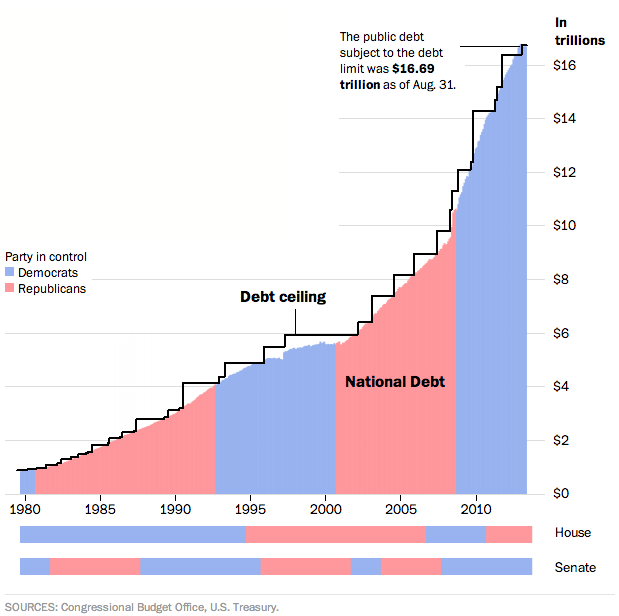

The US debt ceiling is a limit on the total amount of money the US government can borrow to meet its existing legal obligations. It's not a limit on spending; rather, it's a limit on the government's ability to finance already-authorized spending. Congress sets this limit, and raising it requires a legislative process involving both the House and the Senate.

Raising the debt ceiling is typically a routine procedure, but in recent years, it has become a highly politicized event. Past debates have resulted in brinkmanship, government shutdowns, and near-defaults, highlighting the fragility of the situation.

- Definition of the debt ceiling: A legally mandated limit on the total amount of money the US government can borrow.

- Consequences of exceeding the debt ceiling: A potential US government default, leading to severe economic consequences.

- Brief history of past debt ceiling crises: Several near-defaults have occurred in recent decades, causing market volatility and uncertainty.

- Key players involved in debt ceiling negotiations: The President, Congress (House and Senate), and the Treasury Department play crucial roles in negotiations.

Treasury Secretary's Warning: An August Crisis Looms

Treasury Secretary Janet Yellen has repeatedly warned Congress about the rapidly approaching deadline. Her statements paint a grim picture, outlining a potential default as early as August if a deal isn't reached to raise the debt ceiling. The Treasury is employing extraordinary measures to manage cash flow, but these are temporary and will soon be exhausted. The Secretary's warnings underscore the urgency of the situation and the potential for a severe economic crisis.

- Specific dates mentioned by the Treasury: While the exact date remains uncertain, August is highlighted as the critical timeframe.

- Summary of the Secretary's warnings: A failure to raise the debt ceiling will lead to a US government default with catastrophic consequences.

- Potential government actions to avoid default: Negotiations and compromise between Congress and the executive branch are essential.

- Specific economic consequences outlined: Market turmoil, higher interest rates, and a potential recession are among the predicted outcomes.

Potential Economic Consequences of a Debt Limit Default

A US government default would have far-reaching and potentially devastating consequences. The global financial system relies heavily on the perceived stability of US debt, and a default would severely damage investor confidence.

- Impact on interest rates and borrowing costs: Interest rates would likely spike dramatically, making borrowing more expensive for individuals, businesses, and the government itself.

- Potential stock market volatility: A significant downturn in the stock market is almost certain, potentially wiping out trillions of dollars in wealth.

- Consequences for the US dollar's value: The value of the US dollar would likely plummet, impacting international trade and the cost of imported goods.

- Impact on consumer spending and economic growth: Consumer confidence would fall sharply, leading to reduced spending and a potential recession.

- Social and political consequences of default: Increased unemployment, social unrest, and a loss of international standing are all potential outcomes.

Political Landscape and Potential Solutions

The political landscape surrounding the debt ceiling debate is deeply polarized. Negotiations between the Republican-controlled House and the Democratic-led Senate are fraught with tension and disagreements over spending levels and policy priorities. Finding a compromise that satisfies both parties is proving incredibly challenging.

- Stances of different political parties: The parties hold differing views on the budget, complicating negotiations and potentially leading to a stalemate.

- Potential compromise solutions: Various options exist, including short-term extensions, spending caps, and a broader budget deal.

- Obstacles to reaching a consensus: Deep ideological divides and political maneuvering are major roadblocks to a swift resolution.

- Short-term and long-term solutions: A short-term fix would only delay the inevitable, while a long-term solution requires a broader agreement on fiscal policy.

Conclusion

The looming US debt ceiling crisis presents a significant threat to the US and global economy. Treasury Secretary Yellen's warning about a potential August default underscores the urgency of the situation. Failure to raise the debt limit could trigger a cascade of negative economic consequences, from market volatility and increased interest rates to a potential recession and social unrest. It’s crucial to stay informed about developments in this critical debate and urge your representatives in Congress to act responsibly and reach a bipartisan solution to address the US debt limit crisis before it’s too late. Follow reputable news sources and government websites for updates on the ongoing negotiations and advocate for responsible fiscal policy.

Featured Posts

-

Behind The Gates Exploring The Exclusive Mansions Of Mtv Cribs

May 11, 2025

Behind The Gates Exploring The Exclusive Mansions Of Mtv Cribs

May 11, 2025 -

The John Wick Experience Las Vegas Launch

May 11, 2025

The John Wick Experience Las Vegas Launch

May 11, 2025 -

Tzesika Simpson Kai I Diatirisi Tis Fonitikis Tis Ikanotitas

May 11, 2025

Tzesika Simpson Kai I Diatirisi Tis Fonitikis Tis Ikanotitas

May 11, 2025 -

Payton Pritchard Nba Sixth Man Award Winner

May 11, 2025

Payton Pritchard Nba Sixth Man Award Winner

May 11, 2025 -

B And W Trailer Hitches Heavy Hitters All Star Event 100 K Bass Fishing Tournament At Smith Mountain Lake

May 11, 2025

B And W Trailer Hitches Heavy Hitters All Star Event 100 K Bass Fishing Tournament At Smith Mountain Lake

May 11, 2025

Latest Posts

-

The Sale Of Banned Candles On Etsy Walmart And Amazon In Canada A Concern

May 14, 2025

The Sale Of Banned Candles On Etsy Walmart And Amazon In Canada A Concern

May 14, 2025 -

Jobe Bellingham Transfer Price Tag Stuns Chelsea And Tottenham

May 14, 2025

Jobe Bellingham Transfer Price Tag Stuns Chelsea And Tottenham

May 14, 2025 -

Investigation Banned Candles Found On Canadian Online Marketplaces Etsy Walmart Amazon

May 14, 2025

Investigation Banned Candles Found On Canadian Online Marketplaces Etsy Walmart Amazon

May 14, 2025 -

Chelsea And Tottenhams Bellingham Pursuit Asking Price Revealed

May 14, 2025

Chelsea And Tottenhams Bellingham Pursuit Asking Price Revealed

May 14, 2025 -

Banned Candles In Canada Etsy Walmart Amazon Sales

May 14, 2025

Banned Candles In Canada Etsy Walmart Amazon Sales

May 14, 2025