US IPO Market: Omada Health And The Andreessen Horowitz Connection

Table of Contents

Omada Health's Business Model and Market Position

Chronic Disease Management through Telehealth

Omada Health's core offering revolves around virtual care programs designed for individuals managing chronic conditions like type 2 diabetes and hypertension. Their target market is precisely those individuals struggling with these conditions, often facing challenges with traditional healthcare approaches. The company utilizes a sophisticated blend of digital tools and remote patient monitoring to deliver personalized, proactive care. This approach offers a compelling value proposition: improved health outcomes, increased patient engagement, and significant cost savings for both patients and healthcare systems.

- Target Market: Individuals with type 2 diabetes, hypertension, and other chronic conditions.

- Technology: Digital health platform, wearable devices for remote monitoring, telehealth consultations, personalized coaching.

- Value Proposition: Improved health outcomes, increased patient engagement, reduced healthcare costs, convenient access to care.

Market Opportunity and Competitive Landscape

The telehealth market is experiencing explosive growth, driven by increasing demand for convenient, accessible healthcare solutions. Omada Health operates within a competitive landscape, but its unique approach and strong performance have helped it carve out a significant market share. The market size for digital therapeutics and remote patient monitoring is projected to grow substantially in the coming years, presenting a significant opportunity for companies like Omada Health. However, competition from established players and emerging startups remains intense.

- Market Size: The global telehealth market is valued at billions of dollars and is projected to experience significant growth.

- Growth Projections: High growth potential fueled by technological advancements, increasing adoption rates, and favorable regulatory changes.

- Key Competitors: Other telehealth companies offering chronic disease management programs, traditional healthcare providers expanding their digital offerings.

- Omada Health's Competitive Advantages: Personalized programs, strong clinical outcomes, established partnerships, and a proven track record.

Andreessen Horowitz's Role in Omada Health's Growth

Investment and Strategic Guidance

Andreessen Horowitz (a16z) has been a crucial partner in Omada Health's journey, providing significant financial backing and strategic guidance. a16z's investment history with Omada Health spans multiple funding rounds, providing the capital necessary for the company's growth and expansion. This financial support, coupled with the strategic insights offered by a16z's experienced team, has been instrumental in shaping Omada Health's trajectory.

- Investment Rounds: Multiple rounds of seed funding, Series A, B, and potentially later-stage funding.

- Funding Amount: Significant capital infusion enabling product development, team expansion, and market penetration.

- Key Individuals: Specific partners or managing directors from a16z involved in the investment and strategic guidance.

Network and Expertise

Beyond financial investment, a16z's extensive network and industry expertise have significantly benefited Omada Health. The firm's connections within the healthcare industry have facilitated strategic partnerships and collaborations. Furthermore, a16z's experienced team has provided invaluable mentorship and guidance, helping Omada Health navigate the complexities of the healthcare market and scale its operations effectively.

- Strategic Partnerships: Access to key players in the healthcare ecosystem, enhancing market penetration and distribution.

- Mentorship and Guidance: Access to seasoned industry veterans, offering advice and support on strategic decision-making.

- Leveraging a16z Resources: Access to a wide range of resources, including legal, regulatory, and marketing expertise.

Analysis of Omada Health's IPO

IPO Valuation and Performance

Omada Health's IPO marked a significant milestone, showcasing investor confidence in the company's potential. The IPO details, including the valuation, initial market reaction, and subsequent stock performance, provide valuable insights into the company's current market standing and future prospects. Analyzing these aspects helps to understand the factors that contributed to the success (or challenges) of the IPO.

- IPO Date: The specific date when Omada Health's shares began trading on the public market.

- Offering Price: The price per share at which Omada Health's stock was initially offered to the public.

- Initial Market Capitalization: The total value of the company's outstanding shares at the time of the IPO.

- Post-IPO Events: Significant events that occurred after the IPO, impacting stock price and investor sentiment.

Factors Contributing to IPO Success (or Challenges)

Several factors influenced Omada Health's IPO success, including market conditions, the company's financial performance, and overall investor sentiment. The timing of the IPO, relative to broader market trends and investor appetite for digital health companies, played a crucial role. Strong financial performance, including revenue growth and profitability, also significantly influenced investor interest. The regulatory environment and investor confidence in the long-term prospects of the telehealth industry were additional key factors.

- Market Timing: The overall state of the IPO market and investor appetite for digital health companies at the time of the offering.

- Financial Performance: Omada Health's revenue growth, profitability, and overall financial health leading up to the IPO.

- Regulatory Environment: The regulatory landscape governing the telehealth industry and its impact on Omada Health's operations.

- Investor Sentiment: The overall optimism or pessimism among investors regarding the future prospects of Omada Health and the telehealth industry.

Conclusion

Omada Health's successful IPO underscores the growing importance of telehealth in the healthcare industry and highlights the crucial role that venture capital firms like Andreessen Horowitz play in fostering innovation and growth within the US IPO market. The company's strong business model, coupled with a strategic partnership with a leading venture capital firm, positioned it for success in the competitive digital health space. The analysis of Omada Health's IPO provides valuable insights into the factors driving success in the US IPO market, particularly within the dynamic telehealth sector. Understanding these dynamics is crucial for both entrepreneurs seeking to enter the public market and investors seeking promising investment opportunities.

Interested in learning more about the impact of venture capital on the US IPO market and the success stories like Omada Health?

Featured Posts

-

Elon Musks Net Worth Falls Below 300 Billion Teslas Troubles And Tariff Impacts

May 10, 2025

Elon Musks Net Worth Falls Below 300 Billion Teslas Troubles And Tariff Impacts

May 10, 2025 -

Bodycam Video Shows Police Saving Toddler Choking On Tomato

May 10, 2025

Bodycam Video Shows Police Saving Toddler Choking On Tomato

May 10, 2025 -

Sensex Today Market Gains Momentum Nifty Climbs Key Highlights

May 10, 2025

Sensex Today Market Gains Momentum Nifty Climbs Key Highlights

May 10, 2025 -

Uterus Transplantation A Community Activists Proposal For Transgender Womens Childbearing

May 10, 2025

Uterus Transplantation A Community Activists Proposal For Transgender Womens Childbearing

May 10, 2025 -

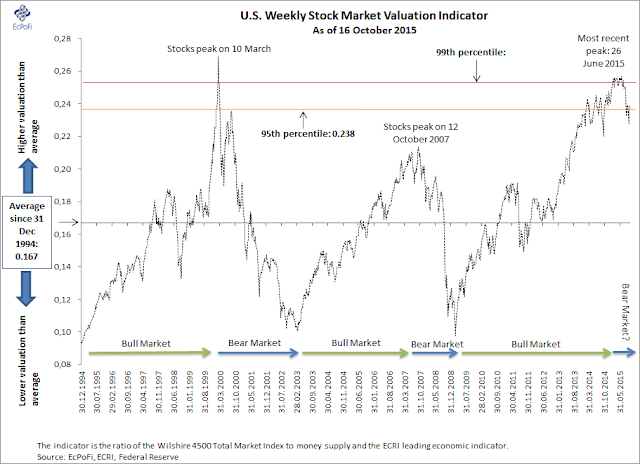

High Stock Valuations Bof As Reasons For Investor Calm

May 10, 2025

High Stock Valuations Bof As Reasons For Investor Calm

May 10, 2025

Latest Posts

-

Rumeysa Ozturk Tufts Student Released From Ice Custody Following Court Order

May 11, 2025

Rumeysa Ozturk Tufts Student Released From Ice Custody Following Court Order

May 11, 2025 -

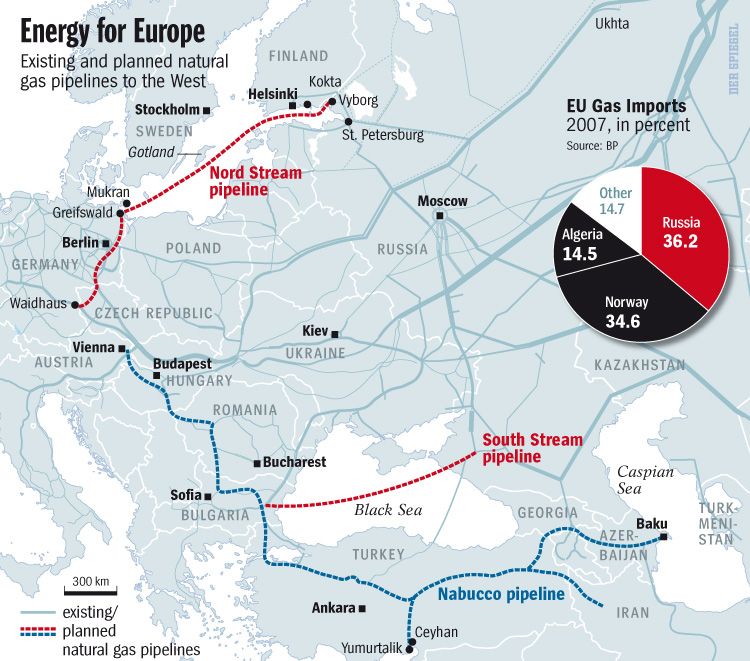

Exclusive Elliott Managements High Stakes Russian Gas Pipeline Investment

May 11, 2025

Exclusive Elliott Managements High Stakes Russian Gas Pipeline Investment

May 11, 2025 -

Elliott Eyes Russian Gas Pipeline An Exclusive Investment Opportunity

May 11, 2025

Elliott Eyes Russian Gas Pipeline An Exclusive Investment Opportunity

May 11, 2025 -

Evaluating High Stock Market Valuations The Bof A Viewpoint

May 11, 2025

Evaluating High Stock Market Valuations The Bof A Viewpoint

May 11, 2025 -

Stock Market Valuation Concerns Bof As Reassurance To Investors

May 11, 2025

Stock Market Valuation Concerns Bof As Reassurance To Investors

May 11, 2025