US Solar Import Duties: Hanwha And OCI's Strategy For Growth

Table of Contents

Hanwha Q CELLS' Response to US Solar Import Duties

Hanwha Q CELLS, a leading solar energy company, has adopted a multi-pronged approach to mitigate the impact of US solar import duties and capitalize on the growing demand for clean energy. Their strategy centers on domestic manufacturing, strategic partnerships, and leveraging government incentives.

Investment in US Manufacturing

Hanwha Q CELLS has made substantial investments in domestic solar cell and module manufacturing facilities within the US. This strategic move not only reduces reliance on imported products, thereby lessening the impact of tariffs, but also stimulates the American economy.

- Factory Locations: Hanwha operates significant manufacturing facilities in Dalton, Georgia, representing a substantial investment in US infrastructure and job creation.

- Production Capacity: These facilities boast a considerable production capacity, contributing significantly to the domestic supply of solar modules and reducing dependence on foreign sources. Specific figures on production capacity are not publicly available but are substantial and growing.

- Job Creation: The establishment and operation of these plants have led to the creation of hundreds, if not thousands, of well-paying jobs in local communities, boosting regional economies.

- Impact on Local Economies: The economic ripple effect extends beyond direct employment, encompassing increased demand for local services, improved infrastructure, and greater overall economic activity in the surrounding regions.

Strategic Partnerships and Supply Chain Diversification

Recognizing the importance of a resilient supply chain, Hanwha Q CELLS has forged strategic alliances with other US companies. These partnerships ensure access to essential materials and components, mitigating risks associated with import disruptions and fluctuating tariff schedules.

- Examples of Key Partnerships: While specific partnership details may be confidential, Hanwha actively seeks collaborations to bolster its supply chain strength and stability.

- Benefits of Diversification: Diversifying its supply chain reduces reliance on single sources and enhances the company's capacity to withstand external shocks like trade disputes and material shortages.

- Reduction in Import Reliance: This strategy decreases the company's vulnerability to tariff increases and fluctuations in global supply chains.

Leveraging Policy and Incentives

Hanwha Q CELLS effectively utilizes US government policies and incentives to enhance its competitive edge. The Investment Tax Credit (ITC), for example, provides significant financial benefits that make solar energy projects more attractive and cost-effective.

- Specific Incentives Utilized: Hanwha leverages the ITC and other renewable energy incentives at both the federal and state levels.

- Impact on Profitability: These incentives improve the profitability of solar projects, making them more appealing to investors and customers alike.

- Competitiveness Advantage Gained: This strategic use of government support gives Hanwha a significant advantage over competitors relying less on domestic production and policy benefits.

OCI's Strategy Amidst US Solar Import Duties

OCI, a leading producer of polysilicon—a crucial raw material for solar panel manufacturing—employs a different, yet equally effective, strategy to navigate the complexities of US solar import duties. Their approach is centered on polysilicon production, vertical integration, and market adaptability.

Focus on Polysilicon Production

OCI's primary strategy revolves around its significant polysilicon production capacity. By controlling a substantial portion of the US polysilicon supply, OCI directly influences the cost and availability of this crucial raw material.

- OCI's Polysilicon Production Capacity: OCI possesses significant polysilicon manufacturing capabilities, placing it in a strong position within the US solar supply chain.

- Market Share: OCI holds a considerable market share in polysilicon production, providing a degree of control over pricing and supply within the US market.

- Impact on US Solar Panel Manufacturing Costs: OCI’s significant production helps moderate the costs of solar panel manufacturing in the US.

Vertical Integration and Long-Term Contracts

OCI's approach to vertical integration within the solar value chain involves securing long-term contracts with customers. This strategy provides price stability and reduces the impact of fluctuating market conditions.

- Benefits of Vertical Integration: Controlling a significant portion of the supply chain mitigates price volatility and ensures a consistent supply of polysilicon.

- Advantages of Long-Term Contracts: These contracts provide price certainty for both OCI and its customers, reducing the uncertainty associated with fluctuating import duties.

- Risk Mitigation Strategies: This vertical integration and the use of long-term contracts are effective risk mitigation strategies in a volatile market.

Adapting to Market Fluctuations

OCI demonstrates flexibility in its operations to adjust to market fluctuations, including changes in import duties and demand.

- Examples of Adaptation Strategies: OCI proactively analyzes market trends and adjusts its production levels and pricing strategies to meet the evolving demands of the US solar market.

- Market Analysis and Forecasting: Sophisticated market analysis and forecasting techniques allow OCI to anticipate market shifts and adjust its strategy accordingly.

- Flexibility in Operations: OCI’s operational flexibility enables the company to quickly respond to changes in market conditions and maintain its competitive edge.

Conclusion

This analysis of Hanwha Q CELLS and OCI’s strategies reveals distinct yet equally effective approaches to tackling the challenges posed by US solar import duties. Hanwha’s focus on domestic manufacturing and strategic partnerships positions it for robust growth, while OCI’s emphasis on polysilicon production and vertical integration secures its position within the US solar supply chain. Understanding these strategies is crucial for anyone involved in or interested in the future of the US solar industry. By implementing similar proactive measures and meticulously analyzing market trends, other players can effectively navigate the complexities of US solar import duties and contribute to a thriving renewable energy sector. Consider how these strategies can inform your own approach to navigating the challenges and opportunities of the dynamic US solar market.

Featured Posts

-

Central Campus Agriscience Program In Des Moines A Temporary Suspension

May 30, 2025

Central Campus Agriscience Program In Des Moines A Temporary Suspension

May 30, 2025 -

Bruno Fernandes Amorim Desmente Rumores De Transferencia

May 30, 2025

Bruno Fernandes Amorim Desmente Rumores De Transferencia

May 30, 2025 -

Ingolstadts Garteig Verstaerkt Augsburg

May 30, 2025

Ingolstadts Garteig Verstaerkt Augsburg

May 30, 2025 -

Iowa School Cell Phone Restrictions The Impact Of The New Legislation

May 30, 2025

Iowa School Cell Phone Restrictions The Impact Of The New Legislation

May 30, 2025 -

Miami Open Raducanu Through To Last Eight

May 30, 2025

Miami Open Raducanu Through To Last Eight

May 30, 2025

Latest Posts

-

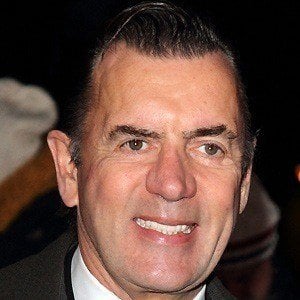

Moroccan Childrens Charity Receives Support From Dragon Dens Duncan Bannatyne

May 31, 2025

Moroccan Childrens Charity Receives Support From Dragon Dens Duncan Bannatyne

May 31, 2025 -

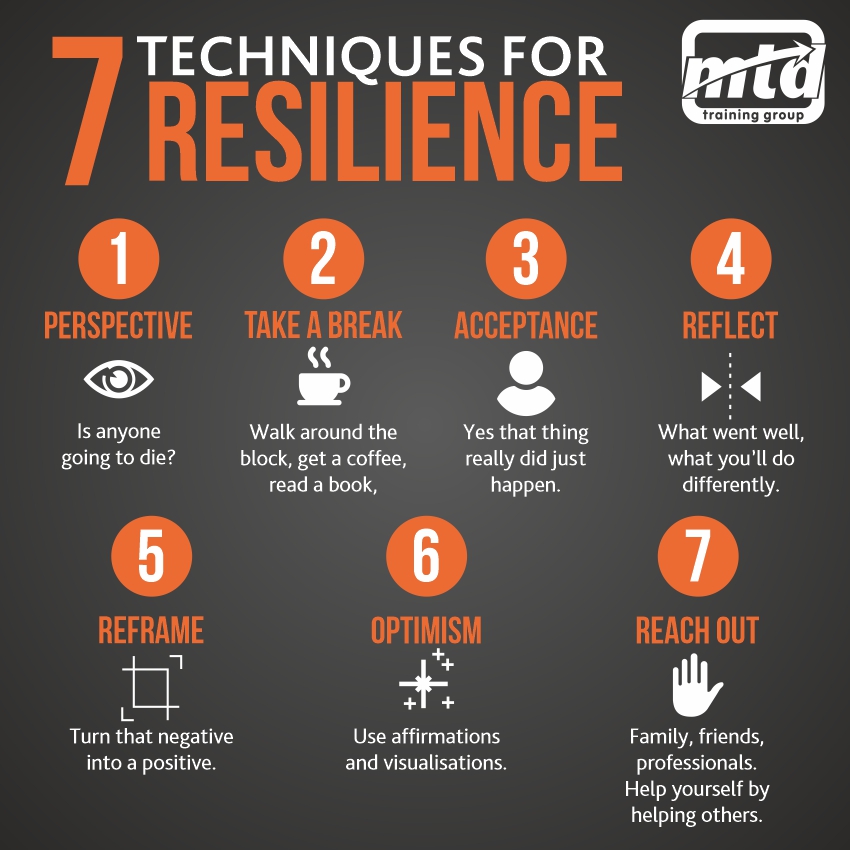

Building The Good Life Strategies For Wellbeing And Success

May 31, 2025

Building The Good Life Strategies For Wellbeing And Success

May 31, 2025 -

Duncan Bannatyne Backs Life Changing Childrens Charity In Morocco

May 31, 2025

Duncan Bannatyne Backs Life Changing Childrens Charity In Morocco

May 31, 2025 -

Designing The Good Life A Practical Guide

May 31, 2025

Designing The Good Life A Practical Guide

May 31, 2025 -

The Good Life Finding Happiness And Fulfillment

May 31, 2025

The Good Life Finding Happiness And Fulfillment

May 31, 2025