Weakening Dollar: Fueling Instability In Asian Exchange Rates

Table of Contents

The Impact of a Weakening Dollar on Asian Currencies

A weaker dollar significantly impacts Asian currencies, leading to both opportunities and challenges. The interconnectedness of global finance means that fluctuations in the dollar directly influence the exchange rates of many Asian nations.

Increased Volatility

A weakening dollar often leads to increased volatility in Asian currencies. This is because many Asian nations either peg their currencies to the dollar or have substantial trade relationships with the US.

- Direct Correlation: Fluctuations in the dollar's value directly translate into fluctuations in their exchange rates, creating uncertainty.

- Trade Impacts: This volatility creates significant uncertainty for businesses engaging in international trade, making it difficult to plan and budget effectively. Import and export costs become unpredictable.

- Investor Hesitation: Investors become hesitant, potentially leading to capital flight as they seek safer investment havens with more stable currencies. This can negatively impact economic growth.

Strengthening of Some Asian Currencies

While some Asian currencies weaken against the dollar, others may strengthen, depending on their economic fundamentals and regional dynamics.

- Strong Fundamentals: Countries with strong economic growth, robust domestic demand, and attractive investment opportunities may see their currencies appreciate against the weakening dollar.

- Regional Dynamics: Regional factors such as political stability and economic growth in neighboring countries also play a role.

- Export Competitiveness: This currency appreciation can boost competitiveness for export-oriented economies, increasing their market share globally. However, it can also make imports more expensive.

Economic Consequences for Asian Nations

The weakening dollar has profound economic consequences for Asian nations, creating a complex mix of challenges and opportunities.

Inflationary Pressures

A weaker dollar can import inflation into Asian economies, especially those heavily reliant on dollar-denominated imports.

- Rising Import Costs: Rising import costs directly affect consumer prices, reducing purchasing power and potentially leading to social unrest.

- Monetary Policy Responses: Central banks in affected nations may need to intervene with monetary policy adjustments, such as raising interest rates, to curb inflation. This can, however, stifle economic growth.

- Balancing Act: This creates a difficult balancing act for policymakers – controlling inflation without hindering economic expansion.

Impact on Trade Balances

The weakening dollar influences the trade balances of Asian nations in unpredictable ways.

- Export Boost (Potentially): Exports become cheaper for consumers in dollar-based economies, potentially increasing demand and boosting export revenues.

- Import Costs Increase: Conversely, imports become more expensive, increasing the cost of production for businesses and potentially reducing consumer spending.

- Net Effect Varies: The net effect on trade balances varies considerably depending on the specific country's export and import composition and the elasticity of demand for its goods and services.

Challenges for Businesses

Businesses operating in Asia face increased exchange rate risk, necessitating sophisticated hedging strategies to mitigate potential losses.

- Forecasting Difficulties: Forecasting future exchange rates becomes significantly more challenging under these conditions, making financial planning difficult.

- Investment Uncertainty: Uncertainty impacts investment decisions, potentially leading to reduced investment and slower economic growth.

- Adaptability Crucial: Businesses need to develop strategies to adapt to volatile market conditions and mitigate exchange rate risk through hedging and diversification.

Geopolitical Implications of a Weakening Dollar in Asia

The weakening dollar has significant geopolitical implications, reshaping regional power dynamics and international relations.

Regional Power Dynamics

A shifting dollar value can alter regional power dynamics within Asia, as some nations benefit more than others from currency fluctuations.

- Increased Competition: Increased competition between Asian economies for export markets can lead to trade tensions and disputes.

- Shifting Alliances: Nations may adjust their alliances and strategic partnerships based on their economic interests and the impact of currency fluctuations.

- Regional Instability: Economic instability stemming from currency volatility can contribute to regional political instability.

International Relations

The weakening dollar's impact on Asian economies can significantly affect international relations and diplomatic efforts.

- Economic Instability Fuels Political Instability: Economic instability can easily translate into political instability, requiring increased international cooperation to manage crises.

- Regional Cooperation: The need for regional cooperation and reliance on regional trade agreements increases in order to mitigate the negative consequences of a weakening dollar and fluctuating exchange rates.

- Global Cooperation: Effective management of the situation requires global cooperation and coordination among central banks and international financial institutions.

Conclusion

The weakening dollar presents a complex and multifaceted challenge for Asian economies. The resulting instability in Asian exchange rates impacts businesses, governments, and citizens alike, creating both opportunities and risks. Understanding the interplay between a weakening dollar, fluctuating exchange rates, and the economic and geopolitical landscape of Asia is crucial for navigating these turbulent times. Staying informed on the trends of a weakening dollar and its implications for Asian exchange rates is essential for making sound financial and business decisions. Continuously monitor the developments surrounding a weakening dollar and its impact on Asian exchange rates to effectively manage risk and capitalize on potential opportunities.

Featured Posts

-

Koku Ve Itibar Olumsuz Koku Etkileri

May 06, 2025

Koku Ve Itibar Olumsuz Koku Etkileri

May 06, 2025 -

Unlocking Investment Success Insights From Buffetts Apple Portfolio

May 06, 2025

Unlocking Investment Success Insights From Buffetts Apple Portfolio

May 06, 2025 -

The New Nike X Hyperice Collection Release Date And Details

May 06, 2025

The New Nike X Hyperice Collection Release Date And Details

May 06, 2025 -

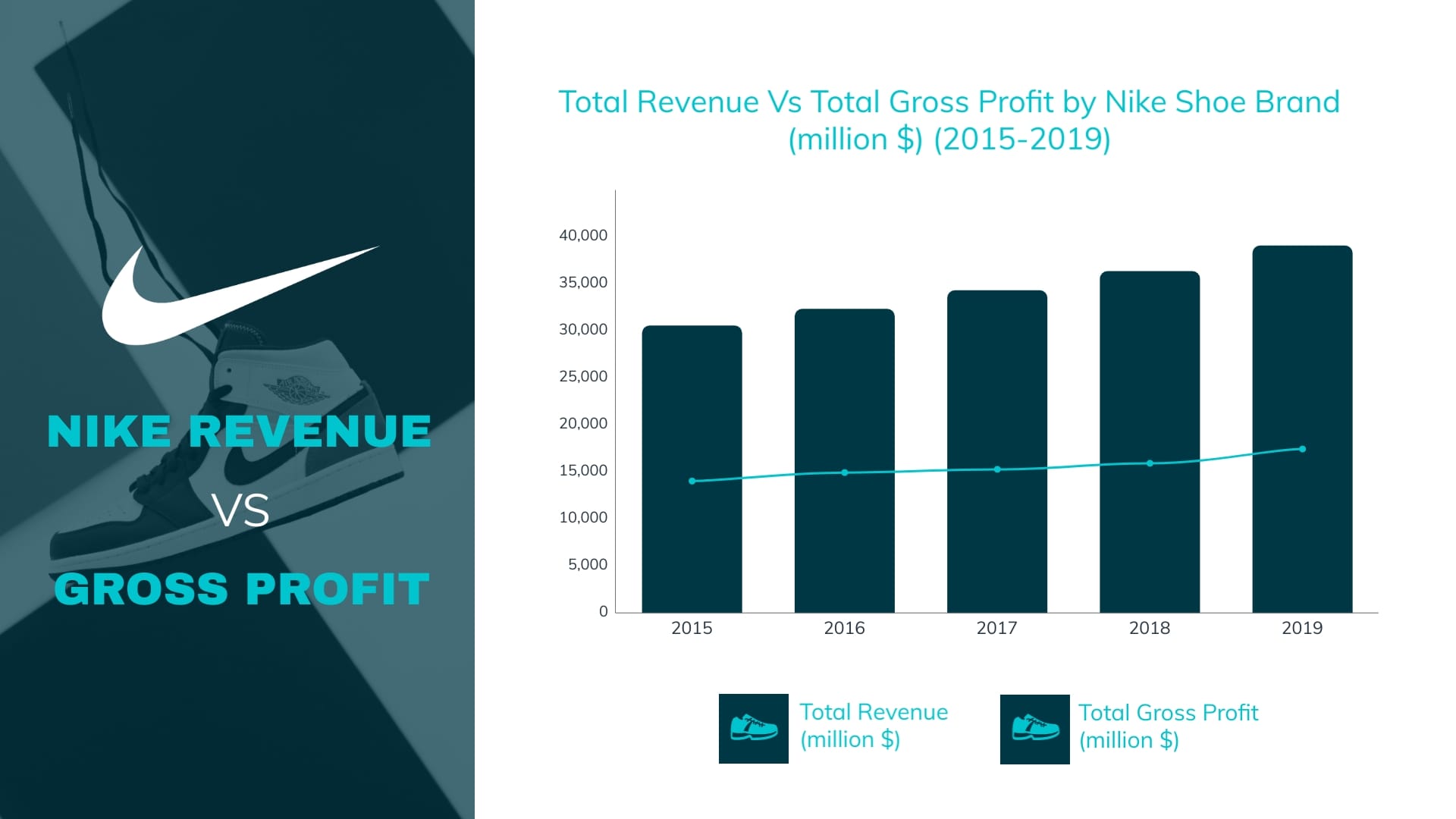

Nikes Revenue A Five Year Low On The Horizon

May 06, 2025

Nikes Revenue A Five Year Low On The Horizon

May 06, 2025 -

Stream March Madness Live Best Online Options For Every Game

May 06, 2025

Stream March Madness Live Best Online Options For Every Game

May 06, 2025

Latest Posts

-

Remembering Priyanka Chopra And Nick Jonass Holi Festivities

May 06, 2025

Remembering Priyanka Chopra And Nick Jonass Holi Festivities

May 06, 2025 -

A Visual Celebration Of Black Women Nashvilles New Mural Project

May 06, 2025

A Visual Celebration Of Black Women Nashvilles New Mural Project

May 06, 2025 -

Priyanka Chopra And Nick Jonass Holi A Detailed Look At Their Celebrations

May 06, 2025

Priyanka Chopra And Nick Jonass Holi A Detailed Look At Their Celebrations

May 06, 2025 -

New Nashville Murals Showcase The Beauty And Strength Of Black Women

May 06, 2025

New Nashville Murals Showcase The Beauty And Strength Of Black Women

May 06, 2025 -

The New Nike X Hyperice Collection Release Date And Details

May 06, 2025

The New Nike X Hyperice Collection Release Date And Details

May 06, 2025