Weihong Liu And The Acquisition Of 28 Hudson's Bay Leases

Table of Contents

Weihong Liu: A Profile of the Investor

Weihong Liu is a prominent figure in the world of real estate investment, known for his astute business acumen and strategic approach. While detailed biographical information about Liu might not be readily available to the public, his success in this acquisition speaks volumes about his expertise. His investment strategy often focuses on undervalued assets with high redevelopment potential, a characteristic likely driving his interest in the Hudson's Bay leases. Previous significant projects (if publicly known) would further illuminate his investment philosophy. His reputation within the business community suggests a keen understanding of market dynamics and a calculated approach to risk.

- Key achievements and milestones: (Insert specific achievements if available. Examples: Successful development of X project, significant returns on previous investments, recognition within the industry.)

- Investment portfolio overview: (Provide an overview of Liu's known investments if publicly accessible. Emphasize the scale and diversity of his holdings.)

- Reputation within the business community: (Describe his reputation. Is he known for being conservative or aggressive? What is his track record?)

The Hudson's Bay Company and its Lease Portfolio

The Hudson's Bay Company, a venerable institution in Canadian retail history, has recently undergone strategic restructuring. This has included the divestment of certain assets, including the 28 leases acquired by Weihong Liu. HBC's shift in focus might involve a concentration on core brands, online retail, or other strategic initiatives, leading them to offload less profitable or strategically less important properties. Understanding HBC's rationale for selling these leases is crucial to analyzing the overall deal.

- Key details about the 28 leases: (Location specifics, property types [e.g., department stores, smaller retail spaces], square footage, and any special features of the locations should be included here if available.)

- Overall value of the acquired leases: (The total financial value of the transaction should be included, if publicly available. This is a crucial detail in assessing the scale of the investment.)

- Geographical distribution of the acquired properties: (Mention the regions where these properties are located. This helps illustrate the scope of Liu's investment and its geographical impact.)

The Acquisition Deal: Terms and Implications

The exact terms of the acquisition—the purchase price, payment structure, and closing date—are often kept confidential in these types of transactions. However, an analysis of the deal's implications for Weihong Liu is readily apparent. This strategic investment allows Liu to gain control of a substantial portfolio of retail properties, potentially providing significant rental income and future appreciation. Liu’s plans for the acquired properties may involve redevelopment, leasing to new tenants, or a combination of strategies, all of which will impact the retail landscape.

- Key clauses or conditions: (If any conditions or clauses from the public record are known, they should be included here. These details can significantly influence the long-term outlook of the investment.)

- Potential benefits for Weihong Liu: (Highlight the potential for rental income, property appreciation, and strategic advantages.)

- Potential risks and challenges: (Discuss potential risks such as economic downturns, changing consumer behavior, and the challenges of redevelopment projects.)

Market Analysis and Future Outlook

The retail real estate market is currently experiencing considerable change, influenced by factors such as e-commerce growth, evolving consumer preferences, and economic conditions. Analyzing these trends is crucial for evaluating the long-term prospects of Weihong Liu's investment. The potential for rental income from the acquired properties depends on the strength of the local retail markets and the ability to secure suitable tenants. The possibility of property appreciation is contingent on broader market trends and successful property management. There might also be similar acquisitions in the market that can help us understand the competitive landscape and the overall investor sentiment.

- Market trends impacting retail real estate: (Discuss factors affecting retail property values, such as online shopping, changing demographics, and economic conditions.)

- Projected rental income and potential for property appreciation: (Offer a reasonable projection based on market data, if possible, for potential rental income and long-term value appreciation.)

- Analysis of risk factors: (Discuss potential risks such as economic downturns, competition, and the need for potential property renovations or upgrades.)

Conclusion: Weihong Liu's Acquisition and the Future of Hudson's Bay Leases

Weihong Liu's acquisition of 28 Hudson's Bay leases represents a significant strategic investment in the retail real estate sector. This deal's implications are far-reaching, impacting both Liu's investment portfolio and the future of HBC's assets. The long-term success of this investment will hinge on market conditions, successful property management, and Liu’s ability to adapt to evolving retail trends. The future of these acquired properties will undoubtedly shape the retail landscape in the affected areas. We encourage you to share your thoughts on Weihong Liu's acquisition of these Hudson's Bay leases and to stay updated on further developments related to Weihong Liu's investments and the retail real estate market. Keep an eye out for more updates on this and other strategic retail real estate deals.

Featured Posts

-

Charleston Open Pegula Upsets Collins To Advance

May 30, 2025

Charleston Open Pegula Upsets Collins To Advance

May 30, 2025 -

Marinis Assessment Aleix Espargaros Moto Gp Comeback

May 30, 2025

Marinis Assessment Aleix Espargaros Moto Gp Comeback

May 30, 2025 -

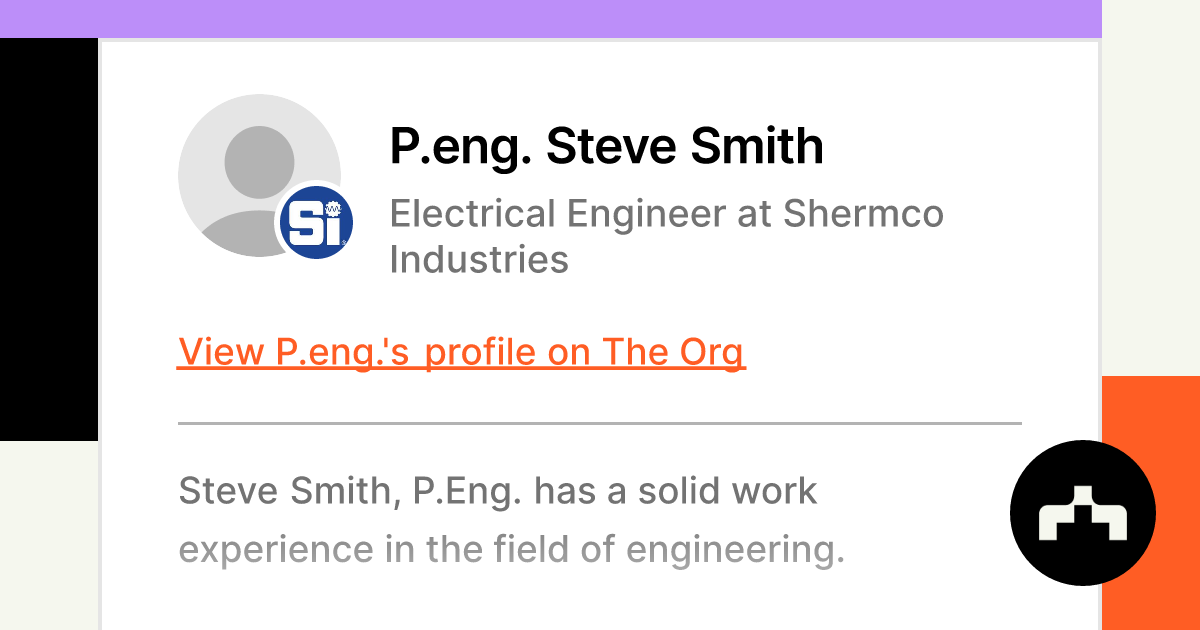

Virginias Second Measles Case Of 2025 Investigation Underway

May 30, 2025

Virginias Second Measles Case Of 2025 Investigation Underway

May 30, 2025 -

Manchester United Elogia Bruno Fernandes O Magnifico Portugues

May 30, 2025

Manchester United Elogia Bruno Fernandes O Magnifico Portugues

May 30, 2025 -

Retraite Le Rn Explore Une Alliance Avec La Gauche Sur L Age De Depart

May 30, 2025

Retraite Le Rn Explore Une Alliance Avec La Gauche Sur L Age De Depart

May 30, 2025

Latest Posts

-

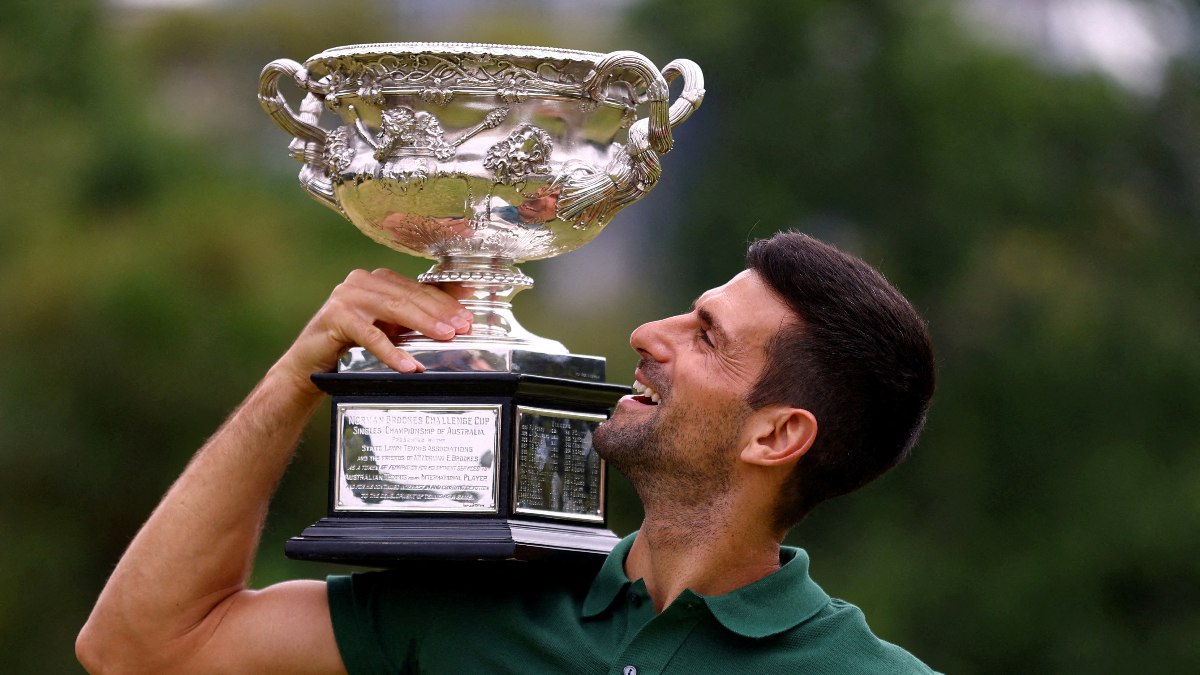

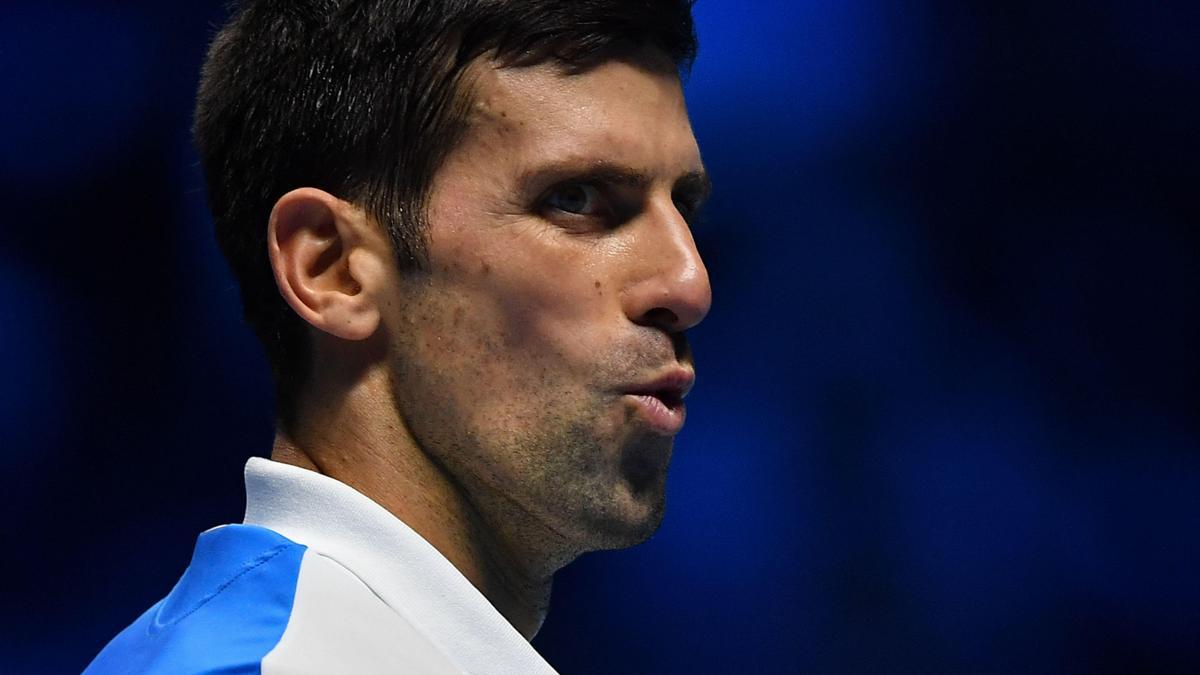

Djokovic Nadal In Rekorunu Gecti Ayrintilar Ve Analiz

May 31, 2025

Djokovic Nadal In Rekorunu Gecti Ayrintilar Ve Analiz

May 31, 2025 -

Van Dong Vien Cau Long Nu Viet Nam Huong Den Top 20 The Gioi

May 31, 2025

Van Dong Vien Cau Long Nu Viet Nam Huong Den Top 20 The Gioi

May 31, 2025 -

Alcaraz Vs Sinner Cu Do Suc Dinh Cao Tai Rome Masters

May 31, 2025

Alcaraz Vs Sinner Cu Do Suc Dinh Cao Tai Rome Masters

May 31, 2025 -

Novak Djokovic Nadal In Rekorunu Nasil Kirdi

May 31, 2025

Novak Djokovic Nadal In Rekorunu Nasil Kirdi

May 31, 2025 -

Cau Thu Cau Long Viet Nam Dat Muc Tieu Cao Tai Giai Dong Nam A

May 31, 2025

Cau Thu Cau Long Viet Nam Dat Muc Tieu Cao Tai Giai Dong Nam A

May 31, 2025