Where To Invest: Pinpointing The Country's Fastest-Growing Business Regions

Table of Contents

The Technological Hubs: Silicon Valleys in the Making

The tech sector continues to be a significant driver of economic growth, and certain regions are emerging as leading technological hubs. Identifying these areas early can provide significant investment opportunities.

Analyzing Emerging Tech Clusters

Several cities and regions are experiencing a boom in technological innovation, attracting substantial investment and creating high-paying jobs. Examples include Austin, Texas, known for its robust startup ecosystem and strength in AI and software development, and Seattle, Washington, a powerhouse in cloud computing, aerospace, and biotech.

- High concentration of startups: These regions attract numerous entrepreneurial ventures, leading to increased competition and innovation.

- Significant venture capital funding: Abundant venture capital fuels growth and expansion within the tech sector.

- Skilled workforce: A large pool of highly educated and skilled workers is crucial for tech companies to thrive.

- Government incentives: Many state and local governments offer tax breaks and other incentives to attract tech businesses.

Data from PitchBook shows Austin received over $10 billion in venture capital funding in 2022, while Seattle consistently ranks among the top cities for tech jobs and startup activity. Companies like Tesla (Austin) and Amazon (Seattle) are major players, further solidifying these regions’ positions as leading tech hubs.

Navigating the Tech Investment Landscape

While the potential returns are high, investing in tech-focused regions also presents challenges.

- Due diligence: Thorough research is paramount to understand the specific risks and opportunities within each sub-sector (AI, biotech, etc.).

- Risk mitigation strategies: Diversification across different tech companies and sub-sectors can help reduce overall portfolio risk.

- Understanding market trends: Staying updated on technological advancements and market shifts is vital for making successful investments.

The rapid pace of technological change means that some companies may fail quickly. A thorough understanding of the market and a robust risk management strategy are essential for navigating this dynamic landscape.

The Booming Manufacturing Belts: A Resurgence of Industry

A resurgence in domestic manufacturing is creating new opportunities for investment in previously overlooked regions. Factors like reshoring initiatives and automation are contributing to this growth.

Identifying Revitalized Industrial Areas

Several areas are experiencing a revival in manufacturing, driven by factors like lower labor costs in certain regions, improved infrastructure, and government support programs aimed at reshoring manufacturing jobs.

- Lower labor costs (in some cases): Certain regions offer lower labor costs compared to traditional manufacturing hubs, making them more attractive to businesses.

- Access to raw materials: Proximity to raw materials can significantly reduce transportation costs and improve efficiency.

- Government support for manufacturing: Government incentives and tax breaks are designed to attract manufacturers and stimulate economic growth.

The renewed focus on domestic manufacturing is creating jobs and boosting economic activity in these areas. The impact of automation is also changing the landscape, requiring a focus on advanced manufacturing techniques and skilled labor.

Mitigating Risks in Manufacturing Investments

Investing in manufacturing presents certain risks that need careful consideration.

- Diversification: Investing in multiple manufacturing companies across diverse sectors can mitigate risks associated with specific industries.

- Supply chain management strategies: Developing robust supply chain management strategies is crucial to avoid disruptions.

- Workforce training initiatives: Investing in workforce training programs can help ensure a skilled workforce to meet the needs of advanced manufacturing.

Supply chain disruptions and labor shortages are key concerns. Companies that effectively manage their supply chains and invest in their workforce are better positioned for success.

The Sustainable Growth Zones: Investing in a Greener Future

The increasing focus on sustainability is creating significant investment opportunities in renewable energy and green technologies.

Renewable Energy and Green Tech Investments

Regions leading in renewable energy development and green technologies are attracting substantial investment.

- Government investment in renewable energy: Government policies and subsidies are driving investment in renewable energy sources, such as solar and wind power.

- Growth in green jobs: The sector is creating a significant number of jobs in areas such as renewable energy installation, maintenance, and research.

- Environmental regulations: Stringent environmental regulations are driving innovation and investment in cleaner technologies.

Areas with substantial renewable energy resources and supportive government policies are experiencing rapid growth in this sector. The expansion of electric vehicle manufacturing and the development of smart grids are also contributing to this trend.

Evaluating the Long-Term Potential of Sustainable Investments

Investing in sustainable growth zones offers significant long-term economic and environmental benefits.

- ESG factors: Considering environmental, social, and governance (ESG) factors is becoming increasingly important for investors.

- Long-term sustainability: Investments in renewable energy and green technologies often offer long-term sustainability and stable returns.

- Reduced environmental impact: These investments contribute to reducing carbon emissions and promoting a more sustainable future.

The long-term growth potential of the sustainable energy sector, coupled with the increasing importance of ESG factors, makes this a compelling area for investment.

Conclusion

Identifying where to invest requires careful consideration of various factors. This article highlighted three key areas experiencing significant growth: technology hubs, revitalized manufacturing belts, and sustainable growth zones. Each presents unique opportunities and challenges, emphasizing the need for thorough due diligence and risk assessment. Remember that understanding the specific economic indicators and market dynamics within each region is crucial for success.

Call to Action: Ready to make informed investment decisions and capitalize on the country's fastest-growing business regions? Conduct further research, explore specific investment opportunities within these highlighted areas, and start building your portfolio today. Don't miss out on the potential for significant returns by understanding where to invest wisely.

Featured Posts

-

Lizzo Sza And Another Artist An Almost Formed Rock Band

May 05, 2025

Lizzo Sza And Another Artist An Almost Formed Rock Band

May 05, 2025 -

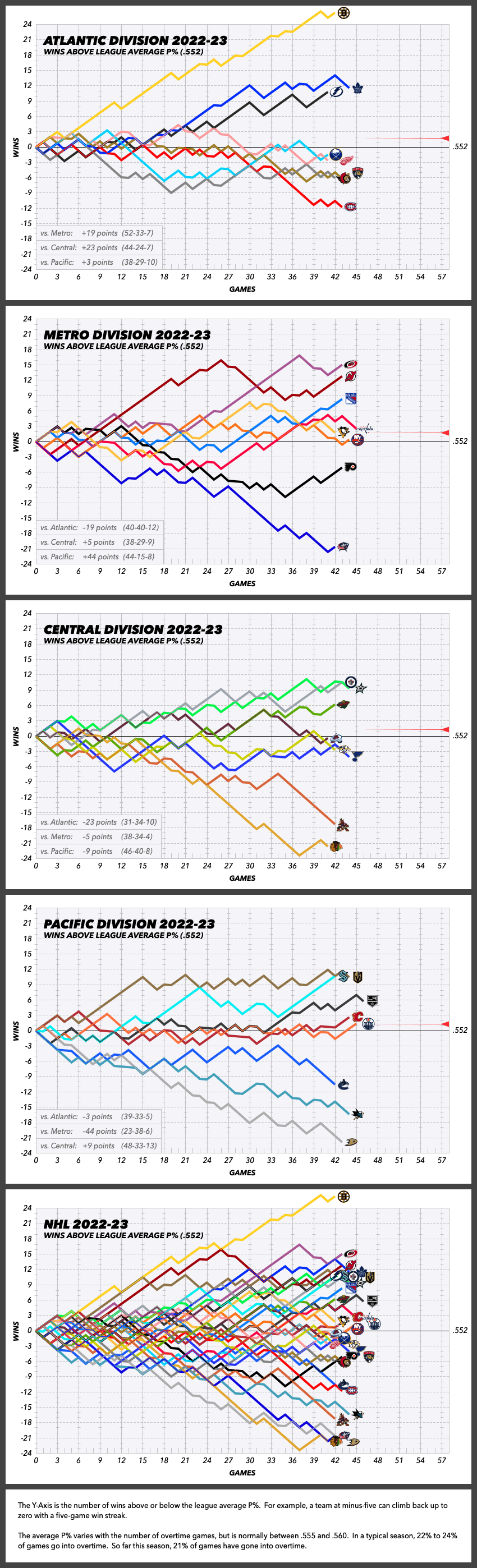

Nhl Standings Who Will Claim The Western Wild Card Spots

May 05, 2025

Nhl Standings Who Will Claim The Western Wild Card Spots

May 05, 2025 -

Fords Continued Sponsorship Of The Kentucky Derby

May 05, 2025

Fords Continued Sponsorship Of The Kentucky Derby

May 05, 2025 -

Kentucky Derby And Ford A Multi Year Partnership Renewed

May 05, 2025

Kentucky Derby And Ford A Multi Year Partnership Renewed

May 05, 2025 -

Fridays Nhl Games Playoff Implications And Standings Update

May 05, 2025

Fridays Nhl Games Playoff Implications And Standings Update

May 05, 2025

Latest Posts

-

Addressing Criticism Lizzos Trainer On Her Fitness Methods

May 05, 2025

Addressing Criticism Lizzos Trainer On Her Fitness Methods

May 05, 2025 -

Lizzos Fitness Journey Her Trainers Powerful Defense

May 05, 2025

Lizzos Fitness Journey Her Trainers Powerful Defense

May 05, 2025 -

Finding Affordable Lizzo In Real Life Tour Tickets Your Guide To Pricing

May 05, 2025

Finding Affordable Lizzo In Real Life Tour Tickets Your Guide To Pricing

May 05, 2025 -

Public Reaction To Lizzos Britney Spears Janet Jackson Comparison

May 05, 2025

Public Reaction To Lizzos Britney Spears Janet Jackson Comparison

May 05, 2025 -

Lizzo Launches New Music On Twitch Get Ready To Gag

May 05, 2025

Lizzo Launches New Music On Twitch Get Ready To Gag

May 05, 2025