Why Investors Shouldn't Fear High Stock Market Valuations: A BofA Perspective

Table of Contents

The Limitations of Traditional Valuation Metrics

Traditional valuation metrics like the Price-to-Earnings Ratio (P/E), Price-to-Sales Ratio (P/S), and the Shiller P/E (Cyclically Adjusted Price-to-Earnings Ratio) can be misleading, particularly in the current economic climate. These metrics, while useful in many contexts, don't always accurately reflect future growth potential, especially in a low-interest-rate environment characterized by rapid technological disruption.

-

Low interest rates justify higher P/E multiples. When interest rates are low, the opportunity cost of investing in equities is reduced, allowing for higher valuations. Investors are less inclined to seek the safety of bonds with low yields, making equities a more attractive option, even at higher P/E ratios.

-

Rapid technological advancements can lead to underestimated future earnings. Traditional valuation metrics often struggle to capture the potential of disruptive technologies and their impact on future earnings. Companies leading in innovation may have high valuations today, reflecting their anticipated future growth, even if current earnings don't fully justify the current market price.

-

Traditional metrics often fail to capture intangible assets and future growth prospects. Many modern companies derive significant value from intangible assets such as intellectual property, brand recognition, and strong data networks. These are often not fully reflected in traditional valuation metrics.

-

BofA's perspective on the limitations of these metrics in the current market. BofA analysts acknowledge the limitations of traditional metrics in today's market, emphasizing the need for a more nuanced approach that considers factors beyond simple ratios. They advocate for a forward-looking perspective that incorporates qualitative factors and anticipated technological advancements.

The Role of Interest Rates and Monetary Policy

Low interest rates play a significant role in influencing stock market valuations. A low-interest-rate environment, often a result of monetary policy such as Quantitative Easing (QE), makes equities comparatively more attractive investments. This is because the return on bonds and other fixed-income securities is lower, reducing the appeal of these traditionally safer assets.

-

Low interest rates reduce the opportunity cost of holding equities. When the returns on safer investments are low, investors are more willing to take on the higher risk associated with equities to achieve higher returns.

-

Monetary policy, such as QE, injects liquidity into the market, supporting asset prices. The injection of liquidity through measures like QE can increase demand for assets, including stocks, leading to higher prices and valuations.

-

BofA's predictions regarding future interest rate movements and their implications for stock valuations. BofA's analysis of macroeconomic factors and monetary policy provides insights into future interest rate movements and their impact on the stock market. While specific predictions vary, their analysis generally suggests a continued influence of low-interest-rate environments on stock valuations.

Long-Term Growth Potential and Technological Disruption

The potential for future growth driven by technological advancements and innovation is a key factor to consider when assessing high stock market valuations. The current high valuations may reflect investors' anticipation of this future growth, which may not be fully captured by current earnings.

-

Examples of disruptive technologies impacting various sectors. Technologies like Artificial Intelligence (AI), cloud computing, and biotechnology are revolutionizing various sectors, creating opportunities for significant growth and innovation.

-

Identification of sectors with high growth potential according to BofA. BofA research identifies specific sectors poised for strong growth, highlighting the long-term potential for outsized returns in these areas despite current high valuations.

-

The importance of considering long-term investment horizons. Focusing solely on short-term market fluctuations can be detrimental. Long-term investing allows investors to weather market volatility and benefit from the long-term growth potential of innovative companies.

-

Strategies for navigating sector rotation in a high-valuation environment. Sector rotation, the process of shifting investments between different sectors of the economy, is crucial to managing risk and taking advantage of growth opportunities within a high-valuation market. BofA’s insights can provide guidance in this area.

Risk Management and Diversification within a High-Valuation Market

Even in a high-valuation market, risk management and diversification remain crucial for long-term investment success. A well-diversified portfolio, spread across various asset classes, can help mitigate risk and reduce the impact of market volatility.

-

The importance of a well-diversified portfolio across various asset classes. Diversification is key to mitigating risk. By spreading investments across different sectors, asset classes (such as equities, bonds, and real estate), and geographies, investors can reduce their exposure to any single market downturn.

-

Strategies for managing volatility in a high-valuation market. Strategies for managing volatility include adjusting asset allocation, employing defensive investing strategies, and establishing stop-loss orders.

-

BofA’s recommendations for adjusting asset allocation based on risk tolerance. BofA's recommendations provide a framework for adjusting investment portfolios based on individual risk profiles, ensuring investments align with investor goals and risk tolerance.

-

The role of defensive investing as a complementary strategy. Defensive investing, focusing on stable, established companies, can serve as a complementary strategy to mitigate risk in a high-valuation market.

Conclusion

While high stock market valuations might initially cause concern, a thorough analysis considering interest rates, long-term growth potential, and strategic risk management, as highlighted by BofA's perspective, suggests that fear may be unwarranted. Investors should focus on long-term growth opportunities and employ appropriate risk management strategies like diversification and careful asset allocation. Don't let fear of high stock market valuations deter you from strategic equity investment. Consult with a financial advisor and develop a well-diversified portfolio tailored to your risk tolerance. Learn more about navigating high stock market valuations and explore long-term investment strategies informed by BofA’s insights.

Featured Posts

-

Hong Kongs Fx Market Intervention Implications For The Us Dollar Peg

May 05, 2025

Hong Kongs Fx Market Intervention Implications For The Us Dollar Peg

May 05, 2025 -

Investing In Electric Motor Innovation A Path To Global Supply Chain Resilience

May 05, 2025

Investing In Electric Motor Innovation A Path To Global Supply Chain Resilience

May 05, 2025 -

Ufc 314 Early Betting Odds And Potential Fight Night Surprises

May 05, 2025

Ufc 314 Early Betting Odds And Potential Fight Night Surprises

May 05, 2025 -

Nhl Playoffs First Round What To Expect And Who To Watch

May 05, 2025

Nhl Playoffs First Round What To Expect And Who To Watch

May 05, 2025 -

Lizzos Britney Spears Janet Jackson Observation A Heated Online Debate

May 05, 2025

Lizzos Britney Spears Janet Jackson Observation A Heated Online Debate

May 05, 2025

Latest Posts

-

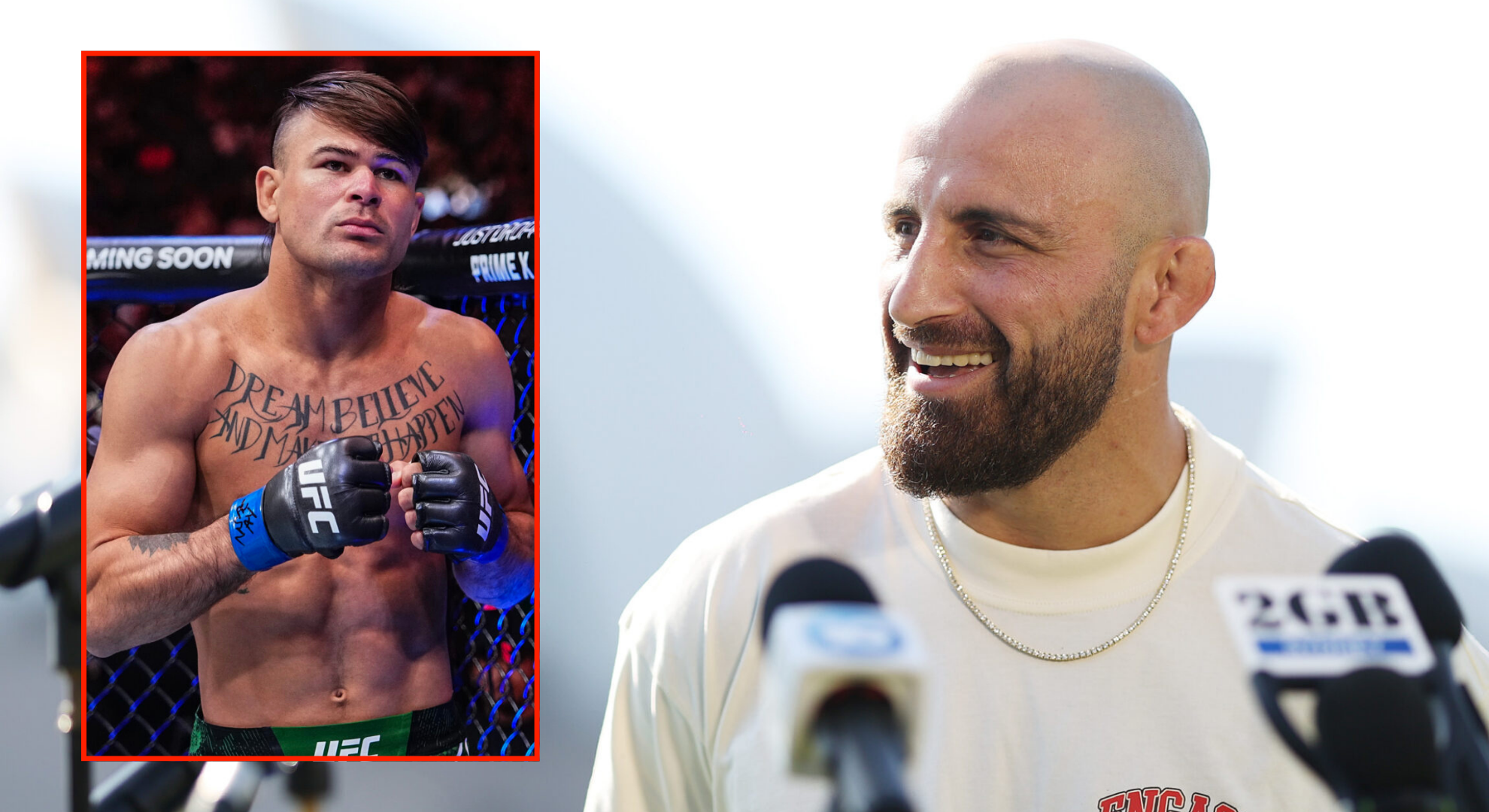

Volkanovski Vs Lopes Ufc 314 A Complete Breakdown Of The Results

May 05, 2025

Volkanovski Vs Lopes Ufc 314 A Complete Breakdown Of The Results

May 05, 2025 -

Ufc 314 Ppv Everything You Need To Know About Volkanovski Vs Lopes

May 05, 2025

Ufc 314 Ppv Everything You Need To Know About Volkanovski Vs Lopes

May 05, 2025 -

Ufc 314 Fight Card Volkanovski Vs Lopes Who Won And Lost

May 05, 2025

Ufc 314 Fight Card Volkanovski Vs Lopes Who Won And Lost

May 05, 2025 -

Ufc 314 Volkanovski Lopes Headliner And Complete Fight Card

May 05, 2025

Ufc 314 Volkanovski Lopes Headliner And Complete Fight Card

May 05, 2025 -

Ufc 314 Complete Results And Analysis Of Volkanovski Vs Lopes Fight Card

May 05, 2025

Ufc 314 Complete Results And Analysis Of Volkanovski Vs Lopes Fight Card

May 05, 2025