Why Investors Shouldn't Fear High Stock Market Valuations: BofA's Perspective

Table of Contents

BofA's Bullish Outlook: Understanding the Rationale

Despite the seemingly high valuations, BofA maintains a relatively bullish outlook on the stock market. This optimism isn't unfounded; it's rooted in a comprehensive analysis of various economic indicators and market trends. BofA's positive stance is supported by several factors:

-

Robust BofA Reports and Analyses: Several recent BofA Global Research reports have highlighted the continued strength of corporate earnings, despite the elevated market levels. These reports often delve into specific sector analyses and provide detailed justifications for their optimistic forecasts. Their analysts often point to sustained consumer spending and resilient business investment as key drivers.

-

Key Economic Indicators: BofA considers several key economic indicators in their assessment, including persistently low interest rates. These low rates make borrowing cheaper for businesses, fueling investment and growth. Furthermore, BofA's analysis often factors in strong corporate earnings, demonstrating the underlying profitability driving many companies, despite higher stock prices.

-

Market Risk Assessment: While acknowledging the inherent risks in a high-valuation market, BofA identifies mitigating factors. These include the ongoing strength of the global economy, albeit with some regional variations, and the continued adaptation of businesses to a post-pandemic world. Their assessment carefully weighs these risks against the potential for continued growth.

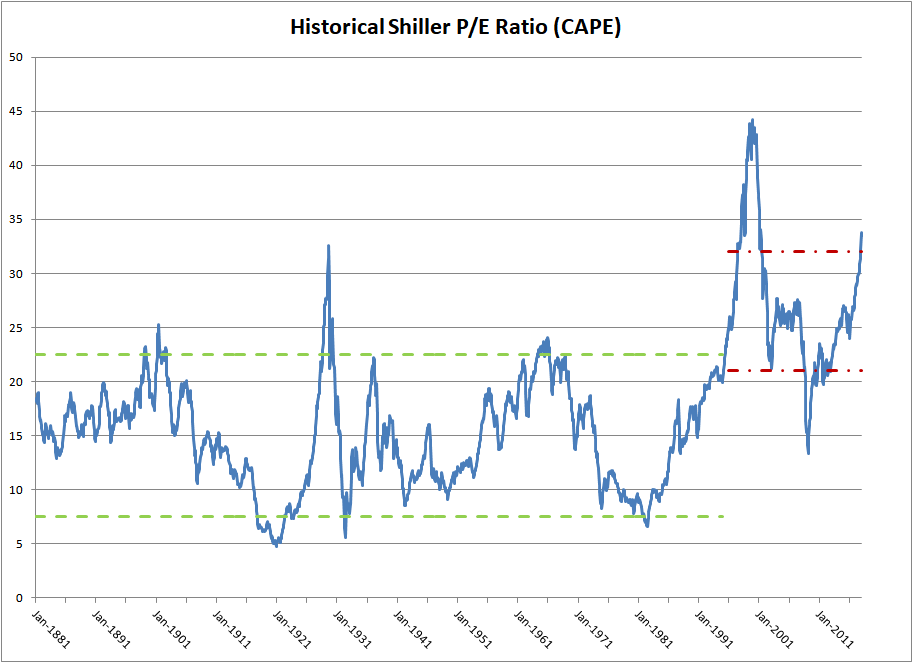

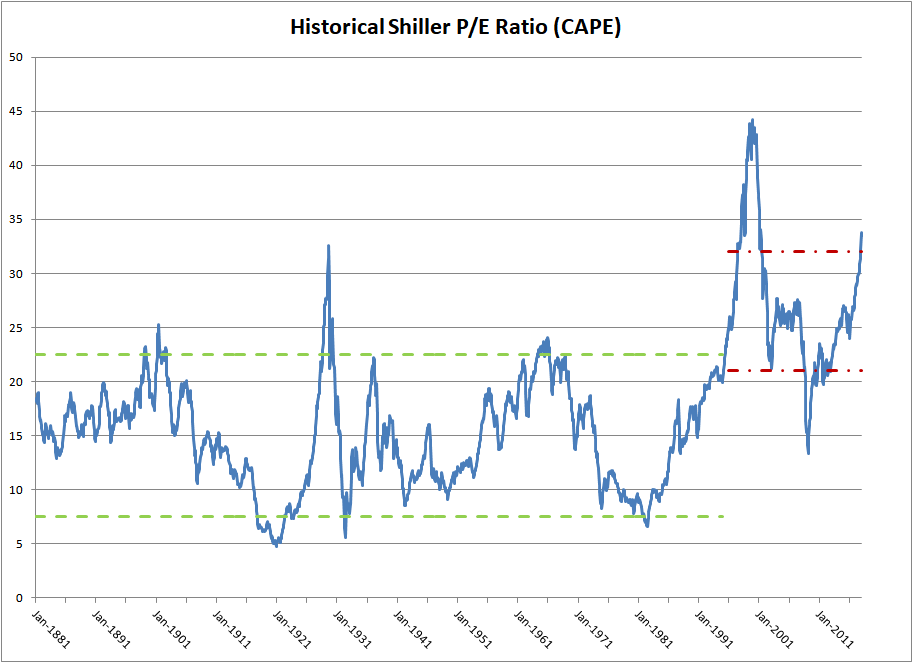

Debunking the "Overvalued" Narrative: A Deeper Dive into Valuation Metrics

The concern about "overvalued" stocks often stems from traditional valuation metrics like Price-to-Earnings (P/E) ratios appearing high compared to historical averages. However, BofA argues that these metrics have limitations in the current low-interest-rate environment.

-

Limitations of Traditional Metrics: In a low-interest-rate environment, the present value of future earnings is higher, making high P/E ratios less alarming than they might seem historically. Simply comparing current P/E ratios to past averages without considering the interest rate context can be misleading.

-

Alternative Valuation Metrics: BofA likely utilizes a more nuanced approach, incorporating alternative valuation metrics such as discounted cash flow (DCF) analysis. DCF analysis considers the time value of money and future cash flows, offering a more comprehensive picture than simple P/E ratios.

-

Growth Justifies Premium Valuations: BofA recognizes that high valuations in certain sectors – particularly those driven by innovation – are often justified by exceptional growth prospects. Companies with disruptive technologies or strong competitive advantages often command premium valuations due to their expected future earnings potential.

The Role of Innovation and Technological Advancements

Technological innovation is a crucial factor driving valuations in today's market. The rapid pace of technological advancements fuels growth and justifies higher valuations for many companies.

-

Disruptive Technologies and Premium Valuations: Companies pioneering disruptive technologies often see higher valuations due to their potential for significant market share capture and exponential growth. This explains the premium placed on many technology companies.

-

Innovation-Driven Sectors: Sectors like technology and healthcare are prime examples of areas where innovation is a major driver of growth and valuation. Companies in these sectors constantly develop new products and services, leading to strong earnings growth and commanding higher valuations.

-

Long-Term Growth Potential: BofA likely emphasizes the long-term growth potential fueled by technological innovation. The sustained investment in research and development, coupled with the adoption of new technologies across various industries, supports a long-term positive outlook.

Managing Risk in a High-Valuation Market: BofA's Strategic Recommendations

While BofA maintains a positive outlook, they acknowledge the inherent risks associated with high valuations. They suggest a range of strategies to mitigate these risks:

-

Diversification: BofA likely recommends a diversified investment portfolio across various asset classes and sectors to reduce exposure to specific risks. This diversification strategy reduces the impact of any single investment underperforming.

-

Long-Term Investment Horizon: BofA emphasizes the importance of maintaining a long-term investment horizon. Short-term market fluctuations are less significant when viewed within a longer-term context. This allows investors to ride out market volatility.

-

Investment Approaches: BofA might recommend a blend of value investing and growth investing, depending on individual risk tolerance and investment goals. Value investing focuses on undervalued companies, while growth investing targets companies with high growth potential, even if their valuations appear high.

Conclusion: Why You Shouldn't Fear High Stock Market Valuations (According to BofA)

BofA's analysis suggests that high stock market valuations, while noteworthy, don't automatically signal an imminent market crash. Their positive outlook is supported by strong corporate earnings, low interest rates, and the transformative power of technological innovation. By understanding the limitations of traditional valuation metrics and embracing a long-term perspective, investors can navigate this environment effectively. Don't let fear of high stock market valuations paralyze your investment decisions. Review BofA's analysis and consider a well-diversified portfolio aligned with their insights. Learn more about managing your investments in a high-valuation market and build a robust, future-proof investment strategy.

Featured Posts

-

Meja Rias Modern Sederhana 2025 Inspirasi And Ide Desain Rumah

Apr 25, 2025

Meja Rias Modern Sederhana 2025 Inspirasi And Ide Desain Rumah

Apr 25, 2025 -

Israel Eurovision Controversy Director Responds To Boycott Calls

Apr 25, 2025

Israel Eurovision Controversy Director Responds To Boycott Calls

Apr 25, 2025 -

Caso Kevin Malouf Q6 Millones De Indemnizacion Una Condena Injusta

Apr 25, 2025

Caso Kevin Malouf Q6 Millones De Indemnizacion Una Condena Injusta

Apr 25, 2025 -

Dnepr Na Puti K Miru I Stabilnosti

Apr 25, 2025

Dnepr Na Puti K Miru I Stabilnosti

Apr 25, 2025 -

Canakkale Duen Buguen Savastan Dogan Dostluk Fotograf Sergisi

Apr 25, 2025

Canakkale Duen Buguen Savastan Dogan Dostluk Fotograf Sergisi

Apr 25, 2025

Latest Posts

-

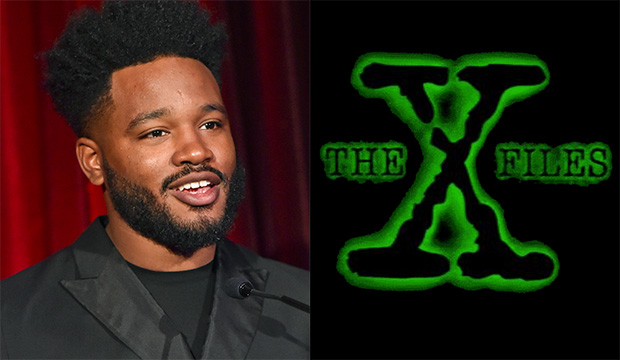

X Files Ryan Coogler A La Realisation D Un Nouveau Depart

Apr 30, 2025

X Files Ryan Coogler A La Realisation D Un Nouveau Depart

Apr 30, 2025 -

Gillian Anderson As Doctor Who Villain Ncuti Gatwas Casting Wish

Apr 30, 2025

Gillian Anderson As Doctor Who Villain Ncuti Gatwas Casting Wish

Apr 30, 2025 -

Le Realisateur De Black Panther Aux Commandes D Un Reboot Des X Files

Apr 30, 2025

Le Realisateur De Black Panther Aux Commandes D Un Reboot Des X Files

Apr 30, 2025 -

Ncuti Gatwa Eyes Gillian Anderson For Doctor Who Villain Role

Apr 30, 2025

Ncuti Gatwa Eyes Gillian Anderson For Doctor Who Villain Role

Apr 30, 2025 -

Ryan Coogler Et Le Reboot Des X Files Rumeurs Et Analyse

Apr 30, 2025

Ryan Coogler Et Le Reboot Des X Files Rumeurs Et Analyse

Apr 30, 2025