Why This AI Quantum Computing Stock Could Be A Bargain

Table of Contents

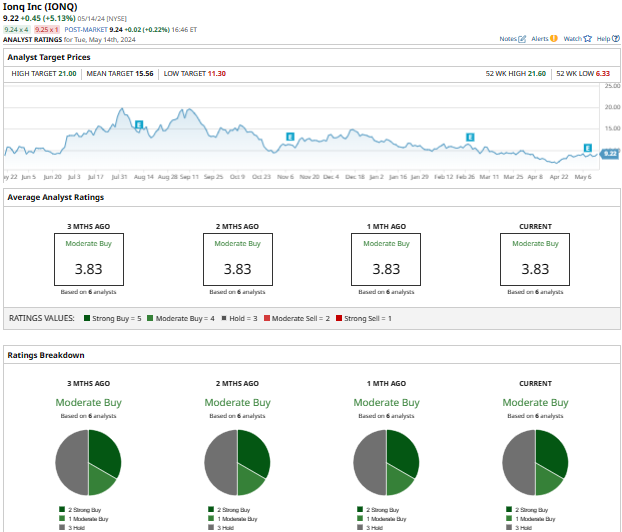

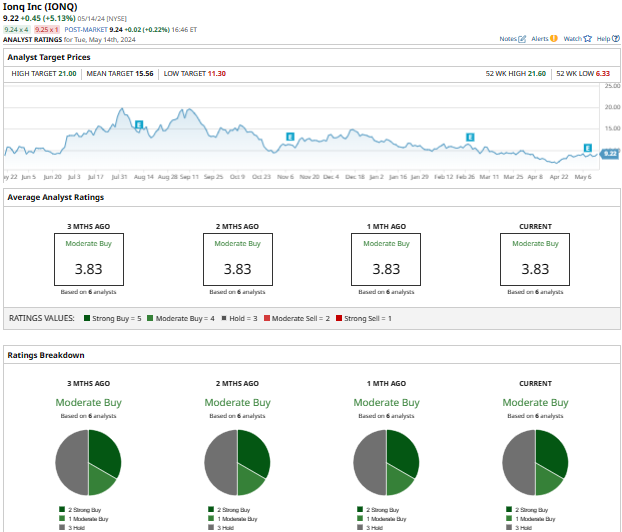

Quantum computing, with its potential to solve currently intractable problems, promises to disrupt fields from drug discovery to materials science. AI, already transforming numerous sectors, will be exponentially enhanced by the processing power of quantum computers. This powerful combination is attracting significant investment, and Company X is at the forefront. We argue that Company X's stock, despite current market fluctuations, is significantly undervalued and represents a strong investment opportunity.

Company X's Unique Position in the AI Quantum Computing Market

Company X distinguishes itself through a combination of innovative technology, strategic partnerships, and a seasoned team. Their competitive advantage stems from several key factors:

- Proprietary Technology and Intellectual Property: Company X boasts a superior qubit technology, offering enhanced stability and coherence times compared to competitors. This translates to more efficient quantum computations and faster problem-solving capabilities. Their extensive patent portfolio further solidifies their market position.

- Strategic Collaborations: Key partnerships with leading AI companies like [Name of Company A] and [Name of Company B] provide access to crucial data sets and AI algorithms, accelerating the development of hybrid AI-quantum computing solutions. These collaborations also open doors to new market segments and expand their reach within the industry.

- Market Leadership in a Niche Segment: Company X has established itself as a leader in the development of quantum algorithms specifically tailored for AI applications, a niche with significant future growth potential. This specialized approach differentiates them from more general-purpose quantum computing companies.

Undervalued Assets and Growth Potential

Despite its strong technological foundation and promising future, Company X's current market capitalization appears significantly below its potential future value. Several factors contribute to this undervaluation:

- Market Sentiment: Short-term market volatility and skepticism surrounding the nascent quantum computing sector have negatively impacted the stock price. However, this presents a buying opportunity for long-term investors.

- Temporary Setbacks: Recent minor setbacks in development timelines or minor financial losses shouldn't overshadow the long-term growth potential of the company. These are common occurrences in high-growth technology sectors.

Here's a look at the positive aspects:

- Projected Revenue Growth: Based on market analysis and internal projections, Company X's revenue is expected to experience substantial growth over the next five years, reaching [estimated revenue figure] by [year].

- High ROI Potential: Investment in Company X offers the potential for significant returns in the medium to long term, potentially exceeding those of investments in other technology sectors. A well-timed investment could yield exceptional returns once the market fully appreciates the company's potential.

- Comparison to Competitors: Compared to similar companies in the AI quantum computing sector, Company X demonstrates a stronger technological foundation and a clearer path to profitability, suggesting a higher potential for future growth and return on investment.

Mitigating Investment Risks in AI Quantum Computing Stocks

Investing in emerging technologies always carries inherent risks. However, Company X is actively mitigating these risks:

- Regulatory Compliance: Company X proactively addresses potential regulatory hurdles through close collaboration with relevant authorities, ensuring compliance with emerging regulations governing quantum computing and AI.

- Competitive Landscape: While competition in the quantum computing market is intensifying, Company X's strong technological foundation and strategic partnerships provide a significant competitive edge, allowing them to navigate the competitive landscape effectively.

- Financial Stability: Company X maintains a strong financial position, providing a buffer against market fluctuations and ensuring the company has the resources to weather temporary setbacks and continue its long-term development.

Investing Strategies for AI Quantum Computing Stocks

Several approaches can be employed when investing in Company X:

- Long-Term Holding: Given the long-term growth potential of AI quantum computing, a long-term holding strategy is recommended. This approach allows investors to ride out short-term market fluctuations and benefit from the long-term growth trajectory.

- Dollar-Cost Averaging: Dollar-cost averaging, by investing a fixed amount of money at regular intervals, can help mitigate the risk associated with market volatility.

Remember:

- Thorough Due Diligence: Before investing, conducting thorough due diligence is paramount. Understand the company's technology, financial position, and competitive landscape.

- Risk Tolerance: Assess your own risk tolerance before investing in a high-growth, albeit potentially risky, sector like AI quantum computing.

- Exit Strategies: Develop a clear exit strategy based on your personal financial goals and risk tolerance. This might involve selling shares after a certain period or when specific financial goals are reached.

Conclusion: Why This AI Quantum Computing Stock Remains a Bargain

Company X's undervalued stock presents a unique opportunity for investors seeking exposure to the rapidly expanding AI quantum computing market. Its proprietary technology, strategic partnerships, and strong financial position significantly mitigate the risks associated with investing in this emerging sector. The potential for substantial returns on investment, coupled with the current undervaluation, makes Company X's stock a compelling bargain. We encourage you to conduct further research into Company X and consider adding this potentially lucrative AI quantum computing stock to your diversified portfolio. [Link to Company X's investor relations page]

Featured Posts

-

Marc Lievremont Se Souvient De Millau L Un De Mes Meilleurs Moments

May 20, 2025

Marc Lievremont Se Souvient De Millau L Un De Mes Meilleurs Moments

May 20, 2025 -

Aston Villa Vs Manchester United Rashfords Goals Secure Fa Cup Progress

May 20, 2025

Aston Villa Vs Manchester United Rashfords Goals Secure Fa Cup Progress

May 20, 2025 -

Ai Industry Celebrates Legislative Victory Yet Faces Uncertain Future

May 20, 2025

Ai Industry Celebrates Legislative Victory Yet Faces Uncertain Future

May 20, 2025 -

Haekkinen On Schumacher F1 Return Still Possible

May 20, 2025

Haekkinen On Schumacher F1 Return Still Possible

May 20, 2025 -

Chinas Automotive Landscape Challenges And Opportunities For Bmw Porsche And Beyond

May 20, 2025

Chinas Automotive Landscape Challenges And Opportunities For Bmw Porsche And Beyond

May 20, 2025