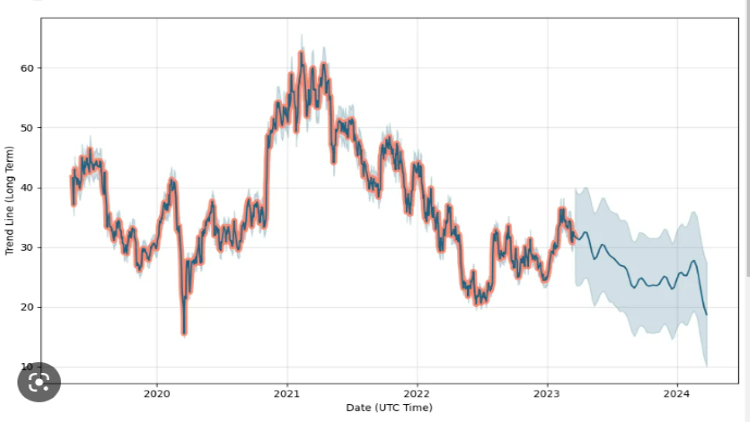

Why Uber Stock Might Weather An Economic Recession

Table of Contents

Uber's Diversified Revenue Streams

Unlike companies reliant on a single product or service, Uber boasts a diversified portfolio of revenue streams. This diversification is a crucial factor in its resilience during economic downturns. Instead of relying solely on its ride-sharing service (Uber Rides), the company has expanded into multiple sectors, creating a safety net against potential drops in demand in any one area.

- Uber Rides: While discretionary spending on rides might decrease during a recession, essential trips—commuting to work, doctor's appointments, airport transfers—remain relatively stable. This provides a base level of consistent revenue.

- Uber Eats: Food delivery services often see increased demand during recessions. As people cut back on restaurant dining due to budget constraints, the convenience and affordability of Uber Eats becomes more appealing. This segment is therefore a significant contributor to recession resilience.

- Uber Freight: The logistics sector frequently experiences increased demand during economic uncertainty. Businesses may seek more cost-effective shipping solutions, benefiting Uber Freight and offering further stability to the company's overall financial performance.

- Other Services: Uber's ongoing expansion into new areas like micromobility (scooters and bikes) and autonomous vehicles offers significant long-term growth opportunities, further mitigating the risk associated with economic downturns. These emerging markets provide potential for future revenue streams and diversification beyond its current core services.

Cost-Cutting Measures and Operational Efficiency

Uber has a proven track record of implementing aggressive cost-cutting measures when needed. This proactive approach enhances profitability and strengthens its ability to withstand economic headwinds. Their sophisticated operational model allows them to adapt quickly to changing market conditions.

- Dynamic pricing: Uber's dynamic pricing model adjusts prices based on real-time demand. This strategy optimizes revenue even during periods of low demand, ensuring that the company maintains profitability.

- Driver incentives: Strategic adjustments to driver incentives can effectively control costs without significantly impacting service levels. Uber can fine-tune these incentives to manage expenses during periods of economic stress.

- Technology investments: Uber's continuous investment in technology and automation reduces operational costs in the long run. This forward-thinking approach positions the company for greater efficiency and cost savings over time, improving its resilience against economic challenges.

Essential Service Nature and Pricing Power

While some Uber services are discretionary, many are becoming increasingly essential, providing a degree of recession resistance. Furthermore, Uber's dominant market position grants them significant pricing power, a critical advantage during uncertain economic times.

- Transportation: Uber provides crucial transportation for essential workers, healthcare professionals, and individuals with limited alternative transportation options. This demand remains relatively inelastic even during economic downturns.

- Food delivery: Uber Eats provides a vital service, particularly for those who are unable or unwilling to cook regularly or lack convenient access to affordable restaurants. This makes it a less discretionary expense compared to restaurant dining.

- Price adjustments: Uber's pricing power allows it to adjust prices to balance demand and profitability in response to changing economic conditions. This flexibility is a key factor in navigating economic uncertainty.

Potential for Increased Market Share During a Recession

Recessions often lead to industry consolidation. Companies with weaker balance sheets struggle to survive, leading to acquisitions and mergers. Uber, with its strong brand, established infrastructure, and significant cash reserves, is well-positioned to acquire struggling competitors and further increase its market share during an economic downturn. This strategic advantage could significantly enhance its long-term profitability.

Conclusion

While no investment is entirely recession-proof, Uber's diversification, cost-cutting potential, and increasingly essential services suggest that its stock might be more resilient than many anticipate during an economic downturn. Its proven ability to adapt and innovate adds further to its appeal as a potential investment in uncertain times. Consider researching Uber stock and conducting your own due diligence before making any investment decisions. Assess the risks and rewards carefully before investing in recession-proof stocks like Uber to see if it aligns with your investment strategy. Remember that past performance does not guarantee future results.

Featured Posts

-

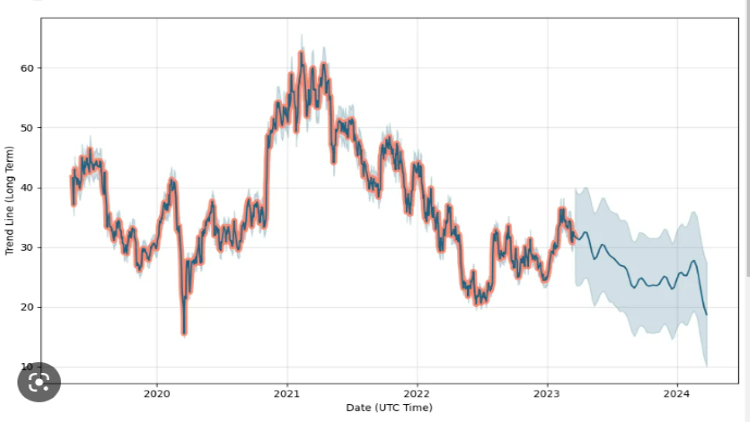

Analyzing Floridas Response To School Shootings Lockdown Effectiveness And Long Term Effects

May 17, 2025

Analyzing Floridas Response To School Shootings Lockdown Effectiveness And Long Term Effects

May 17, 2025 -

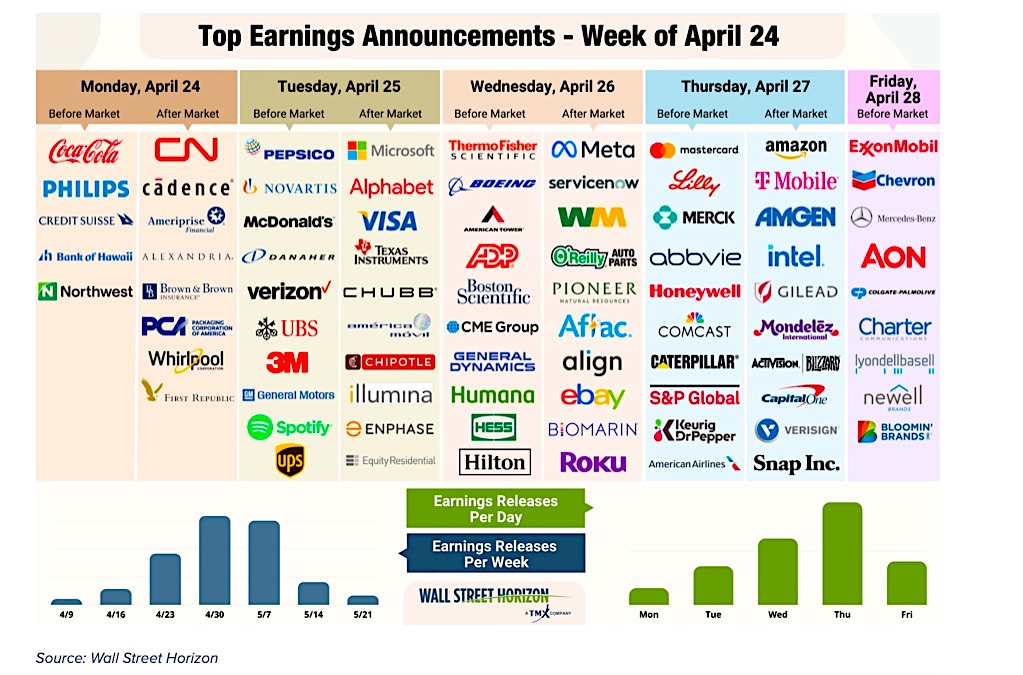

Rockwell Automations Strong Earnings Drive Stock Surge Market Movers

May 17, 2025

Rockwell Automations Strong Earnings Drive Stock Surge Market Movers

May 17, 2025 -

Fortnite Players Demand Change After Backwards Music Update

May 17, 2025

Fortnite Players Demand Change After Backwards Music Update

May 17, 2025 -

Knicks Face A Difficult Decision What To Do With Landry Shamet

May 17, 2025

Knicks Face A Difficult Decision What To Do With Landry Shamet

May 17, 2025 -

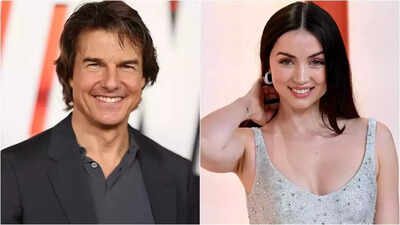

Tom Cruises Past Relationships A Comprehensive Look At His Dating Life

May 17, 2025

Tom Cruises Past Relationships A Comprehensive Look At His Dating Life

May 17, 2025

Latest Posts

-

Nba Playoffs Knicks Vs Pistons Bet365 Bonus Code Nypbet And Betting Guide

May 17, 2025

Nba Playoffs Knicks Vs Pistons Bet365 Bonus Code Nypbet And Betting Guide

May 17, 2025 -

Nba Playoffs 2024 Zeygaria Programma And Imerominies Agonon

May 17, 2025

Nba Playoffs 2024 Zeygaria Programma And Imerominies Agonon

May 17, 2025 -

Knicks Vs Pistons Series Bet365 Bonus Code Nypbet Odds Predictions And Picks

May 17, 2025

Knicks Vs Pistons Series Bet365 Bonus Code Nypbet Odds Predictions And Picks

May 17, 2025 -

Serangan Rudal Houthi Dubai Dan Abu Dhabi Dalam Bahaya

May 17, 2025

Serangan Rudal Houthi Dubai Dan Abu Dhabi Dalam Bahaya

May 17, 2025 -

Peringatan Houthi Rudal Mengancam Dubai Dan Abu Dhabi

May 17, 2025

Peringatan Houthi Rudal Mengancam Dubai Dan Abu Dhabi

May 17, 2025