Will Big Oil Increase Production? OPEC+ Meeting In Focus

Table of Contents

Current Global Oil Market Conditions

The current global oil market is characterized by high demand and constrained supply, creating a volatile and uncertain environment. Geopolitical instability, inflation, and concerns about energy security further complicate the situation. Several key factors are at play:

-

High global demand: Post-pandemic economic recovery has led to a surge in global oil demand, exceeding pre-pandemic levels in many regions. This increased consumption is putting immense pressure on existing oil supplies.

-

Supply chain disruptions: The ongoing disruption of global supply chains, impacting oil production, refining, and transportation, has exacerbated the supply shortage. Logistics bottlenecks and labor shortages continue to constrain the ability to get oil to market efficiently.

-

Geopolitical tensions: The war in Ukraine has significantly impacted global oil exports and prices, with sanctions on Russian oil creating a major supply deficit. Geopolitical instability in other regions also contributes to market uncertainty and price volatility.

-

Inflationary pressures: The rising cost of energy is a significant driver of global inflation, impacting consumers and businesses alike. High oil prices contribute to increased costs for transportation, manufacturing, and other essential sectors.

-

Energy security concerns: Many nations are concerned about their reliance on volatile oil markets and are seeking ways to diversify their energy sources and enhance their energy security. This is driving investments in renewable energy and alternative fuels.

OPEC+'s Role and Past Decisions

OPEC+, a coalition of the Organization of the Petroleum Exporting Countries (OPEC) and other major oil-producing nations (including Russia), plays a significant role in shaping global oil production. Its decisions regarding production quotas have historically had a substantial impact on oil prices.

-

Past OPEC+ production decisions: OPEC+ has implemented both production increases and significant production cuts in the past, each impacting global oil prices dramatically. Analyzing these past decisions is crucial for understanding the potential outcomes of the upcoming meeting.

-

Power dynamics within OPEC+: The alliance's decision-making process is influenced by the power dynamics between its member countries, particularly Saudi Arabia and Russia. These nations' individual interests and economic priorities will play a key role in shaping the final decision.

-

Impact of previous production cuts: Previous production cuts by OPEC+ have resulted in significant increases in oil prices, sometimes contributing to inflationary pressures and economic uncertainty. The effectiveness of these cuts in managing supply and price stability is a subject of ongoing debate.

-

Challenges in coordinating production: Coordinating production among OPEC+ member countries with diverse economic interests and production capabilities presents a complex challenge. Reaching a consensus on production levels can be difficult and time-consuming.

Factors Influencing OPEC+'s Decision

Several critical factors will likely influence OPEC+'s decision at the upcoming meeting:

-

Current oil price levels and OPEC+'s price targets: The current price of crude oil is a significant factor. OPEC+ will likely consider whether current prices align with its desired price range.

-

Economic forecasts and projections for future oil demand: Forecasts for future oil demand will influence the decision. Strong demand projections may encourage higher production, while weaker projections could lead to a more conservative approach.

-

Geopolitical risks and their potential impact on oil production and supply: Ongoing geopolitical instability and potential disruptions to oil production in various regions will be carefully evaluated.

-

Individual member countries' economic needs and production capacities: Each member country's economic situation and production capacity will influence its position on production levels. Countries facing economic hardship may advocate for higher production to increase revenue.

-

Potential pressure from consuming nations to increase oil output: Consuming nations are likely to exert pressure on OPEC+ to increase production to alleviate high oil prices and address inflation concerns.

Potential Outcomes and Their Implications

The OPEC+ meeting could result in several different outcomes, each with significant implications for the global oil market:

-

Scenario 1: Significant increase in production: A substantial increase in production could lead to a decrease in oil prices, easing inflationary pressures and improving global energy affordability. However, it could also lead to increased market volatility if demand does not keep pace with the supply increase.

-

Scenario 2: Minor increase or no change in production: A small increase or no change in production would likely maintain relatively high oil prices, potentially prolonging inflationary pressures and economic uncertainty. This could also trigger increased market volatility as investors react to the lack of production relief.

-

Scenario 3: Further production cuts: Further cuts in production would likely drive oil prices even higher, creating even greater economic instability and further straining global energy markets. This scenario could exacerbate inflationary pressures and significantly impact consumer affordability.

-

The role of the energy transition: The ongoing energy transition towards renewable energy sources and the increasing investment in renewables are vital in mitigating the impact of future oil price shocks and reducing reliance on volatile oil markets.

Conclusion

The upcoming OPEC+ meeting is a crucial event for the global energy market. The decision regarding Big Oil's production levels will significantly impact oil prices, inflation, and global economic stability. The factors influencing the decision are numerous and complex, ranging from current oil prices and economic forecasts to geopolitical risks and the individual needs of member countries. The potential outcomes are wide-ranging, from a significant increase in production leading to lower prices to further cuts leading to even higher prices and greater market volatility. Staying informed about the OPEC+ meeting and its impact on oil prices is crucial. Follow reputable news sources and continue to monitor developments regarding Big Oil production and the global energy supply to stay informed about fluctuations in oil production. Understanding the dynamics of the oil market is crucial, especially concerning the future of Big Oil and its role in the global energy landscape.

Featured Posts

-

Belgiums Merchant Energy Market Financing A 270 M Wh Bess Project

May 04, 2025

Belgiums Merchant Energy Market Financing A 270 M Wh Bess Project

May 04, 2025 -

Position De Netanyahu Un Etat Palestinien Une Erreur Selon Macron

May 04, 2025

Position De Netanyahu Un Etat Palestinien Une Erreur Selon Macron

May 04, 2025 -

Raya Ev Charging Offer Shell Recharge Provides Up To 100 Rebate East Coast

May 04, 2025

Raya Ev Charging Offer Shell Recharge Provides Up To 100 Rebate East Coast

May 04, 2025 -

Nigel Farages Shrewsbury Trip Local Reaction To Relief Road Debate

May 04, 2025

Nigel Farages Shrewsbury Trip Local Reaction To Relief Road Debate

May 04, 2025 -

Jet Zeros Innovative Triangle Jet 2027 Flight Plans

May 04, 2025

Jet Zeros Innovative Triangle Jet 2027 Flight Plans

May 04, 2025

Latest Posts

-

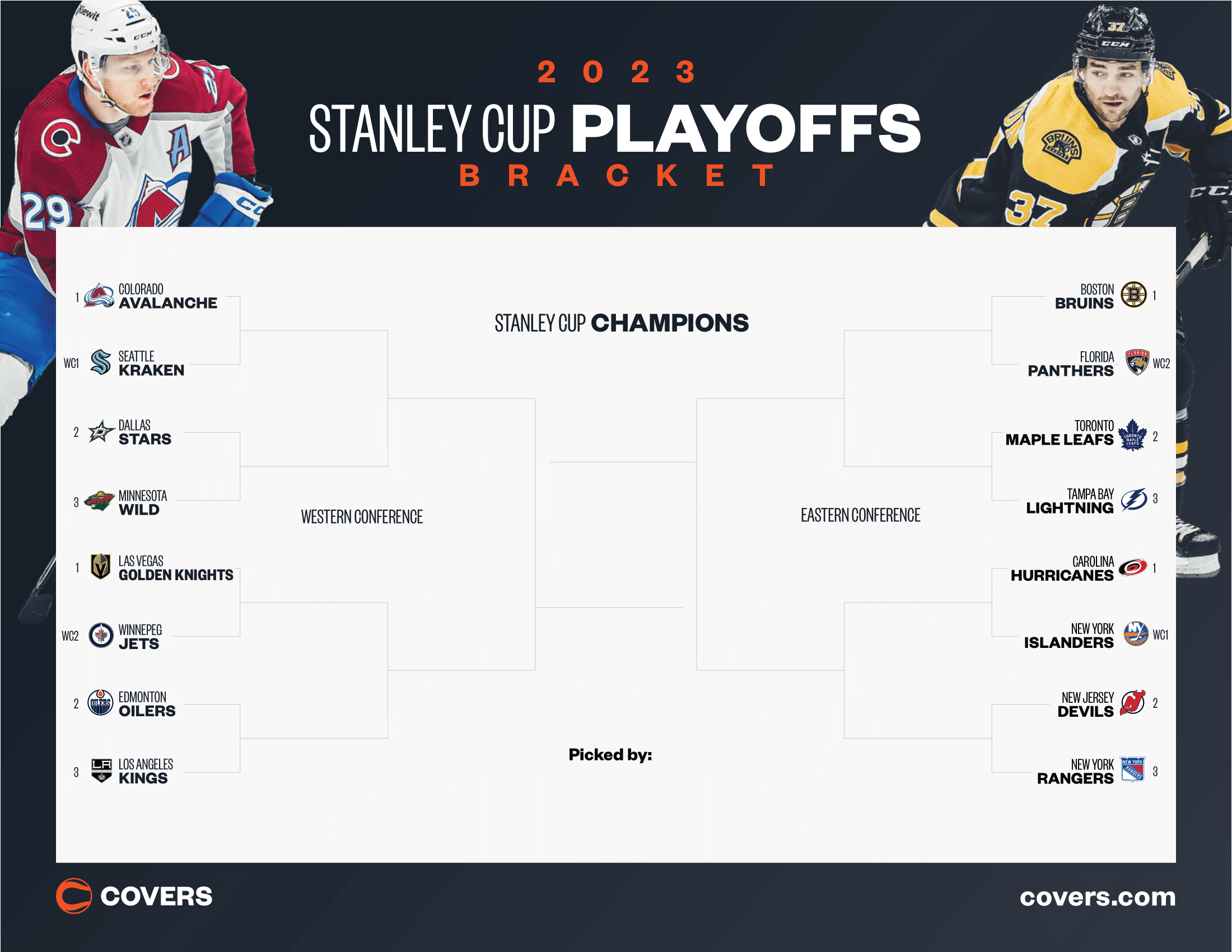

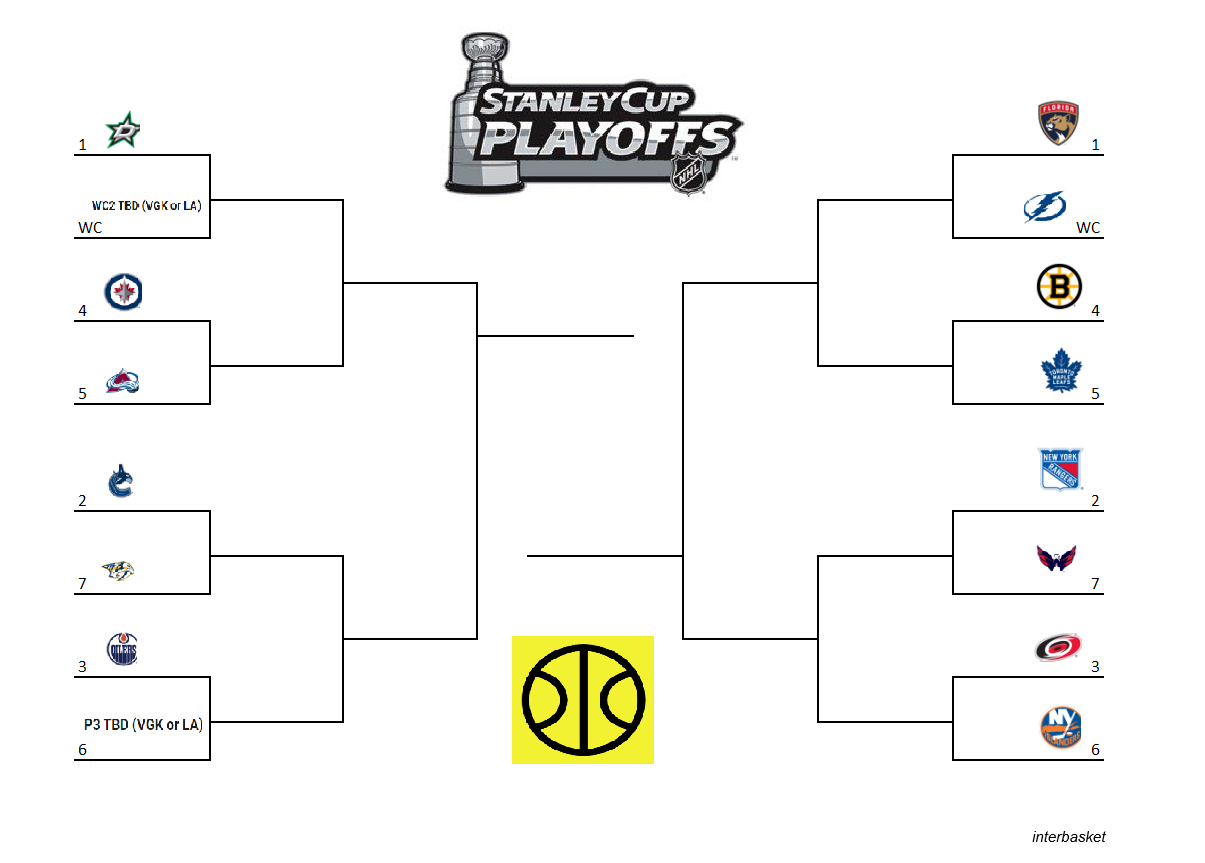

Analyzing The Nhl Standings Must See Games On Showdown Saturday

May 04, 2025

Analyzing The Nhl Standings Must See Games On Showdown Saturday

May 04, 2025 -

Nhl Playoff Race Heats Up Showdown Saturdays Key Matchups And Standings

May 04, 2025

Nhl Playoff Race Heats Up Showdown Saturdays Key Matchups And Standings

May 04, 2025 -

Showdown Saturday A Look At The Tight Nhl Playoff Standings

May 04, 2025

Showdown Saturday A Look At The Tight Nhl Playoff Standings

May 04, 2025 -

Nhl Playoffs Showdown Saturdays Crucial Standings Battles

May 04, 2025

Nhl Playoffs Showdown Saturdays Crucial Standings Battles

May 04, 2025 -

Nhl Playoff Standings Showdown Saturday What To Watch

May 04, 2025

Nhl Playoff Standings Showdown Saturday What To Watch

May 04, 2025