Will Tariffs Replace Income Taxes? Four Factors To Consider

Table of Contents

H2: The Revenue Generation Capacity of Tariffs

Could tariffs truly replace the revenue generated by income taxes? The answer is a resounding no, at least without causing significant economic disruption. Let's look at the limitations.

H3: Limitations of Tariff Revenue

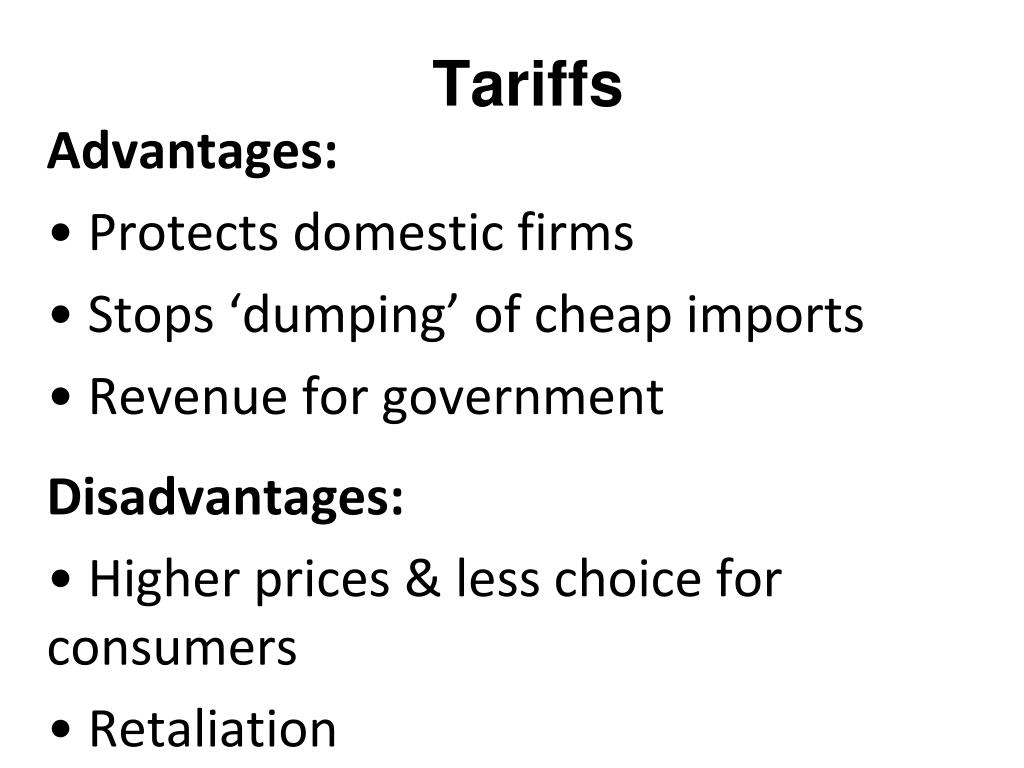

Tariffs are inherently limited in their revenue-generating potential. They only apply to imported goods, and relying solely on them would severely restrict the government's ability to raise sufficient revenue. Excessive tariffs also carry significant drawbacks:

- Reduced consumer spending due to increased prices: Higher prices on imported goods lead to reduced consumer purchasing power and potentially decreased overall economic activity.

- Retaliatory tariffs from other countries leading to trade wars: Imposing high tariffs invites retaliatory measures from other nations, escalating into damaging trade wars that hurt both exporting and importing countries.

- Potential for smuggling and black market activity: High tariffs incentivize smuggling and the growth of a black market, undermining government revenue and control.

H3: Fluctuations in Tariff Revenue

Revenue from tariffs is highly volatile. It's heavily influenced by global trade patterns and economic fluctuations. A downturn in global trade, for example, would dramatically reduce tariff revenue, creating significant budget instability.

- Dependence on the volume of imported goods: Tariff revenue is directly tied to the volume of imported goods. Any decrease in imports directly impacts government revenue.

- Sensitivity to global economic conditions: Global economic downturns or shifts in trade patterns can significantly impact tariff revenue, making reliable budget forecasting incredibly difficult.

- Unpredictability makes budgeting extremely difficult: The inherent unpredictability of tariff revenue makes it unsuitable as the sole source of government funding. Consistent, reliable revenue streams are crucial for stable government operations.

H2: The Distributional Effects of Tariff-Based Revenue

Even if tariffs could generate enough revenue, their distributional effects are deeply problematic.

H3: Regressive Nature of Tariffs

Tariffs are inherently regressive. Lower-income households spend a larger portion of their income on imported goods, meaning they bear a disproportionately larger burden of tariff increases. This exacerbates income inequality.

- Higher prices on essential goods like clothing and electronics: Many essential goods are imported, meaning that tariffs on these goods directly impact the budgets of low-income households.

- Limited ability for lower-income individuals to absorb increased costs: Lower-income individuals have less flexibility to absorb price increases caused by tariffs, leading to reduced living standards.

- Exacerbation of existing economic disparities: A tariff-based system would further widen the gap between rich and poor, creating significant social and economic instability.

H3: Impact on Specific Industries

The impact of tariffs is uneven across industries. While some domestic industries might benefit from increased protectionism, others reliant on imported raw materials or intermediate goods would face significant cost increases.

- Increased competitiveness for domestically produced goods in protected industries: Tariffs can protect domestic industries from foreign competition, leading to increased competitiveness and potentially higher profits.

- Increased costs for industries reliant on imported raw materials or intermediate goods: Industries relying heavily on imported components will experience increased production costs, potentially affecting their competitiveness and profitability.

- Job losses in sectors heavily reliant on imports: Increased import costs might lead to reduced demand for goods and services, potentially resulting in job losses in import-dependent sectors.

H2: Political and Economic Feasibility of a Tariff-Only System

Shifting entirely to a tariff-based system is highly improbable due to significant political and economic hurdles.

H3: International Relations and Trade Wars

Replacing income tax with tariffs would almost certainly trigger international trade disputes and potential trade wars. Other countries would likely retaliate, leading to significant economic disruption.

- Risk of retaliatory tariffs and trade sanctions: Other countries would likely respond to increased tariffs with their own, creating a cycle of retaliation and escalating trade tensions.

- Damage to international trade relations and alliances: Trade wars damage international cooperation and alliances, undermining global economic stability.

- Potential for significant economic disruption: The resulting disruptions to global trade flows could lead to widespread economic instability and uncertainty.

H3: Domestic Political Opposition

Such a drastic shift would face significant domestic opposition from businesses, consumers, and various political groups due to the negative impacts on specific industries and consumers.

- Lobbying efforts from affected industries and interest groups: Industries negatively impacted by tariffs would actively lobby against the policy.

- Public backlash due to higher prices and reduced consumer choice: Consumers would likely oppose higher prices and reduced selection of goods.

- Political instability and challenges in implementation: The political fallout from such a controversial policy shift could lead to significant instability.

H2: The Role of Complementary Tax Policies

Even with significantly increased tariffs, they couldn't fully replace income tax revenue. Complementary tax policies are necessary to maintain government revenue and meet social and economic objectives.

- Possible reliance on Value Added Tax (VAT) or other consumption taxes: Other taxes, like VAT, might be necessary to bridge the revenue gap.

- Continued need for tax mechanisms to address income inequality: Alternative tax mechanisms are needed to address income inequality and ensure a fair distribution of the tax burden.

- Complexities of creating a balanced and equitable tax system: A balanced tax system requires a multifaceted approach, not solely reliance on tariffs.

3. Conclusion:

Replacing income taxes with tariffs is a highly complex and impractical proposition. The limitations in revenue generation, regressive nature, potential for international conflict, and the need for supplementary taxes all make such a shift unlikely and potentially damaging to the economy. While tariffs play a role in fiscal policy, relying solely on them to fund government operations is a recipe for economic instability and social inequity. Understanding the intricacies of tariff implementation and their impact on various economic sectors is crucial for informed policy discussions. To further explore this complex topic, research the impact of different tariff structures and their implications for various economic sectors. Consider the limitations and challenges of replacing income taxes with tariffs.

Featured Posts

-

Priscilla Pointer 1923 2023 Remembering A Legendary Actress And Teacher

May 01, 2025

Priscilla Pointer 1923 2023 Remembering A Legendary Actress And Teacher

May 01, 2025 -

Phipps Australian Rugbys Dominance Questioned

May 01, 2025

Phipps Australian Rugbys Dominance Questioned

May 01, 2025 -

Targets Dei Initiatives A Reassessment Of Its Policies

May 01, 2025

Targets Dei Initiatives A Reassessment Of Its Policies

May 01, 2025 -

Dragons Den Investment Strategies What Works And What Doesnt

May 01, 2025

Dragons Den Investment Strategies What Works And What Doesnt

May 01, 2025 -

Meta Faces Ftc Current Status Of The Instagram And Whats App Lawsuit

May 01, 2025

Meta Faces Ftc Current Status Of The Instagram And Whats App Lawsuit

May 01, 2025

Latest Posts

-

Bonusdeildin Dagskra Yfir Meistaradeildina Og Nba Leiki

May 01, 2025

Bonusdeildin Dagskra Yfir Meistaradeildina Og Nba Leiki

May 01, 2025 -

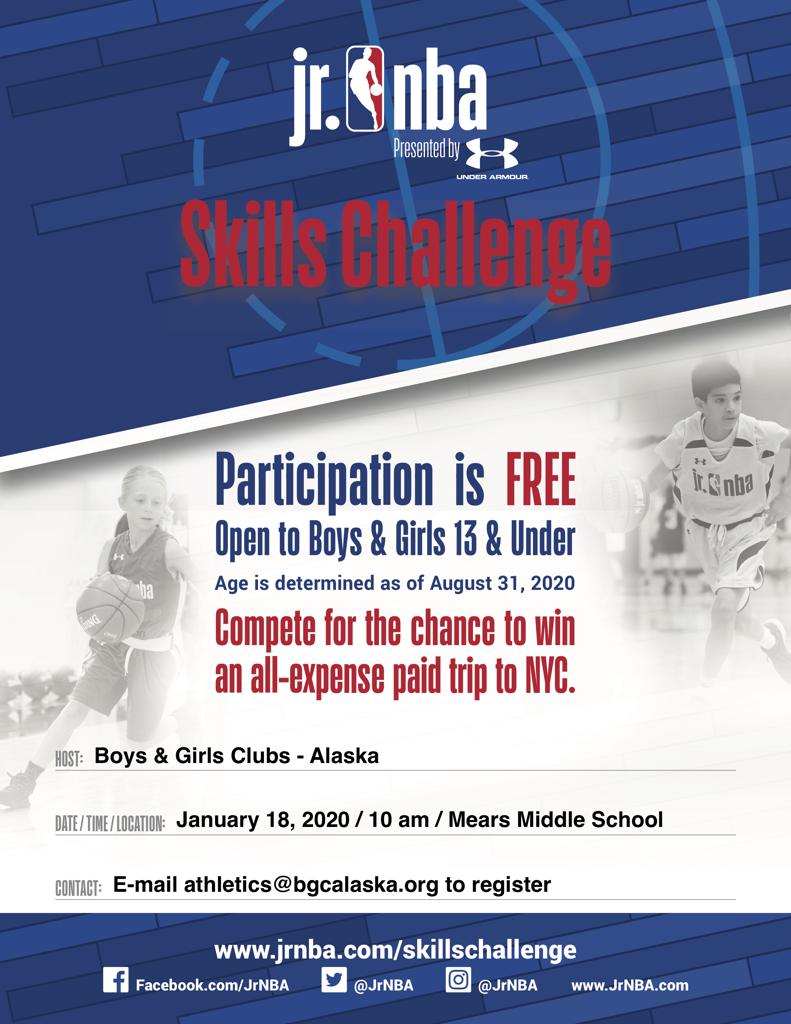

Nba Skills Challenge 2025 Players Teams And Competition Format Explained

May 01, 2025

Nba Skills Challenge 2025 Players Teams And Competition Format Explained

May 01, 2025 -

Meistaradeildin Og Nba I Bonusdeildinni Dagskra Og Upplysingar

May 01, 2025

Meistaradeildin Og Nba I Bonusdeildinni Dagskra Og Upplysingar

May 01, 2025 -

Nba Skills Challenge 2025 A Complete Guide To Players Teams Format Rules And Tiebreakers

May 01, 2025

Nba Skills Challenge 2025 A Complete Guide To Players Teams Format Rules And Tiebreakers

May 01, 2025 -

Dagskrain Meistaradeildin Og Nba Stjoernukapp I Bonusdeildinni

May 01, 2025

Dagskrain Meistaradeildin Og Nba Stjoernukapp I Bonusdeildinni

May 01, 2025