Will The Bank Of Canada Cut Rates Again? Job Losses From Tariffs Spur Predictions

Table of Contents

The Impact of Tariffs on Canadian Employment

The imposition of tariffs, particularly in the context of ongoing trade tensions, has significantly impacted Canadian employment, creating uncertainty and fueling calls for Bank of Canada interest rate cuts.

Job Losses in Key Sectors

Specific sectors of the Canadian economy have been disproportionately affected by tariffs, leading to substantial job losses. The manufacturing and agricultural sectors, for example, have experienced significant setbacks.

- Manufacturing: Companies reliant on exporting goods have faced reduced demand due to retaliatory tariffs, leading to production cuts and layoffs. For instance, XYZ Manufacturing reported a 15% reduction in its workforce in Q3 2024 due to decreased export orders. ABC Steel experienced similar challenges, resulting in a hiring freeze and the loss of several contract positions.

- Agriculture: Farmers exporting commodities like canola and lumber have been hit hard by tariffs imposed by major trading partners. This has led to reduced farm incomes and a decrease in related agricultural jobs. The Canadian Federation of Agriculture reported a notable decline in employment within the sector.

- Tariff Impacts on Exports and Imports: Tariffs increase the cost of imported goods, making Canadian products less competitive in international markets. Simultaneously, reduced export opportunities decrease domestic production and employment. This creates a double-edged sword impacting both import and export-oriented businesses and jobs.

Weakening Consumer Confidence

Tariff-related job losses contribute to decreased consumer confidence, negatively impacting overall economic activity. Uncertainty about future employment prospects leads to reduced consumer spending, creating a ripple effect across the economy.

- Decreased Consumer Spending: Statistics Canada data shows a significant drop in consumer spending in the last quarter, directly correlating with the rise in tariff-related job losses. This decline is particularly noticeable in discretionary spending categories.

- Ripple Effect on Other Industries: The decreased spending in one sector affects other related businesses. For instance, reduced spending on new vehicles impacts the automotive industry, its suppliers, and related services. This highlights the interconnectedness of the Canadian economy and the wide-reaching impact of decreased consumer confidence.

Current Economic Indicators and Bank of Canada's Stance

Analyzing current economic indicators is crucial to understanding the rationale behind potential Bank of Canada interest rate cuts. The Bank's stance will be heavily influenced by these factors.

Inflation Rates and GDP Growth

Recent economic data provides crucial context for the debate surrounding Bank of Canada interest rate cuts.

- Inflation Rates: Inflation has remained relatively subdued, potentially giving the Bank of Canada some room to maneuver in terms of interest rate adjustments. The current inflation rate is below the Bank of Canada's target range.

- GDP Growth: GDP growth has slowed in recent quarters, signaling a weakening economy and reinforcing the argument for stimulating growth through rate cuts. The current GDP growth is below the Bank of Canada's projections.

- Comparison to Bank of Canada Targets: The divergence between current economic indicators (slow GDP growth, low inflation) and the Bank of Canada's targets suggests a possible need for intervention through monetary policy adjustments, such as interest rate cuts.

Bank of Canada's Previous Statements

The Bank of Canada's recent communications offer valuable insight into their thinking on potential rate cuts.

- Statements from Press Releases: The Bank's latest press releases emphasize the need to monitor the economic situation closely and respond appropriately to emerging challenges, leaving the door open for future rate adjustments.

- Governor's Speeches: The Governor has highlighted the uncertainties surrounding trade and their potential impact on the Canadian economy, suggesting a cautious approach with a willingness to act if needed.

- Hawkish vs. Dovish Language: While some statements suggest a cautious approach (dovish), others emphasize the need for economic stability (hawkish), indicating ongoing deliberation within the Bank of Canada.

Arguments For and Against Further Rate Cuts

The decision on further Bank of Canada interest rate cuts involves weighing the potential benefits against potential risks.

Arguments in Favor

Proponents of rate cuts argue they are necessary to address the current economic slowdown and mitigate the negative impacts of tariffs.

- Stimulate Economic Growth: Lower interest rates can encourage borrowing and investment, stimulating economic activity and job creation.

- Prevent Recession: Rate cuts can act as a preventative measure against a potential economic recession by supporting businesses and consumer spending.

- Support Employment: By fostering economic growth, rate cuts can help reduce unemployment and improve the overall labor market situation.

- Expert Opinions: Several prominent economists are advocating for rate cuts, citing the weakening economy and need for stimulus.

Arguments Against

Opponents express concerns about the potential negative consequences of further rate reductions.

- Risk of Inflation: Lower interest rates could potentially fuel inflation if the economy starts to overheat.

- Potential for Asset Bubbles: Reduced interest rates can inflate asset prices (like real estate), creating the risk of future market corrections.

- Limited Effectiveness: Some argue that monetary policy alone may not be sufficient to address structural issues stemming from trade tensions.

- Expert Opinions: Other economists warn against aggressive rate cuts, emphasizing the need for fiscal policy solutions in addition to monetary adjustments.

Conclusion

The question of whether the Bank of Canada will cut rates again remains a complex one, heavily influenced by the evolving economic landscape and the impact of ongoing trade tensions. The impact of tariffs on employment, current economic indicators showing slow GDP growth and low inflation, and differing viewpoints on the effectiveness of further rate reductions all play a significant role.

Call to Action: Understanding the potential for Bank of Canada interest rate cuts is crucial for making informed financial decisions. Stay informed about the latest developments by regularly checking reputable financial news sources for updates on Bank of Canada interest rate cuts and their implications for the Canadian economy. Monitoring announcements and analyzing economic data will help individuals and businesses better navigate this period of economic uncertainty.

Featured Posts

-

Whoop Under Fire Users Furious Over Unfulfilled Upgrade Offers

May 11, 2025

Whoop Under Fire Users Furious Over Unfulfilled Upgrade Offers

May 11, 2025 -

Apple And Google An Unexpected Symbiosis

May 11, 2025

Apple And Google An Unexpected Symbiosis

May 11, 2025 -

Manfred On Bristol Anticipation Builds For Massive Crowd

May 11, 2025

Manfred On Bristol Anticipation Builds For Massive Crowd

May 11, 2025 -

Understanding The Jurickson Profar 80 Game Ped Suspension

May 11, 2025

Understanding The Jurickson Profar 80 Game Ped Suspension

May 11, 2025 -

Michael Johnson On The Tyreek Hill Noah Lyles Debate A Track And Field Perspective

May 11, 2025

Michael Johnson On The Tyreek Hill Noah Lyles Debate A Track And Field Perspective

May 11, 2025

Latest Posts

-

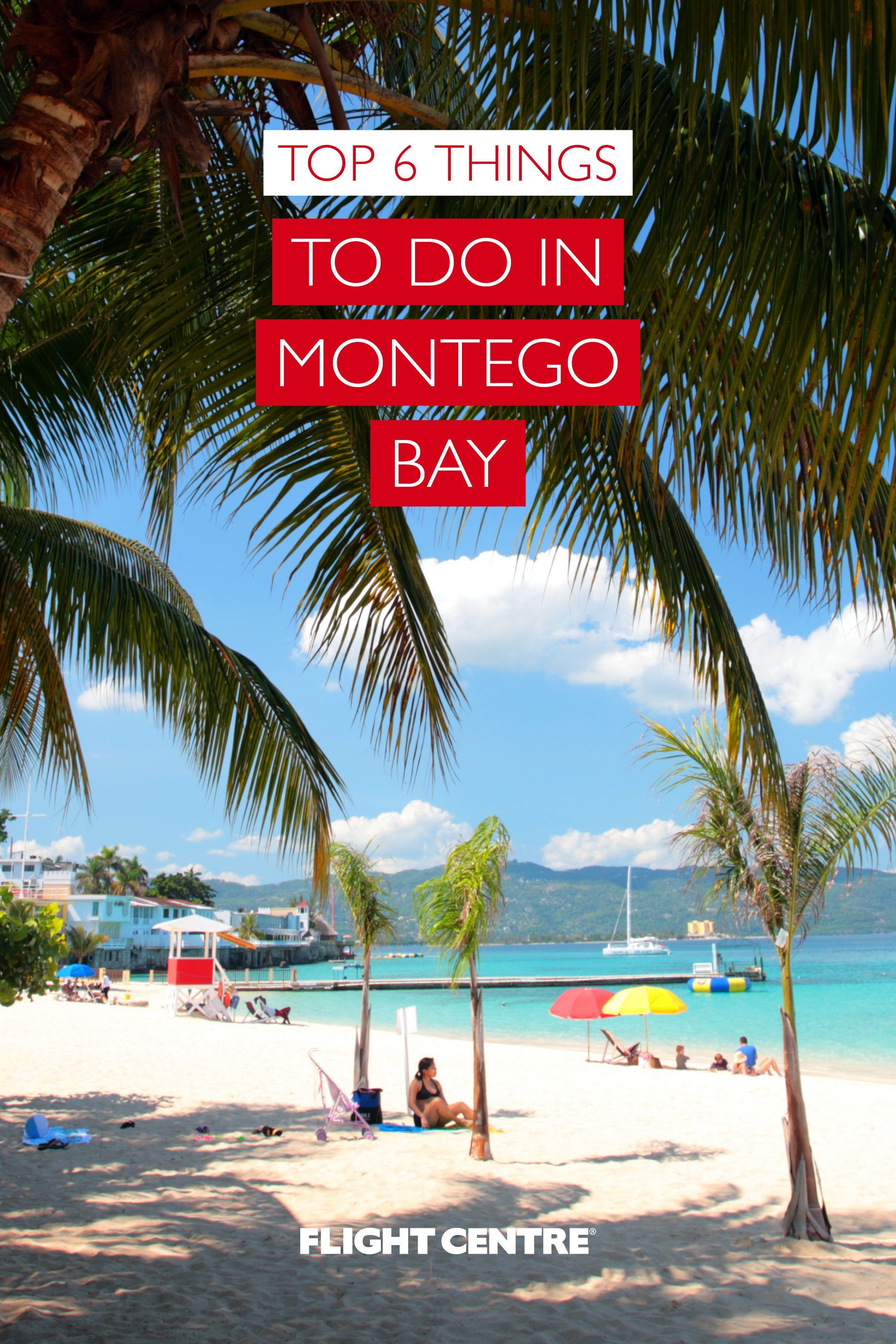

Planning Your Trip To Montego Bay

May 11, 2025

Planning Your Trip To Montego Bay

May 11, 2025 -

Your Guide To Montego Bay Jamaica

May 11, 2025

Your Guide To Montego Bay Jamaica

May 11, 2025 -

Max Orders Crazy Rich Asians Tv Series From Director Jon M Chu

May 11, 2025

Max Orders Crazy Rich Asians Tv Series From Director Jon M Chu

May 11, 2025 -

Crazy Rich Asians A New Tv Series In Development At Hbo Max

May 11, 2025

Crazy Rich Asians A New Tv Series In Development At Hbo Max

May 11, 2025 -

Diamond League 2024 Duplantis And The Shifting Landscape Of Track And Field

May 11, 2025

Diamond League 2024 Duplantis And The Shifting Landscape Of Track And Field

May 11, 2025