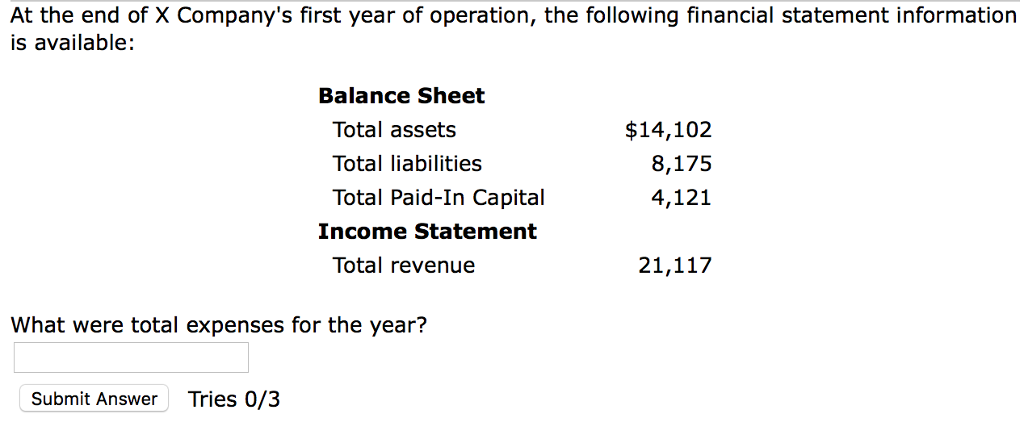

X Corporation's Financial Transformation Post-Debt Sale

Table of Contents

Improved Debt Structure and Financial Flexibility

The successful debt sale represents a major step in X Corporation's journey towards enhanced financial stability. By strategically reducing its debt burden, the company has significantly improved its financial flexibility and positioned itself for future success. The sale involved [Specify amount] in debt, successfully offloaded to [Name of buyer(s) or type of buyer, e.g., institutional investors]. The terms of the sale included [briefly describe key terms, e.g., favorable interest rates, staggered repayment schedule].

This X Corporation debt reduction has yielded several crucial benefits:

- Reduction in overall debt-to-equity ratio: This key metric has improved significantly, indicating a healthier financial position and lower risk profile for the company. [Include specific figures if available, e.g., from X to Y].

- Improved credit rating and access to more favorable financing options: The reduced debt load has resulted in upgraded credit ratings from major agencies, opening doors to more attractive financing opportunities with lower interest rates.

- Increased capacity for strategic investments and acquisitions: With a lighter debt burden, X Corporation now has significantly more financial headroom to pursue strategic investments and acquisitions that will fuel its growth strategy.

- Lower interest expense, boosting profitability: The reduction in debt has directly translated into lower interest expenses, positively impacting the company's bottom line and enhancing profitability.

Strategic Investments and Growth Opportunities

The improved financial health resulting from the debt sale is already enabling X Corporation to pursue ambitious X Corporation investments and growth initiatives. The company is leveraging this newfound financial flexibility to capitalize on strategic opportunities that were previously unattainable.

These initiatives include:

- Investment in research and development of new products or services: X Corporation is significantly increasing its R&D budget to develop innovative products and services that will strengthen its market position and drive future growth. [Give specific examples if possible].

- Expansion into new markets or geographical regions: The company is actively exploring opportunities to expand its operations into new and emerging markets, both domestically and internationally. [Mention specific markets or regions].

- Acquisition of complementary businesses to broaden the company's portfolio: X Corporation is actively pursuing acquisitions that will expand its product offerings and strengthen its overall market presence. [Mention any acquisitions already completed or being considered].

- Upgrading of existing infrastructure and technology: The company is investing in upgrading its infrastructure and technology to enhance operational efficiency, productivity, and competitiveness.

Enhanced Shareholder Value and Investor Confidence

The X Corporation financial transformation is delivering tangible benefits to shareholders and restoring investor confidence. The improved financial health and future growth prospects are driving increased shareholder value and attracting new investors.

Key indicators of this success include:

- Increased stock price following the debt sale: The market has responded positively to the debt reduction strategy, leading to a noticeable increase in X Corporation's stock price. [Include specific figures if available].

- Improved dividend payouts to shareholders: The enhanced profitability is allowing X Corporation to increase dividend payouts to shareholders, rewarding their continued support. [Include specific figures if available].

- Positive analyst ratings and increased investor interest: Leading financial analysts have upgraded their ratings for X Corporation, reflecting increased confidence in the company's future performance.

- Stronger market capitalization: X Corporation’s market capitalization has grown significantly, underscoring the positive impact of the financial transformation on investor perception.

Addressing Potential Challenges and Risks

While the X Corporation financial transformation is largely positive, it's important to acknowledge potential challenges and risks. Economic downturns, unexpected market fluctuations, and unforeseen competitive pressures could all impact the company's performance. However, X Corporation is actively mitigating these risks through robust X Corporation risk management strategies.

These strategies include:

- Developing robust financial models to forecast potential impacts of economic fluctuations: The company utilizes sophisticated financial models to anticipate and prepare for potential economic downturns.

- Diversifying revenue streams to reduce reliance on any single market or product: This strategy ensures resilience against market fluctuations.

- Implementing contingency plans for unforeseen circumstances: X Corporation has well-defined contingency plans to address unexpected challenges effectively.

Conclusion

X Corporation's financial transformation following its debt sale represents a significant step towards long-term stability and growth. The reduced debt burden, coupled with strategic investments, has significantly enhanced shareholder value and investor confidence. This X Corporation financial transformation showcases a clear path toward sustainable growth and profitability.

Call to Action: Stay informed about X Corporation's ongoing financial progress and its continued journey of financial transformation. Follow our updates for the latest news on X Corporation's financial performance and its impact on the market. Learn more about X Corporation's financial transformation by visiting [link to X Corporation's investor relations page].

Featured Posts

-

Red Sox Offseason Strategy Securing A Replacement For Tyler O Neill

Apr 28, 2025

Red Sox Offseason Strategy Securing A Replacement For Tyler O Neill

Apr 28, 2025 -

Coras Lineup Strategy Red Sox Doubleheader Game 1

Apr 28, 2025

Coras Lineup Strategy Red Sox Doubleheader Game 1

Apr 28, 2025 -

How The Red Sox Can Replace Tyler O Neill In 2025

Apr 28, 2025

How The Red Sox Can Replace Tyler O Neill In 2025

Apr 28, 2025 -

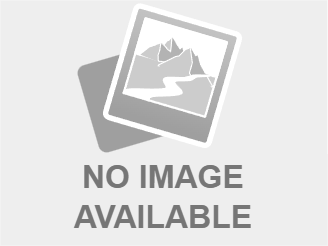

12 3 Win Max Frieds Yankees Debut And Offensive Powerhouse Performance

Apr 28, 2025

12 3 Win Max Frieds Yankees Debut And Offensive Powerhouse Performance

Apr 28, 2025 -

Final Days Hudsons Bay Liquidation Sale Up To 70 Off

Apr 28, 2025

Final Days Hudsons Bay Liquidation Sale Up To 70 Off

Apr 28, 2025