XRP Price Prediction: Will XRP Hit $10? Ripple's Dubai License And Resistance Breakout

Table of Contents

Ripple's Dubai License and its Impact on XRP Price

Keywords: Ripple Dubai license, XRP regulation, Ripple regulatory developments, Dubai cryptocurrency regulation, XRP adoption

Ripple obtaining a license to operate within Dubai's virtual asset regulatory framework is a landmark event with potentially significant implications for the XRP price. This regulatory approval signifies a crucial step towards greater legitimacy and wider adoption of XRP.

-

Enhanced Legitimacy: The Dubai license enhances Ripple's credibility, mitigating concerns surrounding regulatory uncertainty that have previously plagued the cryptocurrency market. This increased legitimacy could attract institutional investors hesitant to engage with less regulated projects.

-

Increased Adoption: Dubai's progressive approach to cryptocurrency regulation, coupled with its position as a major global financial hub, positions XRP for increased adoption among financial institutions and businesses operating within the region. This increased usage could drive up demand and, consequently, the price.

-

Institutional Investor Influx: Regulatory clarity is a key factor for institutional investors. The Dubai license signals a more stable and predictable environment, potentially attracting significant investments that could significantly boost XRP's market capitalization.

-

Global Financial Hub Advantage: Dubai's status as a global financial center amplifies the impact of the license. Adoption in this key market could trigger a ripple effect, leading to broader international adoption and increased XRP price.

-

Further Regulatory Approvals: Securing a license in Dubai could pave the way for similar approvals in other jurisdictions, further bolstering investor confidence and potentially driving the XRP price higher.

Technical Analysis: Breaking Key Resistance Levels

Keywords: XRP technical analysis, resistance levels, support levels, chart patterns, trading volume, XRP price chart, bullish indicators

Technical analysis plays a crucial role in predicting potential price movements. Identifying and analyzing key resistance levels is particularly important.

-

Resistance Levels: Resistance levels represent price points where selling pressure tends to outweigh buying pressure, hindering further price increases. Breaking through these levels is a strong bullish signal.

-

XRP Price Chart Analysis: Examining recent XRP price charts reveals key resistance levels that need to be broken for the price to surge towards $10. This requires careful observation of price action, volume, and indicator signals.

-

Chart Patterns: The emergence of bullish chart patterns, such as head and shoulders reversals or cup and handle formations, can suggest an imminent price breakout. These patterns provide visual cues about potential price direction.

-

Trading Volume Confirmation: A significant increase in trading volume accompanying a breakout through resistance levels confirms the strength of the move and increases the likelihood of sustained price appreciation. High volume indicates strong conviction among buyers.

-

Macroeconomic Factors: While technical analysis is valuable, macroeconomic conditions also significantly impact cryptocurrency prices. Factors such as overall market sentiment, inflation rates, and regulatory changes need to be considered.

Market Sentiment and Adoption Rates

Keywords: XRP market sentiment, social media sentiment, XRP adoption rate, institutional adoption, retail adoption, FOMO (Fear of Missing Out)

Market sentiment and adoption rates are intertwined factors driving cryptocurrency price movements. Positive news and regulatory developments contribute to increased positive sentiment.

-

Positive News Impact: The Ripple Dubai license and other positive developments significantly influence investor sentiment, creating a wave of optimism that could push the XRP price higher.

-

Social Media Sentiment Analysis: Monitoring social media sentiment regarding XRP can provide valuable insights into investor confidence and potential price fluctuations. Positive sentiment, coupled with increased online discussion, could amplify price appreciation.

-

Institutional Adoption Growth: The increasing adoption of XRP by financial institutions and businesses is a significant bullish factor. Institutional adoption brings stability and liquidity to the market, supporting price growth.

-

Retail Investor Interest (FOMO): A surge in retail investor interest, often fueled by FOMO (fear of missing out), can further accelerate price increases, especially if coupled with positive news and technical breakouts.

-

Market Capitalization and Trading Volume: Monitoring XRP's market capitalization and trading volume provides additional data points to assess market strength and potential for future price movements.

Addressing the Challenges: Potential Roadblocks to $10

Keywords: XRP risks, regulatory uncertainty, market volatility, competition, bearish sentiment

Reaching $10 for XRP is an ambitious target, and several challenges could hinder its achievement.

-

Regulatory Uncertainty: While the Dubai license is positive, regulatory uncertainty remains a risk in other jurisdictions. Negative regulatory developments could negatively impact XRP's price.

-

Market Volatility: The cryptocurrency market is inherently volatile. Unexpected market downturns can significantly impact even the most promising cryptocurrencies.

-

Competition: The cryptocurrency market is highly competitive. The emergence of new, innovative projects could divert investor interest away from XRP.

-

Bearish Sentiment: Negative news or market trends could create bearish sentiment, dampening investor enthusiasm and potentially leading to price declines.

-

Inherent Cryptocurrency Risks: Investing in cryptocurrencies always carries inherent risks, including the possibility of complete loss of investment.

Conclusion:

This article analyzed the potential for XRP to reach $10, considering Ripple's Dubai license, technical analysis, market sentiment, and potential roadblocks. While achieving $10 is ambitious and faces significant challenges, positive regulatory developments and a successful resistance breakout could contribute to substantial price increases. However, investors should approach cryptocurrency investments cautiously, conducting thorough research and understanding the inherent risks before committing funds.

Call to Action: Want to stay informed about the latest XRP price prediction updates and the ongoing journey towards a potential $10 price target? Follow us for continuous insightful analysis on XRP and other cryptocurrencies! Stay tuned to monitor the XRP price and upcoming market movements!

Featured Posts

-

Elon Musks Successor An Exclusive Look At Teslas Ceo Search

May 02, 2025

Elon Musks Successor An Exclusive Look At Teslas Ceo Search

May 02, 2025 -

Dallas Mourns Passing Of 100 Year Old Star

May 02, 2025

Dallas Mourns Passing Of 100 Year Old Star

May 02, 2025 -

Fortnite Item Shop Player Experience Enhanced With New Feature

May 02, 2025

Fortnite Item Shop Player Experience Enhanced With New Feature

May 02, 2025 -

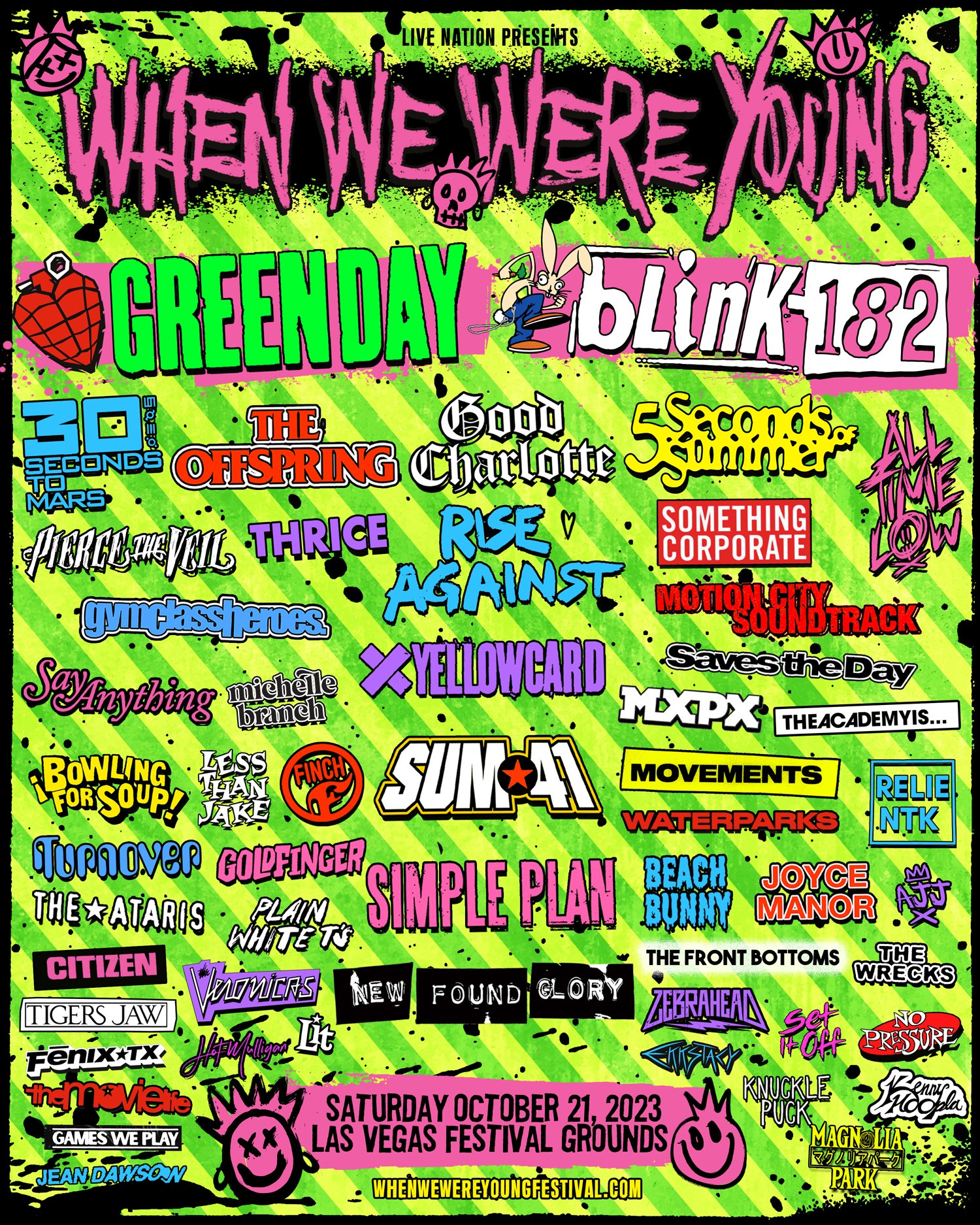

Riot Fest 2025 Lineup Green Day Blink 182 And Weird Al Yankovic Lead The Charge

May 02, 2025

Riot Fest 2025 Lineup Green Day Blink 182 And Weird Al Yankovic Lead The Charge

May 02, 2025 -

Priscilla Pointer Dallas And Carrie Actress Dead At 100

May 02, 2025

Priscilla Pointer Dallas And Carrie Actress Dead At 100

May 02, 2025