XRP (Ripple) Below $3: A Detailed Investment Analysis

Table of Contents

Ripple's Legal Battle and its Impact on XRP Price

The SEC lawsuit against Ripple Labs is undeniably the biggest factor influencing XRP's price. This legal battle casts a long shadow over the cryptocurrency's future, creating significant uncertainty for investors.

The SEC Lawsuit

The Securities and Exchange Commission (SEC) alleges that Ripple sold XRP as an unregistered security, violating federal laws. This accusation has significant implications for XRP's value, as a ruling against Ripple could severely impact its price and potentially even lead to its delisting from major exchanges.

- Arguments Presented: The SEC argues that XRP sales constituted an investment contract, offering investors the expectation of profits based on Ripple's efforts. Ripple counters that XRP is a decentralized currency, not a security, and that its sales were not investment contracts.

- Potential Outcomes and Effects: A favorable ruling for Ripple could significantly boost XRP's price, potentially pushing it well above $3. Conversely, an unfavorable ruling could lead to a substantial price drop, possibly causing long-term damage to its market value. The uncertainty surrounding the outcome fuels considerable market volatility.

- Investor Sentiment and Volatility: The lawsuit has undoubtedly affected investor sentiment. Periods of positive news regarding the case are often followed by price increases, while negative developments trigger price drops. This creates a volatile trading environment for XRP, making it a high-risk investment.

Market Sentiment and Investor Confidence

Investor confidence in XRP is directly correlated to the progress of the SEC lawsuit. News and social media significantly influence the overall market sentiment.

- Price Fluctuations and Lawsuit Progress: Any positive development in the legal battle, such as a favorable court ruling or settlement, is likely to cause a surge in XRP's price. Conversely, negative news can trigger sharp declines.

- Social Media Influence: Twitter, Reddit, and other social media platforms play a crucial role in shaping investor perceptions and driving price volatility. Positive or negative sentiment expressed online can significantly influence trading activity.

- Trading Volume and Market Capitalization: Analyzing XRP's trading volume and market capitalization provides insights into the market's confidence. Increased trading volume during periods of uncertainty suggests high investor engagement, which can lead to price fluctuations.

Technical Analysis of XRP Price

Understanding XRP's price movements requires a technical analysis of its charts and indicators.

Chart Patterns and Price Predictions

Analyzing XRP's historical price charts can reveal potential support and resistance levels, providing insights into future price movements.

- Short-Term and Long-Term Predictions: Based on current chart patterns and technical indicators, short-term predictions are highly susceptible to news related to the lawsuit. Long-term predictions depend heavily on the outcome of the legal battle and the overall adoption of XRP within the financial sector.

- Price Targets (Favorable/Unfavorable Outcomes): A positive resolution could propel XRP to significantly higher prices, potentially reaching and surpassing previous highs. A negative ruling could push the price much lower.

- Technical Indicators (Moving Averages, RSI, MACD): Analyzing technical indicators such as moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) can help predict short-term trends and potential turning points. [Insert relevant chart here]

Trading Volume and Market Liquidity

Assessing XRP's trading volume and liquidity is essential for understanding its market health and investment potential.

- Implications of High/Low Trading Volumes: High trading volume indicates strong investor interest, which can lead to price fluctuations. Low trading volume can suggest a lack of interest and potential for slower price movements.

- Liquidity and Ease of Trading: High liquidity allows for easier buying and selling of XRP without significant price slippage. Low liquidity can make it challenging to enter or exit positions quickly.

- Comparison to Other Cryptocurrencies: Comparing XRP's liquidity to other cryptocurrencies provides context and helps assess its relative market strength.

Fundamental Analysis of XRP and Ripple

Analyzing Ripple's technology and XRP's utility is crucial for understanding its long-term potential.

Ripple's Technology and Adoption

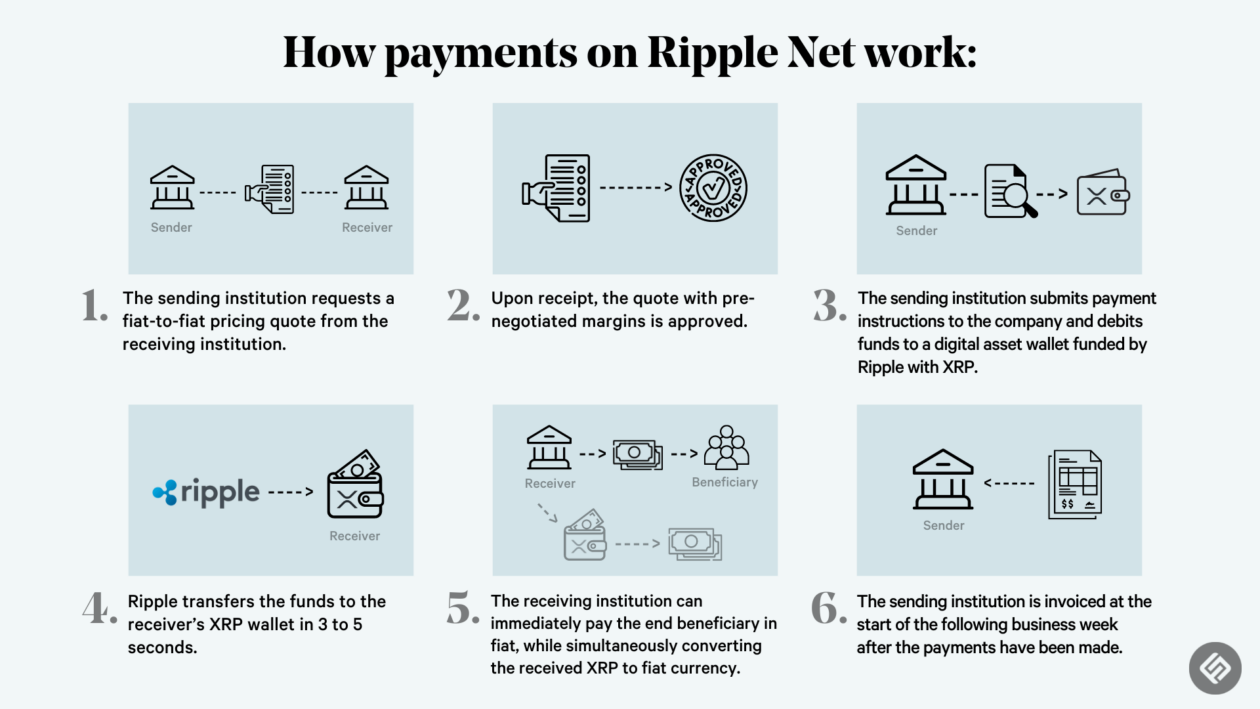

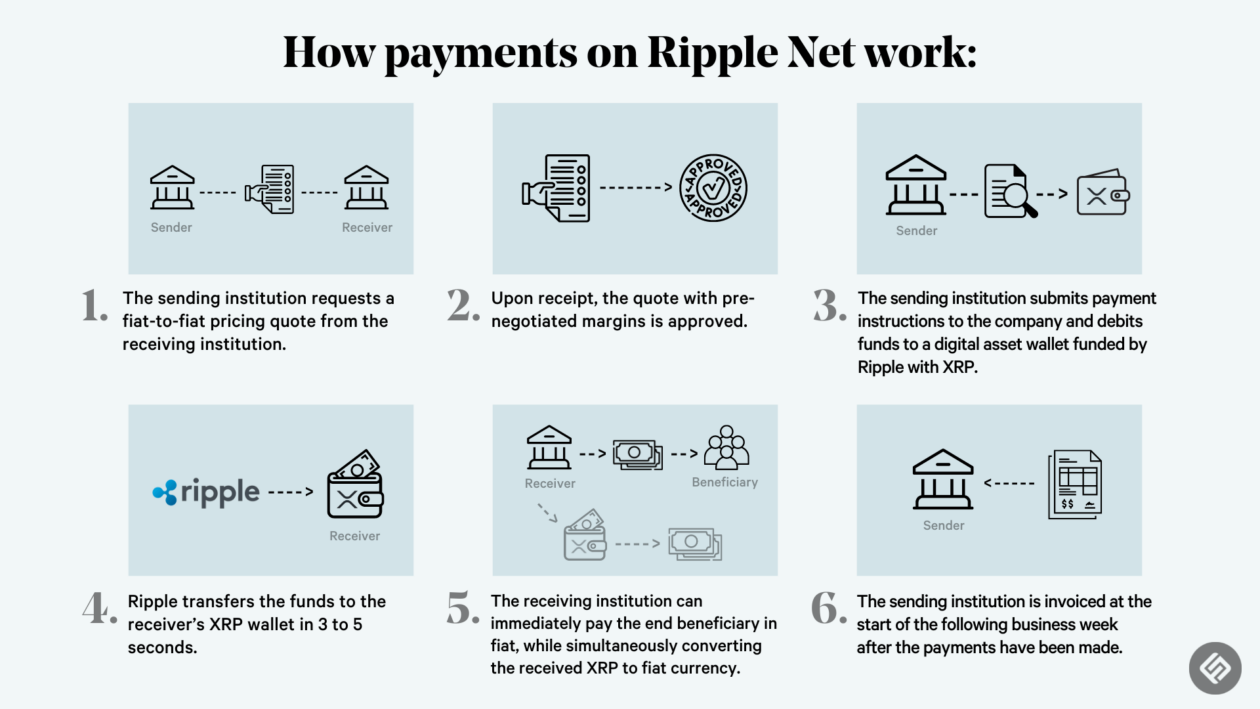

Ripple's technology, particularly xRapid, xCurrent, and xVia, aims to revolutionize cross-border payments.

- Facilitating Cross-Border Payments: Ripple's solutions offer faster and cheaper cross-border transactions compared to traditional banking systems.

- Partnerships and Collaborations: Ripple has partnered with numerous financial institutions, demonstrating growing adoption of its technology. This adoption is a positive sign for XRP's future.

- Potential for Wider Adoption: The wider adoption of Ripple's technology by banks and other financial institutions could significantly increase the demand for XRP, leading to price appreciation.

XRP's Utility and Use Cases

XRP's primary utility lies within the RippleNet ecosystem, facilitating transactions.

- Faster and Cheaper Transactions: XRP helps reduce transaction times and costs, making it attractive for cross-border payments.

- Potential Future Use Cases (DeFi, etc.): While primarily used within RippleNet, XRP's potential use cases extend to other areas, such as decentralized finance (DeFi) and other blockchain applications.

- Comparison to Other Cryptocurrencies: Comparing XRP's utility and use cases to other cryptocurrencies helps determine its unique selling points and competitive advantage.

Conclusion

Analyzing XRP (Ripple) below $3 reveals a complex situation shaped by the ongoing SEC lawsuit, market sentiment, and the underlying technology. The legal battle remains the dominant factor influencing its price, creating considerable volatility. While the fundamental aspects of Ripple's technology and potential future adoption remain promising, the uncertainty surrounding the lawsuit makes it a high-risk investment. Therefore, investing in XRP (Ripple) below $3 requires careful consideration and a thorough understanding of the risks involved. Keep an eye on XRP (Ripple) below $3, monitor the legal developments closely, and diversify your crypto portfolio to mitigate risk. Conduct further research and make informed investment decisions.

Featured Posts

-

Priscilla Pointer Amy Irvings Mother And Carrie Star Dies At 100

May 01, 2025

Priscilla Pointer Amy Irvings Mother And Carrie Star Dies At 100

May 01, 2025 -

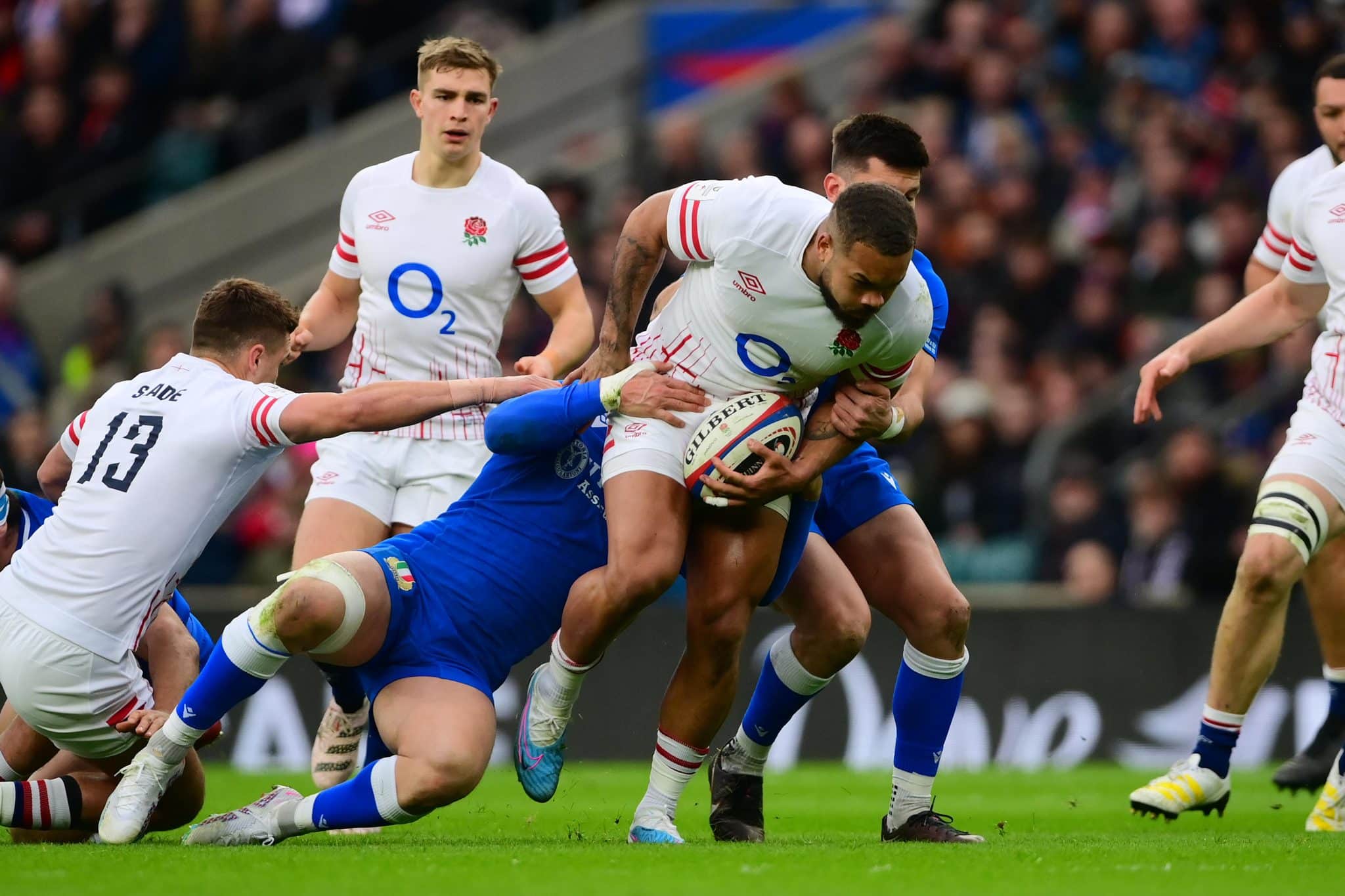

Italy Vs France Six Nations Implications For Irelands Title Hopes

May 01, 2025

Italy Vs France Six Nations Implications For Irelands Title Hopes

May 01, 2025 -

Home Court Loss For Lady Raiders Cincinnati Wins 59 56

May 01, 2025

Home Court Loss For Lady Raiders Cincinnati Wins 59 56

May 01, 2025 -

Nrc En The New York Times Een Tijdelijke Samenwerking Uitgelegd

May 01, 2025

Nrc En The New York Times Een Tijdelijke Samenwerking Uitgelegd

May 01, 2025 -

Ripple And Sec Settle Implications For Xrp Price And Future

May 01, 2025

Ripple And Sec Settle Implications For Xrp Price And Future

May 01, 2025

Latest Posts

-

Remembering A Dallas Legend Stars Name Passes Away

May 01, 2025

Remembering A Dallas Legend Stars Name Passes Away

May 01, 2025 -

Obituary Dallas Star 100

May 01, 2025

Obituary Dallas Star 100

May 01, 2025 -

Dallas Mourns Passing Of Centenarian Star

May 01, 2025

Dallas Mourns Passing Of Centenarian Star

May 01, 2025 -

Renowned Dallas Figure Passes Away Aged 100

May 01, 2025

Renowned Dallas Figure Passes Away Aged 100

May 01, 2025 -

100 Year Old Dallas Star Dies

May 01, 2025

100 Year Old Dallas Star Dies

May 01, 2025