XRP (Ripple) Under $3: A Prudent Investment Strategy

Table of Contents

Understanding the Current Market Conditions for XRP

XRP, the native cryptocurrency of Ripple, has experienced significant price fluctuations. Currently trading below $3, its recent market trends reflect a complex interplay of factors. Regulatory uncertainty, stemming primarily from the ongoing SEC lawsuit, heavily influences market sentiment. However, technological advancements within the XRP Ledger, such as improved speed and scalability, continue to drive adoption in certain sectors.

- Recent price fluctuations and volatility: XRP's price has shown considerable volatility, influenced by news related to the SEC lawsuit and broader cryptocurrency market trends.

- Analysis of trading volume and market capitalization: Monitoring trading volume and market capitalization provides insights into investor confidence and overall market health. A decrease in volume may indicate reduced interest, while a shrinking market cap could signal bearish sentiment.

- Impact of news and events (e.g., SEC lawsuit updates) on XRP price: News regarding the SEC lawsuit significantly impacts XRP's price. Positive developments might lead to price increases, while negative updates can trigger significant drops.

Assessing the Risks of Investing in XRP at this Price Point

Investing in cryptocurrencies, including XRP, inherently involves substantial risk. The cryptocurrency market is notoriously volatile, and XRP is no exception. The ongoing SEC lawsuit presents a major regulatory risk, with potential outcomes ranging from a favorable settlement to an unfavorable ruling that could severely impact XRP's price and future.

- Potential for further price drops: Given the uncertainties surrounding the SEC lawsuit, the potential for further price declines remains significant.

- Risk of regulatory action and its impact on XRP's value: The SEC lawsuit’s outcome directly influences XRP’s legal standing and its potential for future growth. An unfavorable ruling could severely depress its value.

- Comparison of XRP risk profile to other cryptocurrencies: Compared to other cryptocurrencies, XRP's risk profile is considered relatively high due to the regulatory uncertainty. Investors should carefully compare its risk-reward profile to other assets in their portfolio.

- Importance of diversification in a crypto portfolio: Diversification is crucial to mitigate risk. Don't put all your eggs in one basket; spread your investment across various cryptocurrencies and asset classes.

Evaluating the Potential Rewards of XRP Investment Below $3

Despite the risks, XRP’s potential rewards are significant. Its underlying technology, the XRP Ledger, boasts advantages such as speed, scalability, and low transaction fees, making it attractive for cross-border payments and other financial applications. Increased adoption by financial institutions could drive significant price appreciation.

- XRP's use in cross-border payments: RippleNet, Ripple's payment network using XRP, facilitates faster and cheaper international transactions, a key driver of potential adoption.

- Potential partnerships and collaborations with financial institutions: Strategic partnerships with banks and other financial institutions could significantly boost XRP's adoption and value.

- Technological advantages of the XRP Ledger (e.g., speed, scalability, low transaction fees): These advantages offer a compelling alternative to traditional payment systems, potentially attracting significant institutional interest.

- Long-term price projections (mentioning that these are speculative): While speculative, long-term price projections suggest potential for substantial growth if the regulatory issues are resolved favorably and adoption increases.

Diversification and Risk Management Strategies for XRP

A prudent investment strategy requires diversification and robust risk management. Don't invest more than you can afford to lose.

- Allocating a percentage of your investment portfolio to XRP: Determine an appropriate allocation based on your risk tolerance and overall investment strategy.

- Dollar-cost averaging to mitigate risk: Investing a fixed amount at regular intervals helps reduce the impact of volatility.

- Setting stop-loss orders to limit potential losses: Stop-loss orders automatically sell your XRP if the price falls below a predetermined level, protecting your investment from significant losses.

- Regularly reviewing your investment strategy: Market conditions change, so regularly review and adjust your investment strategy as needed.

Conducting Thorough Due Diligence Before Investing in XRP

Before investing in XRP, conduct thorough due diligence. Understand the technology, the risks, and the regulatory landscape.

- Researching XRP's whitepaper and technology: Familiarize yourself with the underlying technology and its potential applications.

- Analyzing the XRP Ledger's performance and scalability: Assess the network's performance and its ability to handle increasing transaction volumes.

- Following reputable news sources and expert opinions: Stay informed about developments affecting XRP through credible sources.

- Understanding the legal and regulatory landscape surrounding XRP: Keep abreast of the ongoing SEC lawsuit and its potential impact.

Conclusion

Investing in XRP at a price under $3 presents both opportunities and challenges. The potential for significant returns is balanced by substantial risks, particularly the regulatory uncertainty. By conducting thorough due diligence, diversifying your portfolio, and employing effective risk management techniques like dollar-cost averaging and stop-loss orders, you can develop a prudent investment strategy for XRP. Remember to always invest responsibly and only what you can afford to lose. Consider carefully whether investing in XRP below $3 aligns with your risk tolerance and financial goals. Is XRP under $3 a right investment for you? Do your research and make an informed decision.

Featured Posts

-

Is Xrp Ripple A Good Buy Under 3 A Comprehensive Analysis

May 02, 2025

Is Xrp Ripple A Good Buy Under 3 A Comprehensive Analysis

May 02, 2025 -

Exclusive Details Teslas Board Initiates Ceo Search To Replace Elon Musk

May 02, 2025

Exclusive Details Teslas Board Initiates Ceo Search To Replace Elon Musk

May 02, 2025 -

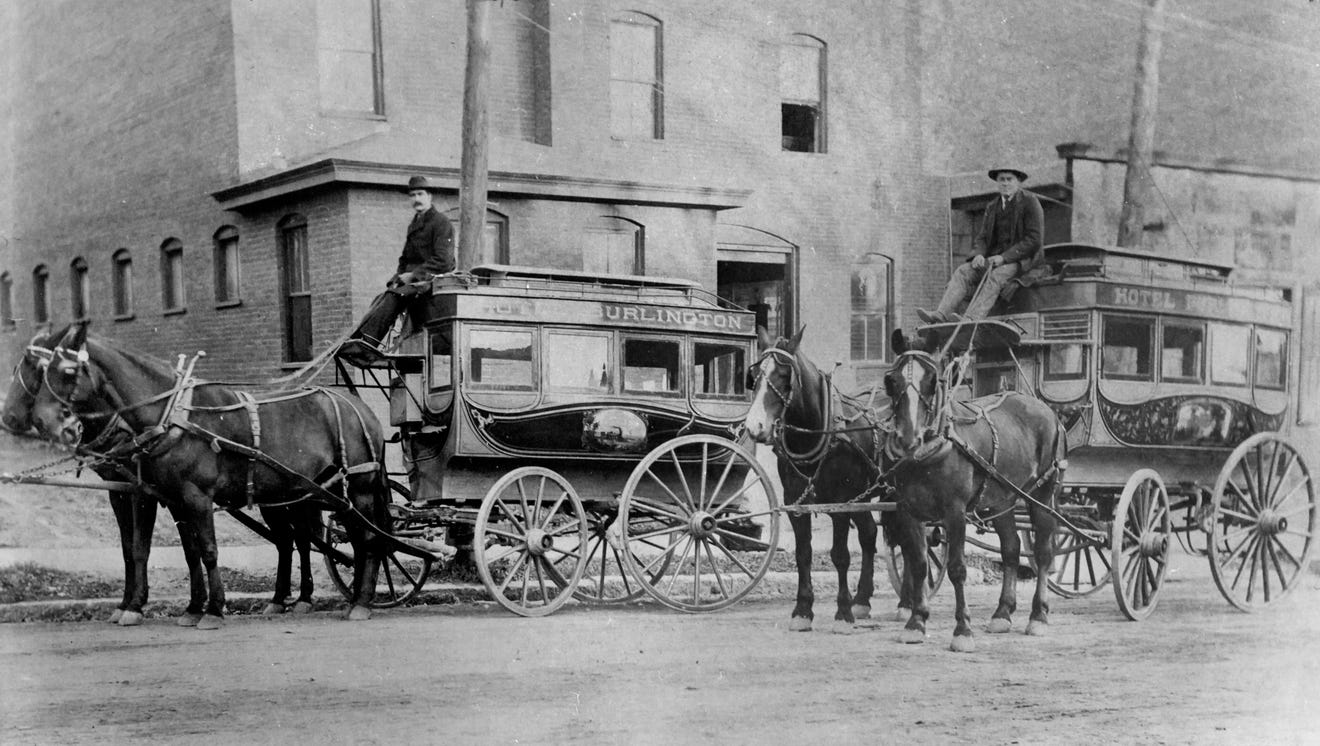

Burlington Play Reading Group Celebrates 135 Years

May 02, 2025

Burlington Play Reading Group Celebrates 135 Years

May 02, 2025 -

Canadian Dollars Response To Trumps Suggestion Of A Deal With Carney

May 02, 2025

Canadian Dollars Response To Trumps Suggestion Of A Deal With Carney

May 02, 2025 -

Glastonbury Festival 2024 Clashing Stage Times Leave Fans Furious

May 02, 2025

Glastonbury Festival 2024 Clashing Stage Times Leave Fans Furious

May 02, 2025