XRP Trading Volume Outpaces Solana Amidst ETF Speculation

Table of Contents

XRP Trading Volume Surge: A Deeper Dive

The recent data paints a compelling picture. XRP's trading volume has not only surpassed Solana's but has also shown substantial growth compared to previous periods. This increase is noteworthy and warrants closer examination.

Analyzing the Recent Data:

- Significant Volume Increase: Over the past [insert timeframe, e.g., week/month], XRP's trading volume increased by [insert percentage]% compared to Solana's [insert percentage]% increase (Source: CoinMarketCap/CoinGecko). Specific numbers should be inserted here, referencing the chosen data source. Consider using a chart or graph visually representing this data.

- Comparison to Previous Periods: Compared to the average trading volume over the past [insert timeframe, e.g., quarter/year], XRP shows a [insert percentage]% increase, significantly outpacing its historical average. (Source: [Data Source]).

- Potential Reasons for the Surge: Several factors could be contributing to this surge. These include:

- Increased Institutional Interest: Large institutional investors may be accumulating XRP in anticipation of a potential ETF approval.

- Retail Investor FOMO (Fear Of Missing Out): Positive news and speculation around XRP's potential could be driving retail investor participation.

- Positive Ripple News: Favorable developments in the ongoing legal battle between Ripple and the SEC might be fueling investor optimism.

The Role of ETF Speculation:

The potential approval of an XRP ETF is undeniably playing a crucial role. The SEC's decision on various ETF applications is heavily influencing market sentiment.

- SEC's Role: The SEC's stance on XRP and other cryptocurrencies is pivotal. A positive ruling on an XRP ETF application would likely significantly boost its legitimacy and accessibility for institutional investors.

- Impact of a Positive Ruling: Approval would likely lead to increased price appreciation, greater liquidity, and broader adoption of XRP. This is a significant catalyst for potential growth.

- Comparison to Other Crypto ETF Applications: Analyzing the approval processes and outcomes of other crypto ETF applications can provide valuable insights into the potential timeline and likelihood of an XRP ETF approval. This comparison should note similarities and differences.

Solana's Performance and Market Dynamics

While XRP's trading volume surges, it's essential to understand Solana's current market position.

Understanding Solana's Current Market Position:

- Market Capitalization and Price Movements: Solana's market capitalization and recent price fluctuations should be analyzed to provide context. (Source: [Data Source])

- Significant News or Events: Any recent news affecting Solana's price, such as network upgrades, partnerships, or regulatory developments, should be considered.

- Comparing XRP and Solana: While both are cryptocurrencies, their use cases differ significantly, impacting investor preferences.

Comparing XRP and Solana's Use Cases:

- XRP's Focus on Payments: XRP's primary focus is on fast, efficient, and low-cost cross-border payments and remittances.

- Solana's Focus on DeFi and NFTs: Solana's strengths lie in its capabilities for decentralized finance (DeFi) applications and non-fungible tokens (NFTs). These cater to a different segment of the market.

Implications for Investors and the Broader Crypto Market

The increased XRP trading volume, fueled by ETF speculation, has significant implications.

Potential Price Predictions and Market Outlook:

It is impossible to provide definitive price predictions, as cryptocurrency markets are inherently volatile. However, potential scenarios based on market trends and regulatory developments can be explored.

- Cautious Outlook: While the increased trading volume is positive, investors should maintain a cautious approach, considering the inherent risks associated with cryptocurrency investments.

- Influencing Factors: Overall market sentiment, regulatory decisions, and technological advancements will all impact the price of XRP and Solana.

Risk Assessment and Investment Strategies:

Responsible investing is crucial in the volatile cryptocurrency market.

- Diversification: Diversifying your portfolio across multiple assets is vital to mitigate risk.

- Thorough Research: Conduct thorough research before investing in any cryptocurrency.

- Invest Responsibly: Only invest what you can afford to lose.

Conclusion

The increased XRP trading volume, surpassing Solana's, is a noteworthy development. This surge is partly driven by the anticipation of potential XRP ETF approval. While the future remains uncertain, the current market dynamics present both opportunities and risks for investors. Understanding the interplay between XRP, Solana, and the wider cryptocurrency landscape is key to informed decision-making.

Call to Action: Stay updated on the latest XRP trading volume and ETF news to make informed investment decisions. [Link to a relevant resource, e.g., a reputable cryptocurrency news site].

Featured Posts

-

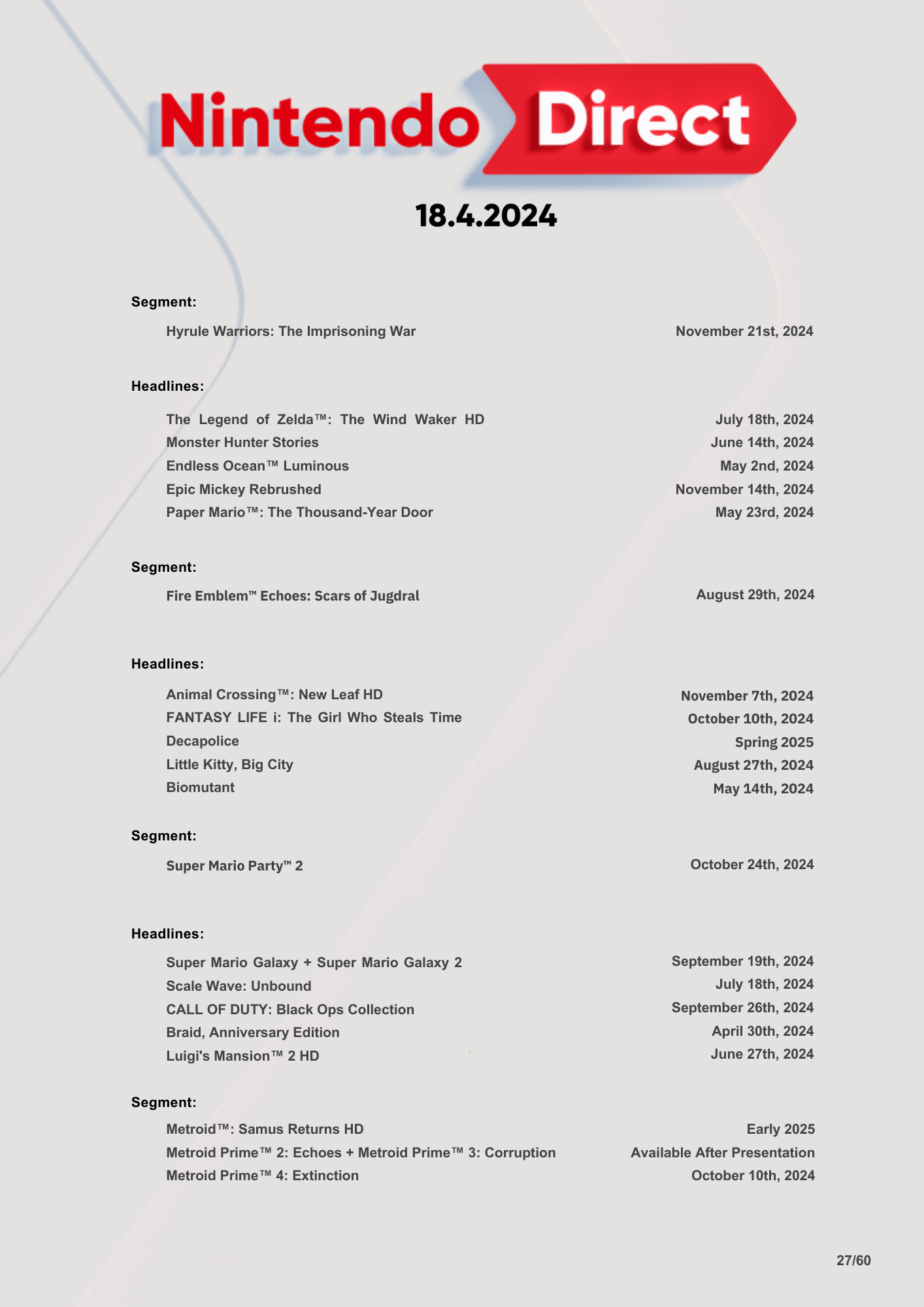

March 2025 Nintendo Direct A Look At Possible Ps 5 And Ps 4 Game Reveals

May 08, 2025

March 2025 Nintendo Direct A Look At Possible Ps 5 And Ps 4 Game Reveals

May 08, 2025 -

El Real Betis Un Equipo Con Historia Y Futuro

May 08, 2025

El Real Betis Un Equipo Con Historia Y Futuro

May 08, 2025 -

Microsoft Surface Pro 12 Features And Specifications

May 08, 2025

Microsoft Surface Pro 12 Features And Specifications

May 08, 2025 -

Psg Angers Canli Yayin Izlemek Icin En Iyi Secenekler

May 08, 2025

Psg Angers Canli Yayin Izlemek Icin En Iyi Secenekler

May 08, 2025 -

Rusya Merkez Bankasi Kripto Para Islemlerine Karsi Uyarida Bulundu

May 08, 2025

Rusya Merkez Bankasi Kripto Para Islemlerine Karsi Uyarida Bulundu

May 08, 2025

Latest Posts

-

Pakistan Super League 10 Ticket Sales Commence

May 08, 2025

Pakistan Super League 10 Ticket Sales Commence

May 08, 2025 -

Imminent Benefit Cuts Dwps Planned Changes

May 08, 2025

Imminent Benefit Cuts Dwps Planned Changes

May 08, 2025 -

Your Psl 10 Tickets Await Purchase Today

May 08, 2025

Your Psl 10 Tickets Await Purchase Today

May 08, 2025 -

Universal Credit Overhaul Warning For Claimants Facing Benefit Cuts

May 08, 2025

Universal Credit Overhaul Warning For Claimants Facing Benefit Cuts

May 08, 2025 -

Dwp Scrapping Two Benefits What You Need To Know

May 08, 2025

Dwp Scrapping Two Benefits What You Need To Know

May 08, 2025