XRP's Road To Recovery: Navigating The Derivatives Market

Table of Contents

Understanding the XRP Derivatives Market

What are XRP Derivatives?

XRP derivatives are financial contracts whose value is derived from the price of XRP. These instruments provide a range of opportunities for both risk management and speculation within the cryptocurrency market. Several types of XRP derivatives exist, each serving different purposes:

-

XRP Futures: These contracts obligate the buyer to purchase XRP at a predetermined price on a specified future date. Futures contracts are primarily used for hedging against price fluctuations or speculating on future price movements. Leverage and margin requirements are typically involved.

-

XRP Options: These contracts grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) XRP at a predetermined price (strike price) on or before a specific date (expiration date). Options trading allows for sophisticated strategies to manage risk or profit from price volatility. Like futures, options trading often involves leverage and margin requirements.

-

XRP Swaps: These are agreements between two parties to exchange cash flows based on the price of XRP. Swaps can be used for hedging purposes, allowing investors to offset exposure to XRP price movements.

Growth and Volume in the XRP Derivatives Market

The XRP derivatives market has experienced significant growth, although the pace has been influenced by the ongoing SEC lawsuit. While precise trading volume data can be challenging to obtain due to the decentralized nature of some exchanges, several key indicators suggest a substantial market:

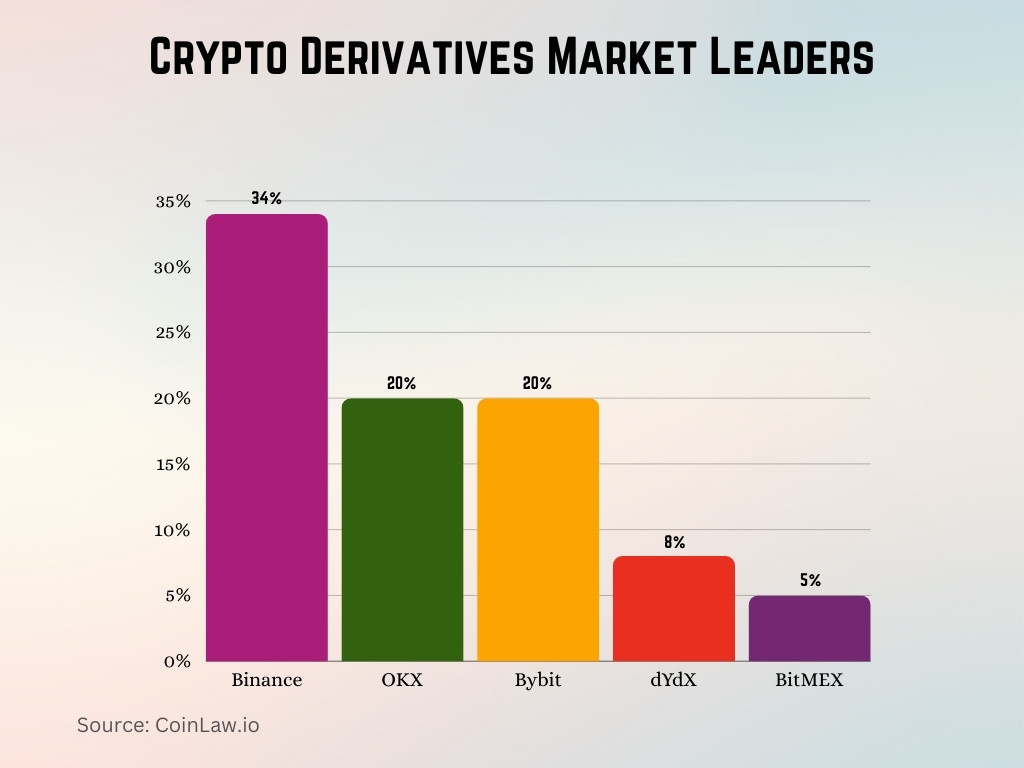

- Key Exchanges: Several prominent cryptocurrency exchanges offer XRP derivatives trading, contributing to increased liquidity and accessibility. The exact volume varies depending on market conditions and regulatory developments.

- Trading Volume Comparison: Although still smaller than Bitcoin or Ethereum derivatives markets, XRP's trading volume in the derivatives space is steadily increasing, indicating growing investor interest and market maturity. Analyzing this growth against the backdrop of regulatory uncertainty provides valuable insights.

- Factors Driving Growth: Increased institutional interest in digital assets, the development of more sophisticated trading tools, and the ongoing evolution of the cryptocurrency regulatory landscape are all contributing factors. Market capitalization fluctuations also impact trading activity.

The Impact of the SEC Lawsuit on XRP Derivatives Trading

Regulatory Uncertainty and Market Volatility

The SEC lawsuit against Ripple Labs, the creator of XRP, has undeniably impacted XRP's price and trading volume in the derivatives market. The uncertainty surrounding the legal outcome has created significant volatility:

- Price Fluctuations: The price of XRP has experienced significant fluctuations since the lawsuit's commencement, directly impacting the value of XRP derivatives contracts. This volatility increases the risk for both buyers and sellers of these instruments.

- Investor Sentiment: The lawsuit has significantly impacted investor sentiment, with periods of both heightened optimism and pessimism influencing trading activity. Positive news often leads to increased trading volume, whereas negative developments can cause sharp declines.

- Potential Regulatory Outcomes: The outcome of the SEC lawsuit will have profound implications for the future of XRP and its derivatives market. A favorable ruling could boost investor confidence and lead to increased market activity, whereas an unfavorable ruling could have the opposite effect.

Adaptation and Resilience

Despite the challenges posed by the SEC lawsuit, the XRP community and exchanges have shown remarkable adaptation and resilience:

- Innovative Solutions: Exchanges and trading platforms have continued to offer XRP derivatives, adapting their risk management practices to mitigate the uncertainty caused by the ongoing legal battle.

- Regulatory Compliance: Many exchanges have taken steps to enhance their regulatory compliance frameworks to address potential concerns related to the SEC lawsuit and broader regulatory developments.

- Decentralized Exchanges (DEXs): The rise of DEXs has offered alternative avenues for XRP derivatives trading, potentially reducing reliance on centralized exchanges subject to more stringent regulatory scrutiny.

The Future of XRP in the Derivatives Market

Potential for Growth and Adoption

The long-term prospects for XRP in the derivatives market remain positive, contingent on several key factors:

- Future Market Trends: Continued growth in the broader cryptocurrency market and increasing institutional adoption could significantly benefit XRP's derivatives market.

- Technological Advancements: Innovations in blockchain technology and decentralized finance (DeFi) could further enhance the liquidity and efficiency of XRP derivatives trading.

- Institutional Adoption: Increased participation from institutional investors could inject significant capital into the XRP derivatives market, driving further growth and maturity.

Risks and Challenges

Despite the potential for growth, investors must acknowledge the inherent risks associated with XRP and the derivatives market:

- Market Risks: The cryptocurrency market is inherently volatile, and XRP is no exception. Price fluctuations can significantly impact the value of XRP derivatives contracts.

- Price Volatility: XRP's price is susceptible to significant volatility, driven by both market sentiment and regulatory developments. This volatility poses considerable risk to leveraged trading strategies.

- Leverage Trading: While leverage can amplify profits, it also significantly magnifies losses. Investors must carefully manage their risk exposure when engaging in leveraged XRP derivatives trading.

- Due Diligence: Thorough due diligence is essential before investing in any XRP derivative product. Investors should carefully research the underlying asset, the specific derivative contract, and the risks involved.

Conclusion

XRP's journey through the derivatives market post-SEC lawsuit has been marked by volatility, adaptation, and resilience. While the regulatory uncertainty continues to present challenges, the market's growth and the potential for future adoption remain significant. Understanding the intricacies of the XRP derivatives market, including the various types of contracts available, the risks involved, and the impact of regulatory developments, is crucial for informed decision-making. Stay informed about the latest developments and continue your research to make informed investment decisions in the evolving XRP derivatives market. Navigating the complexities of XRP’s recovery requires a comprehensive understanding of the XRP derivatives landscape and careful consideration of the inherent risks.

Featured Posts

-

Jenna Ortega Inspiracioja Ez A Szineszno

May 07, 2025

Jenna Ortega Inspiracioja Ez A Szineszno

May 07, 2025 -

Atfaqyt Laram Wkhtwt Jnwb Alsyn Aljwyt Ltezyz Alrhlat Aljwyt Byn Afryqya Walsyn

May 07, 2025

Atfaqyt Laram Wkhtwt Jnwb Alsyn Aljwyt Ltezyz Alrhlat Aljwyt Byn Afryqya Walsyn

May 07, 2025 -

John Wick 5 Is It Really Happening A Look At The Latest News

May 07, 2025

John Wick 5 Is It Really Happening A Look At The Latest News

May 07, 2025 -

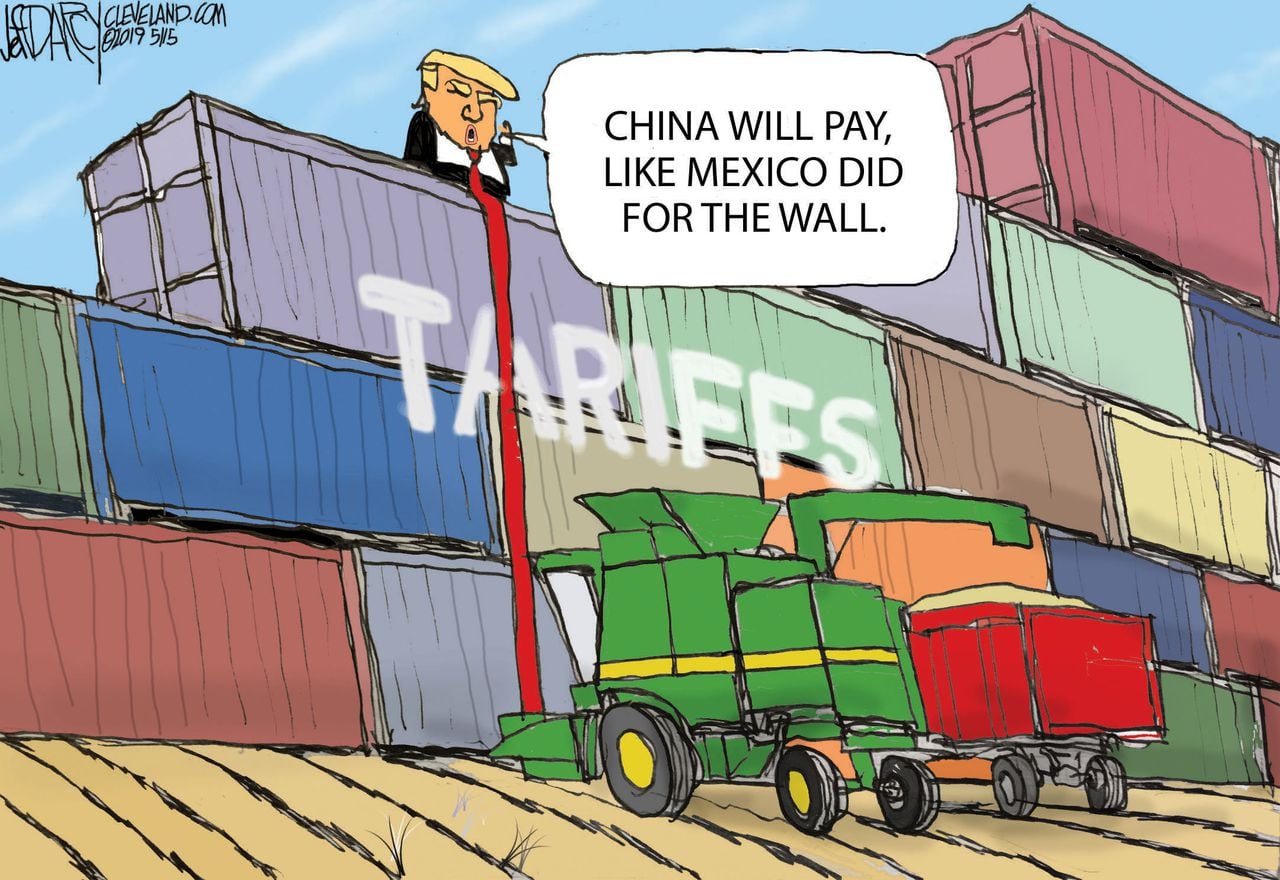

Trumps 100 Tariff Threat On Foreign Films A Deep Dive

May 07, 2025

Trumps 100 Tariff Threat On Foreign Films A Deep Dive

May 07, 2025 -

Jayzt Alinjaz Mda Alhyat Ljaky Shan Fy Mhrjan Lwkarnw Alsynmayy

May 07, 2025

Jayzt Alinjaz Mda Alhyat Ljaky Shan Fy Mhrjan Lwkarnw Alsynmayy

May 07, 2025

Latest Posts

-

Nba Thunder Players Heated Response To National Media

May 08, 2025

Nba Thunder Players Heated Response To National Media

May 08, 2025 -

Thunder Players Public Dissenting Of National Media Commentary

May 08, 2025

Thunder Players Public Dissenting Of National Media Commentary

May 08, 2025 -

Players Of The Okc Thunder Fire Back At National Media

May 08, 2025

Players Of The Okc Thunder Fire Back At National Media

May 08, 2025 -

New Trailer For The Long Walk Even Stephen King Found It Too Dark

May 08, 2025

New Trailer For The Long Walk Even Stephen King Found It Too Dark

May 08, 2025 -

Nbas Thunder Take Aim At National Media

May 08, 2025

Nbas Thunder Take Aim At National Media

May 08, 2025