$1,500 Ethereum Price Target: Will Support Hold?

Table of Contents

Current Market Conditions and Ethereum's Support Levels

Currently, the market sentiment surrounding Ethereum is cautiously optimistic. While not overtly bullish, the recent price stabilization above the $1400 mark suggests a degree of support. Key support levels to watch include $1400 and $1300. Breaching $1300 could signal a more significant downturn, while holding above $1400 indicates potential for further upward movement.

Technical indicators offer a mixed picture. The 50-day moving average is currently trending upward, a bullish signal. However, the Relative Strength Index (RSI) is hovering around the 50 mark, suggesting neither overbought nor oversold conditions. The Moving Average Convergence Divergence (MACD) shows a slight bullish trend, but lacks the strong momentum needed for a decisive price surge towards $1500.

- Potential Catalysts for Upward Movement: Successful completion of the Shanghai upgrade, increased institutional investment, and a broader bullish crypto market trend.

- Potential Risks and Bearish Scenarios: Regulatory uncertainty, macroeconomic headwinds, and a sudden downturn in Bitcoin's price.

- [Insert Chart Illustrating Support and Resistance Levels – ideally a clear, well-labeled chart showing key levels and moving averages].

Factors Influencing Ethereum's Price Trajectory

Several key factors influence Ethereum's price trajectory, impacting the feasibility of the $1500 Ethereum price target.

Network Developments and Upgrades

The upcoming Ethereum network upgrades play a crucial role. The Shanghai upgrade, enabling staked ETH withdrawals, is anticipated to significantly impact the market. This addresses a key concern of many investors and could unlock substantial liquidity, potentially boosting demand and price.

- Specific Upgrades and Potential Effects:

- Shanghai Upgrade: Facilitating staked ETH withdrawals could alleviate selling pressure and attract new investors.

- Future Upgrades: Further scalability improvements and enhancements to the network's security will continue to drive adoption and value. These ongoing developments are key for long-term price growth.

The technical aspects of these upgrades, while complex, ultimately aim to improve transaction speeds, reduce fees, and enhance the overall user experience, contributing to higher adoption rates and potentially influencing the $1500 Ethereum price target.

Regulatory Landscape and Institutional Adoption

The regulatory landscape remains a significant uncertainty. Favorable regulations could boost institutional adoption, leading to increased price stability and potential upward pressure. Conversely, stricter regulations could stifle growth. Growing institutional interest, however, signifies a maturing market, potentially reducing volatility in the long term.

- Examples of Recent Regulatory Announcements and Their Influence: [Insert examples of recent regulatory news and their impact on the crypto market, focusing on Ethereum].

- Specific Institutional Investors Involved in Ethereum: [Mention specific examples of institutional investors holding significant Ethereum assets].

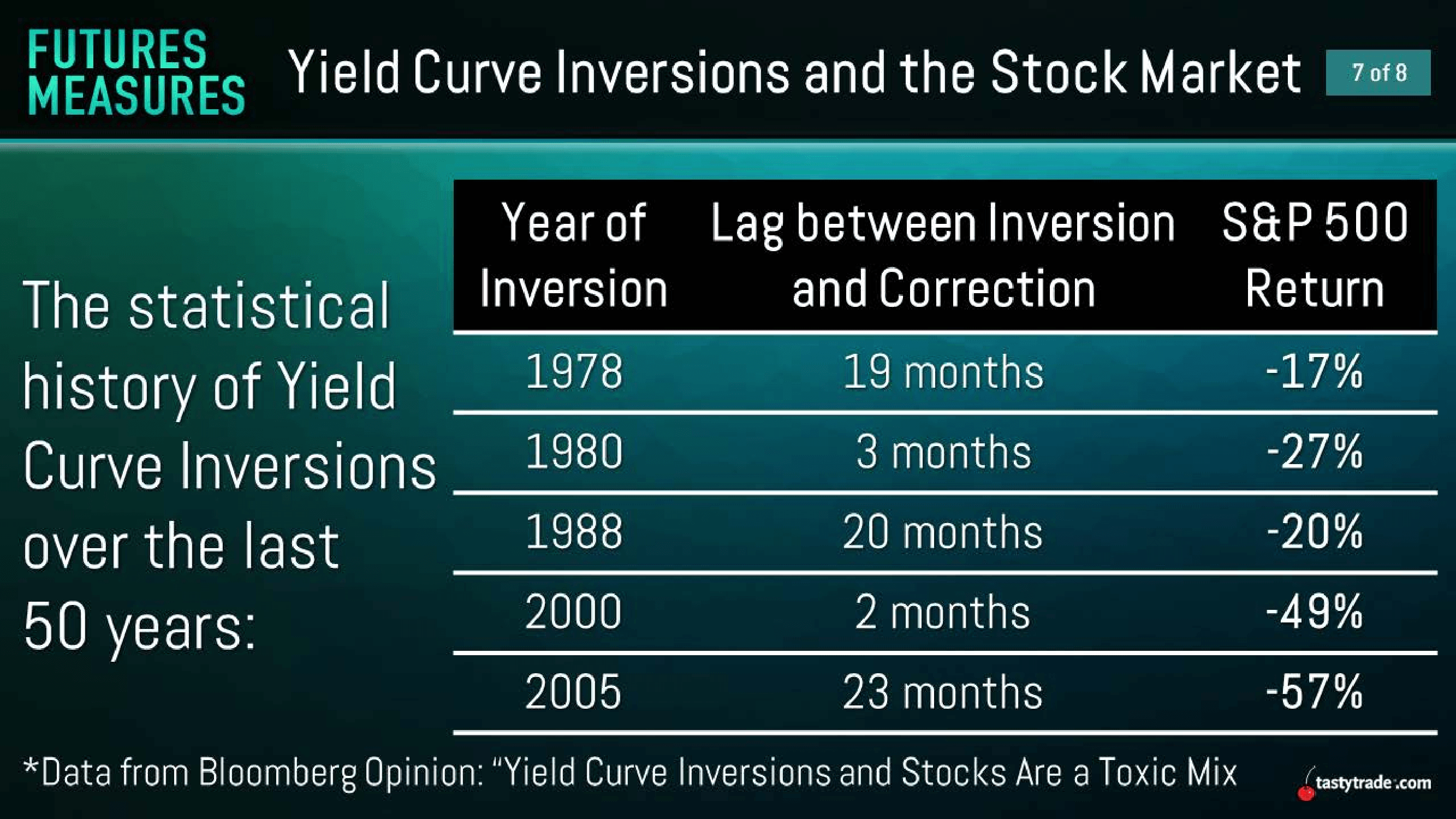

Macroeconomic Factors and Bitcoin's Influence

Ethereum's price is strongly correlated with Bitcoin's price and broader macroeconomic conditions. A Bitcoin bull run typically leads to increased interest in altcoins like Ethereum, while negative macroeconomic indicators (high inflation, rising interest rates) can negatively impact the entire cryptocurrency market.

- Correlation Between Bitcoin and Ethereum's Price: Historically, Ethereum's price has followed Bitcoin's trends, albeit with occasional deviations.

- Potential Macroeconomic Factors Impacting Crypto Markets: Inflationary pressures and monetary policy decisions by central banks significantly influence investor sentiment and risk appetite, affecting cryptocurrency prices, including Ethereum's journey towards $1500.

Analyzing the Probability of Reaching the $1,500 Ethereum Price Target

Reaching the $1500 Ethereum price target hinges on a confluence of positive factors. While the bullish case rests on successful upgrades, increased institutional adoption, and favorable macroeconomic conditions, bearish scenarios include regulatory crackdowns, a Bitcoin downturn, or a general decline in investor confidence. Data from CoinMarketCap and CoinGecko suggests considerable volatility, making accurate prediction challenging.

- Key Arguments for Reaching $1500: Successful network upgrades, increased institutional interest, and a generally positive crypto market.

- Key Arguments Against Reaching $1500: Regulatory uncertainty, macroeconomic headwinds, and potential for significant market corrections.

- [Include expert opinions or predictions from reputable sources, with proper attribution].

Conclusion

The $1500 Ethereum price target remains a significant milestone, its attainment contingent upon a complex interplay of technical, regulatory, and macroeconomic factors. While positive developments like the Shanghai upgrade offer bullish potential, risks associated with regulatory uncertainty and broader market conditions cannot be ignored. This analysis highlights the importance of considering both bullish and bearish scenarios. Remember, this information is for educational purposes only and does not constitute financial advice. Conduct thorough research before making any investment decisions.

Call to Action: Stay informed about the latest developments affecting the $1500 Ethereum price target. Keep up with market trends and analysis to make informed investment decisions. Follow [Your Website/Platform] for continued coverage on Ethereum price predictions and cryptocurrency market updates, and for further analysis on reaching the $1500 Ethereum price target.

Featured Posts

-

Champions League Semi Final Arsenals Chances Against Psg

May 08, 2025

Champions League Semi Final Arsenals Chances Against Psg

May 08, 2025 -

If The Monkey Is 2025s Worst Stephen King Movie It Ll Still Be A Great Year For King

May 08, 2025

If The Monkey Is 2025s Worst Stephen King Movie It Ll Still Be A Great Year For King

May 08, 2025 -

De Andre Hopkins Joins Baltimore Ravens Contract Breakdown And Impact

May 08, 2025

De Andre Hopkins Joins Baltimore Ravens Contract Breakdown And Impact

May 08, 2025 -

Artis Goesteren Sms Dolandiriciligi Sikayetleri Tehditler Ve Oenlemler

May 08, 2025

Artis Goesteren Sms Dolandiriciligi Sikayetleri Tehditler Ve Oenlemler

May 08, 2025 -

Military Historian Ranks The Most Realistic Wwii Films Is Saving Private Ryan 1

May 08, 2025

Military Historian Ranks The Most Realistic Wwii Films Is Saving Private Ryan 1

May 08, 2025

Latest Posts

-

The Xrp Etf Outlook Weighing Supply Headwinds Against Potential Growth

May 08, 2025

The Xrp Etf Outlook Weighing Supply Headwinds Against Potential Growth

May 08, 2025 -

Analyzing The Challenges Facing Xrp Etfs Supply And Demand Imbalance

May 08, 2025

Analyzing The Challenges Facing Xrp Etfs Supply And Demand Imbalance

May 08, 2025 -

Xrp Etf Risks High Supply And Low Institutional Adoption

May 08, 2025

Xrp Etf Risks High Supply And Low Institutional Adoption

May 08, 2025 -

Will Xrp Etfs Disappoint Assessing Supply Headwinds And Institutional Interest

May 08, 2025

Will Xrp Etfs Disappoint Assessing Supply Headwinds And Institutional Interest

May 08, 2025 -

Xrp Etf Disappointing Prospects Due To Supply And Low Institutional Demand

May 08, 2025

Xrp Etf Disappointing Prospects Due To Supply And Low Institutional Demand

May 08, 2025