The XRP ETF Outlook: Weighing Supply Headwinds Against Potential Growth

Table of Contents

The Case for XRP ETF Approval

The potential approval of an XRP ETF presents several compelling arguments for investors. Increased accessibility, regulatory clarity, and the potential for price appreciation are key factors driving the positive outlook.

Increased Liquidity and Accessibility

An XRP ETF would dramatically increase the liquidity of XRP, making it more accessible to a wider range of investors, including institutional investors traditionally hesitant to deal directly with cryptocurrencies. This increased accessibility could drive significant price appreciation due to increased demand.

- Easier trading: Investing in XRP would become significantly simpler through regulated exchange-traded funds.

- Reduced volatility (potentially): The increased trading volume associated with an ETF could potentially lead to a reduction in price volatility.

- Broader market participation: The ETF structure opens doors to a massive pool of investors who might otherwise avoid direct cryptocurrency exposure. This broader participation could significantly impact the XRP market capitalization.

Regulatory Clarity and Institutional Adoption

XRP ETF approval would signal a degree of regulatory acceptance for XRP, potentially boosting investor confidence. Institutional investors, often constrained by regulatory requirements, are more likely to invest in a regulated XRP ETF.

- Increased investor confidence: Regulatory approval lends credibility and reduces the perceived risk associated with XRP investment.

- Potential for institutional investment inflows: Large institutional investors, such as pension funds and hedge funds, could allocate significant capital to an XRP ETF, driving significant price action.

- Reduced regulatory uncertainty: The clarity provided by ETF approval could significantly reduce the uncertainty surrounding XRP’s regulatory status.

Potential for Price Appreciation

Increased demand from institutional and retail investors could lead to a significant increase in XRP's price. The limited supply of XRP, compared to other cryptocurrencies, could exacerbate this price appreciation.

- Price discovery mechanism: The ETF structure provides a more transparent and efficient price discovery mechanism for XRP.

- Potential for significant returns: The confluence of increased demand and limited supply could create a compelling investment opportunity with substantial returns.

- Scarcity value: While XRP has a large circulating supply, the limited total supply could contribute to its scarcity value, potentially driving its price upwards.

The Supply-Side Headwinds Facing XRP

Despite the potential benefits, significant supply-side headwinds threaten to hinder the growth of an XRP ETF. These include the ongoing SEC lawsuit, the high circulating supply of XRP, and broader market sentiment.

The Ongoing SEC Lawsuit

The ongoing legal battle between Ripple and the SEC casts a significant shadow over the XRP ETF outlook. A negative ruling could severely impact XRP's price and ETF prospects. Uncertainty surrounding the outcome creates volatility and hesitancy among potential investors.

- Legal uncertainty: The unresolved lawsuit creates significant uncertainty regarding XRP's regulatory status.

- Potential for negative price impact: An unfavorable ruling could trigger a significant sell-off and depress XRP's price.

- Investor hesitation: The legal uncertainty discourages many investors from committing significant capital to XRP until the outcome is known.

High XRP Supply

While XRP has a capped supply, the already substantial circulating supply could limit significant price appreciation even with increased demand. This large supply dilutes the potential impact of new investment inflows.

- Dilution of value: The substantial existing supply could mitigate the price impact of new investment into an XRP ETF.

- Limited scarcity: Compared to some other cryptocurrencies with significantly smaller supplies, XRP’s abundance reduces its scarcity value.

- Potential for slower price increases compared to scarcer assets: The large circulating supply could lead to slower price appreciation compared to assets with more limited supplies.

Market Sentiment and Competition

Negative market sentiment surrounding the cryptocurrency industry as a whole could impact the success of an XRP ETF. Competition from other cryptocurrencies and established asset classes could also limit XRP ETF growth.

- Overall crypto market performance: The performance of the broader cryptocurrency market will significantly impact investor sentiment toward XRP ETFs.

- Competition from other ETFs/assets: Investors might choose to allocate funds to other, potentially more attractive, investment options.

- Investor preference: Investor preferences and risk tolerance play a crucial role in determining the success of any specific ETF, including those focused on XRP.

Conclusion

The outlook for an XRP ETF is complex, characterized by a potential for significant growth but tempered by substantial supply-side headwinds. While increased liquidity and regulatory clarity could drive price appreciation, the SEC lawsuit and the large circulating supply of XRP present significant hurdles. Investors should carefully weigh these factors before investing in XRP or XRP-related products. Thoroughly researching the potential risks and rewards associated with the XRP ETF before making any investment decisions is crucial. Stay informed about developments in the ongoing SEC lawsuit and broader market trends to assess the evolving XRP ETF outlook.

Featured Posts

-

Inter Milan Contract Expiry Key Players Facing 2026 Deadline

May 08, 2025

Inter Milan Contract Expiry Key Players Facing 2026 Deadline

May 08, 2025 -

Inters Shock Win Against Bayern In Ucl First Leg

May 08, 2025

Inters Shock Win Against Bayern In Ucl First Leg

May 08, 2025 -

Xrp Ripple Investment Assessing The Risks And Rewards For Lifetime Financial Goals

May 08, 2025

Xrp Ripple Investment Assessing The Risks And Rewards For Lifetime Financial Goals

May 08, 2025 -

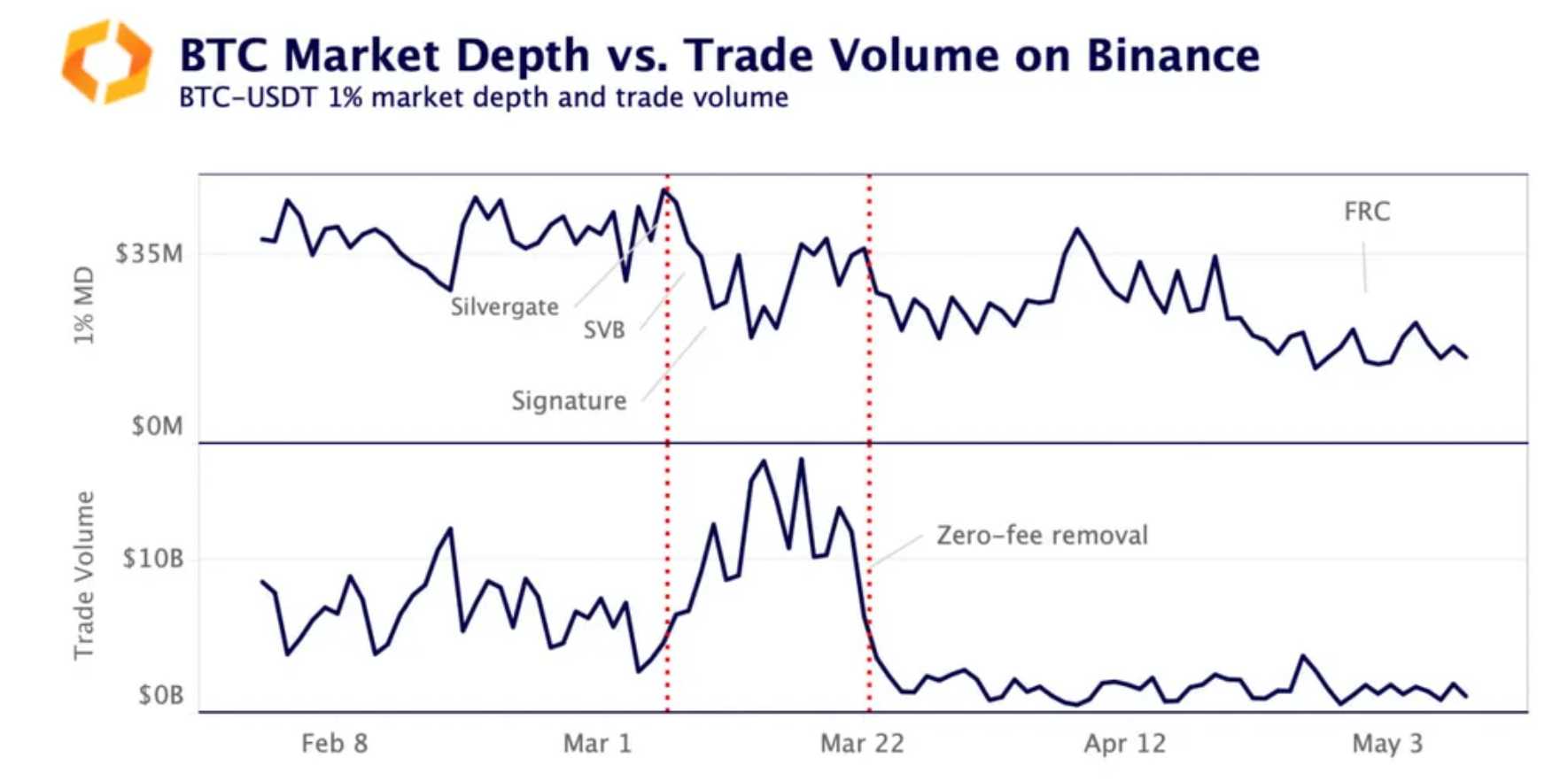

Bitcoin Buying Volume On Binance Exceeds Selling After Six Months

May 08, 2025

Bitcoin Buying Volume On Binance Exceeds Selling After Six Months

May 08, 2025 -

Lotto 6aus49 Die Gewinnzahlen Des 19 April 2025

May 08, 2025

Lotto 6aus49 Die Gewinnzahlen Des 19 April 2025

May 08, 2025

Latest Posts

-

Proposed Jhl Privatisation Faces Strong Opposition From Gha

May 08, 2025

Proposed Jhl Privatisation Faces Strong Opposition From Gha

May 08, 2025 -

Bitcoin Vs Micro Strategy Stock Which To Invest In For 2025

May 08, 2025

Bitcoin Vs Micro Strategy Stock Which To Invest In For 2025

May 08, 2025 -

Wall Streets Prediction 110 Growth For Black Rock Etf Backed By Billionaires

May 08, 2025

Wall Streets Prediction 110 Growth For Black Rock Etf Backed By Billionaires

May 08, 2025 -

Jhl Privatisation Ghas Strong Opposition And Concerns

May 08, 2025

Jhl Privatisation Ghas Strong Opposition And Concerns

May 08, 2025 -

Black Rock Etf Billionaire Investments And Potential 110 Growth In 2025

May 08, 2025

Black Rock Etf Billionaire Investments And Potential 110 Growth In 2025

May 08, 2025