$67 Million Ethereum Liquidated: Analyzing The Market Impact

Table of Contents

Understanding Ethereum Liquidations

Before diving into the specifics of the $67 million ETH liquidation, it's crucial to understand the mechanics of liquidations in the Ethereum ecosystem. Simply put, an Ethereum liquidation occurs when a trader's position in a leveraged trade is automatically closed by a lender or decentralized exchange (DEX) due to insufficient collateral. This typically happens when the price of the underlying asset (in this case, ETH) falls below a certain threshold, triggering a margin call.

Let's define some key terms:

- Collateral: The assets pledged to secure a loan or leveraged position. In DeFi, this could be ETH, other cryptocurrencies, or stablecoins.

- Leverage: Borrowing funds to amplify potential profits (and losses) from a trade. Higher leverage magnifies both gains and losses.

- Liquidation Price: The price point at which a leveraged position is automatically liquidated.

- Margin Call: A demand from a lender for additional collateral to cover potential losses on a leveraged position.

Common scenarios leading to ETH liquidations include:

- Unexpected Market Downturns: A sudden and sharp drop in the Ethereum price can trigger liquidations across the board.

- Flash Crashes: Brief, intense price drops can overwhelm even well-collateralized positions, leading to forced liquidations.

- DeFi Protocol Vulnerabilities: Exploits or bugs in DeFi lending protocols can cause cascading liquidations.

Keywords used in this section include: Ethereum leverage, margin trading, collateralized debt positions (CDPs), DeFi lending.

Analyzing the $67 Million ETH Liquidation Event

The $67 million ETH liquidation event, which occurred on [Insert Date and Time of Event], stands out due to its sheer scale. While the exact causes are still being investigated, several contributing factors are suspected: [Insert details about potential causes, e.g., a broader market downturn impacting several DeFi protocols, a specific vulnerability in a DeFi lending platform, a flash crash concentrated on Ethereum]. We can analyze this event further using data from blockchain explorers like [mention specific explorers, e.g., Etherscan] and analytics platforms such as [mention specific analytics platforms].

[Insert chart or graph here visually demonstrating the price fluctuations of ETH around the time of the liquidation and the volume of liquidations]. This visual representation will help illustrate the severity of the event and its impact on the Ethereum price.

Keywords used in this section include: DeFi liquidation, Ethereum price chart, crypto market analysis, on-chain data.

Market Impact and Ripple Effects

The immediate impact of this $67 million ETH liquidation was a noticeable dip in the Ethereum price. [Insert details on the price drop percentage and duration]. This event also had broader implications for the cryptocurrency market. We observed [describe the correlation with Bitcoin and other altcoins – was there a similar drop, or was Ethereum more heavily affected?].

The impact on DeFi protocols was significant, particularly those involved in lending and borrowing. The event highlighted the interconnectedness and systemic risks within the DeFi ecosystem. Large-scale liquidations can trigger a cascade effect, leading to further liquidations and amplified price volatility. The long-term consequences might include a shift in investor sentiment and reduced confidence in certain DeFi protocols.

Keywords used in this section include: Bitcoin correlation, altcoin market, DeFi impact, market sentiment, investor confidence.

Lessons Learned and Future Considerations

The $67 million ETH liquidation serves as a crucial lesson in risk management within the DeFi space. Investors must understand and actively manage leverage, ensuring that their collateral adequately covers potential losses. Diversification across multiple assets is also vital.

Key takeaways include:

- Prudent Leverage Management: Avoid excessively high leverage ratios.

- Diversified Portfolios: Don't put all your eggs in one basket. Diversify across different cryptocurrencies and DeFi protocols.

- Regular Monitoring: Continuously monitor your positions and market conditions.

- Emergency Liquidity: Ensure you have sufficient funds available to meet margin calls.

Regulatory oversight also plays a critical role. Clearer guidelines and frameworks might help prevent future large-scale liquidations and enhance investor protection.

Keywords used in this section include: risk management, DeFi risk, leverage management, cryptocurrency regulation, crypto portfolio diversification.

Conclusion: Understanding the Implications of Large-Scale Ethereum Liquidations

The $67 million ETH liquidation event underscores the inherent volatility and risks associated with leveraged trading within the DeFi ecosystem. It highlights the interconnected nature of DeFi protocols and the potential for cascading liquidations. The key takeaway is the critical need for robust risk management strategies, including careful leverage management, portfolio diversification, and a keen awareness of market conditions. Understanding the implications of large-scale Ethereum liquidations is vital for protecting your cryptocurrency investments. Further research into Ethereum liquidations and the implementation of effective risk mitigation strategies are essential for navigating the complexities of the DeFi and broader crypto markets. Stay informed about market fluctuations and the impact of large-scale Ethereum liquidations to protect your investments. Learn more about managing Ethereum liquidation risk and develop a sound crypto investment strategy to mitigate market volatility.

Featured Posts

-

Top 10 Most Intense War Films Streaming On Amazon Prime Right Now

May 08, 2025

Top 10 Most Intense War Films Streaming On Amazon Prime Right Now

May 08, 2025 -

Ligata Na Shampionite Vesprem Go Pobedi Ps Zh I Go Zapisha Desettoto Triumfalno Izdanie

May 08, 2025

Ligata Na Shampionite Vesprem Go Pobedi Ps Zh I Go Zapisha Desettoto Triumfalno Izdanie

May 08, 2025 -

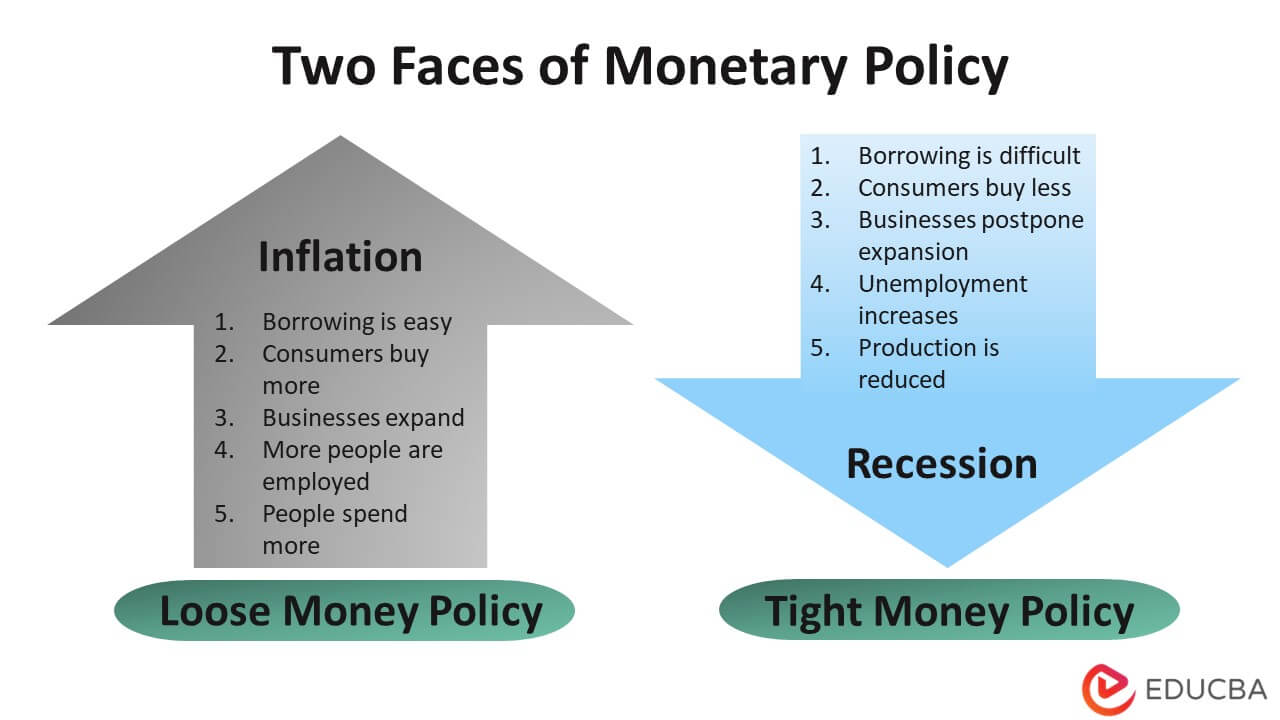

Chinas Monetary Policy Shift Lower Rates And Increased Bank Lending

May 08, 2025

Chinas Monetary Policy Shift Lower Rates And Increased Bank Lending

May 08, 2025 -

The Unexpected Power Of Unscripted Scenes A Case Study Of Saving Private Ryan

May 08, 2025

The Unexpected Power Of Unscripted Scenes A Case Study Of Saving Private Ryan

May 08, 2025 -

Iniciando Con Fuerza Los Dodgers Buscan Superar El Record De Los Yankees

May 08, 2025

Iniciando Con Fuerza Los Dodgers Buscan Superar El Record De Los Yankees

May 08, 2025

Latest Posts

-

The Xrp Etf Outlook Weighing Supply Headwinds Against Potential Growth

May 08, 2025

The Xrp Etf Outlook Weighing Supply Headwinds Against Potential Growth

May 08, 2025 -

Analyzing The Challenges Facing Xrp Etfs Supply And Demand Imbalance

May 08, 2025

Analyzing The Challenges Facing Xrp Etfs Supply And Demand Imbalance

May 08, 2025 -

Xrp Etf Risks High Supply And Low Institutional Adoption

May 08, 2025

Xrp Etf Risks High Supply And Low Institutional Adoption

May 08, 2025 -

Will Xrp Etfs Disappoint Assessing Supply Headwinds And Institutional Interest

May 08, 2025

Will Xrp Etfs Disappoint Assessing Supply Headwinds And Institutional Interest

May 08, 2025 -

Xrp Etf Disappointing Prospects Due To Supply And Low Institutional Demand

May 08, 2025

Xrp Etf Disappointing Prospects Due To Supply And Low Institutional Demand

May 08, 2025