Amsterdam's AEX: Record Low After 4%+ Market Crash

Table of Contents

Causes of the AEX Market Crash

The sharp decline in the AEX index is a multifaceted issue stemming from a combination of global economic headwinds and sector-specific challenges within the Dutch economy.

Global Economic Factors

The current global economic climate has significantly impacted the AEX. Several interconnected factors contributed to this market crash:

-

Impact of global inflation and rising interest rates: Soaring inflation rates globally have forced central banks, including the European Central Bank, to aggressively raise interest rates. This has increased borrowing costs for businesses, dampening investment and slowing economic growth, directly impacting the AEX's performance. Higher interest rates also make bonds more attractive relative to stocks, leading to capital flight from the equity market.

-

Influence of geopolitical instability (e.g., war in Ukraine, energy crisis): The ongoing war in Ukraine and the resulting energy crisis have created significant uncertainty in the global market. The Netherlands, heavily reliant on energy imports, is particularly vulnerable to these disruptions, leading to increased energy prices and impacting numerous sectors within the AEX.

-

Weakening of the Euro and its effect on Dutch exports: The weakening Euro against other major currencies makes Dutch exports more expensive, reducing their competitiveness in the global market. This negatively affects the performance of export-oriented companies listed on the AEX, contributing to the overall decline.

-

Specific Economic Indicators: Several key economic indicators contributed to the crash, including:

- A sharp decline in consumer confidence.

- Increased inflation exceeding the ECB's target.

- A significant drop in manufacturing PMI (Purchasing Managers' Index).

Sector-Specific Challenges

Beyond global factors, specific sectors within the AEX experienced disproportionate challenges:

-

Performance of specific sectors within the AEX (e.g., technology, energy, financials): The technology sector, sensitive to interest rate hikes and decreased investor appetite for risk, experienced a particularly sharp decline. Similarly, the energy sector faced pressure due to volatile energy prices and supply chain disruptions. Financial institutions also felt the impact of decreased economic activity and increased uncertainty.

-

Analysis of individual company performance within the affected sectors: Several major AEX-listed companies, including [insert examples of specific companies and their performance], reported disappointing earnings, further fueling the market downturn.

-

Impact of supply chain disruptions on Dutch businesses: Ongoing supply chain disruptions continue to hamper the operations of many Dutch businesses, leading to production bottlenecks, increased costs, and reduced profitability. This negatively affects their stock prices and contributes to the AEX decline.

-

Underperformance of key AEX companies: Several key companies within the AEX underperformed expectations, contributing to the overall negative sentiment and market crash. Examples include [insert specific examples].

Consequences of the AEX Decline

The significant decline in the AEX has far-reaching consequences, both for investors and the wider Dutch economy.

Impact on Investor Confidence

The market crash has severely eroded investor confidence:

-

Decline in investor confidence and potential capital flight: Investors are pulling back from the market, leading to capital flight and exacerbating the decline in the AEX. This is partly driven by fear and uncertainty about the future economic outlook.

-

Increased market volatility and uncertainty: The market is experiencing heightened volatility, making it difficult for investors to predict future price movements and increasing the risk of further losses.

-

Impact on retirement funds and pension schemes: The AEX decline has directly impacted the value of retirement funds and pension schemes invested in Dutch equities, raising concerns about future retirement security for many Dutch citizens.

-

Psychological Impact: The market crash has had a significant psychological impact on investors, leading to anxiety, fear, and uncertainty about their investments.

Economic Ramifications for the Netherlands

The AEX decline has significant implications for the Dutch economy:

-

Potential slowdown in economic growth: The market crash suggests a slowdown in economic activity, potentially leading to reduced investment, lower consumer spending, and decreased overall economic growth.

-

Impact on employment and unemployment rates: A weakening economy could lead to job losses and increased unemployment rates, further impacting consumer confidence and economic growth.

-

Effect on consumer spending and overall economic sentiment: Negative economic news and market volatility often lead to decreased consumer spending and a pessimistic outlook, creating a self-reinforcing negative cycle.

-

Potential Consequences for the Dutch Economy: The AEX crash could trigger a broader economic slowdown in the Netherlands, affecting various sectors and potentially leading to government intervention.

Potential Recovery Strategies and Outlook for the AEX

While the situation is challenging, several potential strategies could contribute to the AEX's recovery.

Government Intervention and Support

The Dutch government may implement measures to stimulate the economy and support the AEX:

-

Potential government measures to stimulate the economy (e.g., tax cuts, infrastructure investments): Fiscal stimulus packages, such as tax cuts and increased infrastructure spending, could help boost economic activity and investor confidence.

-

Central bank actions to stabilize the market (e.g., interest rate adjustments): The Dutch central bank may adjust interest rates to manage inflation and encourage investment. However, this requires careful balancing to avoid further economic damage.

-

Analysis of the effectiveness of potential government interventions: The effectiveness of government interventions depends on their design, timing, and implementation. Past experiences with similar economic downturns can inform policy decisions.

-

Potential Government Responses: The Dutch government's response will likely involve a combination of fiscal and monetary policies aimed at stabilizing the economy and boosting investor confidence.

Long-Term Investment Strategies

For investors, navigating the current market downturn requires a long-term perspective and strategic approach:

-

Advice for investors on navigating the market downturn: Investors should avoid panic selling and maintain a diversified portfolio to mitigate risk.

-

Discussion of diversification strategies to mitigate risk: Diversifying investments across different asset classes, geographical regions, and sectors can help reduce the impact of market volatility.

-

Importance of long-term investment horizons: A long-term investment horizon allows investors to ride out market fluctuations and benefit from the potential for long-term growth.

-

Strategies for Investors to Consider: Investors should focus on fundamental analysis, research promising companies, and consider seeking advice from financial professionals.

Conclusion

The 4%+ market crash that sent the Amsterdam AEX to a record low is a complex issue resulting from a combination of global economic headwinds and sector-specific challenges. This has negatively impacted investor confidence and the Dutch economy. Understanding the causes and consequences is crucial for navigating this challenging period. The outlook for the AEX depends on the effectiveness of government interventions, the resolution of geopolitical uncertainties, and the resilience of the Dutch economy.

Call to Action: Stay informed about the evolving situation of the Amsterdam AEX and its impact on the Netherlands. Monitor key economic indicators like inflation, interest rates, and the Euro's exchange rate. Consider consulting with a financial advisor to develop robust investment strategies that account for this market volatility and learn more about effective risk management techniques to navigate future market fluctuations in the Amsterdam AEX and the broader Dutch stock market.

Featured Posts

-

H Nonline Sk Tisice Prepustenych V Nemecku Reakcia Na Hospodarsky Pokles

May 24, 2025

H Nonline Sk Tisice Prepustenych V Nemecku Reakcia Na Hospodarsky Pokles

May 24, 2025 -

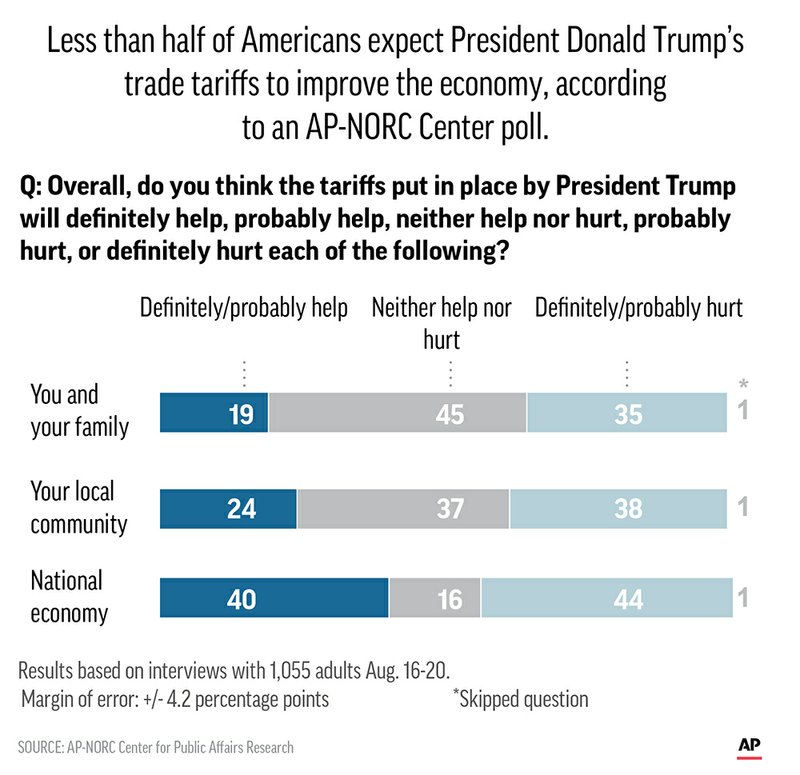

Buffetts Apple Investment Navigating The Impact Of Trump Era Tariffs

May 24, 2025

Buffetts Apple Investment Navigating The Impact Of Trump Era Tariffs

May 24, 2025 -

Glastonbury 2025 Headliners Disappointment And Anger From Fans

May 24, 2025

Glastonbury 2025 Headliners Disappointment And Anger From Fans

May 24, 2025 -

The 2025 Philips Future Health Index Ais Impact On Global Healthcare And The Call To Action

May 24, 2025

The 2025 Philips Future Health Index Ais Impact On Global Healthcare And The Call To Action

May 24, 2025 -

De Snelle Markt Draai Europese Aandelen En De Toekomst Van Wall Street

May 24, 2025

De Snelle Markt Draai Europese Aandelen En De Toekomst Van Wall Street

May 24, 2025

Latest Posts

-

Debate Reignited Sean Penn Questions Dylan Farrows Claims Against Woody Allen

May 24, 2025

Debate Reignited Sean Penn Questions Dylan Farrows Claims Against Woody Allen

May 24, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy A Closer Look

May 24, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy A Closer Look

May 24, 2025 -

Sean Penns Comments On Dylan Farrows Accusations Against Woody Allen

May 24, 2025

Sean Penns Comments On Dylan Farrows Accusations Against Woody Allen

May 24, 2025 -

Understanding Frank Sinatras Four Marriages And Relationships

May 24, 2025

Understanding Frank Sinatras Four Marriages And Relationships

May 24, 2025 -

Woody Allen Sexual Assault Accusations Sean Penn Expresses Doubts

May 24, 2025

Woody Allen Sexual Assault Accusations Sean Penn Expresses Doubts

May 24, 2025