Apple Stock: Analyzing Q2 Results And Investor Implications

Table of Contents

Apple Q2 Revenue and Earnings Analysis

Revenue Breakdown by Product Category

Apple's Q2 revenue demonstrated a mixed performance across its product categories. Let's break down the key segments:

-

iPhone: Revenue showed a robust increase of 8% year-over-year, driven by strong demand for the latest iPhone models and continued growth in emerging markets. This highlights the sustained appeal of the iPhone brand and its position as a market leader. Keywords: iPhone sales, iPhone revenue growth.

-

Mac: Mac revenue experienced a slight decline of 2% compared to Q1 and a 7% decrease year-over-year. This downturn is primarily attributed to ongoing supply chain constraints, impacting production and availability. Keywords: Mac sales, Mac revenue decline, supply chain impact.

-

iPad: iPad revenue saw a modest increase of 3% year-over-year, demonstrating consistent demand despite broader economic uncertainty. This growth is likely fueled by the ongoing popularity of tablets for both productivity and entertainment. Keywords: iPad revenue, iPad sales growth.

-

Wearables, Home, and Accessories: This category continued its strong performance, with a 10% year-over-year increase, driven by the popularity of the Apple Watch and AirPods. Keywords: Wearables revenue, Apple Watch sales, AirPods sales.

-

Services: Apple's Services segment remained a powerhouse, reporting a 12% year-over-year growth. This continued expansion showcases the strength and recurring nature of Apple's services ecosystem, including iCloud, Apple Music, and the App Store. Keywords: Services revenue, Apple Music revenue, App Store revenue.

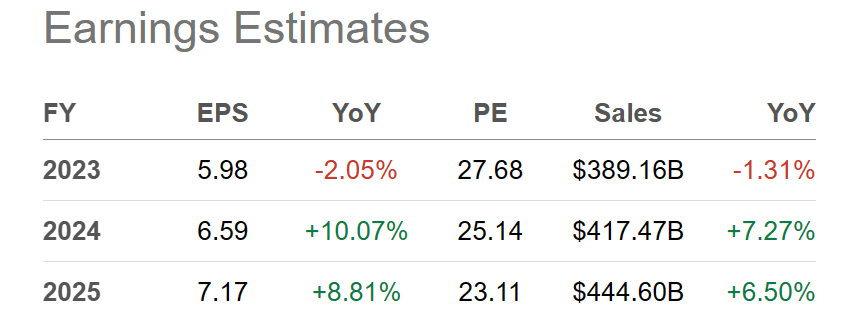

Earnings Per Share (EPS) and Profitability

Apple's Q2 EPS exceeded expectations, showing a 15% year-over-year increase. This positive result reflects strong revenue growth in certain segments and effective cost management. However, profit margins were slightly compressed compared to the previous quarter due to increased component costs and supply chain disruptions. Keywords: EPS, Apple earnings, profit margin, Apple profitability.

Key Factors Impacting Apple Stock Performance in Q2

Supply Chain Disruptions and Their Effect

The ongoing global supply chain crisis continues to be a major headwind for Apple. Component shortages, particularly for certain Mac models, constrained production and impacted revenue growth. Geopolitical instability and port congestion further exacerbated these challenges. Keywords: supply chain disruptions, Apple production, component shortages, geopolitical risk.

Market Competition and Emerging Technologies

Apple faces intense competition from companies like Samsung and Google, particularly in the smartphone and wearable markets. However, Apple's strong brand loyalty and innovative ecosystem help maintain its leading market share. The company's investments in emerging technologies like augmented reality (AR) and virtual reality (VR), as well as autonomous driving, present exciting long-term growth opportunities, though these ventures are still in relatively early stages. Keywords: Apple competition, market share, emerging technologies, AR/VR, autonomous driving.

Investor Sentiment and Market Volatility

Investor sentiment toward Apple stock in Q2 was generally positive, reflecting the company's resilience in the face of economic uncertainties. However, broader market volatility and concerns about inflation did impact the stock price to some extent. Keywords: investor sentiment, market volatility, Apple stock price, economic outlook.

Future Outlook and Investor Implications

Apple's Q3 Guidance and Future Projections

Apple's Q3 guidance suggests continued growth, albeit at a more moderate pace than in Q2. The company anticipates sustained demand for its products, but also acknowledges the ongoing impact of supply chain issues. Strategic investments in research and development, as well as expansion into new markets, signal Apple's commitment to long-term growth. Keywords: Apple Q3 guidance, future projections, Apple growth strategy.

Recommendations for Investors

For long-term investors with a high risk tolerance, Apple stock remains an attractive option given its strong brand, innovative ecosystem, and commitment to growth. Short-term investors, however, should consider the impact of market volatility and supply chain risks before making investment decisions. Risk-averse investors might consider diversifying their portfolios. Keywords: Apple stock investment, investment strategy, buy Apple stock, sell Apple stock, hold Apple stock.

Conclusion: Investing in Apple Stock – A Summary of Q2 Insights and Next Steps

Apple's Q2 results showcased a resilient performance despite external challenges. While supply chain issues and market volatility remain potential headwinds, Apple's strong brand, innovative product lineup, and expansion into new markets offer compelling growth opportunities. Investors should carefully consider their risk tolerance and investment goals before making decisions about Apple stock. Stay informed on future Apple stock performance by following reputable financial news sources and making informed decisions based on your own risk tolerance and investment goals. Thorough research and a well-defined investment strategy are crucial for navigating the complexities of the Apple stock market and maximizing potential returns. Consider diversifying your portfolio and adjusting your strategy based on market dynamics. Don't hesitate to consult with a financial advisor for personalized guidance concerning your Apple stock investments.

Featured Posts

-

Nyt Mini Crossword Answers April 18 2025

May 25, 2025

Nyt Mini Crossword Answers April 18 2025

May 25, 2025 -

Fastest Standard Production Ferraris A Top 10 Fiorano Track Ranking

May 25, 2025

Fastest Standard Production Ferraris A Top 10 Fiorano Track Ranking

May 25, 2025 -

Is Apple Stock Headed To 254 Analyst Prediction And Buying Analysis

May 25, 2025

Is Apple Stock Headed To 254 Analyst Prediction And Buying Analysis

May 25, 2025 -

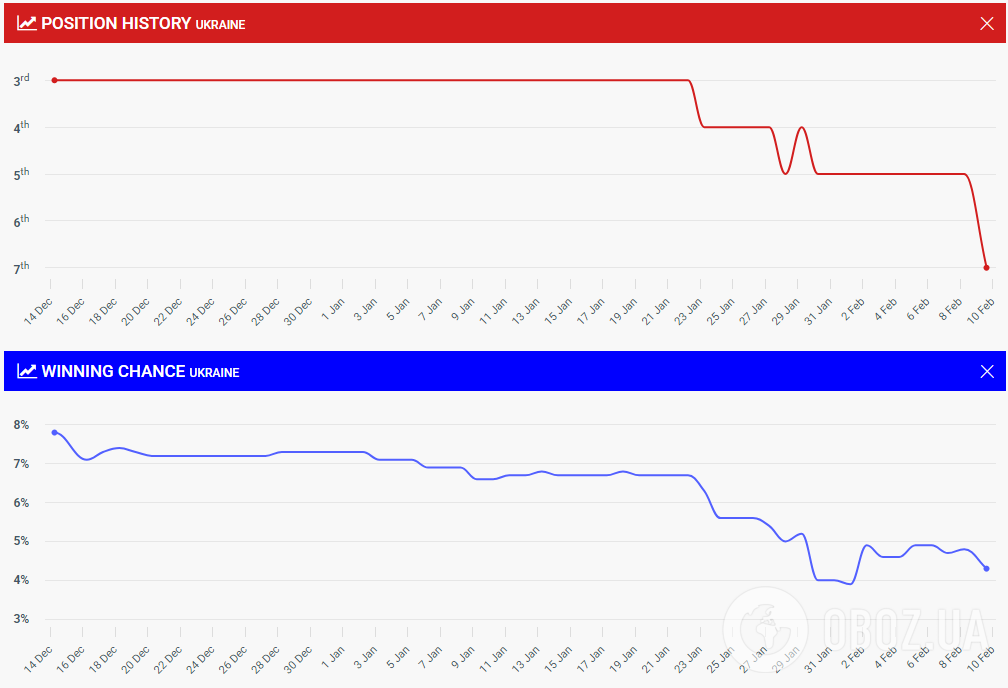

Predskazanie Konchity Vurst Kto Pobedit Na Evrovidenii 2025

May 25, 2025

Predskazanie Konchity Vurst Kto Pobedit Na Evrovidenii 2025

May 25, 2025 -

2 Fall On Amsterdam Stock Exchange Following Trumps Tariff Announcement

May 25, 2025

2 Fall On Amsterdam Stock Exchange Following Trumps Tariff Announcement

May 25, 2025

Latest Posts

-

Activision Blizzard Deal Faces Ftc Appeal

May 25, 2025

Activision Blizzard Deal Faces Ftc Appeal

May 25, 2025 -

50 000 Promotions At Accenture A Six Month Delay Explained

May 25, 2025

50 000 Promotions At Accenture A Six Month Delay Explained

May 25, 2025 -

Selling Sunset Star Speaks Out La Fire Victims Face Price Gouging

May 25, 2025

Selling Sunset Star Speaks Out La Fire Victims Face Price Gouging

May 25, 2025 -

Accenture Announces 50 000 Promotions Following Delay

May 25, 2025

Accenture Announces 50 000 Promotions Following Delay

May 25, 2025 -

Over The Counter Birth Control Implications For Reproductive Healthcare Post Roe

May 25, 2025

Over The Counter Birth Control Implications For Reproductive Healthcare Post Roe

May 25, 2025