Berkshire Hathaway And Apple: Will Buffett's Succession Impact Apple Stock?

Table of Contents

Berkshire Hathaway's Investment in Apple: A Deep Dive

Berkshire Hathaway's Apple investment is a legendary tale of shrewd investment and market-beating returns. Understanding this relationship is crucial to assessing the potential consequences of Buffett's departure.

The History of Berkshire Hathaway's Apple Investment

Berkshire Hathaway's journey with Apple began with initial purchases in 2016, a time when some analysts were skeptical about Apple's long-term growth. Buffett, however, saw something others didn't: the enduring power of the Apple brand and its loyal customer base.

- Timeline: The initial investments were relatively modest, but Berkshire Hathaway steadily increased its holdings over the years, becoming one of Apple's largest shareholders.

- Rationale: Buffett's investment philosophy centers on identifying strong, fundamentally sound businesses with durable competitive advantages. Apple, with its powerful brand, loyal customer base, and recurring revenue streams from services, perfectly fit this model.

- Statistics: At its peak, Berkshire Hathaway's Apple holdings represented a significant percentage of its overall portfolio, making it a pivotal component of its investment strategy. (Note: Specific figures should be updated with current market data.) These holdings represent a considerable investment value, highlighting the magnitude of this partnership. Keywords: Berkshire Hathaway Apple investment, Buffett Apple stock, Apple share ownership.

The Role of Warren Buffett in the Investment Decision

Warren Buffett's personal involvement in the Apple investment is noteworthy. His investment philosophy, emphasizing long-term value creation and understanding the underlying business, profoundly shaped Berkshire Hathaway's approach to this significant stake.

- Alignment with Philosophy: Buffett's belief in the power of strong brands and the importance of consistent cash flow aligns perfectly with Apple's business model.

- Long-Term Holding Strategy: His influence ensured that Berkshire Hathaway adopted a long-term holding strategy, resisting short-term market fluctuations and focusing on the company's fundamental strength. Keywords: Warren Buffett investment strategy, Berkshire Hathaway investment philosophy, Apple stock long term.

The Succession Plan and its Potential Implications

The looming succession at Berkshire Hathaway introduces an element of uncertainty into the Apple investment equation. While the company has a carefully planned succession process, the potential for a shift in investment strategy is undeniable.

Understanding Berkshire Hathaway's Succession Plan

Berkshire Hathaway's succession plan centers on Greg Abel and Ajit Jain, who are poised to take on significant leadership roles. While both have demonstrated strong capabilities, their investment philosophies may subtly differ from Buffett's.

- Transition of Leadership: The transition is likely to be gradual, aiming for a smooth transfer of power and minimizing disruption.

- Potential Changes in Strategy: While a complete overhaul of Berkshire Hathaway's investment strategy is unlikely, subtle changes in emphasis are possible. The focus might shift slightly, potentially affecting the allocation of resources and individual holdings. Keywords: Berkshire Hathaway succession plan, Greg Abel, Ajit Jain, future of Berkshire Hathaway.

Potential Scenarios for Apple Stock Post-Succession

Several scenarios are possible regarding Berkshire Hathaway's Apple holdings following Buffett's departure:

- Scenario 1: Continued Strong Performance: Abel and Jain may continue to view Apple as a core holding, maintaining or even increasing their stake. This would likely lead to stability in Apple's stock price.

- Scenario 2: Partial Divestment: A partial sale of Apple shares might occur to diversify the portfolio and reflect a slightly altered investment strategy. This could trigger some market volatility.

- Scenario 3: Significant Shift and Sell-Off: A more dramatic shift in investment philosophy could result in a significant reduction or even complete divestment from Apple, leading to a potentially substantial impact on Apple's stock price. This scenario, however, seems less likely given the strength of Apple's fundamentals.

- Likelihood Analysis: The likelihood of each scenario will depend on a multitude of factors, including the new leadership's investment priorities, prevailing market conditions, and Apple's future performance. Keywords: Apple stock price prediction, Apple stock future, Berkshire Hathaway Apple stock sale.

Market Sentiment and Investor Reaction

Market sentiment and investor reaction will be crucial in determining the actual impact of the succession on Apple's stock price.

Analyzing Market Reactions to Succession News

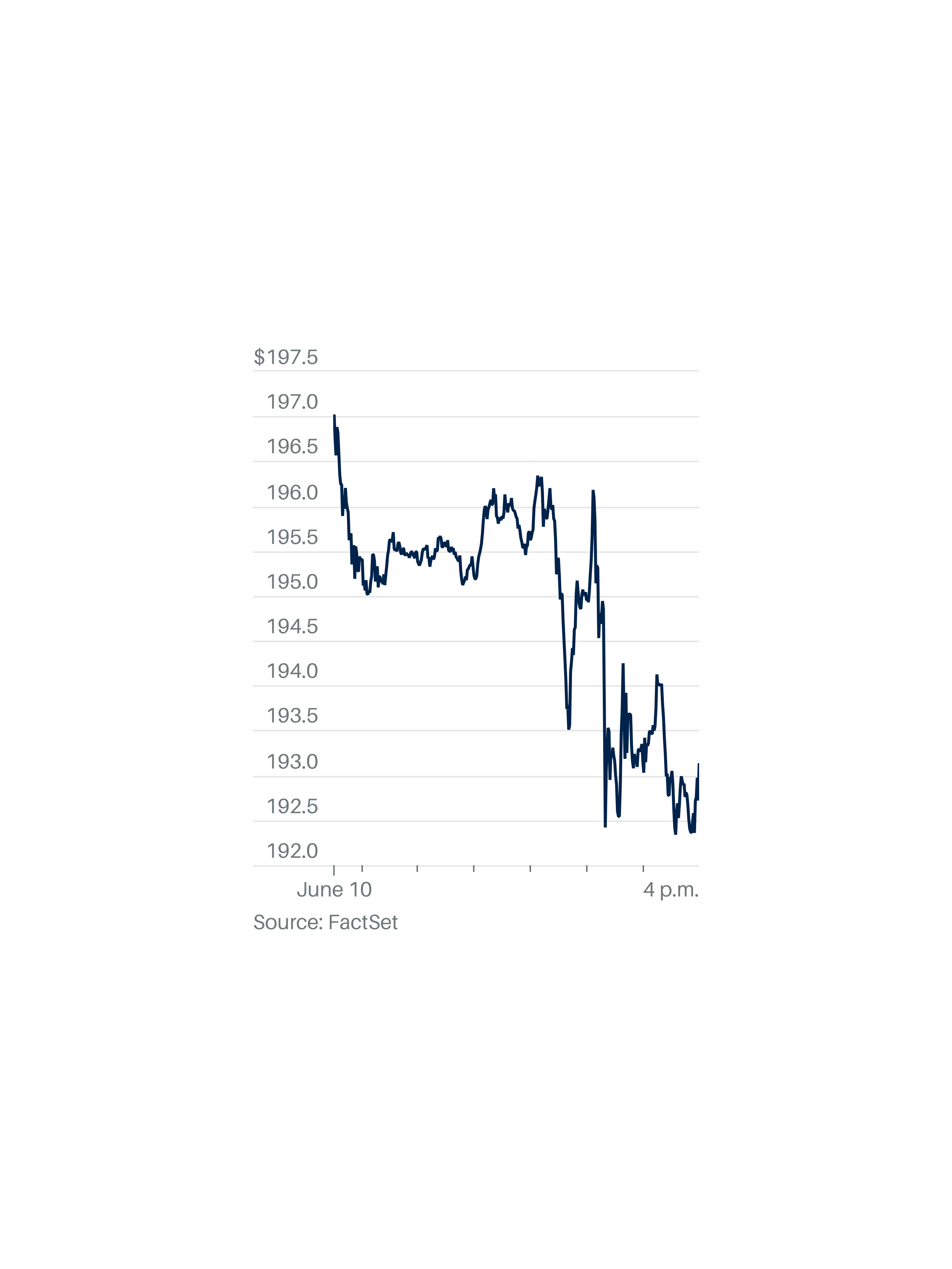

The period leading up to and immediately following the succession is likely to see increased market volatility. Investors will closely scrutinize any statements or actions from the new leadership regarding Berkshire Hathaway's Apple holdings.

- Historical Precedents: Examining how markets reacted to similar leadership transitions in other large companies can offer valuable insights.

- Predicting Volatility: Predicting the precise level of volatility is challenging, but the potential for short-term price fluctuations is undeniable. Keywords: Market volatility, investor sentiment, Apple stock market reaction.

Expert Opinions and Analyst Predictions

Financial experts and analysts offer diverse perspectives on the future of Apple stock post-Buffett.

- Range of Opinions: While some remain bullish on Apple's long-term prospects, others express caution, highlighting the uncertainties associated with the leadership transition.

- Importance of Diversified Views: It's crucial to consider a wide range of expert opinions to develop a well-rounded understanding of the situation. Keywords: Financial analysts, expert opinions, Apple stock forecast.

Conclusion: Berkshire Hathaway and Apple: What the Future Holds

Berkshire Hathaway's substantial Apple investment represents a pivotal aspect of both companies' success stories. The upcoming succession introduces uncertainty, but the potential impact on Apple's stock price will likely depend on the new leadership's investment strategy. The scenarios outlined—continued strong performance, partial divestment, or a significant sell-off—each carry varying degrees of likelihood and potential market consequences. Maintaining a balanced perspective, considering both potential risks and opportunities, is crucial. Stay informed about the developments surrounding Berkshire Hathaway's succession and its potential impact on its Apple holdings. Conduct further research into Berkshire Hathaway's investment strategies and Apple's future prospects to form your own informed opinion on the future of this significant partnership. Understanding "Berkshire Hathaway's Apple holdings," analyzing "Buffett's Apple legacy," and considering the "future of Berkshire Hathaway's Apple investment" are essential steps in navigating this significant market event.

Featured Posts

-

A Fungi That Could Spread As The World Heats Up A Growing Threat

May 25, 2025

A Fungi That Could Spread As The World Heats Up A Growing Threat

May 25, 2025 -

Apple Stock Slumps 900 Million Tariff Impact

May 25, 2025

Apple Stock Slumps 900 Million Tariff Impact

May 25, 2025 -

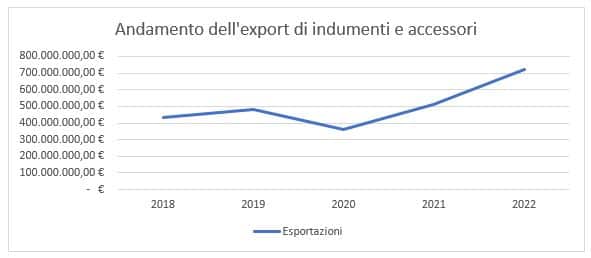

Effetti Dei Dazi Sulle Importazioni Di Abbigliamento Negli Stati Uniti

May 25, 2025

Effetti Dei Dazi Sulle Importazioni Di Abbigliamento Negli Stati Uniti

May 25, 2025 -

Konchita Vurst Predskazyvaet Pobediteley Evrovideniya 2025 Goda

May 25, 2025

Konchita Vurst Predskazyvaet Pobediteley Evrovideniya 2025 Goda

May 25, 2025 -

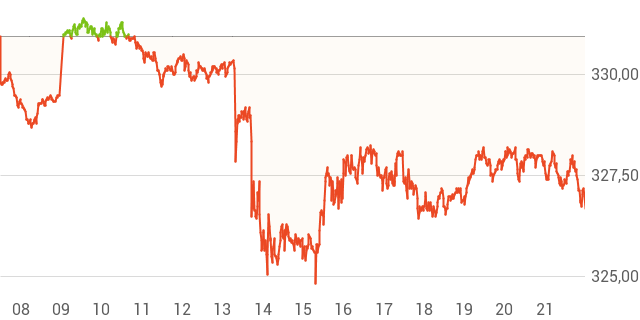

Amundi Msci All Country World Ucits Etf Usd Acc Nav Calculation And Implications

May 25, 2025

Amundi Msci All Country World Ucits Etf Usd Acc Nav Calculation And Implications

May 25, 2025

Latest Posts

-

Apples Stock Dip Examining Tim Cooks Performance And Future Prospects

May 25, 2025

Apples Stock Dip Examining Tim Cooks Performance And Future Prospects

May 25, 2025 -

The Expanding Reach Of Pathogenic Fungi In A Warming World

May 25, 2025

The Expanding Reach Of Pathogenic Fungi In A Warming World

May 25, 2025 -

Fungal Infections And Climate Change A Dangerous Combination

May 25, 2025

Fungal Infections And Climate Change A Dangerous Combination

May 25, 2025 -

Tim Cooks Challenges A Deeper Look At Apples 2023 Struggles

May 25, 2025

Tim Cooks Challenges A Deeper Look At Apples 2023 Struggles

May 25, 2025 -

Harmful Fungi The Impact Of A Changing Climate

May 25, 2025

Harmful Fungi The Impact Of A Changing Climate

May 25, 2025