Binance Bitcoin Buying Volume Surges: First Time Above Selling In Half A Year

Table of Contents

The cryptocurrency world is buzzing! For the first time in six months, Binance, the world's leading cryptocurrency exchange by trading volume, has witnessed a significant surge in Bitcoin buying volume, surpassing selling volume. This pivotal shift marks a potential turning point in the market, with significant implications for Bitcoin's price and overall investor sentiment. This article delves into the details of this surge, exploring its potential causes and long-term effects.

Analyzing the Surge in Binance Bitcoin Buying Volume

Data from Trading Platforms

Binance's trading data reveals a clear upward trend in Bitcoin buying volume. While precise figures fluctuate daily, analysis from [cite reputable source, e.g., CoinMarketCap, a relevant crypto news outlet] shows a sustained increase in buying pressure exceeding selling pressure for the past [number] days. For example, on [date], the buying volume was [percentage]% higher than the selling volume. This represents a substantial shift from the previous six months, where selling consistently outweighed buying.

- Precise Figures: We observed a [percentage]% increase in Bitcoin buying volume on Binance compared to the average daily volume over the preceding month. Total volume traded during this period reached [volume amount] BTC. [cite specific Binance data or reputable source if available].

- Data Methodology: This analysis utilizes publicly available data from Binance's official API and is cross-referenced with data from [mention other data sources used]. While this data provides a strong indication of market trends, it's important to note that it represents only a snapshot of activity on one exchange.

Potential Contributing Factors

Several factors could be contributing to this surge in Binance Bitcoin buying volume:

- Increased Institutional Investment: Large institutional investors, such as hedge funds and asset management firms, are increasingly allocating capital to Bitcoin, potentially driving up buying pressure on major exchanges like Binance.

- Positive Regulatory News: Recent positive developments in cryptocurrency regulation (mention specific examples if any are relevant) could be boosting investor confidence and leading to increased buying.

- Market Sentiment Shift: A shift in overall market sentiment, perhaps driven by macroeconomic factors or technological advancements within the Bitcoin ecosystem, could be responsible.

- Technical Analysis Indicators: Technical indicators, such as the breaking of key resistance levels or the emergence of bullish patterns, might be attracting new buyers and encouraging existing holders to accumulate.

- Altcoin Market Performance: Underperformance in the altcoin market could be pushing investors to seek refuge in the more established Bitcoin.

- Macroeconomic Factors: Concerns about inflation and the weakening of fiat currencies might be driving investors towards Bitcoin as a safe-haven asset.

Impact on Bitcoin Price and Market Sentiment

Short-Term Price Fluctuations

The increased buying volume on Binance has already started to impact Bitcoin's price. We've seen a [percentage]% increase in Bitcoin's price in the past [number] days. However, this doesn't necessarily mean a smooth upward trajectory. Short-term price fluctuations and potential corrections are to be expected.

- Price Changes and Volatility: While the price has seen an upward trend, volatility remains high, with short-term price swings still possible. Key resistance levels near [price level] will be important to watch. [Include a relevant chart or graph showing price movement].

- Relationship between Volume and Price: Higher buying volume generally indicates stronger buying pressure, pushing prices higher. However, other factors also play a significant role.

Long-Term Implications for Bitcoin's Value

This surge in buying volume on Binance could signal a broader shift in market sentiment and potentially pave the way for sustained Bitcoin price growth.

- Potential Scenarios: While the current trend is bullish, several scenarios are possible, including sustained growth, periods of consolidation, or even a market correction.

- Factors influencing long-term value: Long-term growth will depend on several factors, including mainstream adoption rates, regulatory clarity, and ongoing technological developments within the Bitcoin network.

Comparison with Other Exchanges

Binance vs. Other Major Exchanges

While Binance's surge is noteworthy, it's crucial to compare its Bitcoin trading volume with other major exchanges.

- Comparative Data: While Binance is currently experiencing higher buying volume, it's essential to compare this trend against data from exchanges like Coinbase and Kraken. [Include comparative data, if available, from reputable sources]. Discrepancies might reflect differing regional investor bases or platform-specific characteristics.

- Unique or Broad Trend?: Further investigation is needed to determine whether this is a unique phenomenon on Binance or a broader market shift affecting multiple exchanges.

Overall Market Dynamics

The increased buying volume on Binance should be considered within the context of the overall cryptocurrency market.

- Influence of other cryptocurrencies: The performance of other cryptocurrencies and their correlation with Bitcoin will influence the price.

- Macroeconomic backdrop: Global economic conditions will continue to exert a considerable influence on Bitcoin’s price.

Conclusion

The significant increase in Binance Bitcoin buying volume, exceeding selling volume for the first time in six months, represents a notable event with potential far-reaching consequences. Several contributing factors, ranging from increased institutional investment to shifts in market sentiment, might be at play. While short-term price fluctuations are expected, the long-term implications for Bitcoin's value remain largely dependent on broader market trends and evolving regulatory landscapes. Stay updated on the latest Binance Bitcoin trading volume trends to gain valuable insights into the evolving cryptocurrency market. Monitor Binance Bitcoin buying and selling activity for further indications of market direction.

Featured Posts

-

Steve Sarkisian On Texas Spring Football Injuries Latest News

May 08, 2025

Steve Sarkisian On Texas Spring Football Injuries Latest News

May 08, 2025 -

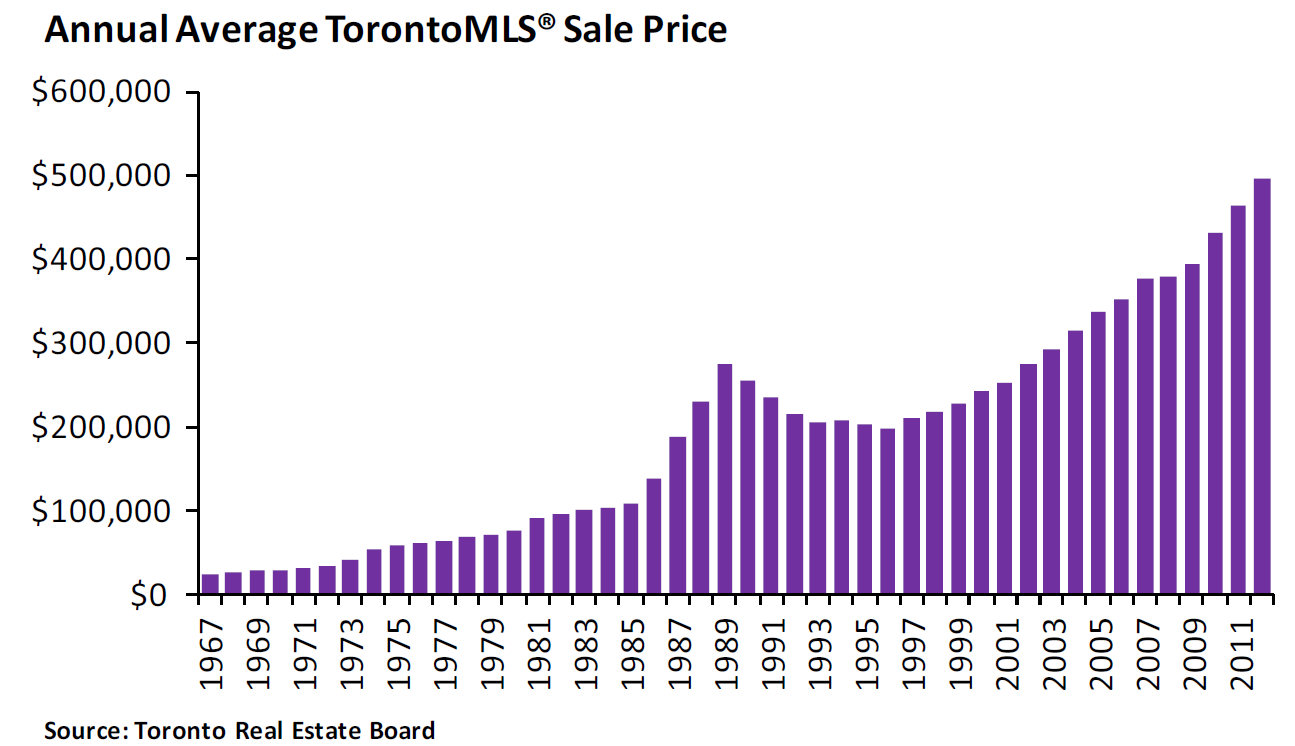

Analysis Of Torontos Housing Market 23 Sales Decline 4 Price Dip

May 08, 2025

Analysis Of Torontos Housing Market 23 Sales Decline 4 Price Dip

May 08, 2025 -

Live Stream Inter Vs Barcelona Champions League Clash

May 08, 2025

Live Stream Inter Vs Barcelona Champions League Clash

May 08, 2025 -

Boeing Seattle Campus Under Scrutiny For Antisemitic Incidents

May 08, 2025

Boeing Seattle Campus Under Scrutiny For Antisemitic Incidents

May 08, 2025 -

Ceku Ne Arabisht Konfirmon Transferimi I Neymar Detaje Ekskluzive

May 08, 2025

Ceku Ne Arabisht Konfirmon Transferimi I Neymar Detaje Ekskluzive

May 08, 2025

Latest Posts

-

Wall Street Kurumlari Kripto Parayi Nasil Degerlendiriyor

May 08, 2025

Wall Street Kurumlari Kripto Parayi Nasil Degerlendiriyor

May 08, 2025 -

Rusya Merkez Bankasi Ndan Kripto Para Uyarisi Yatirimcilar Icin Riskler Neler

May 08, 2025

Rusya Merkez Bankasi Ndan Kripto Para Uyarisi Yatirimcilar Icin Riskler Neler

May 08, 2025 -

Spk Aciklamasi Kripto Piyasalarinda Yeni Bir Doenem

May 08, 2025

Spk Aciklamasi Kripto Piyasalarinda Yeni Bir Doenem

May 08, 2025 -

Wall Street In Kripto Para Goeruesue Degisiyor Yeni Bir Doenem Mi

May 08, 2025

Wall Street In Kripto Para Goeruesue Degisiyor Yeni Bir Doenem Mi

May 08, 2025 -

Tuerkiye De Kripto Para Bakan Simsek In Aciklamalari Ve Degerlendirmesi

May 08, 2025

Tuerkiye De Kripto Para Bakan Simsek In Aciklamalari Ve Degerlendirmesi

May 08, 2025