Bitcoin Price Prediction: Will Trump's Policy Impact Surpass $100,000?

Table of Contents

Analyzing Historical Bitcoin Price Trends

Understanding Bitcoin's past performance is crucial for any Bitcoin price prediction. Analyzing historical trends provides insights into potential future movements, though it's important to remember that past performance is not necessarily indicative of future results.

Bitcoin's Past Performance and Market Cycles

Bitcoin's history is punctuated by dramatic bull and bear markets.

- Halving Events: The halving of Bitcoin's block reward, which occurs roughly every four years, has historically been followed by significant price increases. This is attributed to reduced supply and increased scarcity.

- Regulatory Changes: Positive regulatory developments, such as the clarification of legal frameworks in certain jurisdictions, have often led to price rallies. Conversely, negative news or increased regulatory scrutiny can trigger sharp declines.

- Technological Advancements: Major upgrades to the Bitcoin network, like the SegWit implementation, often positively influence market sentiment and price.

- Market Sentiment: Fear, uncertainty, and doubt (FUD) can drive sharp price drops, while periods of exuberance and optimism fuel bull markets.

Predictive Models and Technical Analysis

Many tools are used to predict Bitcoin's price, although their accuracy is debatable.

- Moving Averages: These indicators smooth out price fluctuations to identify trends.

- Relative Strength Index (RSI): This oscillator helps determine overbought or oversold conditions, potentially indicating price reversals.

- Other Indicators: Many other technical indicators, like MACD and Bollinger Bands, are employed, but none provide foolproof predictions. It's crucial to remember that these are tools for analysis, not guarantees of future price movements.

Macroeconomic Factors Influencing Bitcoin Price

Global economic events significantly influence Bitcoin's value.

- Inflation: High inflation often drives investors towards Bitcoin as a hedge against currency devaluation.

- Recession: During economic downturns, Bitcoin's price can fluctuate wildly, sometimes acting as a safe haven asset, and sometimes mirroring broader market declines.

- Quantitative Easing (QE): The printing of money by central banks can impact Bitcoin's value by altering the perception of fiat currency's stability.

- Geopolitical Instability: Times of global uncertainty often increase demand for Bitcoin, driving its price upwards.

Trump's Potential Economic Policies and Their Impact on Bitcoin

Donald Trump's potential economic policies could significantly impact the cryptocurrency market, influencing the Bitcoin price prediction.

Potential Deregulation of Cryptocurrencies

A less regulated environment for cryptocurrencies could be highly beneficial for Bitcoin.

- Increased Institutional Investment: Reduced regulatory hurdles could encourage larger institutional investors to allocate more capital to Bitcoin.

- Wider Mainstream Acceptance: Simplified regulations could lead to greater adoption by the general public.

Fiscal Policy and Bitcoin

Trump's fiscal policies, such as tax cuts or increased government spending, could indirectly influence Bitcoin's price.

- Inflationary Pressures: Expansionary fiscal policies could lead to increased inflation, potentially making Bitcoin more attractive as a store of value.

- Investor Behavior: Changes in the overall economic climate could affect investor risk appetite, impacting demand for Bitcoin.

Geopolitical Implications of Trump's Policies on Bitcoin

Trump's policies on international relations could influence Bitcoin's role as a safe haven asset.

- Increased Global Uncertainty: Heightened geopolitical tensions could drive investors towards Bitcoin, leading to price increases.

- Trade Wars: Trade disputes and protectionist policies could impact global economic stability, potentially influencing Bitcoin's price.

Factors Beyond Trump's Influence Affecting Bitcoin's Price

Several other factors, independent of Trump's policies, are crucial to any accurate Bitcoin price prediction.

Technological Advancements in Bitcoin

Ongoing development within the Bitcoin ecosystem can significantly impact its value.

- Scaling Solutions: Improvements to Bitcoin's transaction speed and scalability could increase its usability and appeal.

- Layer-2 Technologies: Solutions like the Lightning Network could enhance Bitcoin's efficiency and potentially boost its price.

- Competition from Altcoins: The emergence of new cryptocurrencies with innovative features could impact Bitcoin's dominance.

Adoption Rates and Institutional Investment

The level of adoption and institutional investment significantly affects Bitcoin's price.

- Growing Institutional Holdings: Increased investments from large financial institutions signal greater confidence in Bitcoin.

- Retail Investor Interest: Public sentiment and retail investor activity significantly impact price fluctuations.

Regulatory Landscape Globally

The global regulatory environment for cryptocurrencies plays a critical role.

- Varying Regulations: Different countries have diverse approaches to regulating cryptocurrencies, impacting market dynamics and prices.

- Regulatory Clarity: Clear and consistent regulatory frameworks in major jurisdictions could boost investor confidence and adoption.

Conclusion: Bitcoin Price Prediction: Will Trump's Influence Tip the Scales to $100,000?

Predicting Bitcoin's price is inherently challenging, a complex equation involving historical trends, macroeconomic factors, technological advancements, and regulatory landscapes, along with the potential impact of political figures such as Donald Trump. While Trump's policies could indeed have a significant influence, the interplay of these many elements makes a definitive prediction about reaching $100,000 highly speculative. A confluence of positive factors—strong adoption, technological improvements, and a favorable regulatory environment—combined with potentially positive impacts from Trump’s policies, could create conditions for such a substantial price increase. However, the inherent volatility of Bitcoin and the possibility of unforeseen events make this a highly uncertain proposition.

Stay informed about Bitcoin price predictions and the latest news affecting the cryptocurrency market to make informed investment decisions. Thorough research and a careful consideration of risk are crucial when engaging with this volatile asset.

Featured Posts

-

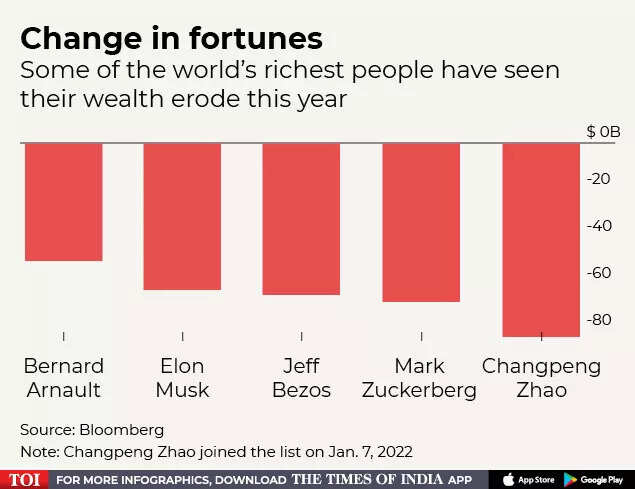

Estimating The Billions Lost By Elon Musk Jeff Bezos And Mark Zuckerberg Post Trump Inauguration

May 09, 2025

Estimating The Billions Lost By Elon Musk Jeff Bezos And Mark Zuckerberg Post Trump Inauguration

May 09, 2025 -

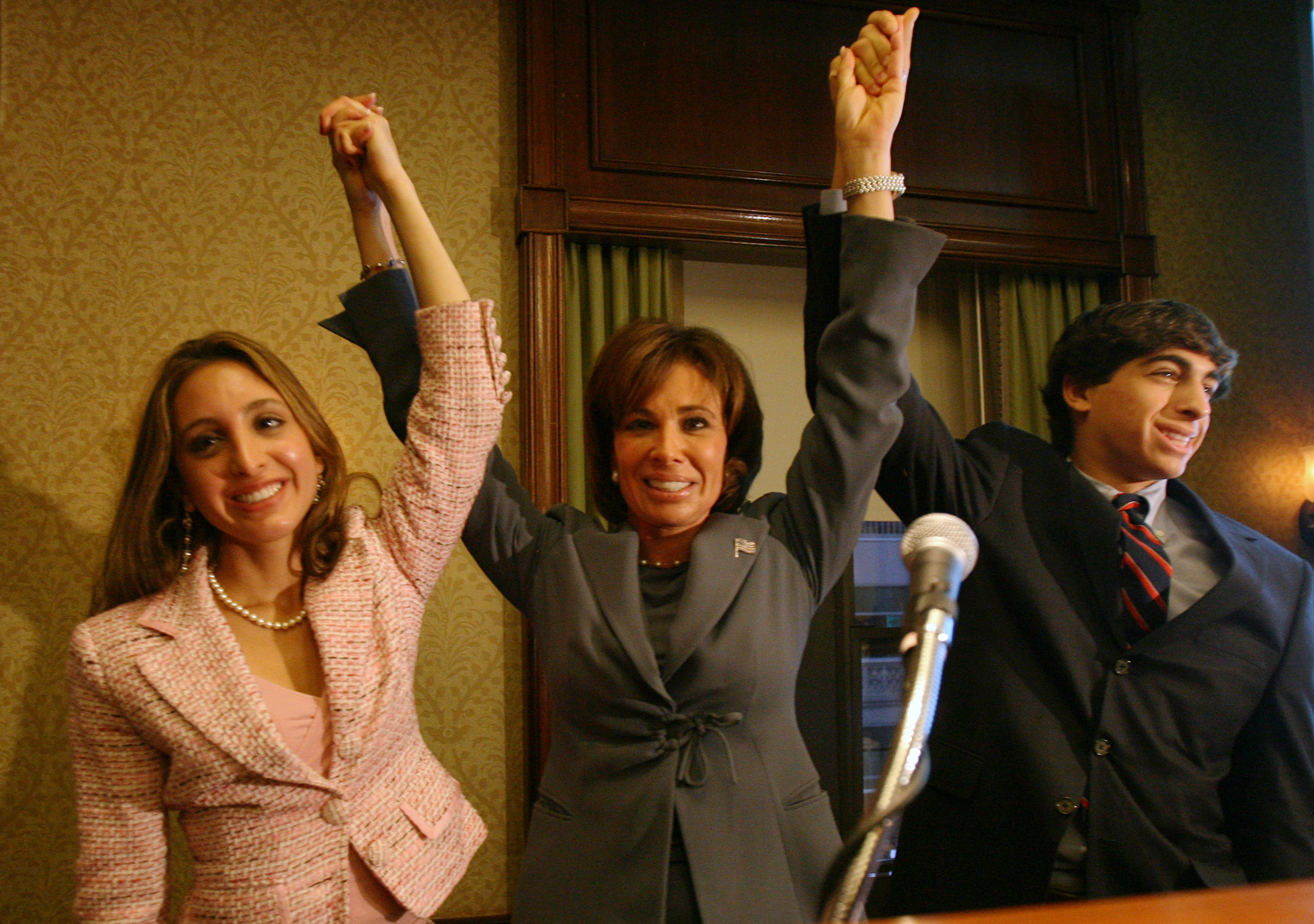

The El Salvador Prison Controversy Jeanine Pirros Position On Due Process

May 09, 2025

The El Salvador Prison Controversy Jeanine Pirros Position On Due Process

May 09, 2025 -

To Buy Or Not To Buy Palantir Stock Before May 5th A Wall Street Perspective

May 09, 2025

To Buy Or Not To Buy Palantir Stock Before May 5th A Wall Street Perspective

May 09, 2025 -

Ferdinand Rules Out Arsenals Champions League Victory His Final Two Predictions

May 09, 2025

Ferdinand Rules Out Arsenals Champions League Victory His Final Two Predictions

May 09, 2025 -

Support Grows For American Samoan Family Accused Of Voter Fraud In Whittier

May 09, 2025

Support Grows For American Samoan Family Accused Of Voter Fraud In Whittier

May 09, 2025