BlackRock ETF: Billionaire Investment Poised For Massive Growth In 2025

Table of Contents

BlackRock's Dominance in the ETF Market

BlackRock's iShares brand is synonymous with exchange-traded funds (ETFs). Their sheer size and market share are undeniable indicators of their success.

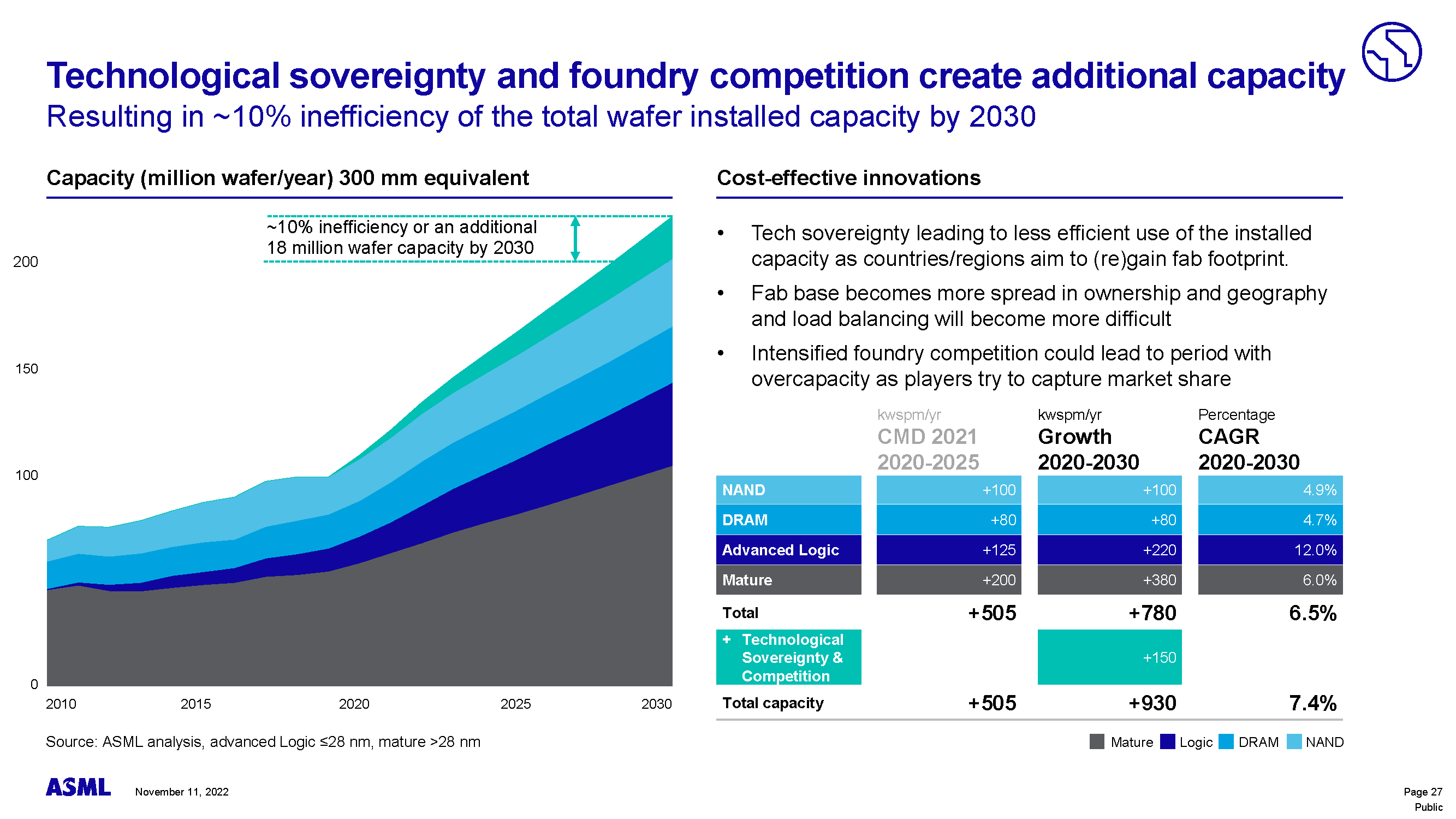

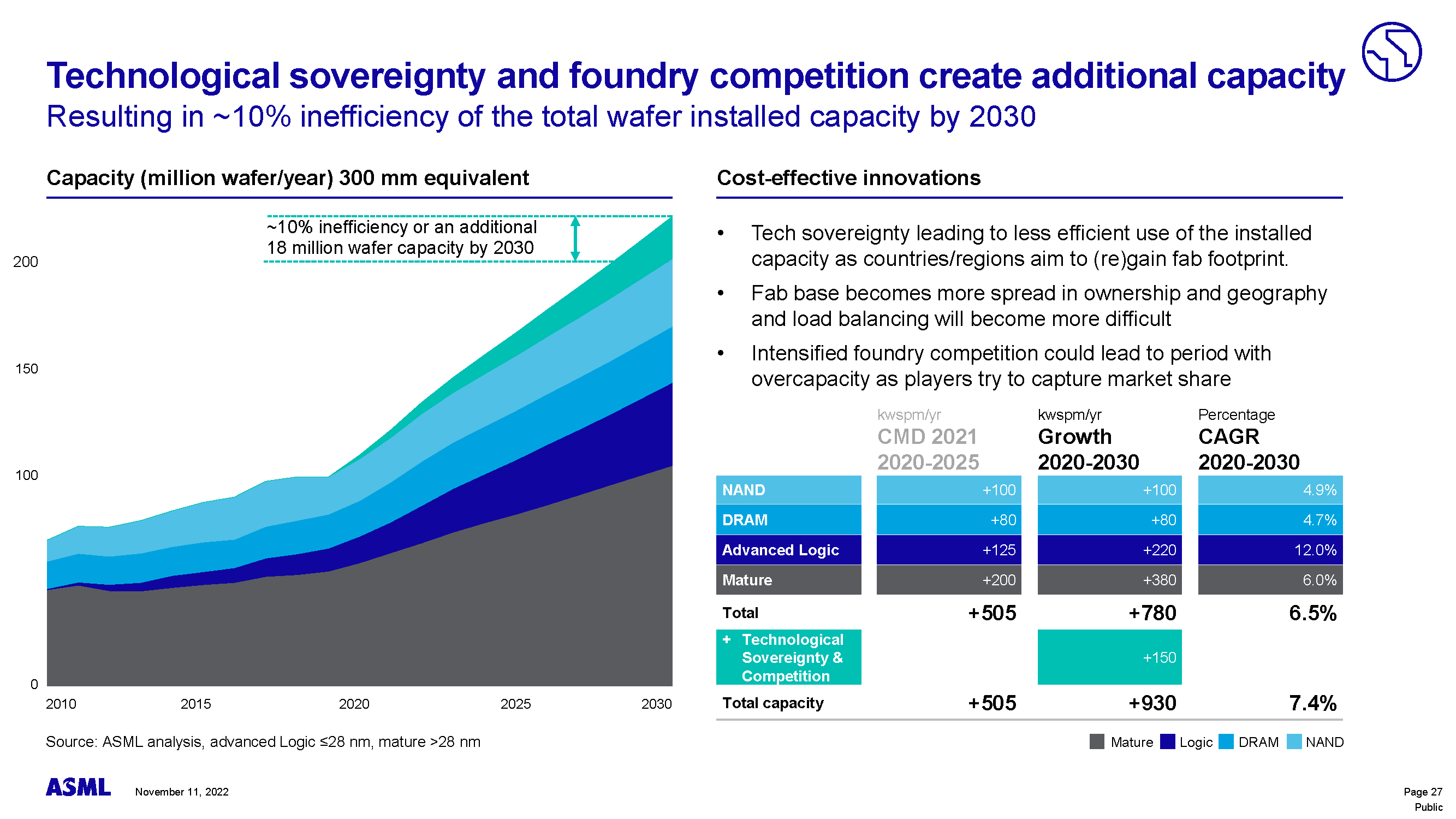

Market Share and AUM

BlackRock boasts a significant portion of the global ETF market, managing trillions of dollars in Assets Under Management (AUM). This dominance is a result of years of innovation, a diverse product range, and a strong reputation for performance. Charts illustrating BlackRock's growing AUM compared to competitors would further solidify this point.

- High-Performing BlackRock ETF Funds: Several iShares ETFs consistently outperform their benchmarks, attracting significant investment. Examples include iShares Core S&P 500 ETF (IVV) and iShares Core U.S. Aggregate Bond ETF (AGG), both known for their low expense ratios and strong performance.

- Breadth of Offerings: BlackRock offers a diverse range of ETFs, catering to various investment strategies and risk tolerances. From broad market indices like the iShares Core series to sector-specific and ESG-focused ETFs (like iShares ESG Aware MSCI USA ETF), BlackRock provides investors with comprehensive choices.

- Industry Recognition: Numerous industry reports consistently rank BlackRock as the top ETF provider, highlighting their market leadership and innovative product development. Citing these reports adds credibility to their dominant position.

Factors Driving BlackRock ETF Growth in 2025

Several key factors point towards continued, even accelerated, growth for BlackRock ETFs in the coming years.

Increasing Institutional Adoption

Institutional investors, including pension funds and university endowments, are increasingly favoring ETFs for their portfolio diversification and cost-effectiveness.

- Advantages for Institutional Investors: ETFs offer several key advantages for institutional investors:

- Diversification: ETFs allow for easy diversification across various asset classes and geographies, reducing overall portfolio risk.

- Low Costs: Compared to actively managed funds, ETFs typically have significantly lower expense ratios.

- Tax Efficiency: ETFs often offer tax advantages compared to other investment vehicles.

- Institutional Examples: Many large institutional investors publicly disclose their holdings, often revealing significant allocations to BlackRock ETFs.

Growing Retail Investor Interest

Retail investors, particularly millennials and Gen Z, are embracing ETFs due to their accessibility and ease of use.

- Accessibility and Ease of Investing: ETFs are easily accessible through most brokerage accounts, making investing straightforward.

- Robo-Advisors and Brokerage Platforms: Many robo-advisors and online brokerage platforms heavily feature BlackRock ETFs in their pre-built portfolios, further driving adoption.

- Financial Education and Media Coverage: Increased financial literacy and positive media coverage of ETFs have contributed to their rising popularity.

Technological Advancements

Technological advancements are making ETF investing even more efficient and accessible.

- Fractional Share Trading and Commission-Free Platforms: The rise of commission-free trading and the ability to purchase fractional shares has made ETF investing more accessible to a wider range of investors.

- Fintech Companies: Fintech companies are playing a significant role in promoting ETF investing through user-friendly platforms and educational resources.

- Advanced Portfolio Management Tools: Sophisticated portfolio management tools now often incorporate BlackRock ETFs into their algorithms, further streamlining investment strategies.

Billionaire Investment Strategies and BlackRock ETFs

High-net-worth individuals utilize BlackRock ETFs for sophisticated portfolio management.

Diversification and Risk Management

Billionaires employ BlackRock ETFs to diversify their holdings and mitigate risk.

- Hedging Against Market Volatility: Certain BlackRock ETFs, such as those focused on bonds or precious metals, can serve as effective hedges against market downturns.

- Strategic Asset Allocation: BlackRock ETFs facilitate strategic asset allocation, allowing for fine-tuning of portfolio exposure to different asset classes.

Tax Efficiency and Cost Optimization

The low expense ratios of BlackRock ETFs are crucial for cost-conscious high-net-worth individuals.

- Expense Ratio Comparisons: Comparing the expense ratios of BlackRock ETFs to actively managed funds clearly demonstrates the cost savings.

- Tax Advantages: The structure of ETFs often provides tax advantages, particularly for long-term investors.

Potential Risks and Considerations

While BlackRock ETFs offer significant advantages, potential risks need to be acknowledged.

Market Volatility

Market fluctuations can impact the value of any ETF, including BlackRock ETFs.

- Diversification Strategies: Diversification across different asset classes and geographies helps mitigate market volatility risk.

- Due Diligence: Thorough research and due diligence are essential before investing in any ETF.

ETF-Specific Risks

Investors should be aware of potential risks specific to ETFs, such as counterparty risk (the risk that the issuer of the ETF may default) and liquidity risk (the risk of not being able to sell the ETF quickly at a fair price).

Conclusion

BlackRock ETFs' massive growth in 2025 is driven by their market dominance, increasing institutional adoption, growing retail investor interest, and technological advancements. Their appeal to billionaire investors stems from their role in diversification, risk management, and cost optimization. While risks exist, the potential for substantial growth makes BlackRock ETFs a compelling investment opportunity. Learn more about how to incorporate BlackRock ETFs into your portfolio today and benefit from their potential for substantial growth in 2025. Visit the BlackRock website for more information.

Featured Posts

-

Brutal Reality Check Angels Farm System Ranked Low By Mlb Experts

May 08, 2025

Brutal Reality Check Angels Farm System Ranked Low By Mlb Experts

May 08, 2025 -

9 4000 360

May 08, 2025

9 4000 360

May 08, 2025 -

Grbovic Fleksibilan Pristup Formiranju Prelazne Vlade

May 08, 2025

Grbovic Fleksibilan Pristup Formiranju Prelazne Vlade

May 08, 2025 -

Cowherds Persistent Attacks On Jayson Tatums Skill

May 08, 2025

Cowherds Persistent Attacks On Jayson Tatums Skill

May 08, 2025 -

Analyzing Bitcoins Potential For A 10x Price Appreciation

May 08, 2025

Analyzing Bitcoins Potential For A 10x Price Appreciation

May 08, 2025

Latest Posts

-

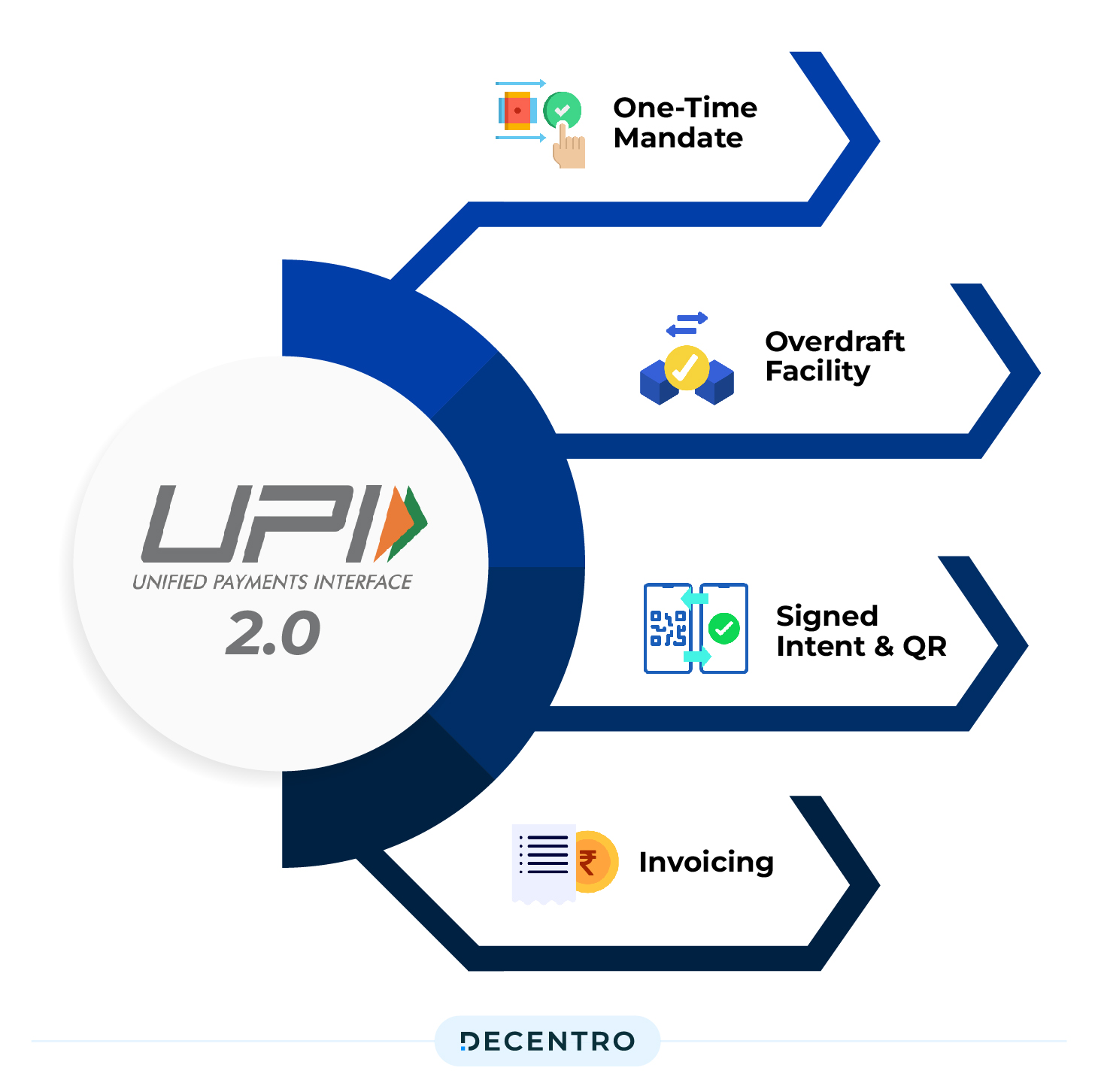

Is Upi Payment Still Working On Uber Auto A Comprehensive Guide

May 08, 2025

Is Upi Payment Still Working On Uber Auto A Comprehensive Guide

May 08, 2025 -

Uber Auto Payment Update What Payment Methods Work Now

May 08, 2025

Uber Auto Payment Update What Payment Methods Work Now

May 08, 2025 -

Understanding Uber Auto Payments A Guide To Upi And Alternatives

May 08, 2025

Understanding Uber Auto Payments A Guide To Upi And Alternatives

May 08, 2025 -

Uber Auto Payment Options Is Upi Still Available

May 08, 2025

Uber Auto Payment Options Is Upi Still Available

May 08, 2025 -

No More Cash Uber Auto Payments Upi And Other Options Explained

May 08, 2025

No More Cash Uber Auto Payments Upi And Other Options Explained

May 08, 2025