Broadcom's VMware Acquisition: AT&T Highlights A Potential 1,050% Cost Increase

Table of Contents

AT&T's 1,050% VMware Licensing Cost Increase

The specifics of AT&T's claims:

AT&T's public statements reveal a projected 1,050% increase in VMware licensing costs following Broadcom's acquisition. While the exact figures remain undisclosed due to confidentiality agreements, the magnitude of the increase is alarming. AT&T's calculations likely involve comparing current licensing agreements with Broadcom's proposed pricing model, factoring in usage volume, specific VMware products, and potential contract renegotiations. This drastic increase suggests a fundamental shift in Broadcom's pricing strategy compared to VMware's previous approach.

-

Current licensing agreements: AT&T, like many large telecoms, relies heavily on VMware virtualization technologies for its network infrastructure and data centers. Its existing contracts with VMware likely involved tiered pricing, volume discounts, and potentially long-term commitments.

-

Broadcom's proposed pricing model: Broadcom's plans reportedly deviate significantly from VMware's previous pricing structures. Details are scarce, but analysts speculate that Broadcom may prioritize higher per-unit costs and reduced volume discounts, leading to the dramatic increase for large clients like AT&T.

-

Impact on AT&T's budget and services: A 1,050% increase represents a substantial financial burden. This could force AT&T to absorb the increased cost, impacting its profitability and potentially leading to higher prices for consumers or reduced investment in network upgrades and service expansion. Alternatively, AT&T may explore alternative virtualization solutions, a costly and time-consuming process.

-

Potential legal challenges: Given the magnitude of the projected cost increase, AT&T may explore legal options, potentially arguing that Broadcom's pricing practices are anti-competitive. This could involve antitrust lawsuits or regulatory complaints.

Competitive Concerns and Antitrust Scrutiny

Reduced Competition in the Networking and Virtualization Market

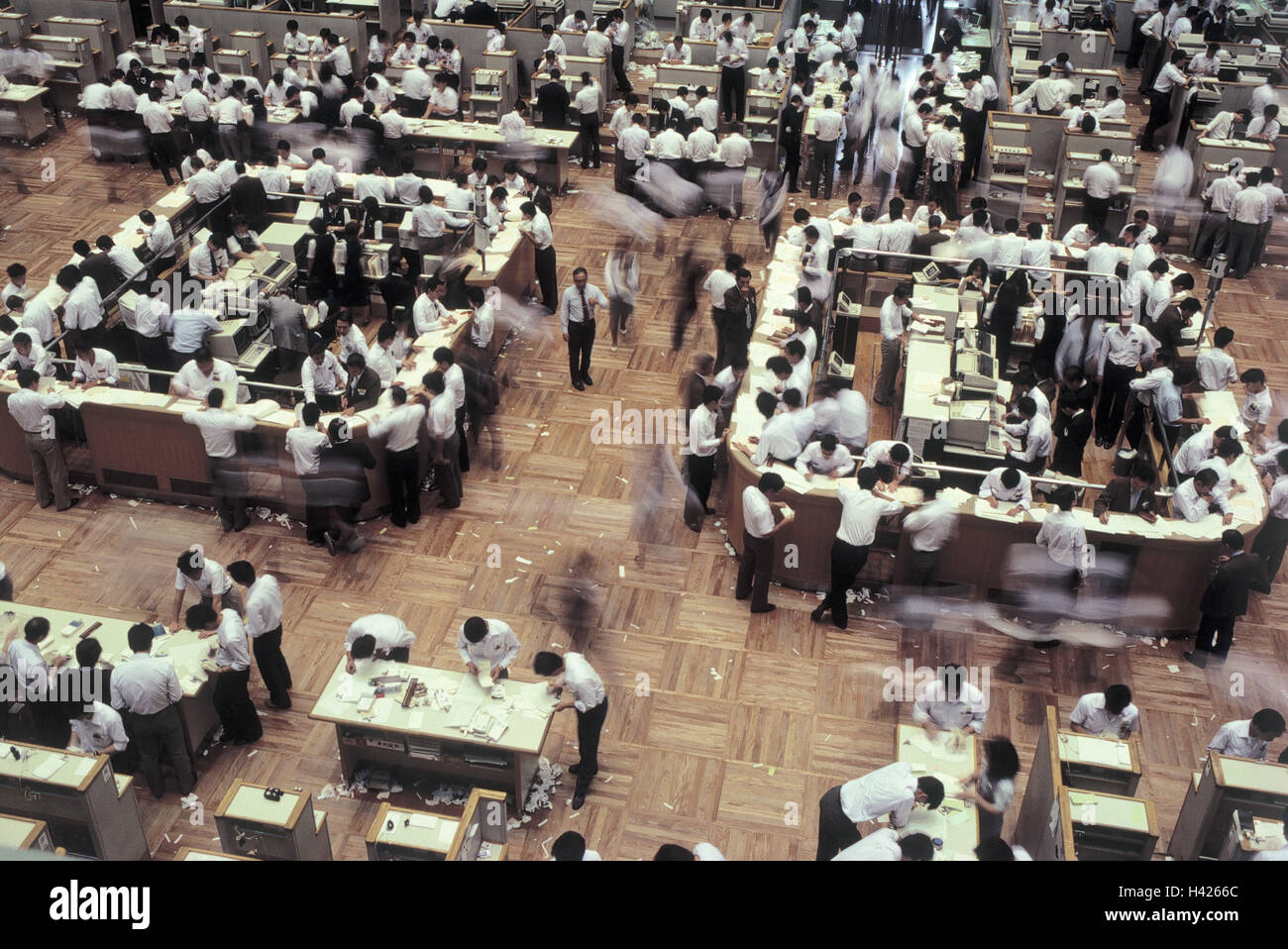

The Broadcom-VMware merger significantly reduces competition in the virtualization and networking markets. Before the merger, VMware was a major player, competing with companies like Citrix and Nutanix. Broadcom, a dominant player in networking chips and infrastructure, acquiring VMware creates a near-monopoly, particularly in the converged infrastructure market.

-

Key competitors: Post-merger, the remaining significant competitors will have a much harder time competing against a combined Broadcom and VMware. This leaves fewer options and less leverage for large telecoms and enterprises.

-

Market power leverage: Broadcom can leverage its expanded market power to dictate prices and potentially limit innovation. They may prioritize their own hardware and software solutions, potentially creating vendor lock-in for customers.

-

Impact on innovation: Reduced competition often stifles innovation. With fewer players vying for market share, the drive for new technologies and improved solutions may decrease, potentially leading to slower technological advancements.

-

Regulatory reviews: The merger is under intense scrutiny from regulatory bodies worldwide, including the US Federal Trade Commission (FTC) and European Union regulators, who are investigating potential antitrust concerns.

The Impact on Cloud Computing and Enterprise Customers

Implications for Cloud Infrastructure Costs

VMware plays a crucial role in cloud infrastructure, offering virtualization solutions that underpin many cloud platforms. Broadcom's ownership could significantly impact cloud computing costs and services for businesses.

-

VMware's role in cloud infrastructure: VMware's vSphere hypervisor is a cornerstone technology for many private and hybrid cloud environments. Its widespread adoption makes it a key component of cloud infrastructure for numerous enterprises.

-

Influence on cloud pricing and vendor lock-in: Broadcom might favor its own hardware and software in VMware's offerings, potentially leading to increased cloud pricing and vendor lock-in, forcing businesses to use specific hardware and software to maximize compatibility.

-

Alternatives for businesses: Businesses concerned about increased costs may seek alternative virtualization solutions, such as open-source options or competing virtualization platforms, though switching can be disruptive and expensive.

-

Impact on smaller businesses and startups: Smaller businesses and startups are likely to be disproportionately affected by increased cloud costs, potentially hindering their growth and competitiveness.

Long-Term Implications for the Telecom Industry

The Future of Networking and Virtualization Costs

The Broadcom-VMware merger carries significant long-term consequences for the telecom industry, impacting pricing, innovation, and industry dynamics.

-

Future price increases: The merger could trigger a wave of price increases for telecom services as the costs of underlying virtualization and networking technologies rise.

-

Impact on technological advancements: Reduced competition might stifle innovation in networking and virtualization technologies, slowing down the adoption of advanced technologies like 5G and edge computing.

-

Shift in industry power: The merger could significantly shift the balance of power in the telecom industry, empowering Broadcom to influence technology choices and pricing strategies for telecom providers.

-

Mitigation strategies: Telecom companies must explore alternative technologies, open-source solutions, and potentially collaborate to negotiate better terms with Broadcom to mitigate the impacts of the merger.

Conclusion

The Broadcom acquisition of VMware presents significant challenges for the telecom industry and its customers. AT&T's projected 1,050% cost increase underscores the potential for drastic price hikes across the board. Concerns regarding reduced competition, stifled innovation, and increased cloud computing costs are significant. The potential for a 1,050% cost increase for some companies due to the Broadcom/VMware deal highlights the urgent need for close monitoring of the situation.

Stay informed about the ongoing developments surrounding the Broadcom/VMware acquisition and its impact on your organization. Actively monitor regulatory decisions and consider alternative virtualization and networking solutions to mitigate potential cost increases from the Broadcom VMware acquisition. Further research on the impact of the Broadcom VMware acquisition is crucial for businesses across industries.

Featured Posts

-

Berkshire Hathaways Stake Boosts Japan Trading House Stock Prices

May 08, 2025

Berkshire Hathaways Stake Boosts Japan Trading House Stock Prices

May 08, 2025 -

Pressure Builds On Arteta Collymores Arsenal Verdict

May 08, 2025

Pressure Builds On Arteta Collymores Arsenal Verdict

May 08, 2025 -

Penny Pritzker And Harvard Unpacking The Billionaires Connection

May 08, 2025

Penny Pritzker And Harvard Unpacking The Billionaires Connection

May 08, 2025 -

Arsenal Ps Zh I Barselona Inter Polufinal Ligi Chempionov 2024 2025 Prognoz I Analiz

May 08, 2025

Arsenal Ps Zh I Barselona Inter Polufinal Ligi Chempionov 2024 2025 Prognoz I Analiz

May 08, 2025 -

The Future Of Symfonisk Sonos And Ikea Officially End Partnership

May 08, 2025

The Future Of Symfonisk Sonos And Ikea Officially End Partnership

May 08, 2025

Latest Posts

-

Nbas Thunder Take Aim At National Media

May 08, 2025

Nbas Thunder Take Aim At National Media

May 08, 2025 -

The Long Walk Trailer Released A Chilling Look At The Intense Thriller

May 08, 2025

The Long Walk Trailer Released A Chilling Look At The Intense Thriller

May 08, 2025 -

Thunder Players Clash With National Media

May 08, 2025

Thunder Players Clash With National Media

May 08, 2025 -

New Horror Movie Trailer Hunger Games Directors Adaptation Of Stephen King

May 08, 2025

New Horror Movie Trailer Hunger Games Directors Adaptation Of Stephen King

May 08, 2025 -

The Long Walk Trailer Stephen King Calls It Too Dark

May 08, 2025

The Long Walk Trailer Stephen King Calls It Too Dark

May 08, 2025